In sifting through the rubble of the junior exploration arena of late, one need not spoor too far n wide to spot good value. Even the highest quality entities, those boasting compelling fundamentals—robust project pipelines, solid management, healthy balance sheets—are being tossed with little regard for their underlying intrinsic value.

This current selling pressure in the shares is puzzling.

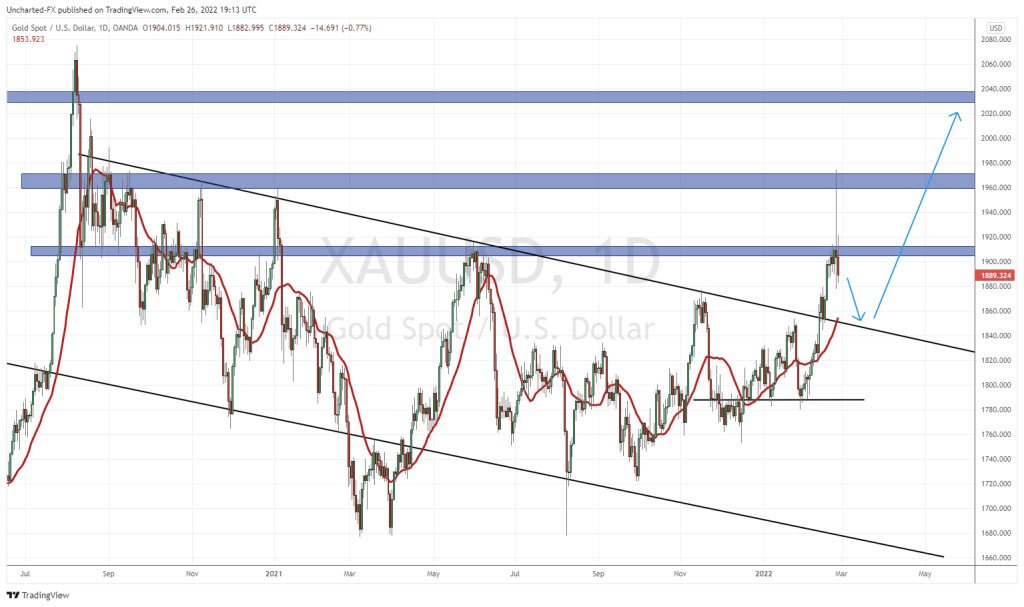

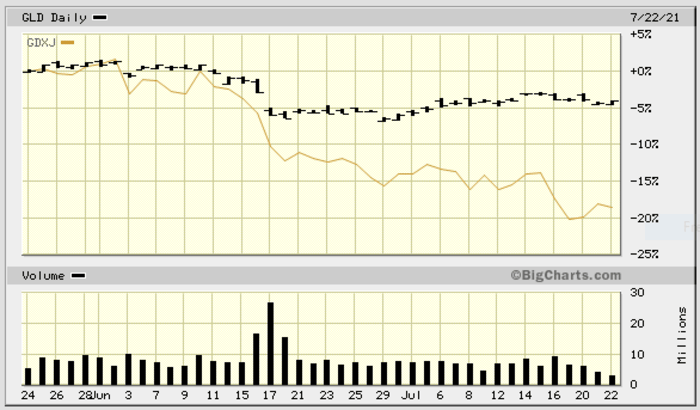

In the Gold arena, there is a divergence—the metal is trading firm while the shares are down hard. The chart below exposes this anomaly—Gold (the SPDR Gold Shares ETF or GLD) versus small-cap gold companies (the Global Junior Gold Miners Index or GDXJ)…

Lousy investor sentiment exacerbates the selling pressure—weak hands rushing for the exit for no other reason than they just want out. This has the feel of a bear market. But it’s not.

I’m convinced we’re in the very early innings of a bull run that will prove epic in scale… once the inevitable rotation into resources kicks into gear.

