The US stock markets continue their chop fest and range as the rally to start 2023 is set to be tested by first quarter earnings. Investors have been expecting earnings to be somewhat mixed or tepid as higher interest rates begin showing their impact on the real economy and resulting in an economic slowdown or recession. The bond markets actually are pricing this in, with interest rate cuts expected around Q4 this year.

Many companies did mention negative forward guidance in Q4 of last year. Mentioning things such as inflation adding to their costs while the consumer economy adjusts to higher rates.

With corporations announcing that demand is slowing, and profits are coming down there really aren’t too many catalysts to motivate stock market bulls and buyers. While investors are seeking clarity of the path of interest rates, the market narrative could be about to change from “Fed pause and rates have peaked” to “recession and when does the Fed cut?”. Keep in mind the Fed has said many times that the economy should expect interest rates to be higher for longer. To do whatever is needed to bring down those inflation numbers. Saying this, falling CPI data could be the catalyst to bring life to the markets.

Before we delve into some earning reports for this week, let’s take a look at what’s coming next week.

Some big names such as Microsoft, Google, Meta and Amazon will be announcing results next week. I will be closely following the earnings of Visa and Amazon. I am seeing signs of the middle class and consumers going more into debt to survive this inflationary wave, maxing out their credit cards. I expect this data to be reflected in Visa’s numbers.

Amazon is perhaps the major earnings play which will give a clear indication of how strong the consumer is. And if they are still spending or are saving for a rainy day.

Now, let’s take a look at the major US markets.

After breaking out above a major trendline, the S&P 500 is finding some resistance at the 4200 zone. We have seen this zone rejected multiple times going back to 2022. If sellers were to force markets down, this is where they would step in nestling their stop losses above the 4200 zone. However, technically the uptrend remains intact as long as the S&P 500 holds above 4075.

The Nasdaq is in a chop fest. The range is apparent. After breaking out above 12,800 there has been no momentum rally. The retest of the breakout has been bought but we just cannot breakout above recent highs. For a trader, we just await the break of the range to give us direction. We can gauge this from the move in the US Dollar and bond yields, but disappointing earnings could be the catalyst for breakdown if a major tech player crashes. More on two in just a bit.

Similar technical play on the Dow Jones as we have with the S&P 500. Near a major resistance zone, which is where we would expect sellers to jump in (and longs to take profits closing positions!) but the uptrend remains in play as long as the Dow holds above the 33,300 level.

As you can see, there is not much motivation for buyers right now, and with disappointing earnings increasing the odds of a recession, there is a strong possibility stock markets will reverse from here. But for now, we play the markets we see, not the ones we want to see, and as mentioned above, technical uptrends remain in play until we break below our validation points.

This week’s earnings were dominated by Tesla and Netflix as well as the banks.

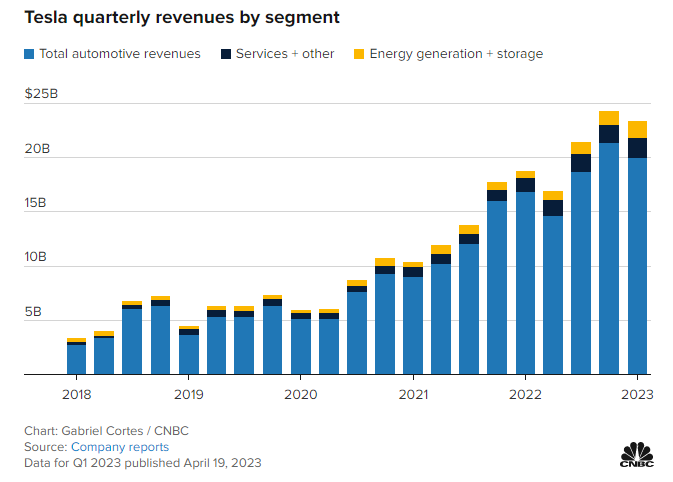

Tesla shares dropped more than 4% after the Company reported Q1 earnings. The results were:

- Earnings per share: 85 cents adjusted vs 85 cents expected, according to the average analyst estimate compiled by Refinitiv

- Revenue: $23.33 billion vs $23.21 billion expected, according to Refinitiv estimates

Tesla said net income fell 24% to $2.51 billion, or 73 cents a share, from $3.32 billion, or 95 cents a share, a year ago.

In the shareholder deck, Tesla stressed the ‘underutilization of new factories‘ stating stressed margins, higher costs of raw material, higher costs of commodities, logistics and warranty costs, lower revenue from environmental credits all contributed to the drop in earnings.

Automotive revenue, Tesla’s core, reached $19.96 billion in the quarter, up 18% from last year. Total revenue rose 24%. Revenue from automotive regulatory credits during the first three months of 2023 amounted to $521 million, down from $679 million in the first quarter of last year.

CEO Elon Musk spoke about an ‘uncertain’ macroeconomic environment that could impact people’s shopping plans for cars. When there is uncertainty, people tend to put a hold on big purchases such as automobiles. Musk said he expects 12 months of “stormy weather” in the economy, stating:

“Every time that the Fed raises interest rates, that’s the equivalent to an increase in the price of a car.”

