It’s Federal Reserve Day. If you follow the stock markets and finance regularly, I don’t think I need to tell you what is expected. The market and analysts expect some sort of taper, and if not, then a taper timeline. Last month, the Federal Reserve told us that they could initiate a gradual taper in mid November. It would take the asset purchasing program from $120 billion a month, down to $105 billion a month. For those who thought a taper may freak out Stock Markets and cause a market drop known as a taper tantrum…it did not happen. Or at least the US Stock Markets are not pricing it in. It could be because the markets see this as a token taper. I mean the Fed would still be purchasing over $100 billion worth of bonds and mortgage backed securities per month. Or, this harkens back to what Stanley Druckenmiller said a few months ago: Stock Markets will NOT react to any taper or Fed tightening policy until the Federal Reserve actually does it. Right now the Fed is all talk and no action, and traders are calling the Fed’s bluff. As Druckenmiller said, the Fed is playing with fire and lulling investor’s and market participants into a false sense of security.

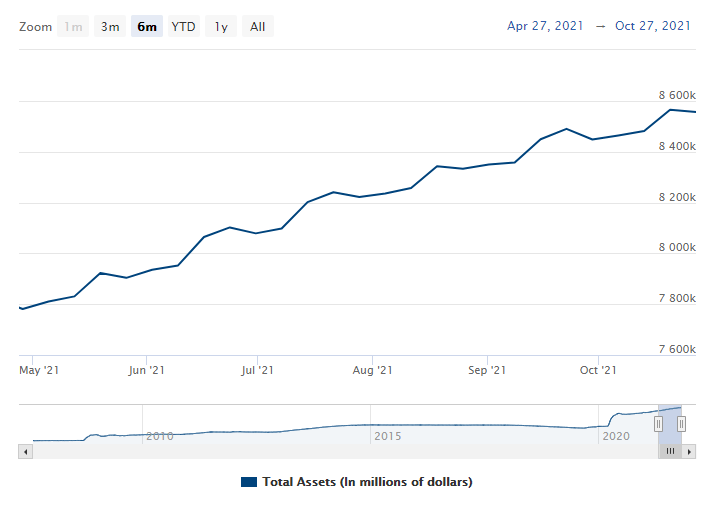

Before we dive a bit deeper into all of this and what the charts are telling us, here is a picture of the Fed’s balance sheet week ended October 27th 2021. I chose a 6 month time frame to show recent Fed policy:

Steadily moving up with some pullbacks here and there. Oh and it sits near $8.6 Trillion.

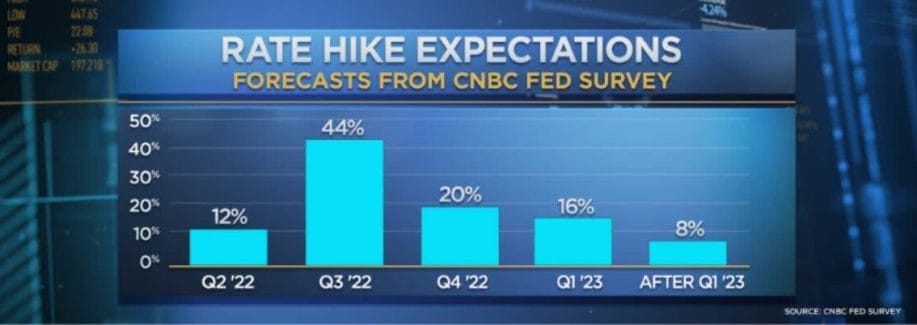

In terms of what comes out from the Fed today, CNBC did a survey and this is what is expected:

Fed funds futures markets have a 58% probability of the first rate hike in June 2022 and a 73% chance of a second increase by December 2022.

The call for faster tightening of policy has arisen from inflation concerns. So let’s just say that the pose-crisis monetary policy will be steeped with uncertainty. Recall that the Federal Reserve said two criteria for a taper (not interest rate hike!) must be met. Reasonable control of inflation and strengthening jobs data. The Fed’s inflation target has always been 2%. Of course we are well over that, but the Fed is telling us this is just temporary. It is due to supply chains, and not the excess money in the system. You know, a situation where there are people with more money competing for the same number of goods and services because productivity didn’t increase. We all know someone (or many people) who quit their jobs to trade stocks and cryptos.

