Markets have already opened with a bang. The S&P 500 and the Nasdaq making new record highs, with the Nasdaq finally pushing above our 4 hour resistance zone, and the Russell lagging behind. I am still in my Dow and Russell long trades. On the fundamentals side, we have President Trump announcing a new plasma treatment against covid, and North Korean leader, Kim-Jong Un, is reportedly in comatose...again. This is the last full week of August, and so ends the summer trading months. We should expect to see volume return and normalize as soon as next week, as wall street traders and managers come back from their breaks. The weekly economic schedule is not too heavy, but all eyes will be on the Jackson Hole Symposium, which is a central bank conference which sees the heads of central banks from around the world, economists, financial market participants, academics, U.S. government representatives and news media to discuss long-term policy issues of mutual concern. Specifically, all eyes will be on Fed chair Jerome Powell’s speech on Thursday, as he is set to address the Fed’s commitment and plans for achieving their inflation targets. In today’s market moment post, I want to address something I said I would last week: the US Dollar.

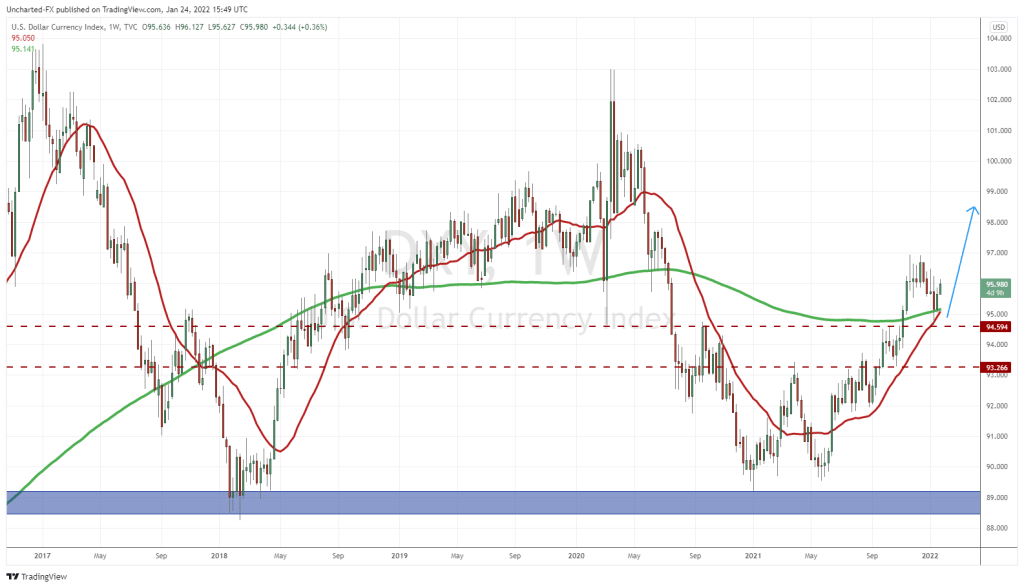

Last year, I wrote a larger post regarding the US Dollar as it pertains to geopolitics and the financial markets titled “The Tale of Two Dollars”. The idea was similar to Brent Johnson’s Dollar Milkshake Theory. That the Dollar will rise, which will cause a lot of problems in the world, before having to be “killed” by the Fed, as the world gets together to condemn a stronger Dollar. A second plaza accord would be agreed upon, the last one of which saw the Dollar devalued by 40%.

The concern here is emerging market debt. Not all, but the ones which do not have sufficient foreign reserves (Dollars) to cover the debt. Red flags are for emerging market countries that have huge debt but less than half the amount of foreign reserves to cover the debt. The top 5 nations of concern are Turkey, Argentina, Mexico, Chile and Indonesia.

