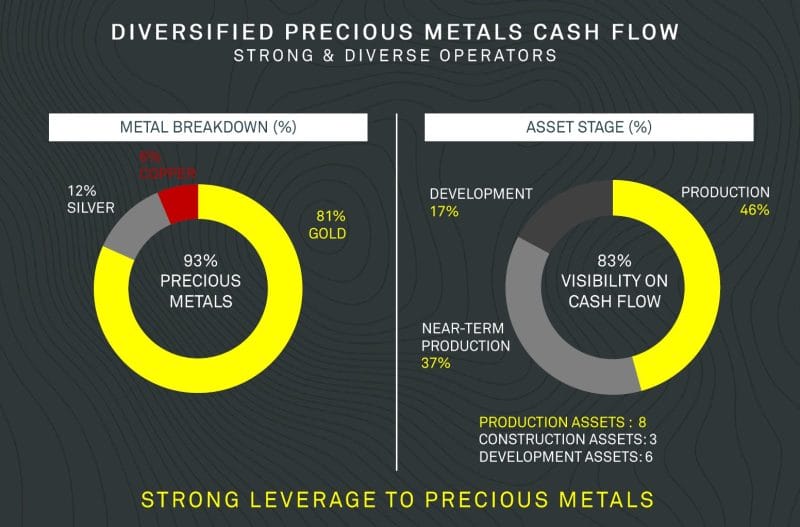

Nomad Royalty (NSR.T) (NSR.NYSE) owns a portfolio of 16 royalty and streaming assets, of which 8 are on currently producing mines. Nomad is on the hunt for additional producing and near-term producing gold & silver streams and royalties.

If bankers knew how to read drill logs, royalty and streaming companies wouldn’t exist. Lacking the geological expertise to accurately assess risk – big banks typically tremble at the knees when they get close to a proposed mine site.

“If we make a bad loan to a one mine company, we own the mine,” said David Scott, of CIBC Capital Markets in a Financial Post interview, “and we don’t want to own mines.”

Streaming companies give cash to miners in exchange for a share of the mine’s future metal sales.

It’s like lending someone $10,000 to build a bakery – with the baker agreeing to give you 1% of the revenues. If the bakery never opens, you lose. If the bakery produces bread for 30 years, you win. If the price of bread triples, you win. If the bakery increases production, you win.

A royalty company is similar but they take 1% of the physical bread pulled from the oven – not money directly from the till.

Building a mine is harder than building a bakery. When I say “harder”, I mean more things can go wrong. That’s why streaming companies assemble hybrid management teams of geologists and financiers.

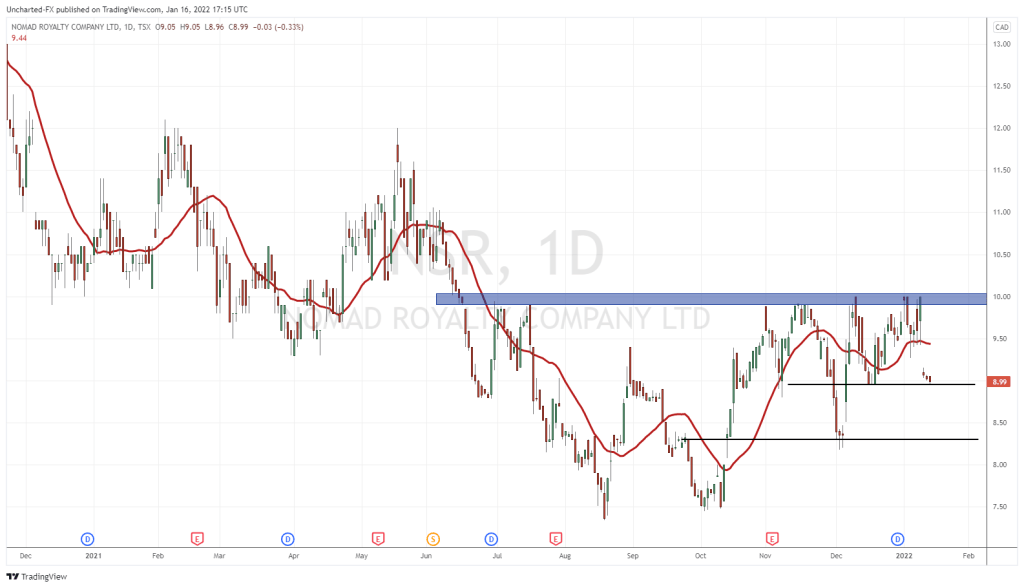

On January 11, 2022 Nomad announced that it is raising $40 million at a price of $9.10 per share.

