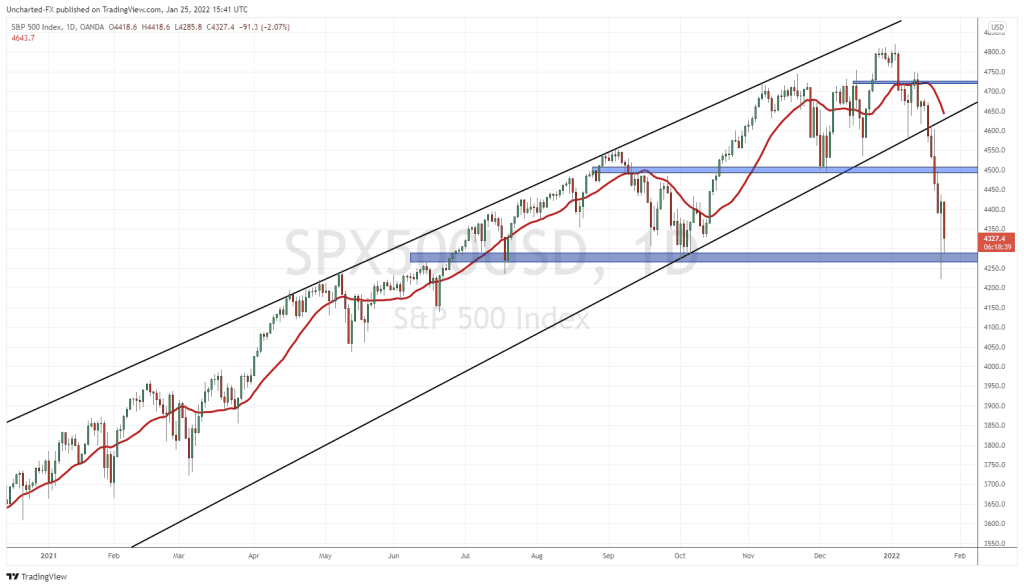

How many have you searched for “Stock Market Crash” this weekend? Come on, hand’s up! Stock Market’s are making headlines but not about new record highs. All US markets have had a considerable correction, and it has investors spooked.

Risk on assets, including Bitcoin and cryptocurrencies, are taking a hit. Precious metals were performing well, but today, they are also dropping. Reminiscent of the pan sell off we had in early 2020. Money is running into cash and risk off assets for safety. Primarily bonds and the US Dollar.

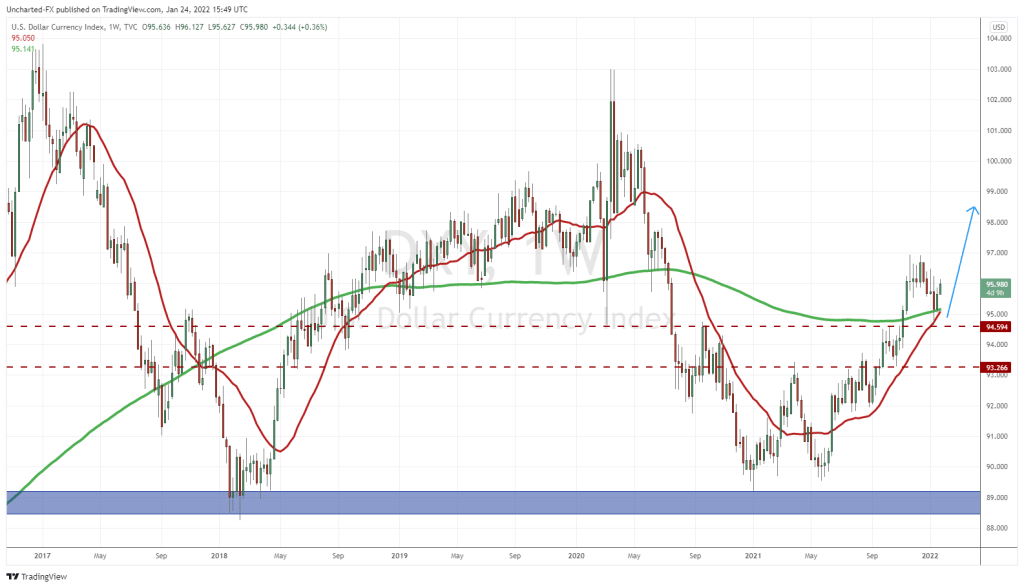

The US Dollar, or the DXY, is what I want to focus on today. Readers know that I have a bullish outlook for the US Dollar. I mentioned the major weekly reversal pattern breakout confirmation back in August 2021. The proof is here. Technically, we have continued higher with one higher low weekly chart swing. And I think our second higher low swing might be in the works right now.

