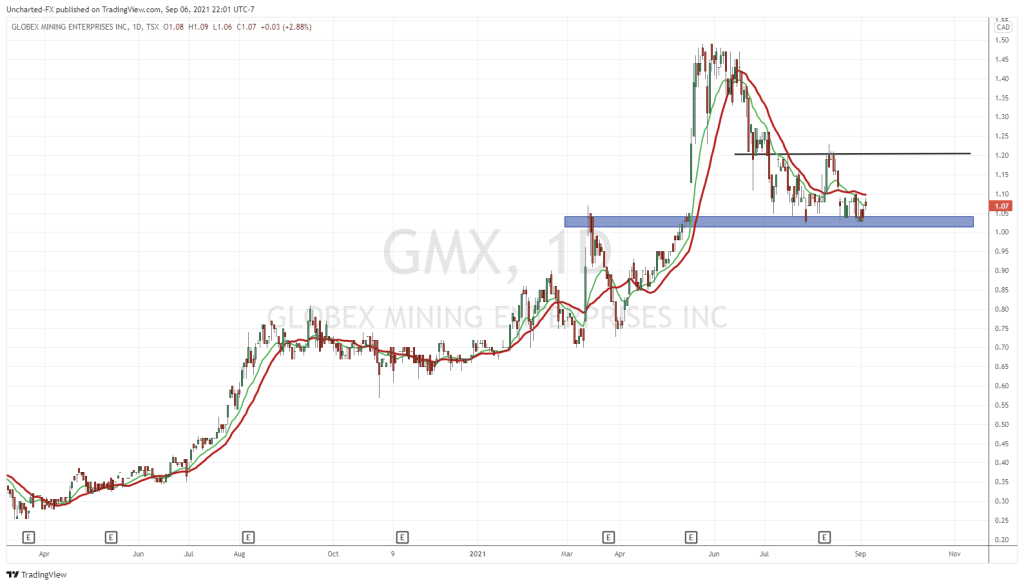

Long time and frequent readers of Equity Guru’s Market Moment should rejoice when they see the chart of Globex Mining (GMX.TO). Similar pattern that we have used to trade and call out monster moves on Gold, Silver, GDX, GDXJ, East Asia Mining, Nexus Gold, Pure Gold Mining just to name a few.