Be prepared to hear more about inflation, and I sincerely believe, be prepared to see more inflation. The Federal Reserve went from telling us inflation is transitory and would be gone in a few months after the re-opening of the economy, to now inflation will last until mid 2022 and then level off. I don’t know about you guys, but it seems like they are either kicking the can down the road, or have no idea when inflation will level off.

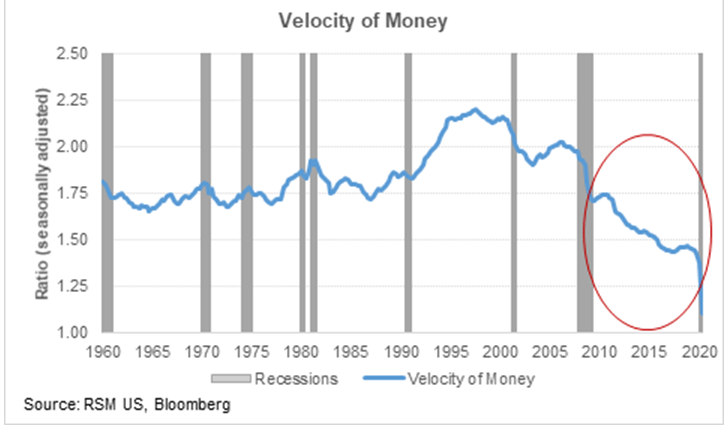

Money velocity has been a key to this, especially since Cathie Wood refuted Jack Dorsey’s hyperinflation claims because money velocity needs to increase. A tell tale sign of hyperinflation is when people spend the money right away because they believe it will be weaker the next day. All this instant spending upon cash arrival increases money velocity and causes hyperinflation. I have been following money velocity for quite some time, and if you have been, then you know that money velocity has been in a downtrend since before 2008:

Then of course we get employment. Just today, ADP payrolls reported strong jobs data. Companies added 571,000 jobs for the month, beating the 395,000 Dow Jones estimate. Jerome Powell did say we don’t need a blowout NFP or employment number. Just signs of an improving jobs market. What keeps people a bit uncertain is the fact that US Jobless Claims still come out at 200,000 per week. Well lower than pandemic highs, but still, 200,000 plus Americans are claiming first time unemployment per week. Pre pandemic numbers were less than 70,000.

To add further drama to this, we have the great resignation. The term is being used to describe many people leaving their jobs. Economist’s say it is because there are many job opportunities out there. I admit, I see ‘help wanted’ signs everywhere. Others say it is because of vaccine mandates. Again, this is the uncertainty heading forward in a post-crisis world. Inflation could still rise, and the great resignation theme may carry on.

What about other central banks? Yes, a few are turning hawkish. I wanted to talk about the Bank of South Korea, but I will save that for another Market Moment post. I think South Korea provides a good case example for what we should expect when interest rates rise. Especially the impact on the stock market.

Last week I covered the Bank of Canada ending their asset purchasing program. I mean it is technically still $4-5 Billion purchases per month, but down from $4-5 Billion per week (or $16-20 Billion) per month. Now the market is expecting the Bank of Canada to raise interest rates next year. Some analysts say three times, taking rates from 0.25% to 1.00%. The first rate hike could come as soon as April 2022.

Another bank to go hawkish is the Reserve Bank of Australia (RBA), who had their interest rate decision yesterday. The RBA has dumped its policy of yield curve control, becoming one of the first large central banks to act against a post-pandemic surge in prices. It will no longer try to keep the yield on three-year bonds at 0.1 %. Another central bank beginning the tightening process. No rush to hike interest rates right now, but the market expects rate hikes in the second half of 2022. but inflation could change that just like the Fed.

The Interest Rate decision I am actually looking forward to is the Bank of England which is out tomorrow. Analysts are actually expecting the UK to raise interest rates by 15 basis points. Mind you they are at 0.10% right now, so a 15 basis point hike would put them at 0.25%, which is where Canada and the US currently sit. Surging inflation is the reason why. But here is the crazy thing. The Bank of England may hike interest rates while not cutting down on their asset purchasing program! Talk about sending confusing signals to the market and investors!

I don’t want to be that guy, but the future of central bank monetary policy is really about how high can interest rates rise before central banks break the government. Many countries had to rely on government debt to keep the economy and citizens propped. Debt is at its highest levels globally. A rate hike means governments owe more on that debt. Either the government cuts down on spending, or increases taxes. Both could cause another economic slowdown or recession. Has the economy stabilized without government spending? If there is an increase in tax, then consumers may tone down on their spending especially since if they borrow, the price of money will be higher. Are we now like Japan, Switzerland and the Euro Zone? Those central banks have cut rates into the negative and are likely never to raise. Some of them have been in negative rate territory for over a decade. Any hike would break the government and the financial system.

