The bond markets are referred to as, “the market that knows it all’. Well, this all knowing market is making a big prediction for 2023.

This week has been heavily bond market focused on Equity Guru. I have written about the current move in the 2 year and 10 year yield and why this is hinting at stock market (and other assets!) weakness. Readers are also well aware with my focus and fascination with the Bank of Japan, which I dubbed the most important central bank to be watching. It finally hit people near the end of the year when the Bank of Japan made its move and we saw global bond markets shuffle.

2023 will have many themes and surprises, and the bond markets will be at the forefront.

Looking at the longer term charts of the bond market, and the market that knows it all is making a bold prediction.

First of all, why do we call it ‘the market that knows it all’?

Two reasons.

The first reason is simple. When was the last time you traded bonds? The truth is, most of the retail crowd trades stocks, forex, commodities or cryptocurrencies. They do not trade the bond market. The ones who do trade the bond markets are institutions. Because of this is why it is important to follow the bond markets. Because the big money institutions are trading the bond markets.

The second reason: inflation. There is a correlation between bonds and inflation. When bonds are selling off or trending downwards like they have been throughout 2022, it means that the big institutions believe that inflation is still a threat. But when bonds are rallying or trending higher, it means big institutions are betting that inflation is less of a threat or disinflation is more of a threat.

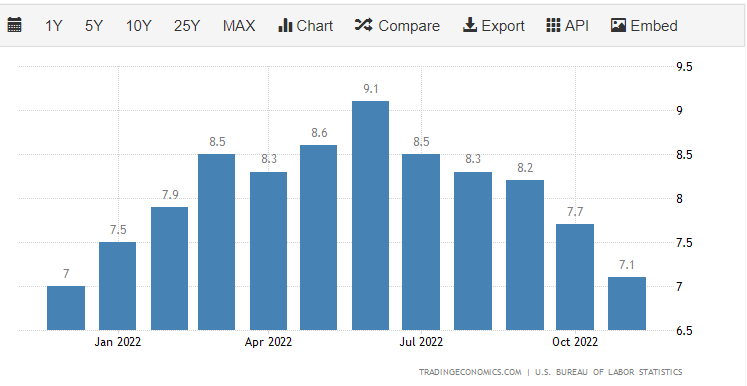

As you are all well aware, the Fed and other central banks around the world are trying to tame inflation, and so far it seems to be working:

US stock markets have popped on Friday’s Non-Farm Payrolls employment numbers. Wages grew slower than anticipated, increasing 0.3% on the month where economists expected 0.4%. Believe it or not, but this 0.1% has got stock markets soaring.

“All investors care about is that the data suggests inflation is moving towards the Fed’s target,” said Michael Arone, chief investment strategist at State Street Global Advisors. “That’s all investors care about and average hourly earnings suggest inflation continues to slow. They are excited about that.”

Markets are once again believing the Fed will go dovish based on the fact that employment data is showing signs of slowing inflation. But the key data print will now be this week’s CPI data.

“There is nothing within the release that would imply it’s anything other than a strong jobs report with moderating wage pressure,” Ian Lyngen, BMO’s head of U.S. rates, said in a note. “As a result, we’ll argue the 25 bp vs. 50 bp rate hike debate now comes down to next week’s CPI print.”

But what about going forward? And this is where the ‘market that knows everything’ comes in.

This is why we look at bonds, and perhaps they can tell us whether inflation is peaking.