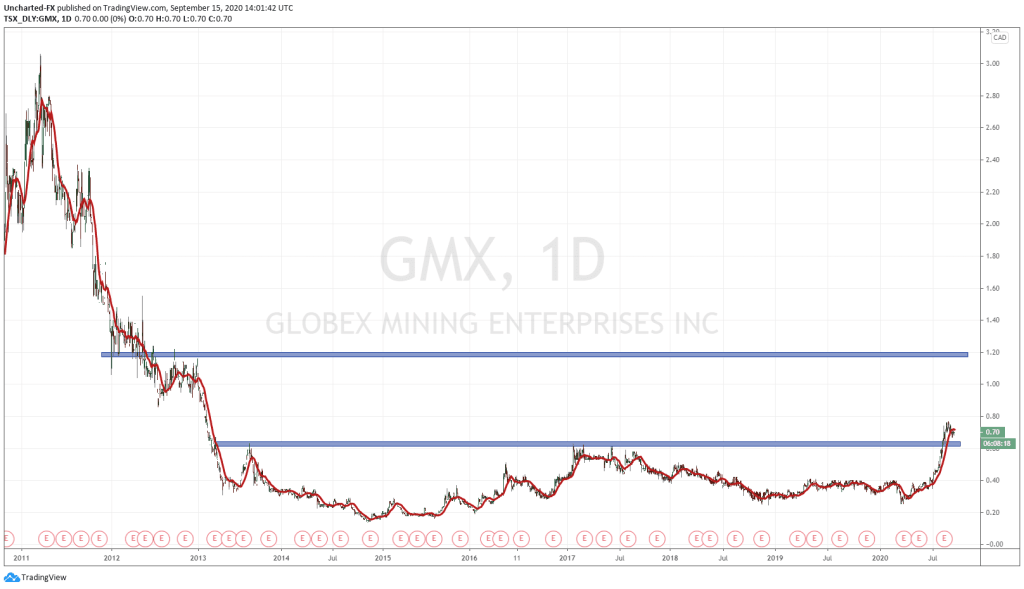

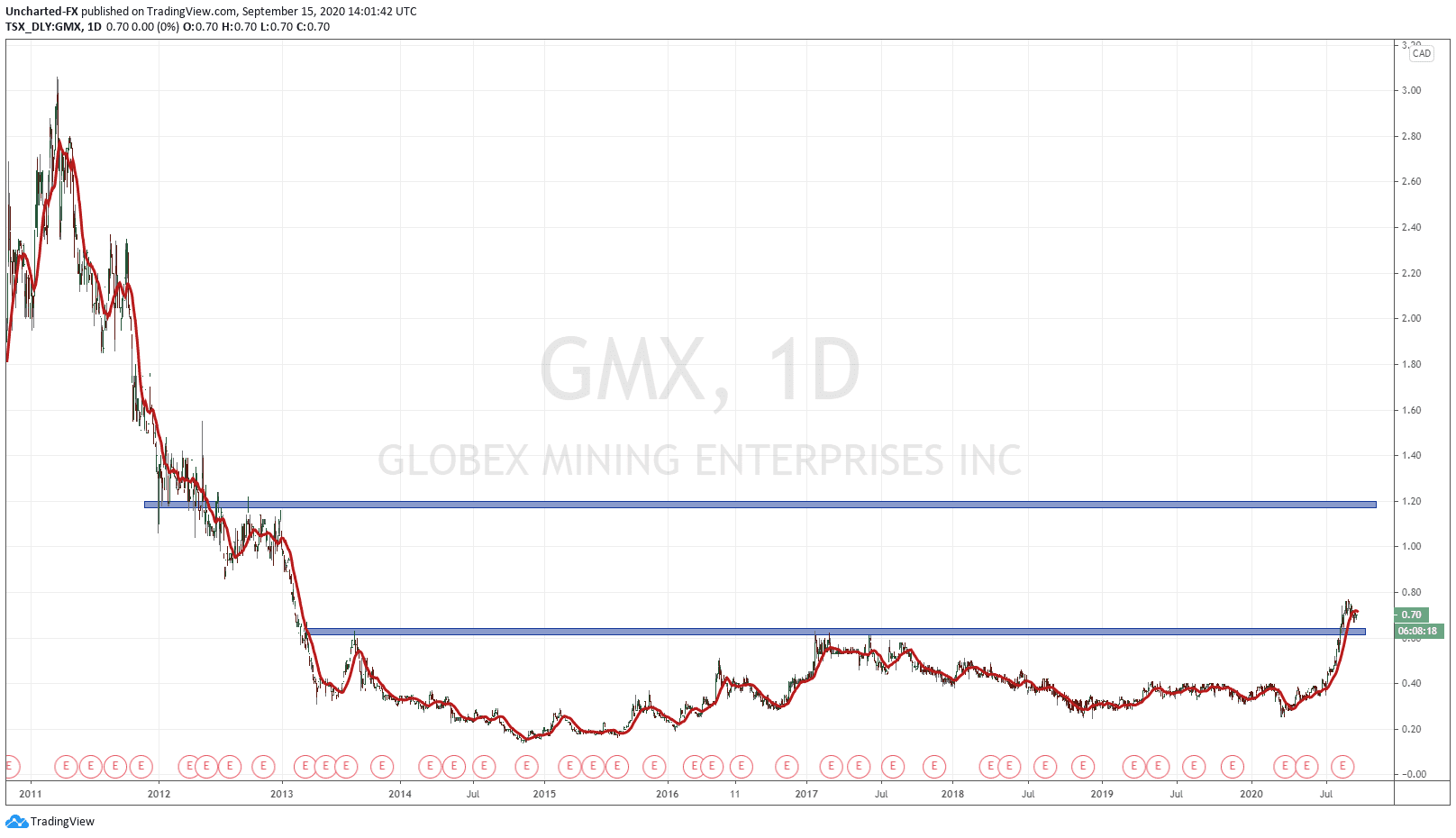

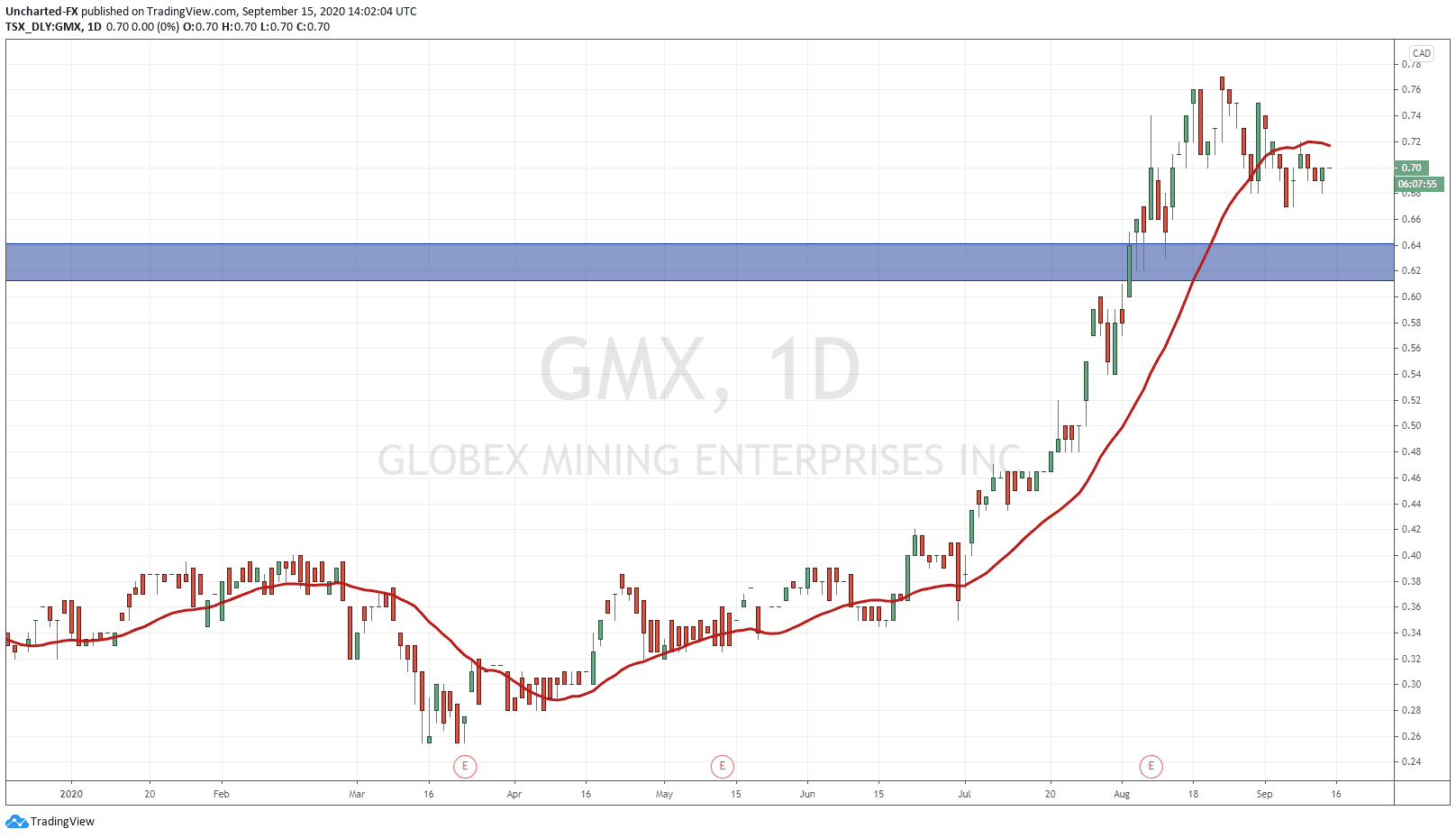

Very simply markets only move in three different ways: downtrend, range and then an uptrend. If we see this pattern on the longer timeframe charts, it is even better. As you can see from GMX, we did indeed have a downtrend which then turned into a range beginning all the way back in 2013! This range broke out 7 years after on August 5th 2020. That was our initial entry. Look at how price even pulled back to retest the breakout zone, seeing buyers step in and drive price higher.

