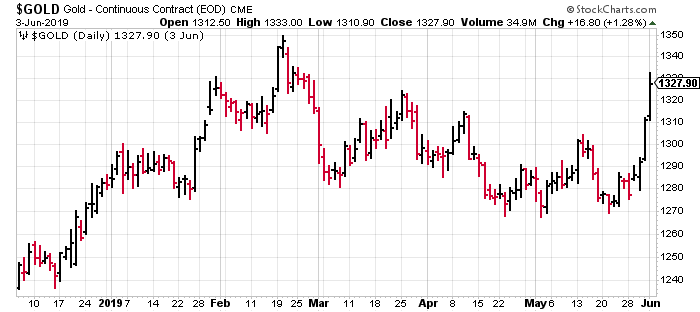

It’s a mugs game, attempting to divine short term price moves in some of our more geopolitically sensitive commodities. Take gold for example…

There’s a whole universe of traders following the price action in the metal, tick by tick. I’m not aware of any TA types who accurately called this latest move to the upside.

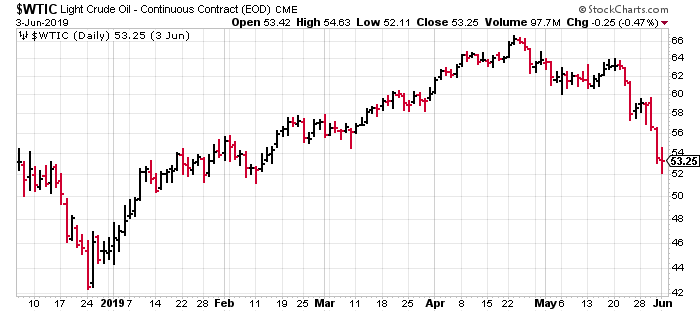

Same story with oil…

There may have been a lot of debate over how escalation in the Trump-China (and now Mexico) trade war would impact prices. But this latest move to the downside surprised more than a few.

With all of this extreme volatility, the best strategy I can think of is to position your funds in the sectors no one wants to talk about, and wait for the mood to change.

The Oils on our list

Our three Oils reported news in recent sessions. We’ll begin stateside and work our way south:

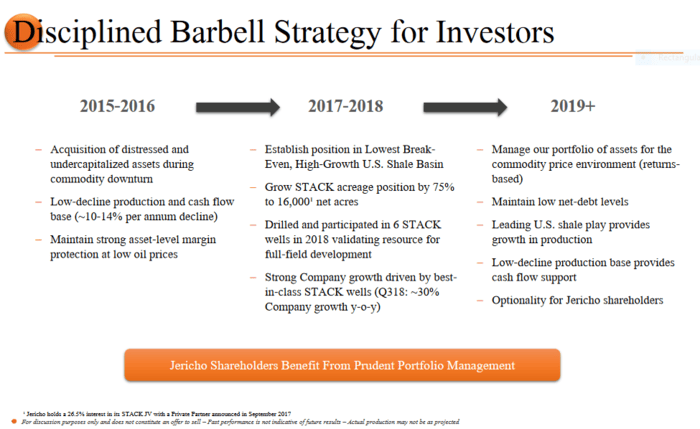

Jericho Oil (JCO.V) capitalized on distressed and undercapitalized assets during the last oil rout and assembled a 55,000 acre land position across Oklahoma, including 16,000 acres in the STACK.

The Jericho crew is currently focused on the prolific oil-prone Meramec and Osage formations along the STACK where they are applying advanced engineering analyses and enhanced geological techniques to under-developed resource areas.

Exxon, Devon, Newfield, XTO, Alta Mesa, et al – Jericho is in a good neighborhood

June 3rd news: Continued Offset Investment and Activity Surrounds Jericho’s STACK Position

The company witnessed activity from multiple, well-known offset operators converging on the surrounding area drilling horizontal wells targeting the Osage formation in the Northern STACK.

Public records from recent horizontal wells targeting the Osage formation demonstrate impressive production results.

