As the US battles through Inflation and Covid, we know who will be steering the ship over at the Federal Reserve. President Biden has picked Jerome Powell to steer the ship over Lael Brainard. In a way, Wall Street breathes a sigh of relief. Bank stocks are popping, and the US Dollar is popping…which we will take a look at in just a second.

In a market and economic environment like this, the markets would rather have someone they ‘know’. Even though Brainard would have stuck the Powell course, the markets have some sense of Powell’s taper timeline. Either way, markets are happy because uncertainty is gone. We know Powell will be around for four more years. Or if you are like me…it doesn’t matter much since we know easy money will likely continue going forward.

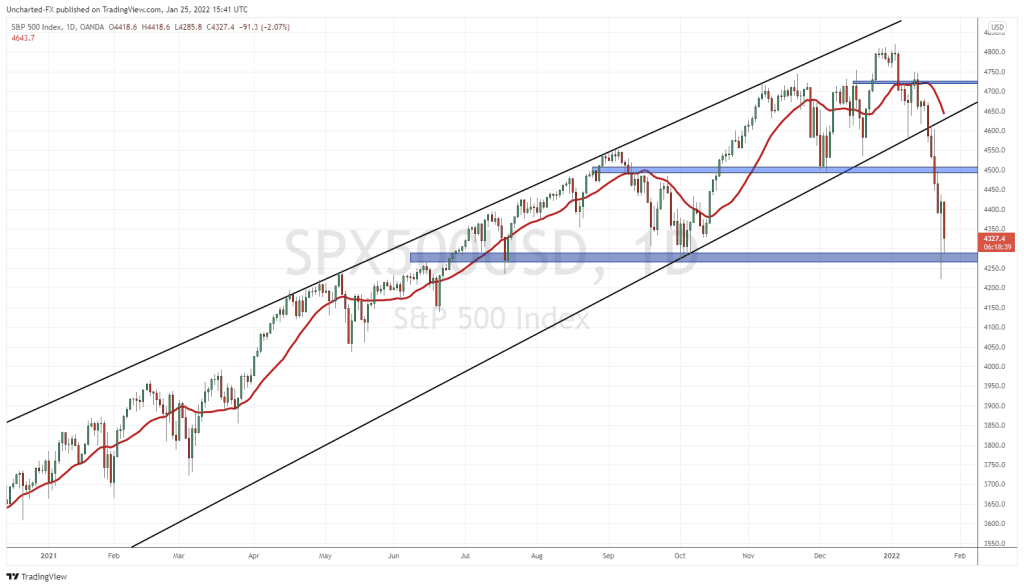

The S&P 500 and the Nasdaq hit new record highs this morning. For those wanting to play something, I would look at this:

The Dow Jones and the Russell 2000 need to play catchup. Technically, very appealing as they are retesting the breakout zone. We should expect to see buyers enter here if both of these markets follow the S&P 500 and the Nasdaq.

Back to Powell. Powell will be the Fed chair, but Lael Brainard will be vice chair of the board of governors.

“As I’ve said before, we can’t just return to where we were before the pandemic, we need to build our economy back better, and I’m confident that Chair Powell and Dr. Brainard’s focus on keeping inflation low, prices stable, and delivering full employment will make our economy stronger than ever before,” Biden said in a statement.

“Chair Powell has provided steady leadership during an unprecedently challenging period, including the biggest economic downturn in modern history and attacks on the independence of the Federal Reserve,” a White House statement said. “During that time, Lael Brainard – one of our country’s leading macroeconomists – has played a key leadership role at the Federal Reserve, working with Powell to help power our country’s robust economic recovery.”

It was not easy sailing though. The nomination comes with some controversy given the recent Fed insider trading scandal where a few Fed Presidents stepped down. Even Powell was implicated as the Fed bought municipal bonds that he owned. And let’s not forget that Elizabeth Warren isn’t a big Powell fan.

There will be some more controversy ahead. Inflation. The Fed has been telling us inflation is transitory. Markets were on edge after the last 6% inflation data print. All eyes on the next number. If it comes higher, then some analysts may be thinking the Fed is losing control of inflation. That inflation is not temporary, and the Fed will need to raise interest rates. This will be a big test for Powell and the Fed if it comes true, although the Fed has been preparing the markets for higher inflation by kicking the transitory story down the road. Supply chain issues may last until mid 2022.

