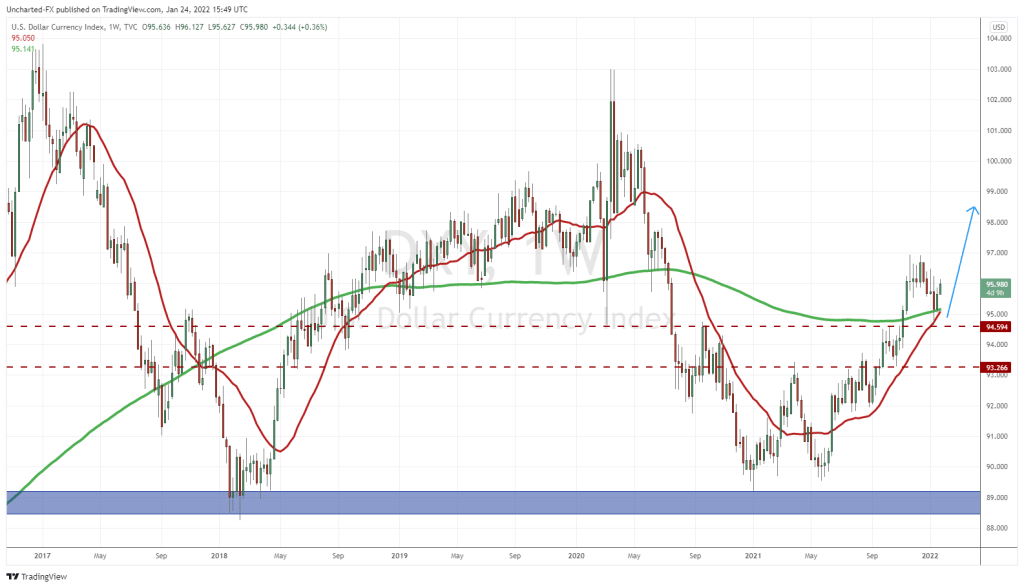

The US Dollar (DXY) has confirmed a major breakout on the weekly chart. A breakout which means that the US Dollar bull run will continue. If you are a regular reader of Market Moment, or are a member of Equity Guru’s Discord channel, for weeks I have been speaking about this LONG term reversal pattern on the US Dollar. Back in August, I spoke about the US Dollar reversal pattern on the cusp of triggering. I believe this US Dollar chart not only has me on edge, but also the Stock Markets. Let’s break things down!

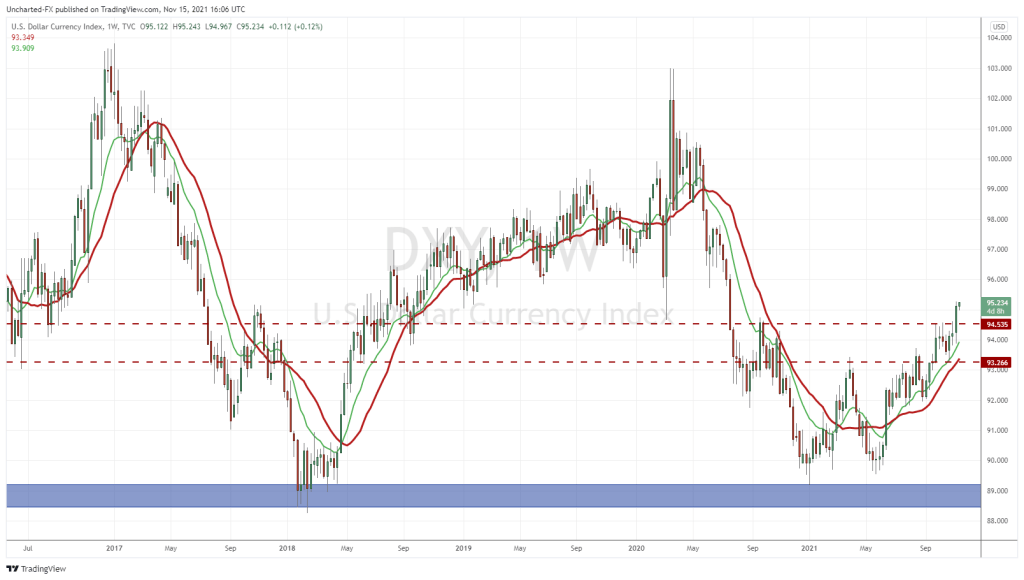

Believe it or not, but above is one of the most important macro charts heading forwards. This is the weekly chart of the US Dollar Index, or the DXY, and note last week’s candle close. Let’s do a quick review. We got the double bottom pattern confirmed with a break above the 93.25 zone. Price then ranged for 6 weeks, just bouncing between 94.55 and finding support at 93.25. Bulls stepped in on the retest of the latter zone. Very important because if price closed back below 93.25, the breakout would have been neutralized. And then as mentioned, the US Dollar broke out confirming or first higher low in a new uptrend. The higher low remains at 93.25. Very bullish signs.

Discussing why the US Dollar is rising makes things more interesting. There are two reasons and I shall go a bit more in depth about them.

