Big day today folks. We hear from the Federal Reserve themselves. The markets expect today to be the beginning of a tightening and rising rates cycle.

With the CME Fedwatch group showing a 100% chance of a hike, the question is by how much. Majority of analysts expect a 25 basis point rate hike, but if the Fed wants to make a statement about combating out inflation, they could raise 50 basis points or more. Honestly, the latter would take the markets by surprise, and the response might be increased volatility. Not something the Fed wants to do. 25 basis points seems to be baked in the cake.

So we know a rate hike is coming, but the important thing I will be watching, and I think you should all be too, is how hawkish the Fed will be. This will be determined by reading the Fed statement, but most prefer to listen to Powell’s press conference. I must admit, the last Fed conference did make it seem like the Fed was less hawkish. Not necessarily dovish, but Powell just sounded a bit all over the place.

Some of you might be thinking why is Vishal talking about birds? Well hawkish and dovish are used to describe monetary policy implemented by central banks. A good definition above, and most central banks are now of course in the hawkish side of things as they raise interest rates to reduce inflation.

Before we move on, I must say that just by hiking interest rates, it doesn’t mean that inflation will magically be reduced. Japan and the EU had negative interest rates, the lowest you can go, and could not get inflation going for years, even decades. Turkey and other nations have double digit interest rates yet inflation still remains high. I might be old fashioned to some Keynesians today, but I consider inflation to be a money supply issue and also factor in money velocity and confidence in the government and central bank.

Remember, we did hear the Fed say that this inflation is all because of supply chains and transitory inflation. It had nothing to do with their monetary policy. Now, this excuse has been retired. Putin and Russia are to blame for this inflation now!

Speaking about Russia, this is where things can get spicy. And I know some contrarians have called this. For those that believe the Fed cannot raise interest rates much because of all the debt out there, there is an excuse for the Fed. Russia Ukraine.

The Fed could come out less hawkish by stating that the situation in Ukraine might require the Fed to adopt a play by play approach. The media will say the Fed is being ‘pragmatic’ given the circumstances. This would mean the market would not get a definite answer on how many rate hikes the Fed expects this year. The contrarians are betting it won’t be anywhere near the 6-7 rate hikes.

Technically, because governments are now spending more on defense spending, they prefer lower interest rates too. Recently, the US passed a $1.5 Trillion spending bill to fund the government. About $14 Billion of it will go to Ukraine.

So if this is the case, then it means more cheap money for longer. The brrr continues, and the stock markets will like it. Inflationary pressures continue, which also drives money into the stock market as it is the best place for real yield.

This is why today’s press conference is very important.

In terms of charts, here is what I will be watching. If this is your first rate decision, then just for fun, I suggest watching the intraday (5 minute or less) charts of these assets. You will see how crazy things move on high risk events. For those who prefer video format, I got you covered:

So I have the chart of the S&P 500 above. Even though a lot of eyes will be on the markets, I don’t think they are the most important charts to watch. The next two below are.

But for stocks, we are now above my 4300 resistance zone. Still a lot of work to do of course, because there are many hours left in the trading day. But, if after all the Fed volatility, the S&P 500 confirms a daily close above 4300, then we have a bullish buy signal. I would expect a nice move higher.

The important markets to watch here will be the debt markets. Above I have the daily chart of the 10 year yield, and then the weekly chart of the bond ETF TLT. These are inverses, so when TLT (bond prices) fall, the yields move higher.

Currently we had a major breakout with yields now above 2.10%. The markets are expecting rising yields.

Take a look at TLT. A major breakdown is occurring. However, this breakdown candle will not be confirmed until Friday’s close. But it is looking like TLT will fall further…meaning much higher yields.

The markets are expecting rates to go up, and a hawkish Fed.

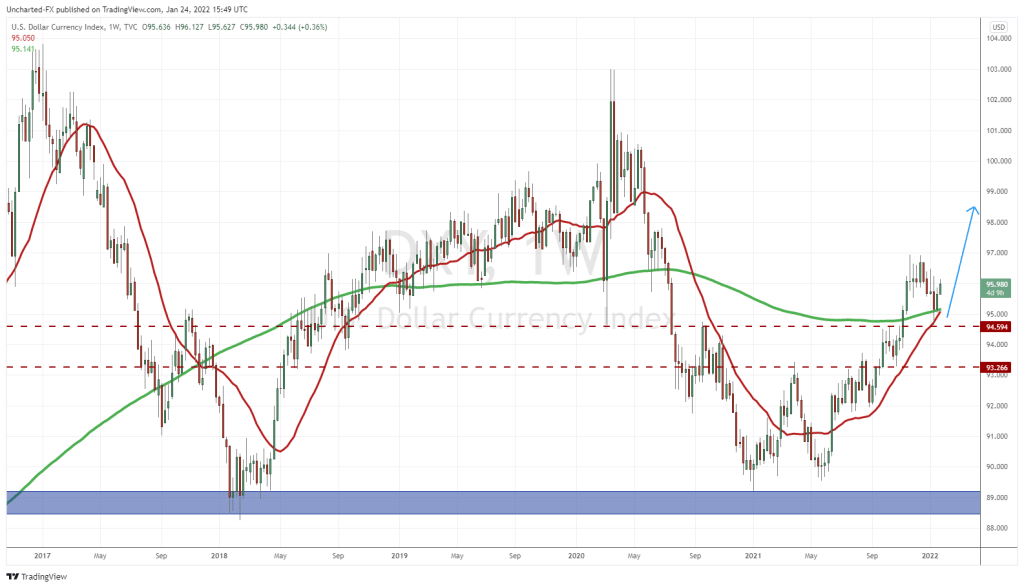

This is where the fun will be. The US Dollar chart will help us determine how hawkish or dovish the Fed is. Or rather correctly, how the market perceives the Fed.

The US Dollar has been strong, and we remain above our major 97.50 support zone. I remain bullish on the Dollar above this level. Recently, the US Dollar has not been able to break above 99.30. So we can say we have been ranging between these two price levels.

The move higher in the Dollar likely means the markets have priced in the rate hike, but it gets a tad bit complicated because the US Dollar probably saw some strength on the safe haven/fear trade. If the Fed surprises and raises rates more than 25 basis points, the Dollar would rally hard and confirm a major breakout. We could very well be talking about DXY over 100 a few days from now.

So in summary watch yields and watch the US Dollar. We would expect yields to pop and the Dollar to pop on a more hawkish Fed. If these assets drop, it doesn’t necessarily mean the Fed is not hawkish. It could be that these markets had already priced in the 25 basis point hike. For us to think the Fed is dovish, we would have to see a LARGE drop in yields and the US Dollar. It is going to be a volatile day, so have your stop losses in place or do what I do, don’t trade on Fed day. Give the markets time to digest everything then enter new positions.