Tesla Energy revenue soared to $1.53 billion, up 148% compared with the same period last year. Tesla’s energy storage systems deployment increased to 3.9 gigawatt-hours, or by 360%, the company said.

Tesla shares have rebounded in 2023 after a major downtrend in 2022, closing above the 50 day moving average. However, the lead up to earnings, and the major gap down post earnings has seen the stock fall back under the moving average.

Going forward, the stock is testing a key support area right now. Buyers could step in here and cause a bounce. The real technical sign will be if Tesla can fill the gap it developed post earnings. If Tesla can bounce and close above the $177.50 zone, it would be bullish. Until then, there is a strong chance that bounces will be sold off.

Netflix posted mixed financial results, and pushed its plans for the rollout of its password-sharing crackdown into Q2. Originally they wanted to roll it out in late Q1.

“While this means that some of the expected membership growth and revenue benefit will fall in Q3 rather than Q2, we believe this will result in a better outcome from both our members and our business,” the company said in its earnings release.

“The launch in Q2 will be broad, including the U.S. and the bulk of our countries when we think about it from a revenue perspective,” said co-CEO Greg Peters on Tuesday’s earnings call. Peters likened the paid sharing transition to that of increasing prices – subscribers initially balk and cancel, then slowly return and sign up for their own accounts.

Netflix added 1.75 million subscribers in Q1 even with subscriber growth being impacted in international markets where the password-sharing initiatives are in place.

Netflix shares dropped more than 10% post earnings, but then recovered most of the drop.

- Earnings per share: $2.88 vs $2.86 expected

- Revenue: $8.16 billion vs $8.18 billion expected

For the quarter ended March 31, Netflix reported earnings of $1.31 billion, or $2.88 a share, compared with $1.6 billion, or $3.53 a share, a year earlier. Revenue grew to $8.16 billion from $7.87 billion in the prior-year period.

Netflix said Tuesday it has been pleased with its push to mitigate password sharing. In Latin America, the company said it saw cancellations after the news was announced, which affected near-term growth. But, Netflix added, those password borrowers would later activate their own accounts and add existing members as “extra member” accounts. As a result, the company said, it is seeing more revenue.

Canada, which will likely serve as a template for the U.S., has seen its membership base grow due to the launch of paid sharing, and revenue growth has accelerated and “is growing faster than in the U.S.”

Netflix believes that paid sharing will increase revenue for the Company and expects to spend about $17 billion in 2024 on content.

For recession watchers, the new $6.99 ad-supported tier data is of interest. Unfortunately, Netflix wasn’t prepared to announce or forecast expectations regarding its ad-supported plan. But said they are pleased with the performance and users moving between tiers is very country specific.

The stock recently broke below support at the $330 zone. Sellers even piled in on the retest as you can see from the long wick printed on April 20th 2023. More downside is expected as long as the stock remains below the $330 zone. I have also drawn an uptrend line which could be tested in coming days or weeks. If the stock closes below this, it would mean a major trend shift.

Banks, but mainly regional banks, have been the talk of the street after the recent banking crisis scare. There are still those that believe banks have issues due to lower deposits and high interest rates discouraging borrowing. After all, the bank’s main business is to lend money.

Bank of America and Morgan Stanley topped estimates, but Goldman Sachs posted Q1 results that missed expectations after taking a $470 million hit tied to the sale of consumer loans.

- Earnings: $9.87 Adjusted vs. $8.10 estimate from Refinitiv

- Revenue: $12.22 billion vs. $12.79 billion

Earnings fell 18% to $3.23 billion, or $8.79 a share, which topped estimates. Excluding the impact of the loan sale, earnings would’ve been $9.87 per share.

Companywide revenue fell 5% to $12.22 billion, below estimates on the consumer loan hit and weaker-than-expected bond trading and asset and wealth management results.

JP Morgan and Citigroup fixed income traders fared well with their trading playing a role in beating Q1 estimates.

But Goldman Sachs traders did not fare well with fixed income trading revenue falling 17% to $3.93 billion, roughly $230 million below the StreetAccount estimate, on lower activity in currencies and commodities.

Equities trading revenue slipped 7% to $3.02 billion, edging out the $2.9 billion estimate. Investment banking revenue remained weak, falling 26% from a year earlier to $1.58 billion, but that was better than the $1.44 billion estimate.

Goldman’s asset and wealth management division posted a 24% increase in revenue from a year earlier to $3.22 billion, well below the $3.7 billion estimate because of the impact of the Marcus loans sale. The bank’s platform solutions business generated $564 million in revenue, a 110% increase from a year earlier and topping the $535.1 million estimate.

Goldman said it posted a roughly $470 million loss on the partial sale of its Marcus loans portfolio, and moved the remainder of loans to the “held for sale” category.

Goldman Sachs, like the other bank stocks, have been recovering after the banking crisis scare. It shrugged off the earnings report sell off.

The stock is now at an important technical zone. It is retesting a support level which broke down in early March 2023. What was once support now becomes resistance. If the stock were to continue lower, you would see sellers pile in here. Watch the next few candle closes. If instead buyers push the price above this zone, it would be very bullish.