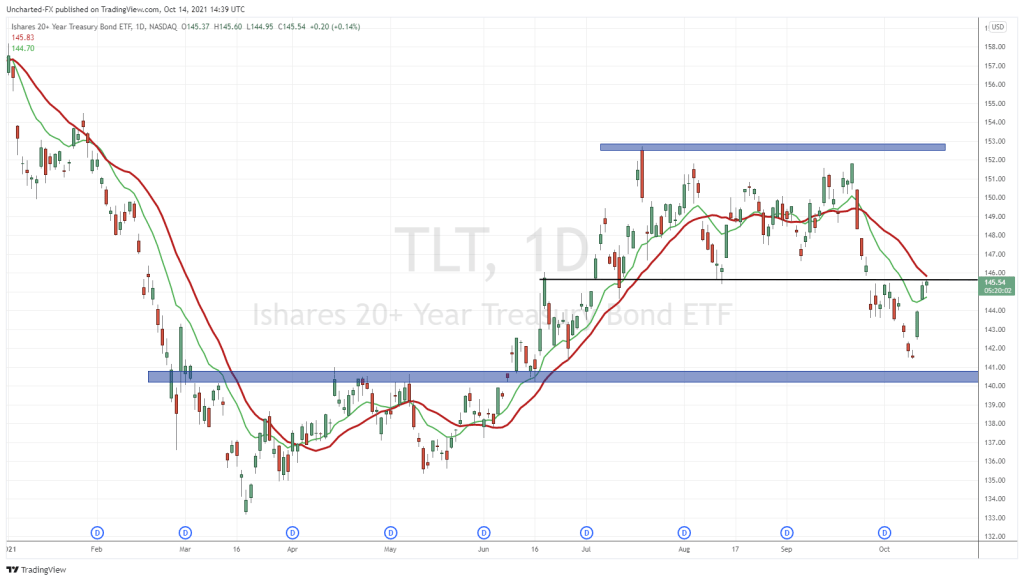

Above is the weekly chart of the TLT. Each candle represents 1 full trading week of price action. You can see that bonds fell considerably throughout 2022. Recently, we hit a low around 92 and have bounced significantly higher from there. In the past several months, bonds have rallied more than 3%. However, after this rally, bonds have once again pulled back.

The technical trader in me sees this as a sell off continuation as the bond market retested resistance at the 110 zone. Exactly where we bounced to before selling off again. But with the recent market reaction, things could be turning.

As TLT heads higher, bond yields are heading lower. 10 year yields are taking a major hit which means markets are expecting lower rates. In a way, they are betting against the Fed’s hawkish statement. More on this below.

Yields dropping lower is positive for stock markets.

Now you may want to write this down as it will be applicable for 2023:

If TLT can manage to reverse and close above the recent highs made in 2022 at 110, it would be a major bullish sign for bonds. It would also be a strong early indication that inflation has peaked and we are likely to see disinflation (falling inflation) in 2023.

Now I can hear some of you already. Surely we are in a period of rising inflation which will last years right?

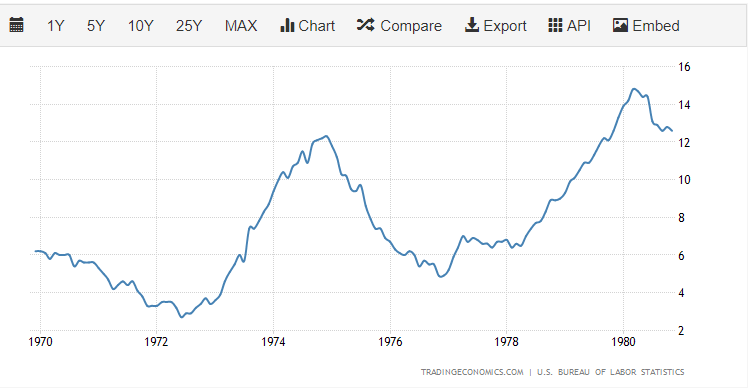

Well above is the inflation chart for the inflationary period of the 70s. A period known for rising inflation. You can see even in the 70s, we had periods of disinflation (falling inflation) even though we generally had rising inflation. 1974-1975 saw disinflation.

If you are a trader, think of it as pullbacks and higher lows in an uptrend. In this case, the uptrend signals rising inflation, and disinflation are just periods of pullbacks.

This is what we could experience in 2023, but let’s wait for the bond market to confirm the bullish reversal (a close above 110) which would increase the probability of falling inflation.

Funnily enough, even Dr. Michael Burry has said something similar. That sometime in 2023, the Fed will pivot and cut interest rates due to a recession. Government stimulus will come in and inflation will then turn to the upside and make new highs in 2023. That the current inflation peak is just a localized high in the new uptrend.

Now what does this mean for US stock markets and to a degree, world stock markets?

Well, if inflation does drop and probabilities increase for a Fed pivot, then we can expect new stock market highs in 2023.

