It is no secret that we here at Equity Guru are big fans of Nomad Royalty (NSR.TO). Earlier this year, we covered why this royalty and streamer company deserves your full attention as they closed a $95 million deal with Greenstone Gold Mines.

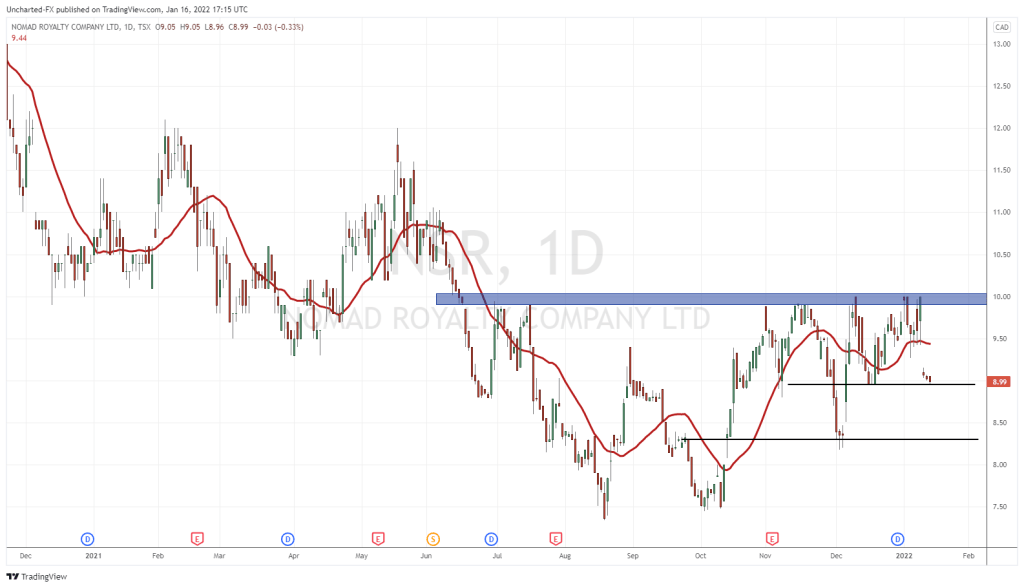

Nomad Royalty had a great 2021, and kicked off the year strong:

Their accomplishments and value didn’t go unnoticed. On May 2nd 2022, it was announced that Sandstorm Gold has agreed to acquire Nomad Royalty in an all-share transaction valued at CAD $755 million. Here are more details:

- The consideration implies a value of ~C$11.57 per Nomad share based on the closing price of the Sandstorm shares on TSX on April 29, 2022, and represents a premium of 21% at the same date.

- Shareholders of Nomad will receive 1.21 common shares of Sandstorm for each share held.

- Nomad shareholders will hold 28% of Sandstorm at the transaction’s closing. The transaction is expected to close in the second half of 2022.

Not surprising to those who follow the precious metals space. I believe we will be seeing more mergers and acquisitions in this space in the near future.

What does Sandstorm get in this deal? A portfolio of 16 royalty and streaming assets, of which 8 are currently producing mines. Also, a royalty and streamer company which posted good earnings for Q1 2022. Earnings which suggest that Nomad’s investments were beginning to pay off. Here are numbers from their Q1 earnings report:

- GEOs(1) sold of 6,604 for Q1 2022 (5,575 for Q1 2021).

- Revenues of $13.8 million for Q1 2022 ($9.7 million for Q1 2021).

- Net income of $2.7 million for Q1 2022 (net loss of $0.3 million for Q1 2021).

- Net income attributable to Nomad’s shareholders of $2.5 million for Q1 2022 (net loss of $0.3 million for Q1 2021).

- Adjusted net income(1) of $2.3 million for Q1 2022 ($1.9 million for Q1 2021).

- $21.5 million of cash as at March 31, 2022.

Readers know that my preferred way to invest in precious metals (besides owning physical!) is to invest in royalty and streamers.