Definitely important topics to consider. I am more of a classical economics guy, and I think Keynesianism is reaching an end. I am not the only one seeing this or saying this.

But let’s end off by taking a look at some charts before the big Fed decision:

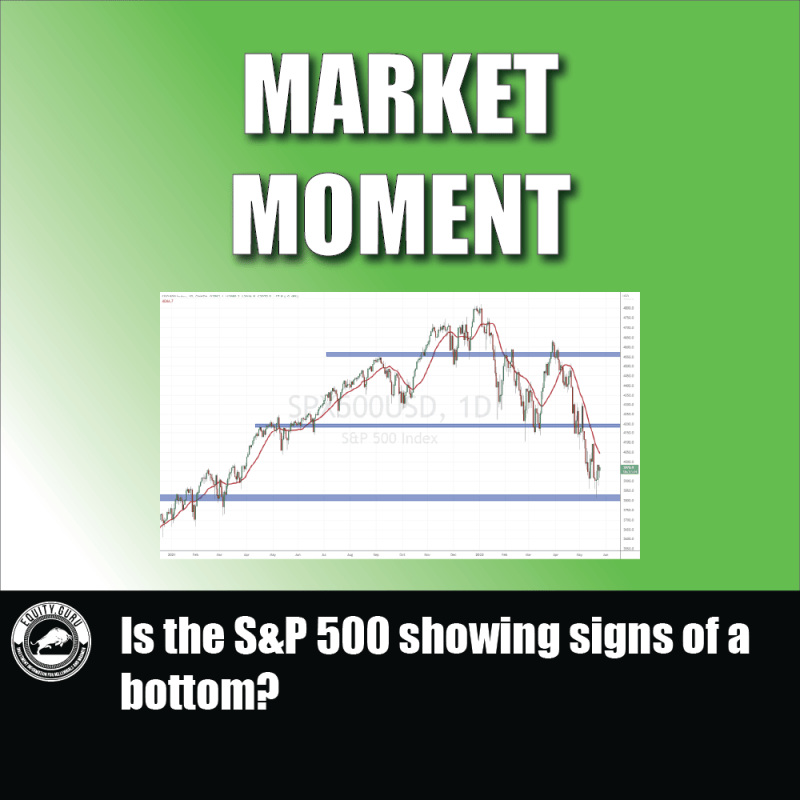

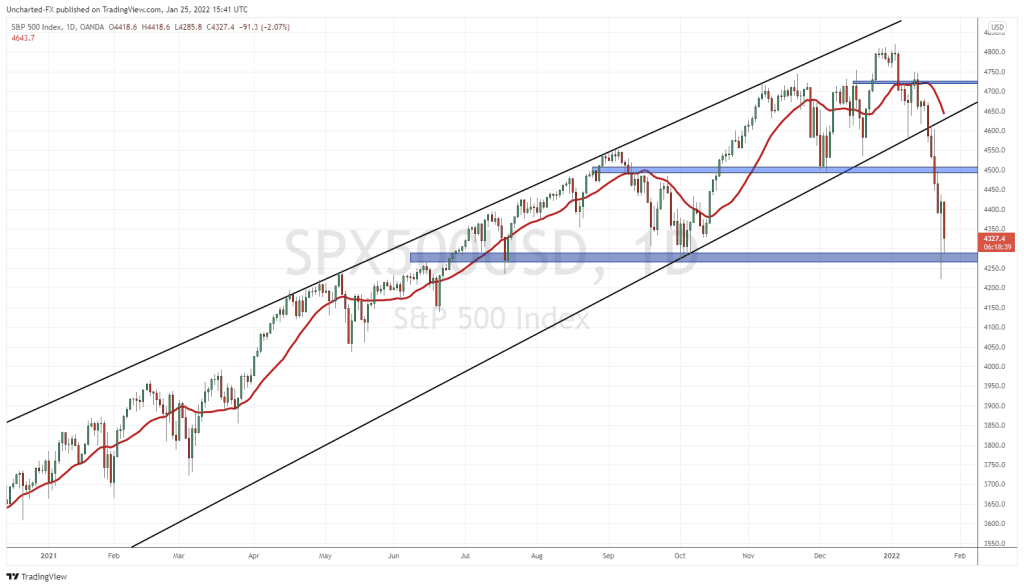

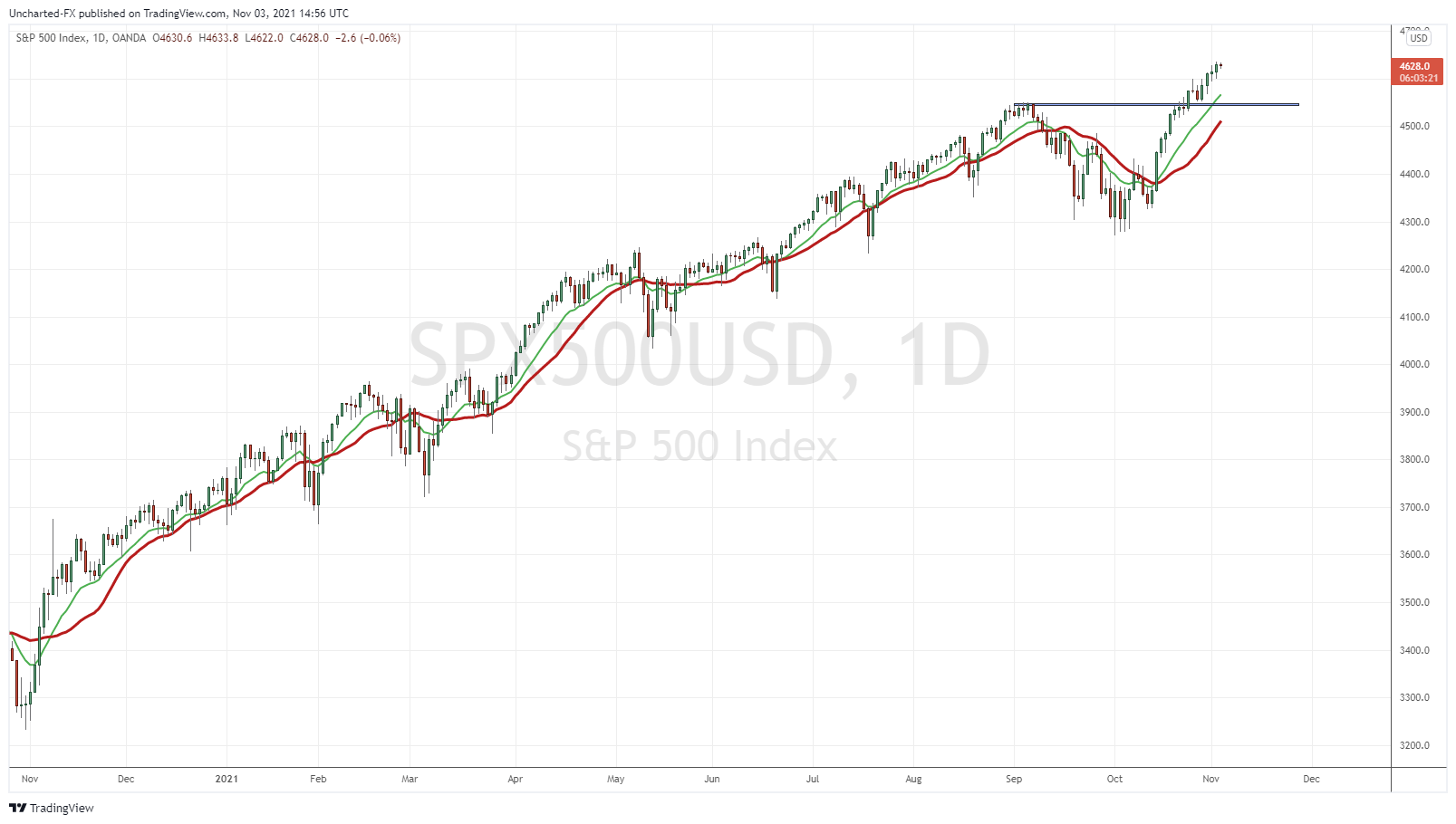

The S&P 500, the Nasdaq and the Dow Jones all made record highs yesterday. In fact, so did the Russell 2000. Right now price is subdued on the large indices, which makes sense on a Fed day. No rush into entering or trading. Just wait until after the Fed and the volatility tapers down. Let the markets digest the news and then enter positions afterwards. That’s what prudent investors and traders would be doing anyways.