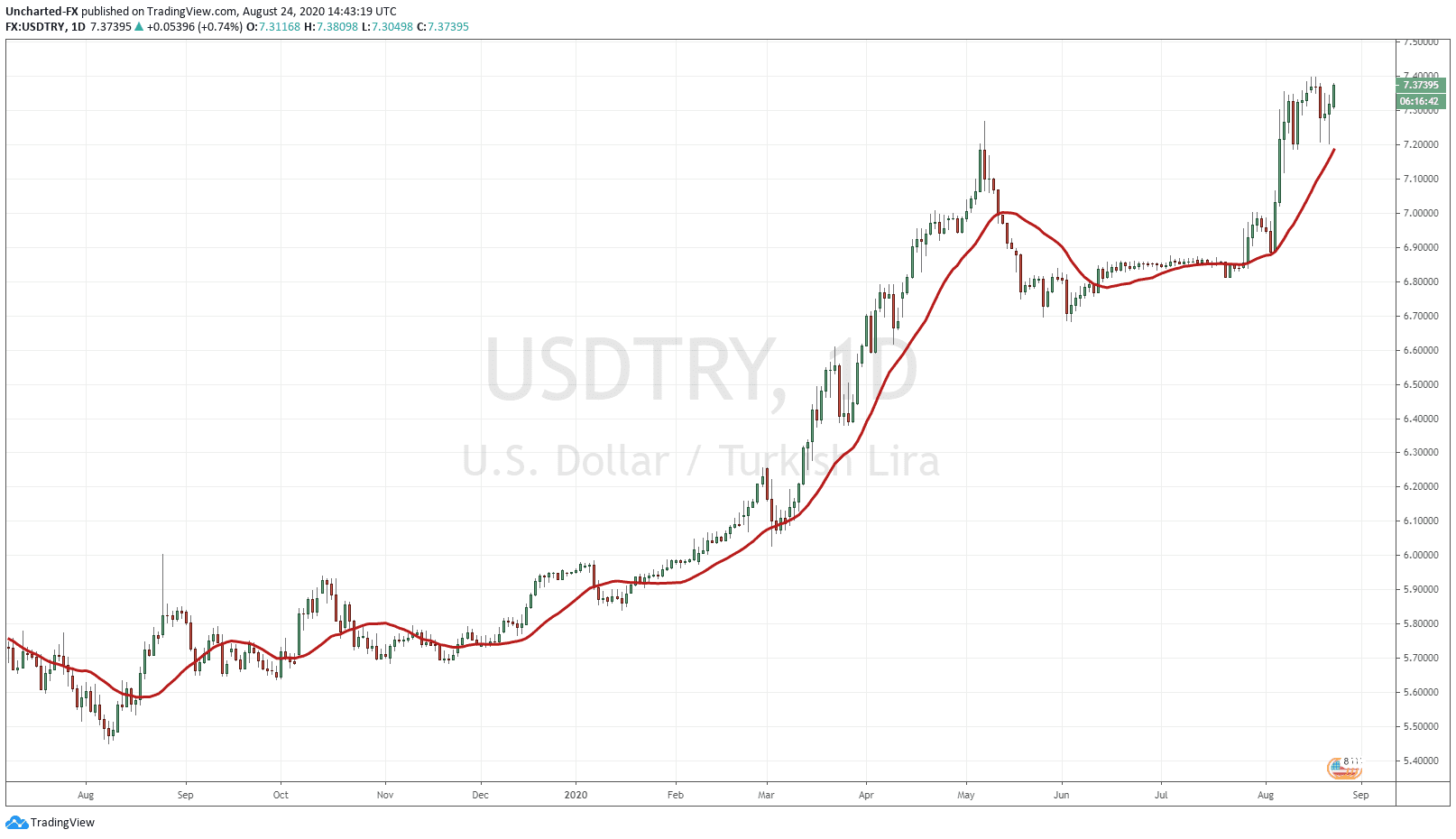

Turkey should have caught your eye. It explains a lot of crazy things happening in Turkey as Erdogan tries to keep the country distracted by enemies outside their borders, while the country is imploding financially. Ventures in Iraq and Syria, attempting to make Hagia Sophia a Muslim mosque, and now encroaching on Cypriot and Greek waters all point to a man attempting to cause distractions. The truth is the Turkish Lira is getting decimated, and Turks have been buying US Dollars to get out of the Lira.

