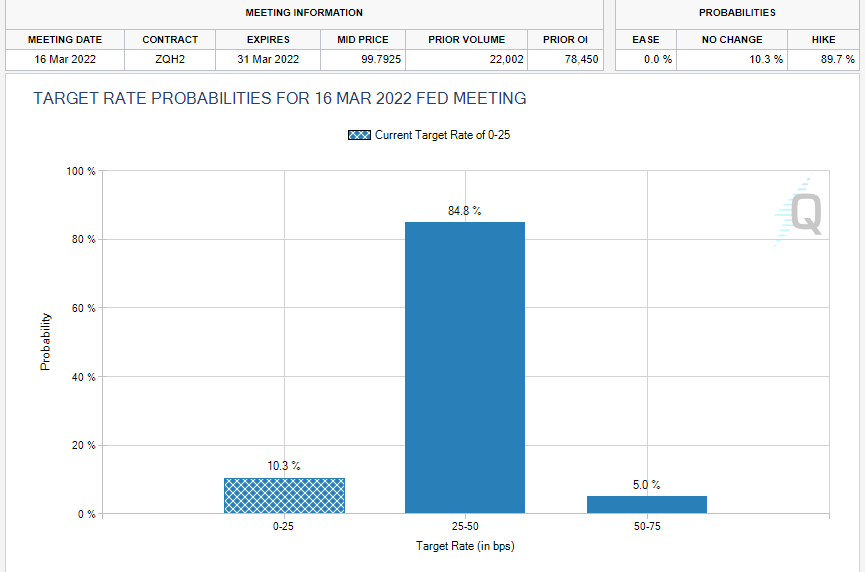

After yesterday’s ‘supernatural’ price action, stock markets are back under pressure. A very big date tomorrow with the Federal Reserve Interest Rate Decision. Currently, Fed Fund futures are not indicating a rate hike tomorrow. They are pricing in a rate hike in March 2022.

However, I am hearing analyst’s say that the Fed may hike tomorrow to begin to combat inflation. In fact, analyst’s here in Canada expect the same. Some are going as far to say the Bank of Canada will actually hike 50 basis points tomorrow, not just 25. Personally, I think a 50 basis hike would take markets by surprise, and that’s the last thing the Central Banks want to do.

Markets expect the Fed to be hawkish with further tightening and signal a rate hike in March. With futures showing a 89.7% probability of a hike, the Fed must raise in March. If the Fed is not hawkish tomorrow, or does not make it clear they are tightening and hinting at a hike in March, the markets could come under some more pressure. The confidence crisis, where markets and others might begin to discuss whether the Fed can even raise rates with all the debt. We would be making comparisons to Japan and the EU who are at negative rates and cannot hike.

With all that volatility coming up tomorrow, I think it is prudent to remain on the sidelines for now. In all my years of trading, I avoid trading through high risk events. Not necessarily due to them being unpredictable in terms of rhetoric and numbers, but more so due to the unpredictability of price action. We can predict what the Fed will say but we just don’t know how markets will react. For this reason, I wait for the decision, and then allow the markets sometime to digest the statement. I then enter on my terms.

The other thing weighing in on markets is geopolitical. The situation in Russia and Ukraine seems to be escalating with the US telling diplomats to leave Kyiv, and the US military being ready to deploy. As I have said in a previous Market Moment article, I am watching Oil and the US Dollar. The latter gets complicated because the Dollar could be rising due to Fed hawkishness rather than a safe haven move.

Before I get to the stock market charts, let me show you a few things.

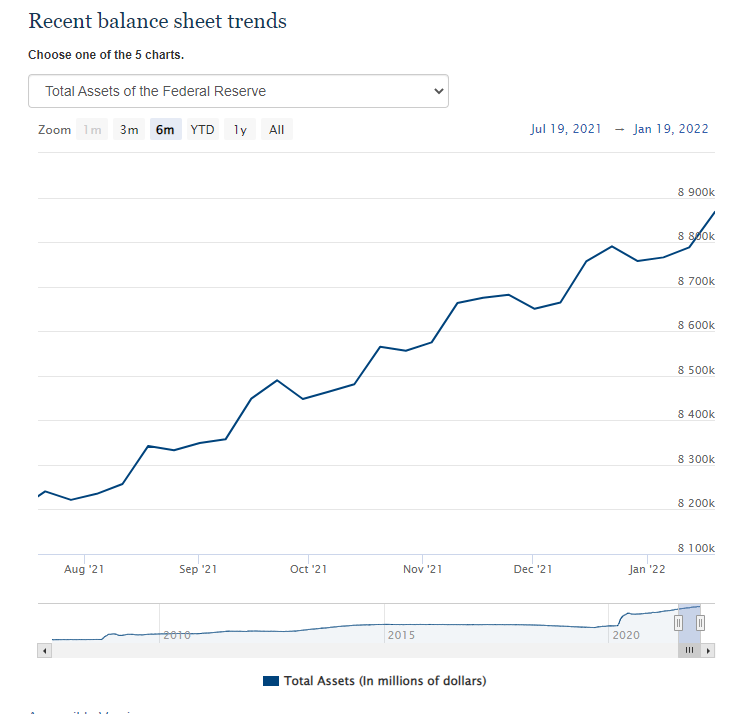

The Federal Reserve balance sheet keeps making new highs even in a tapering environment. We know they are buying treasuries and mortgage backed securities, but some say the plunge protection team might be buying stocks. This might not be the best approach, but many traders keep buying the dip as long as the Fed balance sheet keeps making new record highs.

The VIX is indicating that volatility is back. Investor’s are expecting wild swings. Yesterday, the VIX hit highs not seen since Fall 2020. At time of writing, the VIX is still holding strong.

Perhaps one of the most important charts right now is the 10 year yield. When we were spiking a few weeks ago, it was the primary driver for stock market pressure. Markets were pricing in multiple rate hikes as yields were increasing. I have mentioned this support retest before, but it remains the crucial level. 1.70% is being held, and we can still continue higher on a hawkish Fed. This could put more pressure on the stock markets, especially if you believe they have been propped up due to cheap money.

I must say though that if inflation persists, we could get a situation where yields and interest rates are increasing AND stock markets are moving higher. To be honest, I am sort of expecting this around the middle of this year. I believe for the Fed to combat inflation, interest rates will need to rise to levels unfathomable to people with mortgages and debt. I don’t think the Fed can do it. In inflationary environments, stock markets tend to do well because they are the best place to make yield to beat inflation.

I will keep it brief on the US Dollar as I wrote a piece yesterday titled, “Is the US Dollar About to Take Off?“. I have been bullish on the US Dollar ever since a weekly double bottom reversal pattern confirmation back in Fall 2021. We have just made one higher low swing in this new uptrend, and I believe another swing is coming. Is the Dollar rising due to Fed hawkishness or safety being the reserve currency? We’ll find out if the Russia-Ukraine situation de-escalates, or how the Dollar reacts to a hawkish Fed.

Now let’s take a look at those stock market charts. Many of them look the same in structure. Very simply: we have broken down, a lower high swing is still possible making new recent lows, and currently, markets are testing and holding major support zones.

The S&P 500 saw a bid up yesterday right at our support zone just above 4250. Things looked good, but it turned out to be a dead cat bounce, meaning we may have our first lower high swing to work with. Currently, we are testing the support once again, and bulls should be praying that we do not close below it today. Given that the Fed is tomorrow, I think markets want to wait until tomorrow. I expect the S&P 500 and other stock markets to hold above their support levels with the make or break happening after 11:30 am PST tomorrow.

For me to go bullish, I would want to see a close above 4500.

The Nasdaq is under pressure. Growth stocks tend to get hit when interest rates are about to rise. You have all heard about the ARK ETF and the damage control Cathie Wood is doing. Netflix stock saw an epic gap down after earnings. We do have Apple and Tesla earnings tomorrow and Thursday. After Netflix’s price action, I will be paying attention to earnings and how these stocks will react. If they fall…uh oh.

The Nasdaq is also right at support. A daily close below 14,000 wouldn’t be great, and some major banks out there are saying this level is the make or break zone. Let’s see if we can form a base here and begin a new uptrend. Technically, the Nasdaq needs to take out the previous lower high above 15,000 to end this downtrend.

The Dow is right at support, and there is a chance the breakdown could see us move down to 32,000. I have hope for the Dow because I expect money to run into safe dividend paying stocks. It doesn’t mean the Dow will not fall, but it may not fall as much as the Nasdaq and the S&P 500. Out in the Twitterverse, I am seeing a lot of posts about “buy large cap dividend paying stocks to play it safe”.

The Russell 2000 is the one that has me excited as a bear. We broke below a huge support zone that has been held since March 2021. We broke down and tumbled. My first support target came around 2000. We hit this zone yesterday and saw bids. First target hit. However, we need to close back above the breakdown zone of 2120 to go bullish. We have not retested the breakdown zone just yet, and this is what I am waiting for. To see if sellers pile in, or if we fake out and close back above nullifying the downtrend.

In summary, all US stock markets are finding support but it does not mean the downtrend is over. We still have long ways to go to take out resistance/lower highs to safely say the downtrend has been neutralized. Until then, another lower high swing is possible meaning new recent lows are coming. A high risk event with the Federal Reserve tomorrow. I think it is prudent to see what the Fed says and give the markets time to digest it. Keep your eyes on that US Dollar and the ten year yield.