So why the US Dollar when the Fed has printed so many Dollars? Good question. It is because currently, the US Dollar is the world reserve currency. This status will get challenged and questioned in the future, but as of now, it puts the US in a strong position. The French called this status ‘exorbitant privilege’ because the US can print as many Dollars without worrying about the debt. Why? Because there was always an artificial demand for the Dollar. This is why the Fed has bailed out other countries by printing US Dollars, and as some call it, have ‘Dollarized’ the world. Read about all the currency swap lines the Fed has set up since 2020. Marin Katusa does a good job explaining this in his new book “The Rise of America“.

While the Fed has artificially kept interest rates low for a long time, many emerging market countries borrowed US Dollars. Turkey is a good example. If you are a corporate in Turkey, would you borrow Lira for interest in the double digits? Or borrow US Dollars, which are freely available to borrow, and at a much lower interest rate? Many emerging markets opted for the second and they did not bet on epic US Dollar strength, so they would have to pay back with stronger Dollars. This is why you will be hearing about emerging market US Dollar denominated debt in the next while.

As I have said in previous posts, a strong US Dollar will actually wreak havoc. Chinese President Xi Jinping has pleaded with the Fed to not raise interest rates. He is warning about emerging markets US Dollar denominated debt. He said this during the virtual Davos conference lase week:

“If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spillovers. They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it,”

The People’s Bank of China actually cut interest rates by 10 basis points because of the economic slowdown due to Omicron. Some say it is for a different reason: to help out banks and Chinese real estate firms deal with the real estate issue. Xi realizes that China will be forced to abandon easing policies when the Fed raises rates. China is burdened with debt, namely in the real estate sector, and developers such as Evergrande cannot currently climb out of its financial grave. But the important point is that China is doing the opposite of what Western central banks are claiming they will do.

Capital will begin to flow from China to the US once it becomes an increasingly attractive place to park money. If America decreases the demand for imports, Chinese exports will feel the brunt of the burden. China heavily relies on its top trading partner, with over $463 billion entering the US through November. This would require China to change their strategy to follow the Federal Reserve…but China still wants cheap money. Adds more drama to the Thucydides trap that is the US and China.

This very well could be the beginning of the US Dollar move which could wreak havoc on financial markets and countries. So much so, that nation’s might band together and force the US to devalue like they did with the Plaza Accord.

I am a fan of Brent Johnson’s US Dollar Milkshake Theory. Here is a video explaining why the Dollar will get a huge run:

Money tends to run into the US Dollar for safety because it is the best fiat out of the bunch. It isn’t perfect and has a lot of problems, but compared to everything else, it is the best option mainly because of its reserve status.

Add the element of a hawkish Fed, and you have a fundamental reason for the Dollar to move higher. If the Fed is going to raise rates multiple times to combat inflation, then the Dollar will look more attractive based on interest rate differentials. If the Fed changes stance…the Dollar may drop, but I think it would garner some bids because of its risk off safe haven status.

Currently Stock Markets are dropping either due to fear of easy money policy ending with an imminent rate hike (maybe as soon as this week!) or because of fear due to the escalating Russia-Ukraine issue. The Dollar is getting a bid either on higher interest rates, or safe haven status.

Take your pick, but this is why I prefer the technicals. I do have a long term fundamental outlook, but the technicals indicate when to enter and exit. Let’s take a look at the very important chart that is the US Dollar.

Quick recap: the US Dollar confirmed the double bottom weekly breakout in September 2021. We then pulled back to retest in the following month in October. We continued higher confirming our FIRST higher low in a new US Dollar bull run. After hitting 97, the Dollar ranged for weeks before pulling back. But we pulled back to support at 94.50, and are seeing bids as expected.

For those interested in Moving Averages, the green one is my 200 day moving average. The Dollar not only retested support, but popped on the retest of the 200 day moving average. Very important as many analysts use this technical indicator for continuation. As long as price remains above the 200 moving average, we remain in an uptrend. So two major confluences here.

I am seeing evidence that a second higher low swing is being printed at 94.50, meaning we will take out recent highs above 97. I am targeting resistance between 99-100.

The technicals remain bullish on the weekly chart of the Dollar. We would need to close below 93.30 to nullify the uptrend. The Dollar is standing firm and has a fundamental case based on rate hikes and geopolitics/risk on. Is this finally the major Dollar run the Dollar Milkshake Theory has been predicting? I think there is a very good chance we see some US Dollar strength here in 2022.