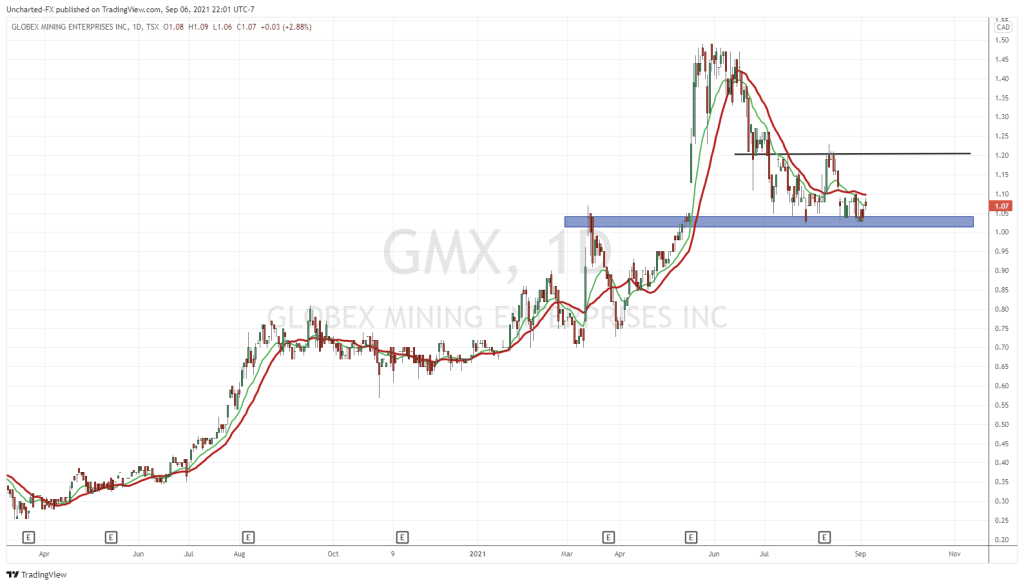

There are a handful of companies that currently stand out in my mind. Inclusive among these is Globex Mining (GMX.T), a force-of-nature in the junior arena that also happens to be an Equity Guru client company (yes, color us biased, but we really dig this Co).

As I highlighted in yesterday’s offering—Tightly run Globex Mining (GMX.T) inks yet another deal, another royalty – adds more cash/shares to its coffers—the Company’s operating model involves scouring the landscape along well-established mining camps, acquiring strategically positioned properties on (very) favorable terms, advancing the newly-acquired projects via good science and intellectual input, and then monetizing the asset, often retaining a significant royalty interest at the close.

Globex is a project bank and incubator.

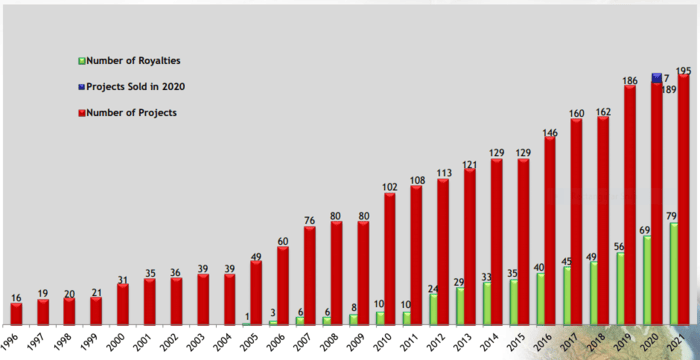

Always a moving target, the Globex project portfolio currently consists of 195 properties, 97 of which are prospective for precious metals, 61 for base metals, and 37 for specialty metals. With new deals (always) in the works, don’t be surprised if the list tops 200 before 2021 is done.

Seventy-nine of these properties carry underlying royalties in favor of Globex—4 are active options (cash/share payments, exploration commitments, Gross Metal Royalties). Fifty-four of these properties hold historic or 43-101 compliant resources—40 host past-producing mines.

I recently had the opportunity to speak with Globex’s CEO, Jack Stoch, where we discussed the Company’s high volume of newflow.

Stoch confirmed that after the dust settles from the sale of his Mid-Tennessee Zinc Mines royalty to Electric Royalties (ELEC.V)—a deal I recently characterized as a watershed event—the company will have roughly $30M in its coffers (Globex is in the final stage of wrapping this deal up).