Now this is where my past article comes in…is the Fed actively weakening the Dollar in order to try to prevent the Turkish Lira from imploding? It seems like it. Perhaps we are at the stage where emerging markets are already getting hit and action is required.

But onto the bullish case for the Dollar. I think the US Dollar will be getting a bid here due to foreign money. Put yourselves in the shoes of a European or Asian money manager. Asian markets have been moving quite nicely, but European markets, besides the German DAX, have not even come close to ripping rallies like their American counterparts. Remember, a bull market in US markets has officially begun with the move into record highs last week. For the money managers who missed that entire move, they will be sure to not miss this breakout.

The S&P 500 breakout with a strong green candle was key. Money is on the sidelines awaiting more confirmation of a sustained break with large momentum. What I am predicting to see is foreign money then BUY Dollars, in order to be able to BUY US stocks. US markets are outperforming that fund managers cannot afford to not be in US stocks. Also, to be honest, economically, the US is in better shape than most western nations. I mean it is still bad, but it is, as some say, “the prettiest sister out of all the ugly sisters”.

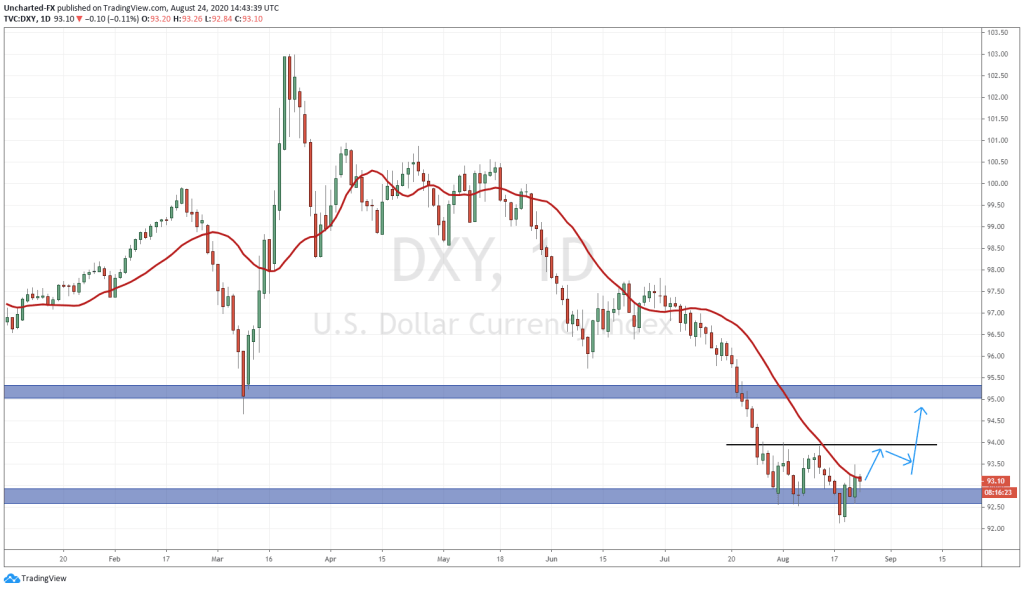

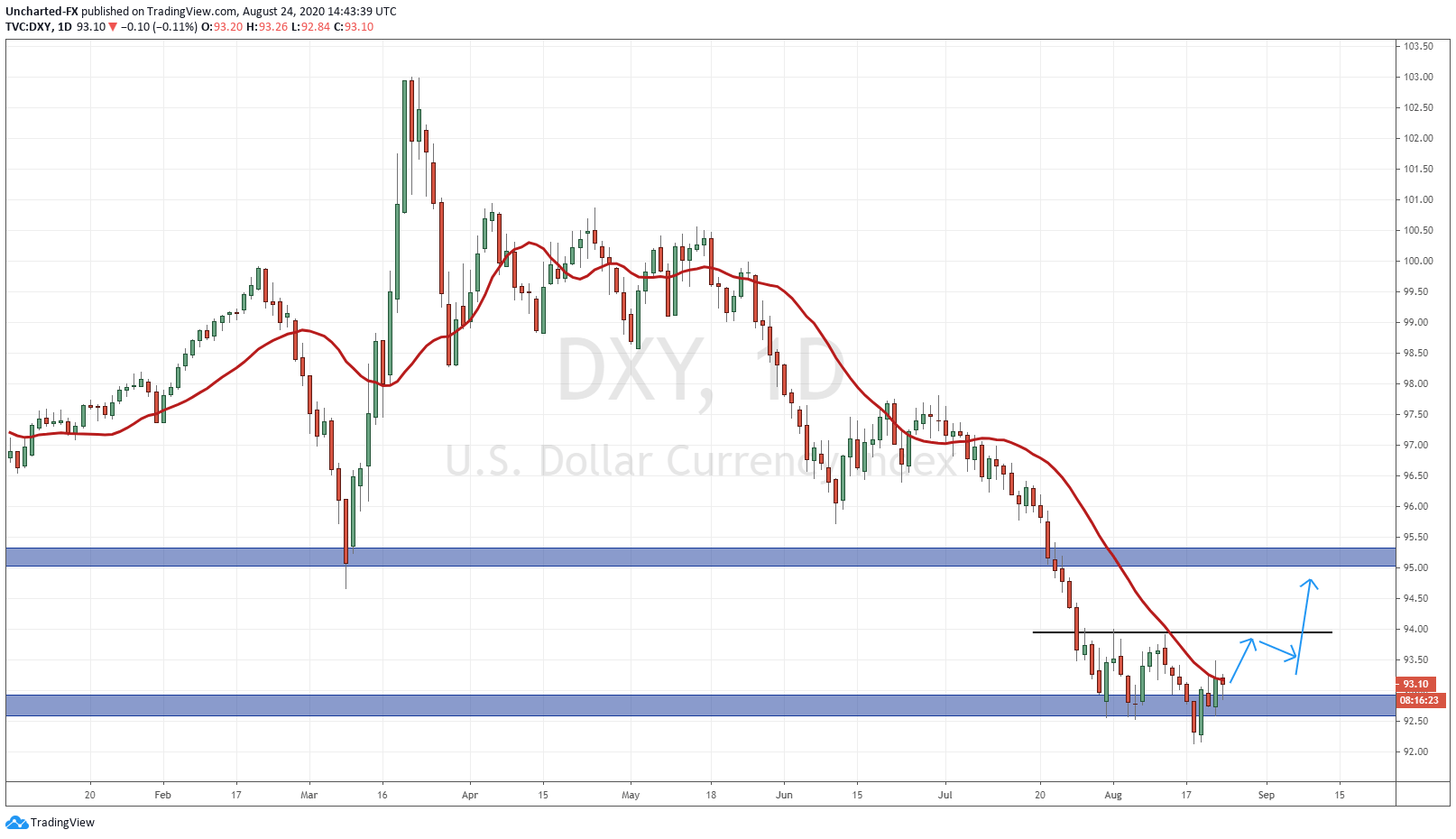

The Dollar has been on a fall for the past few weeks. You can clearly see the downtrend with the lower highs and lower lows. We then began to base at a major support zone at 92.50. From here, we have seen a battle between the bulls and the bears. There is a potential that we see a reversal by way of an inverse head and shoulders pattern I have drawn out. This could either be the beginning of a new uptrend, or just a pullback to the 95-96 zone. We will assess candle by candle.

The key here is that the Dollar will not be rising due to a run for safety, with the greenback being a safe haven currency. It will be moving higher due to foreign money purchasing Dollars in order to purchase US stocks.

Also want to highlight my current trade idea in shorting Silver and Gold, which will be a pullback or a correction in my opinion. It is entirely possible that this Dollar case I have presented, is what causes the Silver and Gold pullback. Currently, the Dollar chart is seeing buyers step in around 93.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA