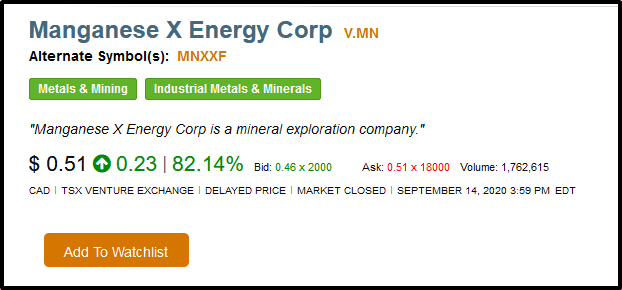

September 14, 2020 the shares of Manganese X (MN.V) gained 82%, jumping from .28 to .51 on 1.7 million shares traded.

By the end of the trading day, MN had a market cap of $40 million.

Note: by 8:30 Tuesday September 15 8:30 a.m. Vancouver time, MN is up another 21% to .62 on 1.8 million shares traded.

Usually, when a stock surges violently (up or down), the catalyzing event is not hard to identify.

Bonanza drill results, FDA approval, robust financials, buy-out rumours…etc.

Yesterday, there was no news so the bull-board pundits poured into the information vacuum, trying to explain the cause of the share-price surge.

“Why would this stock steadily and slowly climb, followed by the sudden surge upward today, right after an 8 cent PP?,” asked Kdog1CA on Stockhouse, “Can it be strictly FOMO [Fear Of Missing Out]? Maybe…but we could also be sitting on a hidden treasure at Battery Hill with the full story yet to be told.”

“Anonymous has been buying… they need to stay incognito,” wrote @scrappydoo on CEO.CA, “TSXV must be thinking halt pretty soon here. They’ll want the company to respond to a 75% price surge.”

“It is not retail that is driving the SP upwards nor is it CEO readers,” posted @deepstate, “It is institutional buyers that are trying their hardest to accumulate before Battery Day. The problem for them is that no one is selling.”

CEO.CA has a lot of smart, dialed-in members.

If you scroll up on the CEO.CA Manganese X bull-board, you’ll find one member of the community who smelled the future.

“I have been buying shares in Manganese X Energy (MN.V) (MNXXF) recently on hype of Tesla’s upcoming battery day on September 22,” revealed @Rougetrader719 a week ago.

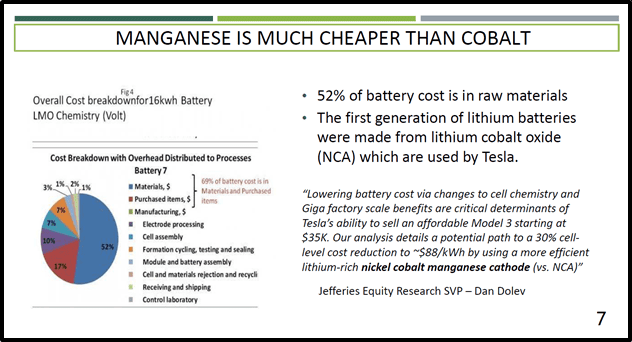

“As electric vehicle companies move away from expensive cobalt as an input to their battery,” continued @Rougetrader719, “Nickel is seen as the prime victor in an NMC (nickel-manganese-cobalt) battery. Cobalt is over $30,000 per tonne and nickel ranges between one-third and one-half of that price. But the third component of that trio – manganese – is priced at less than one-tenth of cobalt. If the prime motivation of EV car producers like Tesla is to get the cost of the batteries down in order to make more affordable vehicles, manganese is the way to get there.”

“Manganese is beginning to play a critical role in the evolution of new off-grid power storage systems, and cutting edge solar energy (storage) technologies,” reported Equity Guru’s Greg Nolan two weeks ago when MN stock could be purchased for .20.

“This brittle, silvery-gray metal was recently added to a list of 23 elements critical to the US economy,” continued Nolan, “Manganese X appears to hold significant tonnage potential in the subsurface layers of its 1,228-hectare flagship Battery Hill Project in mining-friendly New Brunswick.”

On September 14, 2020 – two hours after the market closed, Manganese X put out a press release.

“Manganese X is pleased to announce that it has completed the tendering of drill contracts related to the upcoming drill program at the Battery Hill project located near Woodstock, New Brunswick. The program is expected to commence within the next three weeks.

Previous holes intercepted significant grades and widths of manganese mineralization such as 10.75% Mn over 52.6 meters (core length), 12.96% Mn over 32.85 meters (core length) and 9.39% Mn over 74.0 meters.

The upcoming drill program will consist of approximated 20 holes totaling a minimum of 3,000 meters. The intent of the program is to upgrade the current classification of mineralization to inferred or higher resource status. The program will focus on near surface, higher grade areas of the deposit such as the Moody Hill zones.

Upon successful completion of the drill program and ongoing metallurgical studies recommended in the June 2020 NI 43-101 technical report, work will be initiated toward the completion of a preliminary economic assessment (PEA)’.

“We are excited to get the drills turning so we can prove out our manganese asset that borders the US,” stated Martin Kepman, CEO of Manganese X Energy, “Companies like Tesla have indicated they want to source battery material from the North American supply chain and we intend to be part of it.”

“One of Earth’s most abundant metals, MANGANESE could help replace expensive cobalt in battery cathodes,” wrote Stocklover83.

“The demand for energy storage is too great for one technology to fulfill it, so we’re looking for environmentally friendly, safe, inexpensive alternatives,” said Jason Croy, a physicist in Argonne’s Chemical Sciences and Engineering division. “Manganese is a good option for that.”

“Float is 56 million shares,” observed @scrappydoo, “and 50 million of them won’t sell at any price right now.”

- Lukas Kane

Full Disclosure: Manganese X is an Equity Guru marketing client.