The money will be used to fund the recently announced acquisitions of streams on the Greenstone Gold project and the Platreef palladium-rhodium-platinum-nickel-copper-gold project.

A month ago, Nomad announced the closing of the first deposit of $13.3 million under its previously-announced gold purchase agreement with OMF Fund II (SC), a subsidiary of Orion Mine Finance, with respect to its 40% interest in the Greenstone Gold Mines.

Nomad is required to make up-front cash payments totalling $95 million, of which $13.3 million was made in mid-December, for 5.9% of gold production attributed to Orion’s 40% interest in GGM until 120,333 ounces have been delivered, and 3.958% thereafter.

120,333 ounces of gold at $1,800/ounce is worth $216 million.

A second and final deposit of $81.7 million is expected to be advanced no later than June 30, 2023 under the Gold Stream.

Nomad is also provided the following updates:

BLYVOOR UPDATES 2022 GUIDANCE: Blyvoor Gold Capital Pty has revised 2022 gold production to 40,000 to 50,000 ounces. The updated 2022 budget accounts for a slower ramp-up to the initial 80,000 ounce per year run rate, primarily as a result of a delay in opening up new mining areas on levels 23 and 25.

WOODLAWN STRATEGIC PROCESS NEARING COMPLETION: The strategic process at the Woodlawn mine is nearing completion. Given the longer than expected timeline to complete the restructuring and restart of Woodlawn, Nomad now does not expect any deliveries from Woodlawn in 2022.

ROBERTSON RESOURCE DEFINITION PROGRAM CONTINUES: On November 4, 2021 , Barrick Gold Corp. announced that resource definition drilling is ongoing at Robertson.

GREENSTONE CONSTRUCTION RAMPING UP: Greenstone is ramping up to full-scale construction, and first gold is scheduled for the first half of 2024. The development is well advanced with 85% of the project engineering completed.

MERCEDES OPENING NEW OREBODIES: At Mercedes, work is underway on a large development program that will increase access to multiple ore bodies. The Mercedes mine was recognized for the eighth consecutive year as a Socially Responsible Company by the Mexican Centre for Philanthropy (CEMEFI).

SOUTH ARTURO OPERATION CONSOLIDATED BY BARRICK: Barrick acquired the 40% interest in the South Arturo Joint Venture that it did not already own. Nomad is entitled to deliveries from Barrick of 40% of the ounces of refined silver in attributable production from the existing mineralized areas at South Arturo and 20% of ounces of refined silver in attributable production from the exploration stream area.

RDM EXPLORATION PROGRAM RESTARTED: Higher volumes of low grade were mined during the third quarter, but the operation still achieved production of 15,880 ounces, and RDM remains on track to achieve 2021 guidance of 60,000 to 65,000 ounces.

MOSS EXPANDS DRILL PROGRAM: Elevation Gold’s program intersected thick zones of significant stockwork-hosted precious metal mineralization in the Gold Bridge area and provided further support for the potential to amalgamate the West and Center pits into a single pit.

TROILUS CONTINUES FAST-PACED DEVELOPMENT SCHEDULE: Following completion of 150,000 metres of drilling, Troilus Gold anticipates releasing an inaugural reserve and initiate the federal permitting process. During the second half of 2022, Troilus plans to release a feasibility study. A construction decision is expected prior year end 2022.

ARTEMIS RAISES $141 MILLION TO FUND DEVELOPMENT AND CONSTRUCTION OF BLACKWATER: On November 16, 2021, Artemis Gold announced a $141 million definitive Precious Metals Purchase Agreement which will be used to fund the advancement of the development and construction of the Project. The start of construction for Blackwater is currently targeted for the second quarter of 2022.

O/M Partners works with institutional and independent money managers who are mandated to buy stock in the open market.