Our readers know the saying: the longer the base, the more the space. The next major resistance target for GMX would be the 1.20 zone. Just a very attractive risk vs reward trade. Stop loss? Well once again, just like all our breakout trades: if price breaks and closes back below the breakout zone at 0.62, the breakout attempt has failed, and the uptrend could not be held. Saying that, we should expect to see our first higher low swing in a new uptrend, and for those that want more solid confirmation for the uptrend, they can await that. This would require a break and close above previous highs at 0.77, and you would place your stop at the previous higher low which forms before price breaks this level. This could be occurring right now, or we pull back deeper to test the support breakout zone once more. The benefit of awaiting for this higher low swing is that your probability of success increases because we have confirmation of a new uptrend with the higher low swing. Yes, you miss out on some of the move, but remember, trading is the business of probabilities. Of course if this is a longer term investment hold, accumulating over 0.62 is a valid reason.

Remember, I am still bullish on Gold and Silver in the long term, and I believe they are the best investments one can hold. I believe the mania in the junior miners and the mining stocks is just beginning. The only concern I have is the US Dollar chart. The breakout that I am looking for, may result in a pullback in the metals.

From their website, Globex is:

(Has) diversified North American portfolio of mid-stage exploration, development and royalty properties containing: Precious Metals (gold, silver, platinum, palladium), Base Metals (copper, zinc, lead, nickel), Specialty Metals and Minerals (manganese, titanium oxide,iron, molybdenum, uranium, lithium, rare earths) and Industrial Minerals and Compounds (mica, silica, apatite, talc, magnesite).

Globex explores for its own account and options many of its numerous projects to other companies which pay Globex cash, shares and a royalty and undertake extensive exploration in order to earn an interest in Globex’s projects.

Greg Nolan, in his recent article on Globex Mining, calls it an undervalued project bank, incubator, explorer, and royalty company that warrants your attention.

Greg mentions that Globex has been around for decades and their most impressive accomplishment is in regards to the share structure, especially being in this industry for that long:

Get this: there are currently 54.63 million Globex shares outstanding (57.5 fully diluted). Since Stoch took over the company in 1983, he has kept the dilutive financings to an absolute minimum and he has never engineered a share rollback.

If you’ve been following the junior exploration sector for as long as I have, you know how remarkable a feat this is. I know of companies who are rolling back their shares within their first year of operation.

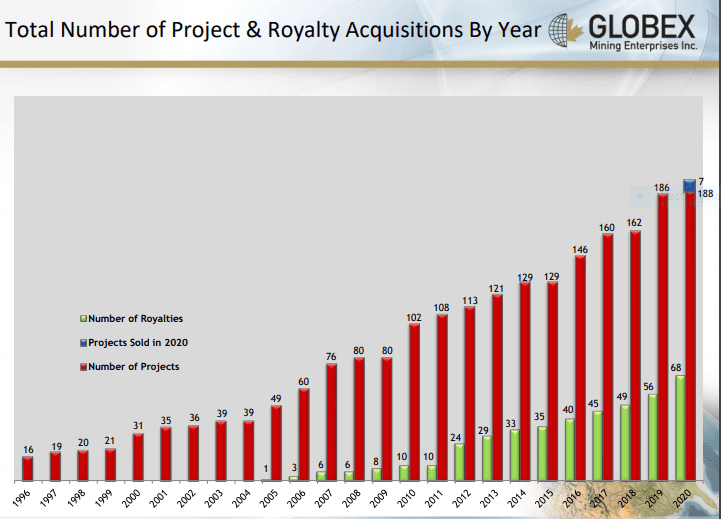

In terms of projects:

With a total of 188 properties in the company’s project portfolio, 95 are prospective for precious metals, 60 for base metals, and 33 for specialty metal metals (lithium, manganese, scandium, and the like).

Breaking things down further, sixty-eight of these properties have an underlying royalty controlled by Globex, two have been optioned to partner Cos, and this is where it gets interesting… fifty-four (54) have either a historical or 43-101 compliant resource.