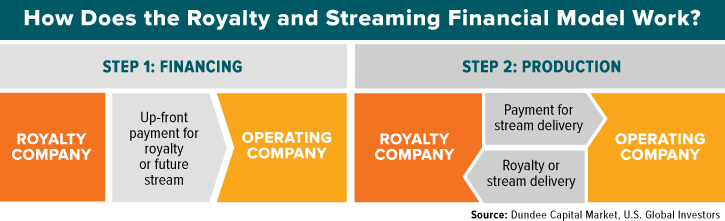

What is a royalty and streamer? Well, it is probably one of the best business models ever created. Streaming companies give cash to mining companies in exchange for a share of the mine’s future metal sales.

It’s like lending someone $10,000 to build a bakery – with the baker agreeing to give you 1% of the revenues. If the bakery never opens, you lose. If the bakery produces bread for 30 years, you win. If the price of bread triples, you win. If the bakery increases production, you win.

A royalty company is similar but they take 1% of the physical bread pulled from the oven – not money directly from the till.

A regular mining company sticks drills into the ground, uses shovels, they try to find and extract the actual Gold and Silver. It is a very expensive business factoring in the labor costs, the machinery and the costs of doing business. Their balance sheets tend to show a lot of debt, and if the price of Gold and Silver drops, they cannot just stop mining.

Streamers generally have a fixed cost (in terms of how much they loan, and labor costs), while their revenue is variable ( the price of the metals they receive varies over time). Royalty and Streamers are leveraged to the price of metals, and their charts often reflect the expectations of precious metals into the future.

Another benefit for investing in a royalty and streamer is the risk. Mining, especially in certain jurisdictions, can be risky. Certain governments may decide to change the laws and take over mines situated in their country. A royalty and streamer does not need to worry about governments increasing taxes on mining once the mine is developed and begins extraction.

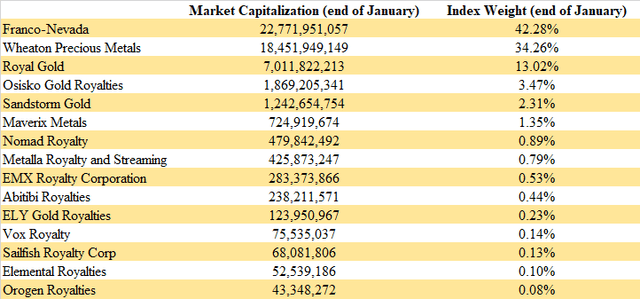

There is an ever increasing list of Royalty and Streamers, but the big five would be Franco-Nevada, Wheaton Precious Metals, Royal Gold, Osisko, and Sandstorm Gold. I am positive that we will be seeing the big boys gobble up more of these up and coming royalty and streamer companies. Especially if they are forecasting gold and silver prices to rise.

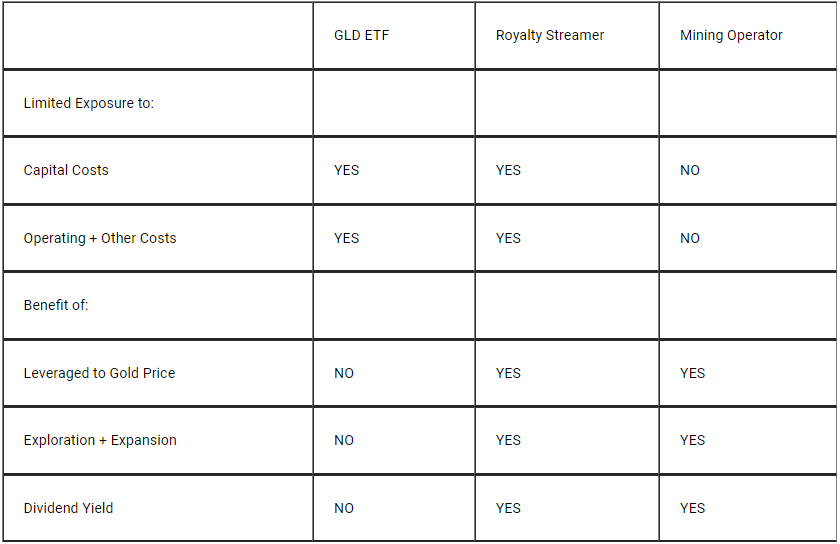

Let’s summarize why royalty and streamers are the best way to invest in precious metals.

A Royalty and Streamer maximizes exploration upside, security of tenure, and focuses on new investments, while minimizing cost exposures, margin encroachment, and involvement in mining.

Let’s break this down in comparison to the GLD ETF and a large mining operator:

The royalty and streamer wins on all fronts.

What happens when Gold and Silver fall? Because Royalty and Streamers are leveraged to the price, they tend to fall as well. But here is the kicker. A mining operator will continue to mine even if margins begin to drop (higher oil prices anyone?), and quite frankly, they start losing money. Hence why their balance sheets generally show a lot of debt.

A Royalty and Streamer will still be making money, will likely be paying out dividends, and can still hammer out catalysts for the stock price. If the management is great, they will use bear markets in precious metals to create and acquire new royalty deals which will pay off handsomely in the future.

In summary, these companies are the safest way to play the precious metals in a bull or bear market, and I highly suggest you consider them for your portfolio.

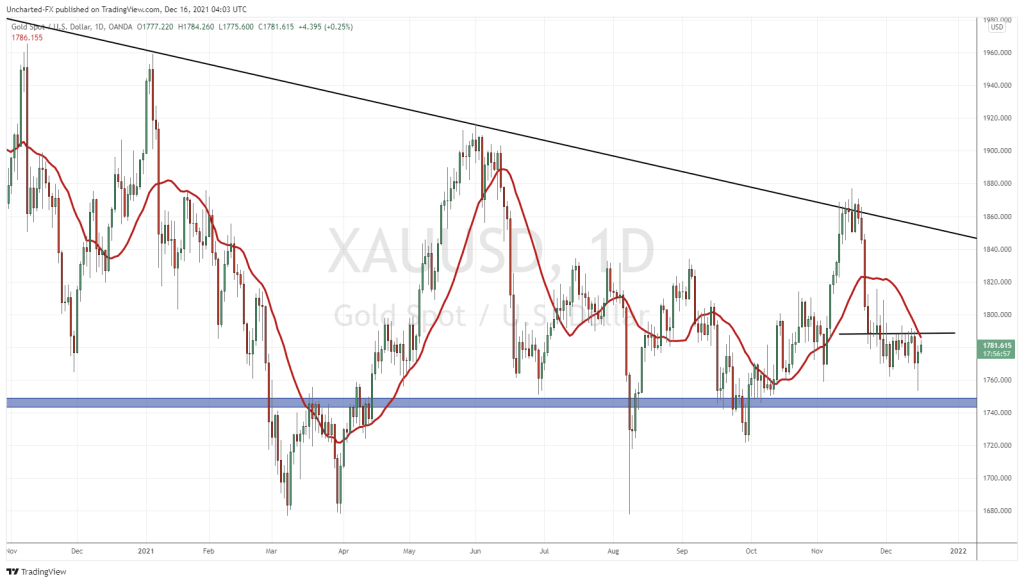

Gold has been ranging after breaking below the $1860 zone. We remain above $1800, and above my uptrend line. Can gold break below this? Sure. But I believe there are just too many support levels below. I would really start worrying if we manage to close below $1740.

$1800 seems to be the floor right now. A break and close above $1860 gets the uptrend going again. A decent chance given the fundamentals of inflation and on goings in the world. One thing to note is higher interest rates tend to hit gold since the precious metal doesn’t yield anything. However, if we look at bond yields and factor in inflation, real yield still comes in negative.

Silver has the same structure to gold. $22 is a HUGE support zone which silver has held on the weekly chart since 2020 but broke below this year! We must climb across this price level for silver to make any large move higher in 2022. To the downside, I am watching $18, but hopefully, silver can form a bottom here and reclaim $22.

Both gold and silver are showing signs of basing at these price levels. If they can break out, expect a nice move in mining stocks. But keep an eye out on those royalty and streamers. They are still making money but smart management will be looking for good deals that will pay off in the next uptrend swing.