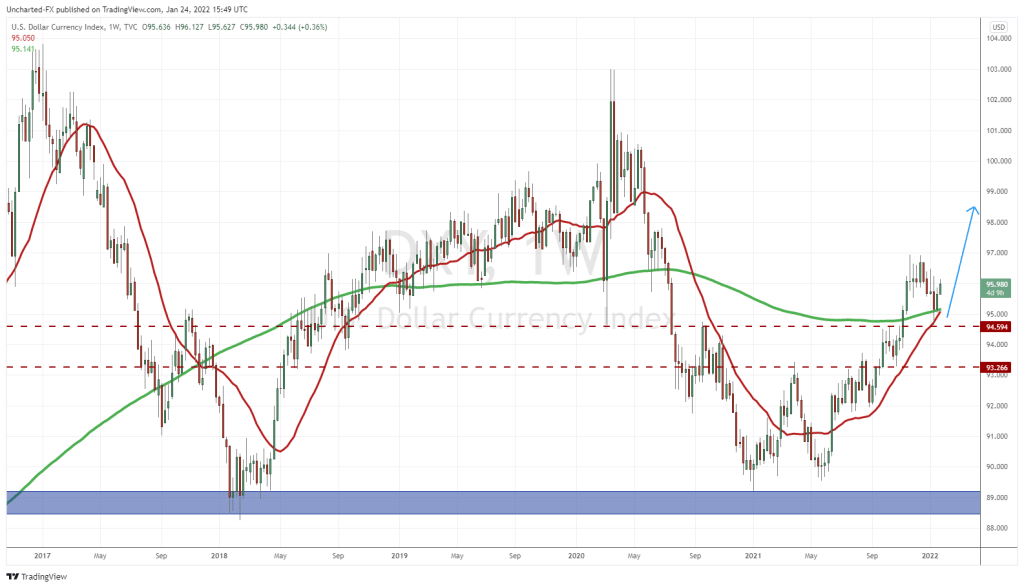

The real action was from the US Dollar.

My readers have been kept up to date on the DXY. I called the weekly double bottom pattern, and why this was super important for us. The Dollar broke above recent highs to start the week. The Dollar likes the ‘hawkish’ Powell compared to the ‘dovish’ perceived Brainard. As I said, the Dollar is either rising due to a run for safety and risk off, but we would look at the US Dollar and the Bond Market to confirm this. Or, the Dollar is rising due to expectations of higher interest rates next year. Mind you, expectations can easily be slammed down depending on Covid this Winter.

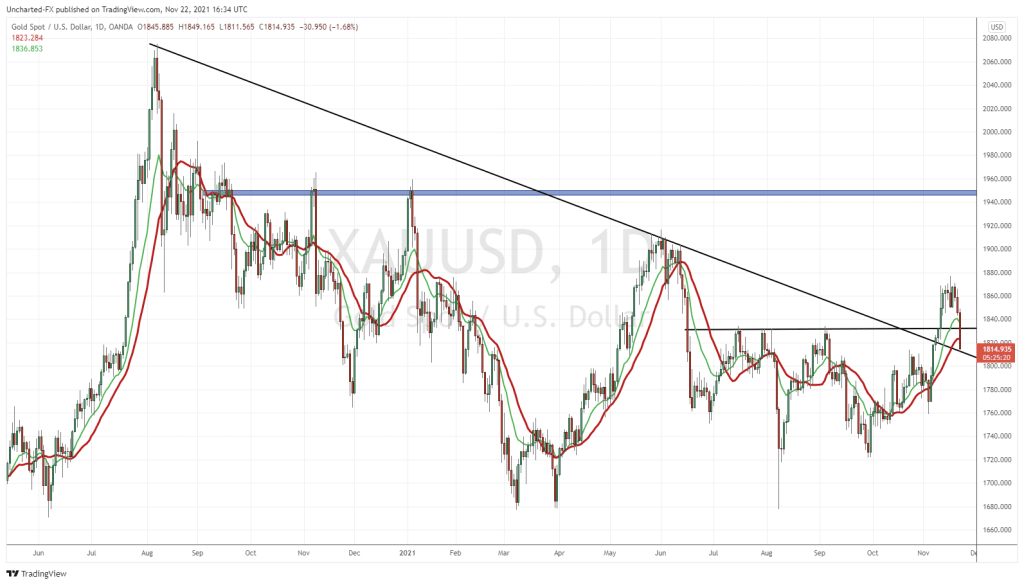

With a stronger US Dollar, comes some pressure on precious metals. Okay, a lot of pressure in this case. A hawkish perceived Powell is weighing in on Gold. A pullback was expected. The $1830 zone was my preferred pullback level. Previous resistance becoming new support. However, we have cut through $1830 quite easily. Some hope here though as we are testing a broken trendline. Truth be told, we must see buyers step in here.

My line in the sand would be $1760, since it is the higher low we are working with. But honestly, it wouldn’t look too good for Gold if we close below the support and trendline, and we close below my moving averages. Some good signs with buyers stepping in at the trendline, but it really is all about the daily close. At time of writing, stock markets are now giving up their gains, I shall watch to see if the Dollar retraces with the markets.