| US and Global Stock Markets are under pressure! A wild day yesterday. Markets initially recovered all the Omicron variant fear drop. Things looked good until news came out that the first Omicron variant case was confirmed in the US. We saw a move from risk on to risk off. The S&P 500, which I have been bearish below my moving average, retreated and took out recent lows.

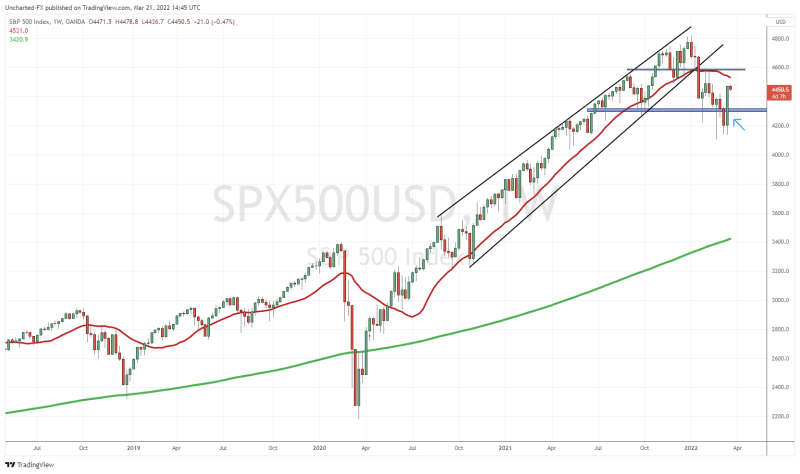

Many traders were looking at 4550 to hold as support. The bad news: we closed BELOW this support, indicating weakness. To neutralize this breakdown, we need a close back above 4550. Another point of interest is my trendline channel. As long as we remain above it, the uptrend, and bull market remains intact.

Big day today, and if we take it down to the 4 hour chart:

You can see that there is a reaction here. What was once support, is now resistance. Currently, sellers are piling in at this resistance. We shall have to wait and see if this is a dead cat bounce, or an actual buy the dip moment. If it is the latter, we need to see a strong daily candle close above 4550. If we take out recent lows at 4500, then watch out below. On the fundamental side, the Fed talking about speeding up a taper doesn’t help if one believes this market is propped up due to cheap money. Perhaps the Fed will quickly change rhetoric to say Omicron may warrant a wait and hold and see approach before changing monetary policy. Markets would love this. More brrrr? As markets sold off, the VIX took out 30.

A massive pop on the fear index. Today started out positive, as fear was subsiding. But now, another bid up in the VIX is occurring as I am writing this post. There is some support 28, let’s see if this holds.

If there is some hope here, I would be looking at two charts. First, the Dow Jones. Both the Dow and the Russell have been much weaker than the S&P 500 and the Nasdaq. The Russell is often used as the leading indicator. When the Russell is weak, it doesn’t bode well for the larger indices. The Russell was giving us warning signs. On the Dow Jones, we are approaching a major support zone. I would stretch it down to 33,000. The point is that we should expect to see buyers entering around here. However, if this turns out to be a dead cat bounce, and we close below 33,000…then I would have to say that a new bear market has initiated. We’ll talk about it more if this occurs. The sad thing about this whole situation is everyone is betting on the Fed to come in to prop things up. It’s a bit scary if you think about the long term implications, and what will happen when the party stops.

The other positive sign comes from Oil. When Oil rises, it helps prop up energy and the big banks. It plays a role in a rising stock market. Big support on Oil here at 62. If I had shorted Oil, this would be a good zone to take profits. What complicates things is OPEC+. Apparently, they have agreed to increase production to 400,000 come January. BUT, they can “make immediate adjustments” should the current market conditions shift. A lot of uncertainty here in markets, and this is the most important chart on my radar:

Bonds could be breaking out. This means money leaving stocks for bonds, or a move from risk on to risk off. Yikes. What is significant for the long term is that when bonds move up, rates move down. So the market is telling us the opposite of what the Fed is saying. No taper and no hikes. In summary, let’s wait to hear news regarding the new Omicron variant. Still conflicting reports on its severity, although it seems to infect faster. Most governments have a case count going, so if this means rising cases, it could mean more lockdowns and restrictions. In this case, the Fed would change its stance and keep easy money policy going. Bonds are telling us this could happen. |