The question I am getting asked a lot is whether it is too late to get into Gold and the Mining stocks. Have we already made the large move? Is this the peak of their move? I believe that this bull market in the miners and junior miners is just beginning. We have not seen anything yet! My esteemed colleagues also agree on this. Money is beginning to flow into GDX from the institutional side. Funds are looking at Gold. In the past I have argued that if large funds even allocate up to 5% in Gold, the price would easily top $2000.

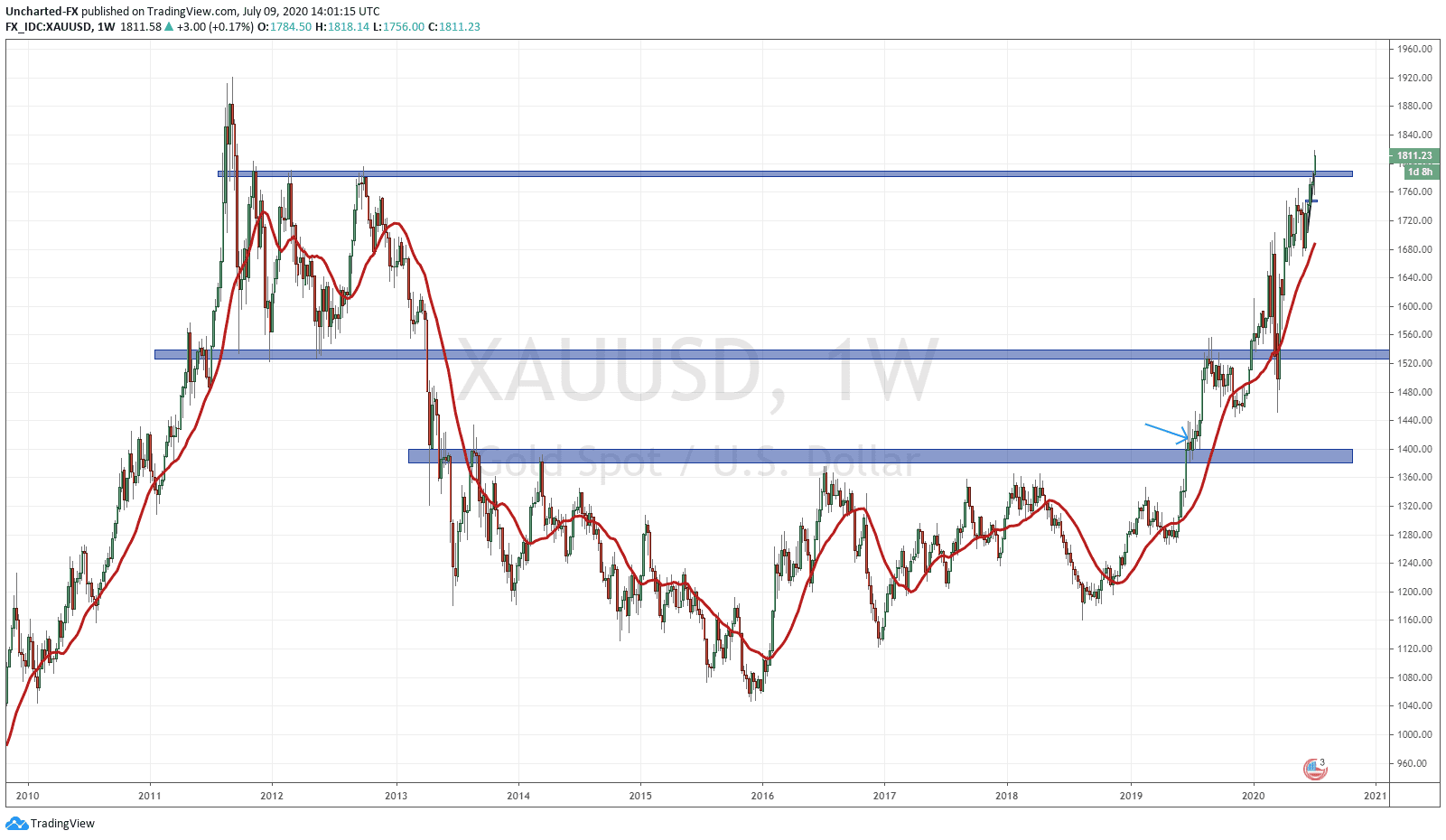

I have written extensively on the question: why Gold? I have maintained the bullish stance on Gold ever since market structure gave me the break above the 1400 zone. More importantly, it is because we displayed the ⅔ ways that all markets move: a down trend and then a range. The uptrend was next but we required the confirmation of the range break. Gold finally did this after 6 years of range, and I turned bullish ever since. That was the beginning of the Gold bull market. An uptrend does not move in a straight line, we pullback to form higher lows. We should expect this, and not be scared when price retraces. If the previous higher low is intact, we remain in the uptrend. For Gold at current prices, the higher low comes in at the 1675 zone. As long as price remains above and closes above this zone, Gold is going to be testing previous all time highs against the US Dollar.

The key takeaway is the pattern. That long range or base. Our readers will recall this:

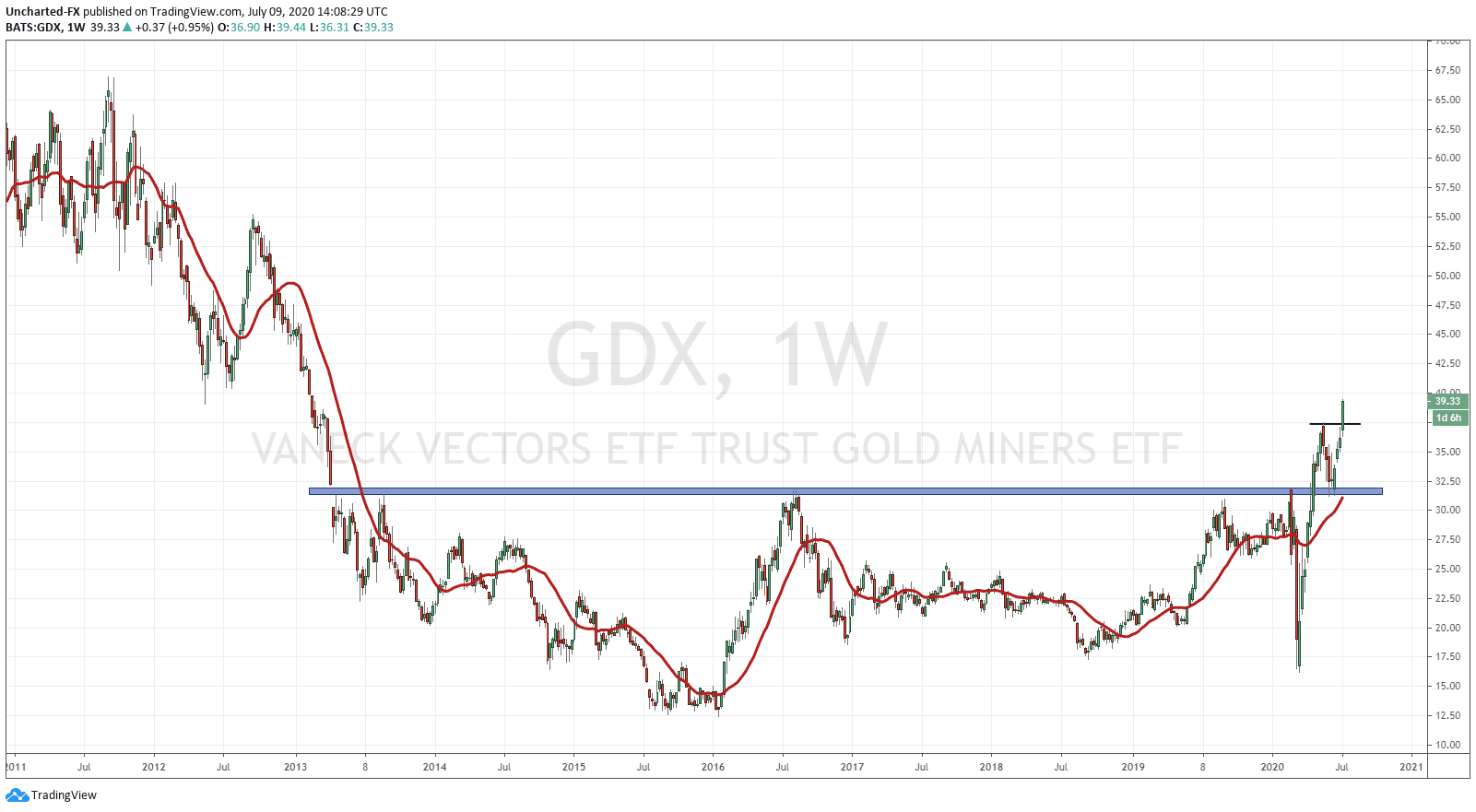

The breakout on GDX was a call I made this year. The GDX has been ranging for 7 years before breaking out. As mentioned, uptrends make higher lows which entails a pullback before breaking above previous highs. We are looking at the weekly chart, and although this week’s candle does not close until the markets close tomorrow, it seems we are on track to confirm our FIRST higher low with a close above recent highs above 37.33. Once again, as long as price remains above the 31.36 zone we remain bullish on the GDX and the Gold miners. Compare this with Gold. The uptrend in GDX still needs to make multiple more higher low swings and I believe this is coming.

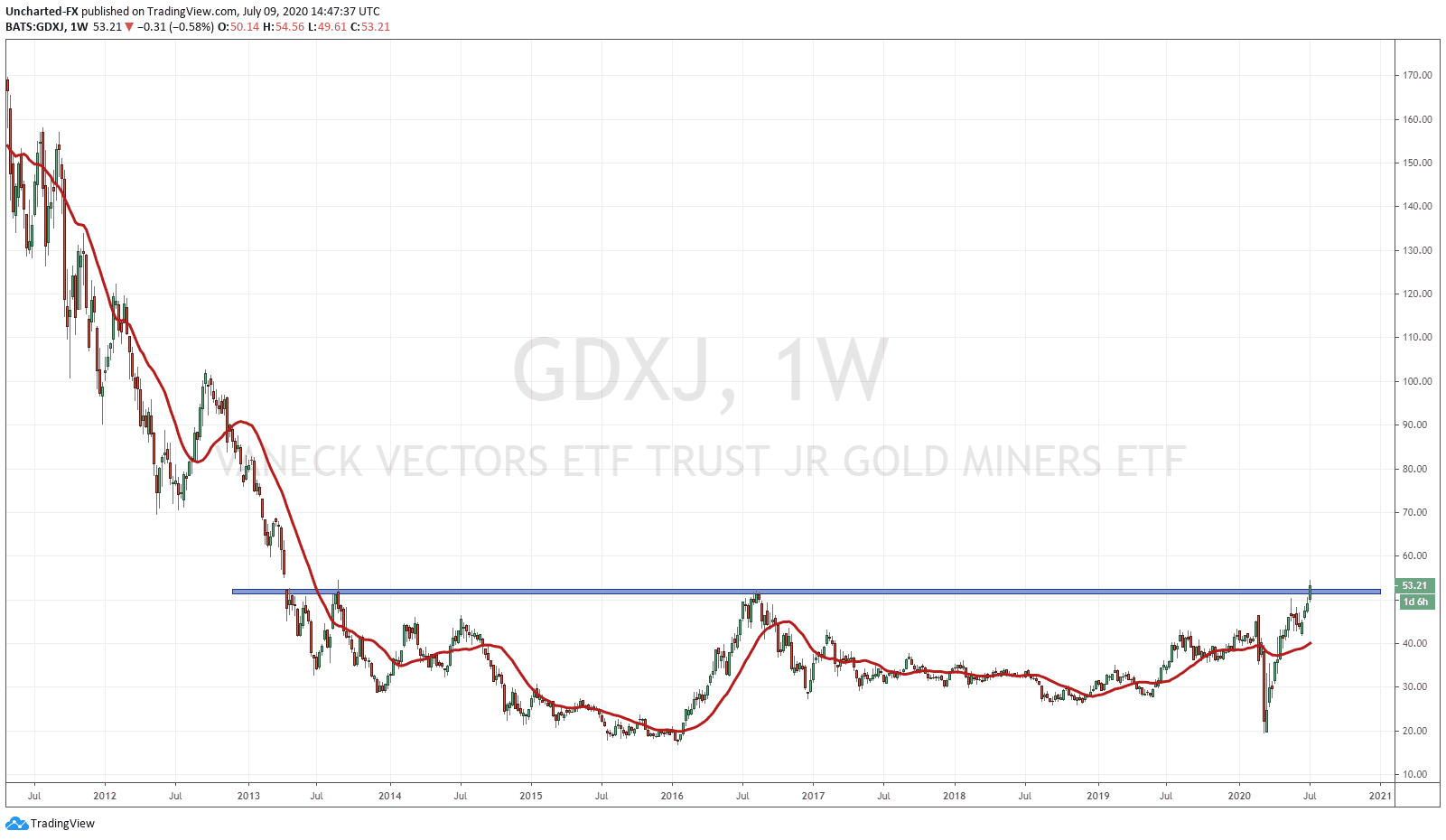

Now I believe the mania in the juniors truly has not started. For those that traded the cryptocurrency and marijuana markets during their mania’s, I expect the same to happen with the junior miners. The trigger? Gold breaking into all time new highs against the Dollar. Once the media and financial media begin talking about it, more attention will go to Gold. The retail crowd will see how cheap a lot of these stocks are which will cause this mania to speed up. It will be akin to how alt coins moved during the crypto mania. Anything that hasn’t moved will be considered undervalued and will be bid up. Personally, I am already positioning myself for this.

My prediction is only gaining steam as we see the GDXJ about to follow Gold and GDX in similarities of the chart pattern. The range/base is about to be broken! A 7 year range may end after we get a confirmed close above once markets close tomorrow. A weekly chart breakout. As of today, the uptrend has not even begun. Exciting times for the Gold and mining space.

So why Gold? My ideas on that are largely known by now. Gold is a confidence crisis metal. People buy it when they begin to lose confidence in governments, central banks and the fiat money system. Division between Americans is at peak levels, and with elections just around the corner, it has a high probability of being ugly. Whatever party wins, the opposition will not accept the results. We will see more violent riots and protests on the streets. The central bank and fiat currency aspect does not need much discussion. Monetary policy seems to be exhausted, and all the central bankers have left is printing more money and heading deeper into negative interest rate territory. Every central bank is attempting to devalue their currency by cutting interest rates in this race to the bottom.

Ray Dalio has said Gold is the best currency to be holding. He considers it the premier safe haven asset. It may even replace fixed income for safety. Bonds are barely yielding anything. Fixed income traders are struggling for yield which has seen them now allocate much more into stocks. Even though Gold has no yield, it can still move up to or more than 3% a month…while providing you safety. This is something which may develop as we go forward. The other replacement for fixed income would be stocks with dividends…although it would not necessarily provide you with that safety/risk off status that is attached to Bonds and Gold.

If you are a Ray Dalio or a larger hedge fund, how do you play this Gold bull market? Well, I hate to disappoint some people, but large funds will not be playing the junior space. It will primarily be the retail crowd. The larger funds will play this three ways: buy the GLD ETF, buy the GDX ETF, and/or buy Royalty and Streamers. It is a safe way to play Gold and to increase their allocation which may be happening right now which could explain this pop in Gold. People and funds are finally realizing what the Gold bulls have been saying for some time: we have just added more debt to combat Covid which will cause many more problems going forward. The macro environment plus the technicals are supporting this run into Gold (and Silver) and we have not seen anything yet!