The only market taking off is the Russell 2000. Breaking out after maintaining a range going back to February of 2021.

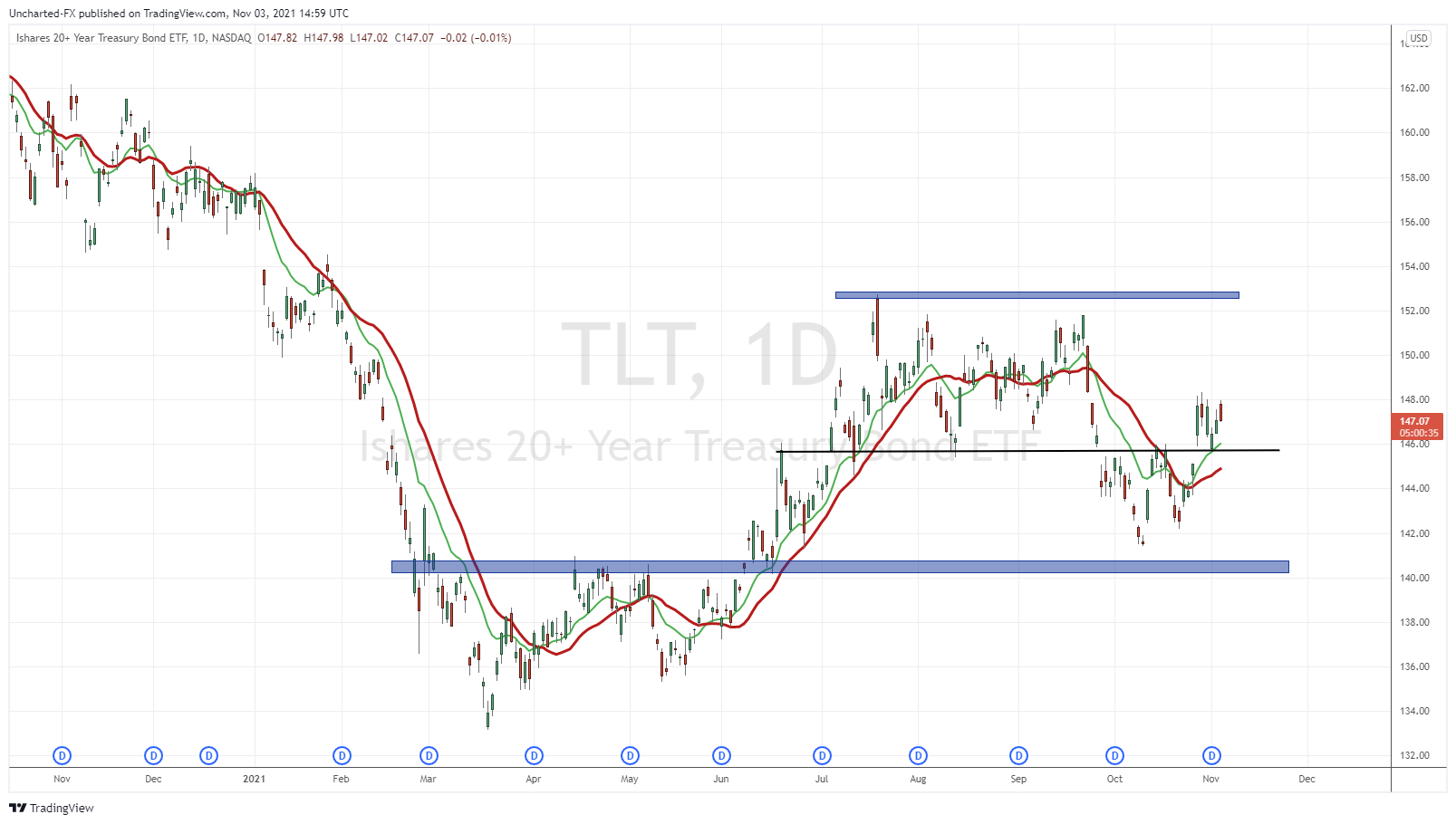

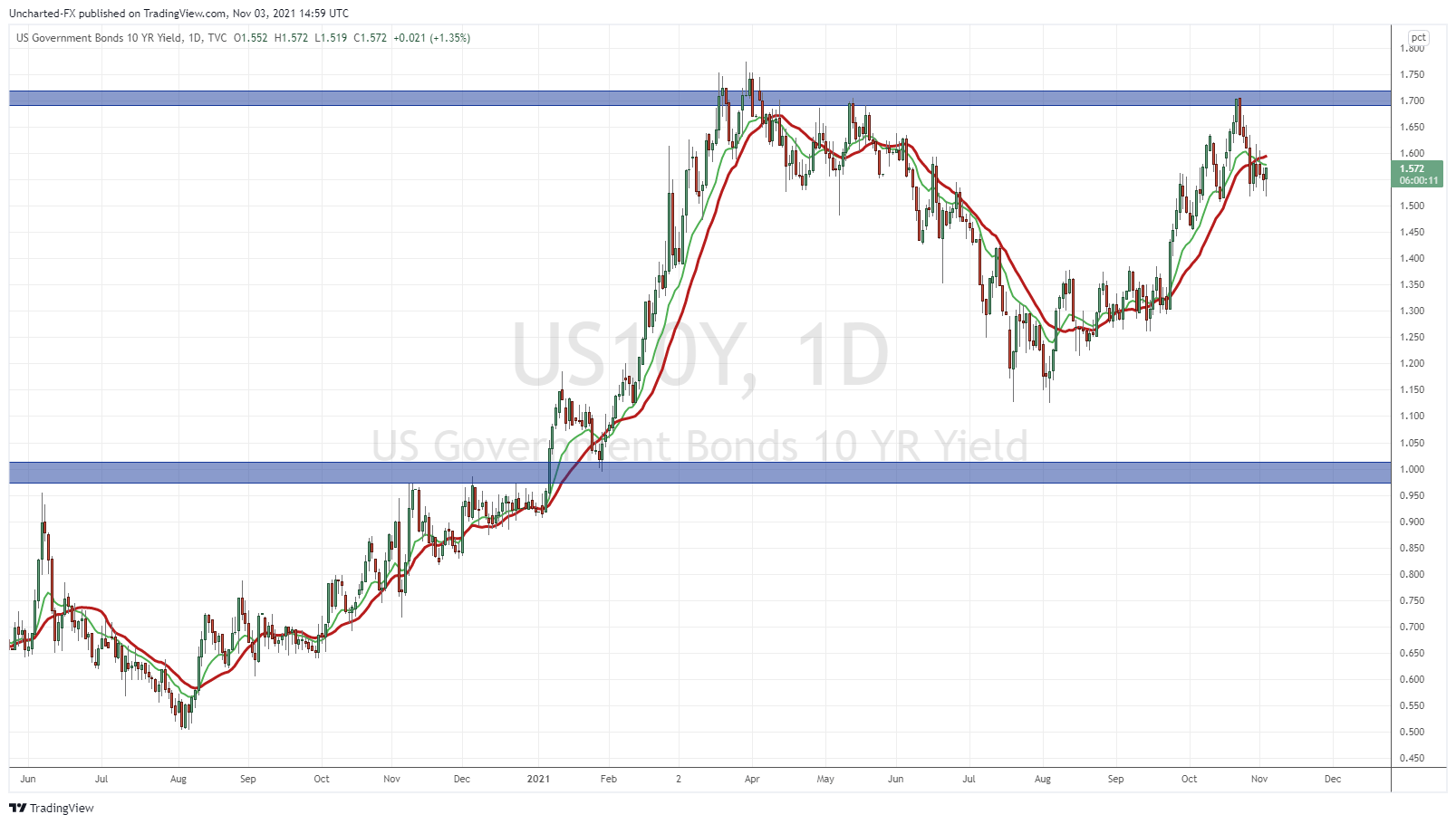

But honestly, when it comes to central bank interest rate decisions, forget about the stock markets. It’s all about the debt market and the currency. The ten year yield and TLT is what I will be watching. So far we are seeing a sell off in bonds, with rates rising. This is intraday. In terms of broader market structure, I see yields near a resistance zone of 1.70%, and perhaps a head and shoulders pattern. If this sells off, then we are seeing money run into bonds with yields dropping. Not really pointing to Fed tapering. But this is only if we break down. If yields climb over 1.70%, then the market is expecting higher rates down the road.

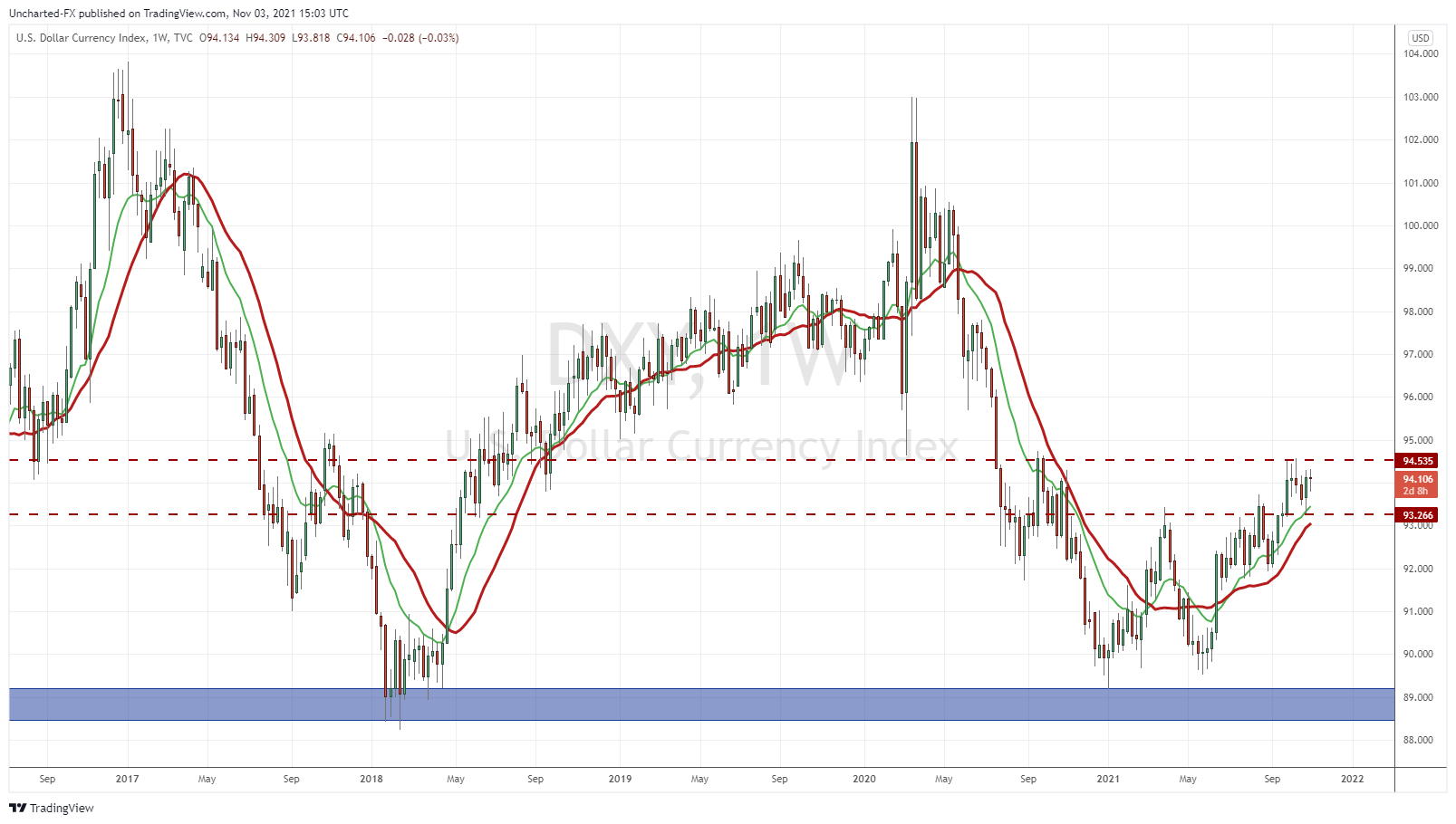

Finally, the US Dollar chart. A chart I have said is probably the most important macro chart right now. In the past few months, I have been highlighting the possibility of a double bottom pattern here on the weekly chart. It is hinting at a bullish US Dollar. This could mean either money runs into the Dollar for safety, or it is running into the Dollar because of the Fed raising rates and going hawkish. My levels are clear. A break below the 93 zone would nullify a US Dollar bull move. A break above recent highs of 94.50 means the Dollar is ready to go.

So on a final note, watch the US Dollar and the Ten Year Yield on the intraday when Jerome Powell speaks. This is where the real action will be.