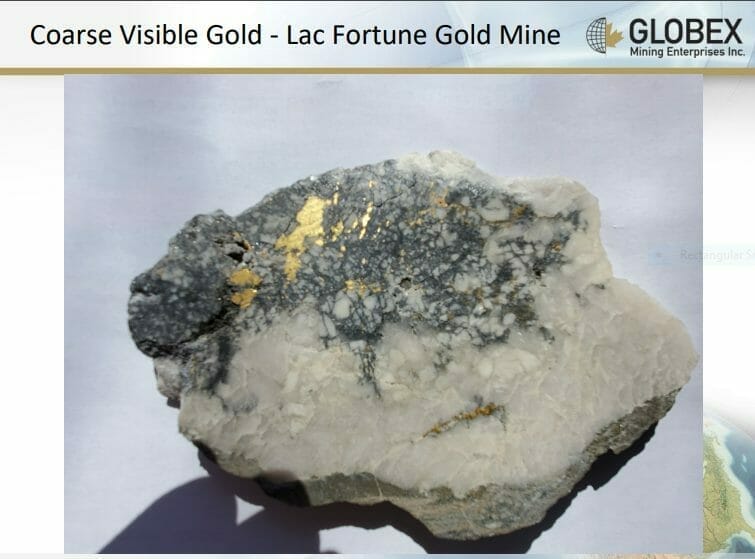

Stoch went on to highlight another significant monetization event regarding the sale of the Company’s Francoeur/Arntfield/Lac Fortune Gold Property to Yamana (YRI.T)—a deal that will continue to add bulk to the balance sheet over the next few years.

The particulars of this transaction are spelled out in a June 22nd press release – Globex Completes Sale of Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for $15 Million:

Globex received an initial payment of $4,000,000 from Yamana, satisfied by Yamana issuing 706,714 shares to Globex at a deemed price of $5.66 per share. As previously announced, the Purchase Agreement provides that Yamana will make the following additional cash payments to Globex, which Globex may elect to receive in Yamana shares:

- On the first anniversary of closing: $3,000,000

- One the second anniversary of closing: $2,000,000

- On the third anniversary of closing: $3,000,000

- On the fourth anniversary of closing: $3,000,000

Globex’s stock position in Yamana will continue to benefit the balance sheet from quarterly dividend payments.

And more recently, the deal involving Maple Gold Mines, highlighted in my July 20th piece—Tightly run Globex Mining (GMX.T) inks yet another deal, another royalty – adds more cash/shares to its coffers—stands to deliver significant cash/share payments over the next ~5-years (the first two $100k cash/share installments are firm commitments).

Globex retains a weighty Gross Metal Royalty (GMR) on both of these deals (Yamana and Maple).

Our conversation then turned to a July 21st headline…

Globex Purchases Rockport Mining Corp.

Here, Globex reported the acquisition of Rockport Mining Corp, a private exploration and holding company that holds two royalties on Globex properties—Devil’s Pike and Bald Hill. Both projects are located in south-western New Brunswick.

Globex acquired Devil’s Pike from Rockport in a deal announced on January 7, 2016. Rockport retained a 1% Net Smelter Royalty that would kick in after 600,000 ounces of production.

Globex acquired the Bald Hill Antimony Project from Rockport in a deal announced on February 16, 2021. Rockport retained a 1% Net Smelter Royalty on all mineral production from this property.

“Through the purchase and amalgamation of Rockport into Globex which was completed on July 14, 2021, the royalties no longer exist thus adding value to the Globex gold and antimony assets, both of which are located in southern New Brunswick. The purchase and amalgamation also provides Globex with contracted access to certain areas facilitating access for various types of surveys and diamond drilling.”

Before we dig further into the guts of this July 21st press release, a few relevant notes from my recent conversation with CEO Stoch:

First off, Bald Hill has antimony and minor indications of gold. Devil’s Pike has gold and minor indications of antimony.

Devils Pike

This road-accessible 2,208-hectare property, located in south-western New Brunswick, has a reported Inferred resource of 214,800 tonnes grading 9.6 g/t Au (cut) or 13.48 g/t Au (uncut).

From Rockport’s 2011 technical report citing Watters (1995), Davis (1998), Lafontaine (2005), and Lafontaine et al. (2005):

“The mineralizing system trends northerly, dips steeply to the west, and has a true width varying from one metre to five metres. Wider mineralized intervals may be a result of en echelon veining or splaying of veins. The veining is structurally controlled along a brittle fracture and is oblique to the regional northeast structural trend. The veining consists mainly of quartz and carbonate with or without sulphides. Many of the veins appear to be composite, consisting of more than one generation of quartz and/or carbonate.”

There’s potential for additional high-grade tonnage along strike, in both directions from the main resource block.

Devil’s Pike is a large property with multiple surface showings. The Company has performed preliminary work on the project including a 3D model of the deposit. Future exploration campaigns will probe the resource expansion potential of the deposit. Devil’s Pike also has exploration upside on a regional scale.