In this November 23, 2021 video, O/M interviews Joseph de la Plante, Founder and Chief Investment Officer of Nomad about the company’s business objectives.

“Earlier this week, we announced a very significant streaming transaction on the Greenstone Goldmine in Ontario, Canada,” explained de la Plante, “This highlights our team’s unique expertise and ability to structure very large transactions in the streaming space.”

“It demonstrates that we have a unique pipeline of opportunities and now we’re executing from that pipeline to create value for our shareholders. And it demonstrates the strong alignment that we have with Orion mine finance, a leading mining finance provider to the mining space and our largest shareholder.”

“By 2024, we will begin receiving our first deliveries from this investment. And these deliveries will be very significant to our portfolio. The mine has a large resource at 5.5 million ounces currently”.

“As we typically see from these mines, once they get up and running, the operators continue to define existing resources and discover new resources which eventually make their way into the mine plan, adding value to our underlying gold stream.”

“From this asset, we will get all the typical benefits that we see with royalty streams being number one in partnership with a very large company Equinox, significant near-term deliveries and cash flow to Nomad.”

“Another important part of this streaming transaction is a new, innovative ESG feature that we were able to structure with our partners where for every ounce of gold delivered to Nomad, we will pay $30. The purpose of this of this funding is for Nomad to give back to the communities around the operation. It’s a very significant investment on our part, it’s new to the royalty space.

“There are no other structures like this, currently. And we think it’s something that demonstrates our high alignment with the operators and our commitment to ESG as a company operating in the mining space.” – End of Joseph de la Plante.

- Quarterly deliveries of 4,772 gold equivalent ounces

- Gold ounces earned of 2,527 and silver ounces earned of 29,929

- Revenues of $6.1 million

- Net income of $0.9 million and adjusted net loss of $0.9 million

- Net income attributable to Nomad’s shareholders of $0.8 million

- Gross profit of $2.1 million

- $24.6 million of cash as at September 30, 2021

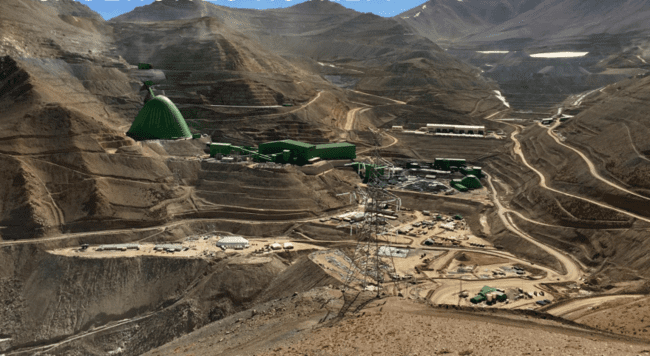

- Completed the acquisition of an additional effective 0.351% net smelter return royalty on the producing Caserones copper mine in Chile

- Commenced trading common shares on the New York Stock Exchange under the symbol “NSR”

- Declared a quarterly dividend of C$0.05 per common share for a total amount of $2.3 million paid on October 15, 2021

Nomad Royalty is a young company with a market cap of $509 million.

As royalty and streaming companies get bigger, they typically become efficient cash generators (unlike miners, they don’t own trucks, run airborne surveys, negotiate with unions etc).

For example, Franco-Nevada (FNV.TSX) and Royal Gold (RGLD.NASDAQ) have combined market caps of $32 billion, and an average operating margin of 55%.

The operating margin is a diagnostic on the core financial engine of the company. It ignores freak expenses or windfalls. If you sold a nickel mine for $100 million, that shows up as revenue, but doesn’t affect the operating margin.

That figure of 55% confirms that commodity royalty and streaming is a powerful way to make money.

In contrast, General Electric (GE.NYSE) and Amazon (AMZN.NASDAQ) have combined market caps of $1.8 trillion, and average operating margins of 4.6%.

Last quarter, Nomad Royalty amended its revolving credit facility increasing the amount from $50 million to $125 million.

It declared a cash operating margin attributable to Nomad’s shareholders of $5.1 million representing 88% of revenue attributable to Nomad’s shareholders.

Full disclosure: Nomad is not currently an Equity Guru marketing client.