- A move to safety

- Market believes the Fed will taper more and may be pricing in interest rate hikes

As many of you know, the US Dollar is the world reserve currency. The US is also the hegemon. Money tends to flow to the Dollar when there is fear, or needs a place to go for safety. The safe haven. I find the same thing happens with the Japanese Yen, and to an extent, the Swiss Franc (mostly wealth in Mainland Europe runs to the Franc…some crazy things are happening but we shall talk about this in another Market Moment). Some might find this laughable given the US debts, the money printing and what seems to be a divided US. But truth be told, the US Dollar is the best out of the fiats. It is the cleanest laundry in the pile of dirty laundry. Because the US Dollar is the reserve currency, the Fed can print as much Dollars without worrying about the debt due to the artificial demand for Dollars. What the French called exorbitant privilege. US Dollar swap lines have opened with many Central Banks around the world, with the US funneling Dollars and Dollarizing the world. If you want to go into more depth about this, I recommend you read up on the EuroDollar. Basically US Dollars printed by other banks around the world that the Fed has no control over.

But for those interested in learning more, two years ago I wrote about the US Dollar, and why a rising US Dollar would wreak havoc. The article is titled, “A Tale of Two Dollars“, and I even discussed Turkey in that piece…something relevant in 2021.

When I see money running into the US Dollar, I start to get a bit cautious. There are other charts I look at too for risk on:

One is the 10 year yield. This will be more relevant with raising rates, but currently it looks like yields want to climb long term. This means that bonds are selling off. Money tends to run into bonds for safety, so this supports point 2 rather than 1 for why the US Dollar is rising.

The VIX is the other one. Stable as of now, but the easy trade right now is to buy at the support for a quick flip. Of course any larger spike means fear and volatility are returning.

Two other quick charts on the US Dollar I want to highlight.

Keep an eye on Turkey and the Turkish Lira. Erdogan has fired multiple bankers, and the central bank has cut rates even when the Lira has been weakening. In fact, it is the weakest it has ever been. I would keep a close eye on the geopolitics of this. Erdogan is a strong man, and if he sees support dwindling at home, then he will look to blame foreigners. Maybe some military action with Greece. War is a popular way to distract people’s attention. From what I am hearing from friends who recently visited Turkey though, is that his support is pretty strong. Most people are blaming others for the weakening of the Lira and not Erdogan and the central bank.

Finally, I need to speak about Gold. I still remain bullish on both Gold and Silver. In a Market Moment post last week, I went over the technicals. “Go long” sums up my sentiment rather succinctly. But this is the most important thing to watch: If both the US Dollar and Gold move up together…then we know a confidence crisis is approaching. Generally, there is an inverse relationship between Gold and the US Dollar, but during times when people begin to lose faith in governments and central banks…basically periods when people think you know what will be hitting the fan, money runs into both Gold and the Dollar. Watch to see if this continues. We saw this happen last week. I cannot stress how important this could be going forward.

The other reason is the market believes the Fed may need to raise interest rates… and do so quickly. We saw inflation come in at the highest levels not seen for 30 years. What not many people are commenting about is that this is the fastest pace of rising inflation ever. That’s what has people worried. The Fed has protected themselves by saying this inflation will continue until mid 2022. But there might be a point where markets may begin to doubt the Fed’s ‘transitory’ inflation story. Funnily enough, this would meet my confidence crisis as mentioned in the previous paragraph. Just today, Mohamed El-Arian came out saying the Fed is losing credibility over its inflation narrative. He said what I am sure is in the minds of many market participants. There could be a point where the Fed has to admit inflation is running out of control, and would have to raise interest rates quickly to combat inflation. The last time this happened, Fed chair Paul Volcker raised interest rates above 20%.

This brings up another debated point: can the Fed even raise rates so much? Not only do consumers have a lot of debt, but so does the government. A rise in interest rates may break both. Let’s not forget that current market conditions in the stock market and real estate are propped up because of low interest rates. Have we now become like Japan, the European Union and Switzerland? Who cannot raise rates for fear of bringing down the economy. Are negative rates the only way to go?

Trust me, this topic will be discussed many times in the near future. Before I end, a quick look at markets.

The channel was discussed last week, and now we are finding sellers at previous highs. I would love to see a pullback to the 4550-4600 zone before buying the dip. Personally, as long as the Fed maintains easy money policy, markets will continue to rally. Only a black swan event could change things up. One of those could be a surprised rate hike if the Fed believes they are losing control of inflation. But that would turn into a whole sh*t show because confidence would be lost.

Since we are talking about a rising US Dollar, let me leave you with our inflation vs deflation signals. Note what happens on a rising Dollar.

Inflation Signals:

- Rising Interest Rates (A Fall in Bond Prices)

- Rise in Foreign Currencies (Euro, Loonie etc) or another way to put it, a fall in the US Dollar

- Rising Gold Prices

Deflation Signals (the opposite of the above):

- Lower Interest Rates (A Rise in Bond Prices)

- A Fall in Foreign Currencies, or a Rise in the US Dollar

- Falling Gold Prices