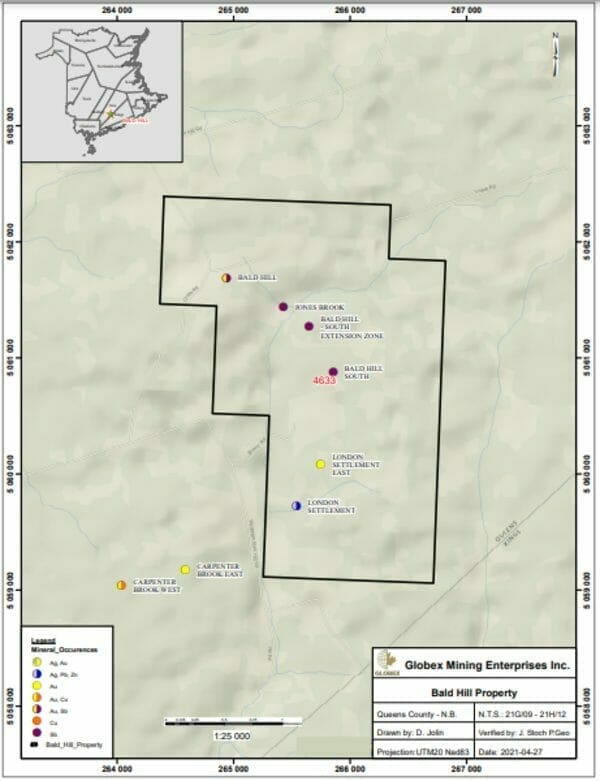

Bald Hill

This is also a large land package—26 claims covering the Bald Hill antimony deposit and surrounding area—with multiple showings of both antimony (Sb) and gold.

Surface trenching at Bald Hill returned up to 43% Sb over 2.0 meters and 2.90% Sb over 8.18 meters.

Sixteen widely spaced drill holes for 3,554 meters outlined an Sb zone measuring 450 meters in length, with the drill bit tagging up 11.7% Sb over 4.51 meters (core length).

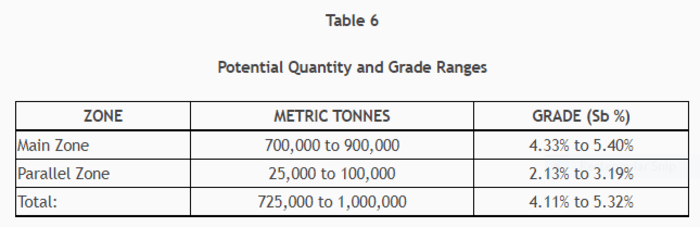

In 2010, a report by Conestoga-Rovers and Associates of Fredericton, New Brunswick titled ‘National Instrument 43-101 Technical Report on the Bald Hill Antimony Project‘ stated the following:

“The potential tonnage and grade of a potential mineral deposit at the Bald Hill Property which is the target of further exploration is expressed as ranges in Table 6 below. The potential quantity and grade is conceptual in nature as there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.”

A subsequent NI 43-101 report titled ‘National Instrument 43-101 Technical Report: Bald Hill Antimony Project’ arrived at the following conclusions:

“Rockport’s drilling on the Bald Hill main grid has confirmed the Sb mineralization over a significant area of approximately 700 meters on surface (Note by Jack Stoch: additional 250 m strike length) and to 300 meters depth. Surface mineralization and soil geochemical anomalies indicate that the mineralization extends for at least 1.5 km, along strike from the delineated mineralized zones. The 2014 trenching program, centered approximately 1.0 km along strike to the southeast from the main Bald Hill occurrences, exposed new antimony mineralization grading 9.04% Sb over 2.60 meters.”

“In addition to the on-site exploration programs, preliminary processing and metallurgical test-work of Bald Hill lithological drill-core and bulk samples was carried out. This work comprised bulk mineralogy, basic chemical profiling, textural features of the ore minerals and preliminary analysis of liberation characteristics and amenability of the ore to gravity concentration and/or flotation, preliminary ore-characterization, mineralogical and chemical profiling, and optical ore examinations.”

“The work completed by Rockport on the Bald Hill Project substantiates the occurrence of a potential resource of economically interesting antimony mineralization. The Project is a valid exploration target that remains largely untested with respect to its full dimensions and its regional structural relationships.”

It’s important to note that Devil’s Pike and Bald Hill lie only a few kilometers apart (synergies may emerge in a development scenario).

Why Antimony?

Ranked high on the USGS critical minerals supply risk list, Antimony is used for a number of industrial applications. It’s also a key pathfinder for gold deposits.