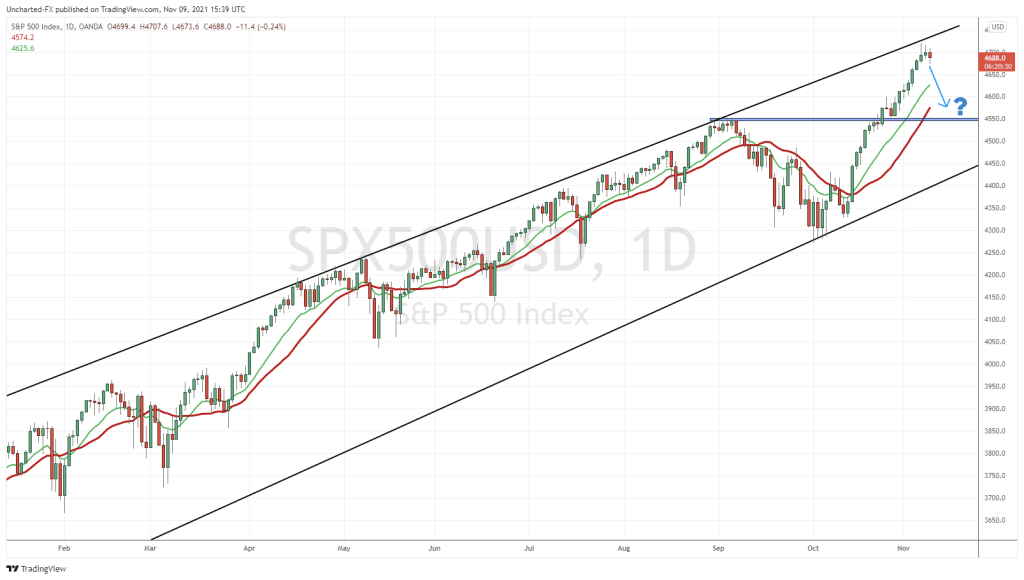

Above are the daily charts of the S&P 500, the Nasdaq and the Dow Jones. Each of these have broken down in December, but due to the lack of liquidity, we have not seen a follow through. Markets have ranged and normal liquidity is coming back.

The S&P 500 is still ways away from its resistance zone at 3920 before I can flip bullish.

The Nasdaq is right at a support zone and is holding. If bond yields drop, or TLT moves higher, it will do wonders for the technology index.

The Dow Jones is the one of more interest given it is close to breaking above its resistance zone and could once again, lead equity markets, just like it did between October-December 2022.

Now how about the other side of the equation. What would lead to bearish markets? A Fed which does not care about market expectations and will do whatever it must to tame inflation. In fact, this is EXACTLY what the Fed is thinking according to last week’s FOMC minutes.

Here are the key points from the hawkish Fed:

“Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time,” the meeting summary stated. “In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy.”

“A number of participants emphasized that it would be important to clearly communicate that a slowing in the pace of rate increases was not an indication of any weakening of the Committee’s resolve to achieve its price-stability goal or a judgment that inflation was already on a persistent downward path,” the minutes said.

“Participants generally indicated that upside risks to the inflation outlook remained a key factor shaping the outlook for policy,” the minutes said. “Participants generally observed that maintaining a restrictive policy stance for a sustained period until inflation is clearly on a path toward 2 percent is appropriate from a risk-management perspective.”

First off, slowing rate hikes is not pivoting like some market participants think. Interest rates will remain high until the Fed sees multiple months of CPI falling. Risks remain for upside inflation but downside for growth.

But here is perhaps the most interesting comment from the FOMC minutes:

“Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee’s reaction function, would complicate the Committee’s effort to restore price stability.”

Fed officials were not happy with the surge in the stock markets which the markets are doing because they believe the Fed is pivoting… when they are not. This will lead to a volatile move in markets once the markets wake up to the fact that the Fed is remaining on the course to do what is necessary to tame inflation. That interest rates will remain higher for longer.

2023 will be a year of volatility with markets betting on some sort of Fed pivot. This article is not even considering the geopolitical environment which can definitely impact financial markets. But for us traders and investors, TLT and the bond markets will be the key to determine where stock markets are heading.