Due to the pervasive nature of antimony in the region—it often outcrops at surface—its presence (found mainly as the sulfide mineral ‘stibnite’) can help geologists vector in on a nearby gold source.

If there’s antimony in the structure, there’s a strong possibility of finding gold along the same rock unit. Proof in the pudding is the presence of antimony in the same rock structure as the Devils Pike resource. Also, note the antimony component (22,030 lbs of Sb) in Galway Metals’ 1.8M oz AuEq Clarence Stream project resource in the same region of south-western New Brunswick.

“In addition to the exploration potential to outline a larger antimony deposit, it is important to note that antimony is a recognized pathfinder for gold. Globex’s nearby Devil’s Pike gold property has significant antimony mineralization in addition to the gold resource as do a number of other gold deposits in New Brunswick.”

But don’t discount the potential economics of antimony on its own.

The current price of antimony—a key ingredient in semiconductors, circuit boards, and lithium-ion batteries—is roughly US $10k per metric ton (as per a 99.65% Ingot).

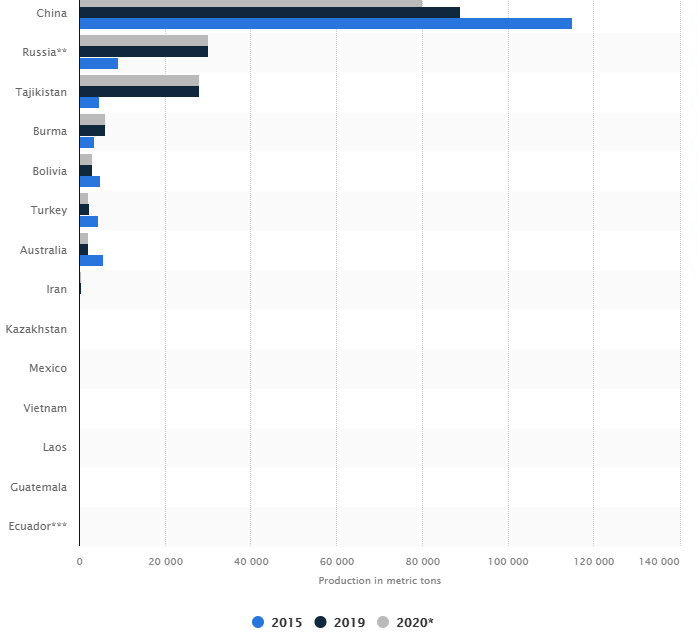

There is currently no antimony production in North America—the lion’s share of the metal is produced in China, which is a problem for the West.

A May 6, 2021 article in Forbes…

Antimony: The Most Important Mineral You Never Heard Of

The Company plans to put boots on the ground at Bald Hill this summer. As this July 21st press release points out, the New Brunswick gov’t, via the New Brunswick Exploration Assistance Program, awarded the Company $20k to kick off their exploration efforts at Bald Hill this summer.

Globex hired the former chief geologist from Rockport to assist its maritime geo-consultant in pouring over the reams of inherited data to prioritize drill targets for this summer campaign (we’ll see a couple of holes poked into Bald Hill during this summer program).

In the fourth paragraph of this July 27th press release, the Company states:

“Lastly, the amalgamation of Rockport with Globex adds non-capital losses carried forward to Globex’s balance sheet which, if applicable, will be very useful considering Globex’s increased income in 2021.”

As I’m sure you’re aware, non-capital losses can be used to offset taxes on current revenue. With the number of deals inked thus far in 2021, Globex is looking at a fairly substantial tax bill. The amount of these non-capital losses carried forward could be (potentially) significant. Stoch offered no specifics.

During our conversation, Stoch talked about the underlying value of this Rockport acquisition. Again, no specifics, but I came away believing that he’s a hard negotiator and landed this deal on very favorable terms.

At the end of our conversation, Stoch touched on a deal he’s currently working on—signatures to paper is all that remains—that will see Globex acquire a property with multiple (small) historic resources on a major gold localizing structure along the Abitibi Greenstone Belt.

We stand to watch.

Globex also trades on the OTCQX International in the US under the symbol GLBXF, and on the Frankfurt, Stuttgart, Berlin, Munich, Tradegate, Lang & Schwarz, L&S Exchange, and TTM Zone Stock Exchanges under the symbol G1MN.

END

—Greg Nolan

Full disclosure: Globex Mining is an Equity Guru marketing client.