Wells completed by Gastar (LUKE 1909 21-1LOH, BIGGIO 1909 7-1LOH), Fairway (BURSON 1-33H) and Alta Mesa (TERMINUS 2109 3-10MH) surround the Company acreage with a combined average 6-month cumulative oil production of 63,000 barrels of oil demonstrating the vast potential for high-return wells in the Osage formation on Company acreage.

These strong results validate Jericho’s resource and acreage value. They also build confidence as the company considers future development options.

While the pace of operated drilling activity by Jericho has been slow, we believe this is for good reason and a part of our overall strategy for Jericho’s long-term shareholder base. Allowing surrounding operators to spend their capital while converging upon our position will yield the strongest return on investment for Jericho as we minimize our capital outlay.

Jericho’s geochemical study

Jericho’s geology team, along with its neighbors, have been working with Advanced Hydrocarbon Stratigraphy Inc (AHS) over the last several months gathering subsurface data to assess the potential of various STACK formations around its acreage.

AHS Inc knows its way around the STACK. They’ve worked with leading companies seeking to gain a broader understanding of the productive nature of the Meramec and Osagean formations.

Utilizing cuttings captured during the drilling process, AHS’ technology allows for a high-resolution image indicating changes in hydrocarbon content, permeability and mechanical strength for better understanding of perforation cluster placement and stimulation consideration.

Shane Matson, Jericho’s lead geologist:

“In the most recent well analysis adjacent to Jericho’s Acreage AHS’ testing shows outstanding oil storage capacity, high permeability and outstanding rock mechanics.”

That’s exactly what you wanna hear from the lead geo regarding the quality of these subsurface drill cuttings.

This data will help Jericho home in on the more prospective areas as they plot a new drilling campaign scheduled for H2 of this year.

Mike Smith, PhD, president of AHS:

“Significant producible Hydrocarbons, chiefly oil, and remarkably good quality reservoir rocks are indicated throughout the Mississippian (Meramec and Osage) in this well. Results are specific to a given location, as other well locations nearby, could have varying prognoses. All other geological, geochemical and nearby production need to be considered in any evaluation.”

This AHS guy really knows his rocks.

Lastly, Jericho’s CEO, Brian Williamson on the efficacy of this geochemical study:

“Our geology team is all about data capture and data sharing. The Northern Stack needs good wells in all formations and cooperation with our neighbors is key. Strong results across the operating teams is good for the basin and ultimately all STACK value. Jericho holds ~16,000 acres in the North STACK Play and is looking to grow that position as well as considering new drilling in the second half of 2019. Our geology team continues to do an outstanding job of digging, digesting and extrapolating data into usable information for our organization. We look forward to the selection of future STACK locations.”

Additional Equity.Guru insights:

Jericho Oil (JCO.V): a Moneyball play in the STACK – Anadarko Super Basin

Jericho Oil (JCO.V) unveils Valkyrie – a 725 BOE per day STACK well

EQUITY.GURU Podcast: Jericho Oil (JCO.V)

Jericho Oil (JCO.V): deep value in the STACK, a contrarian play

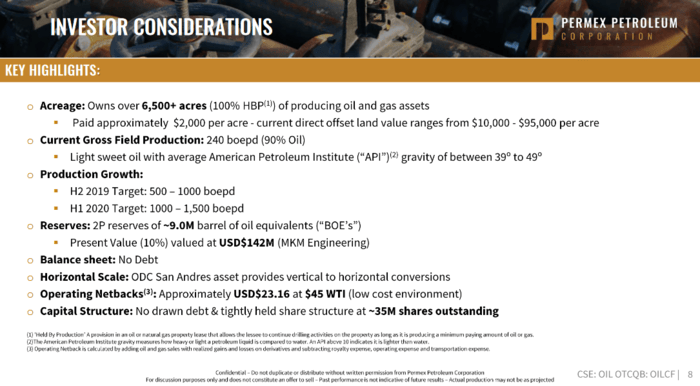

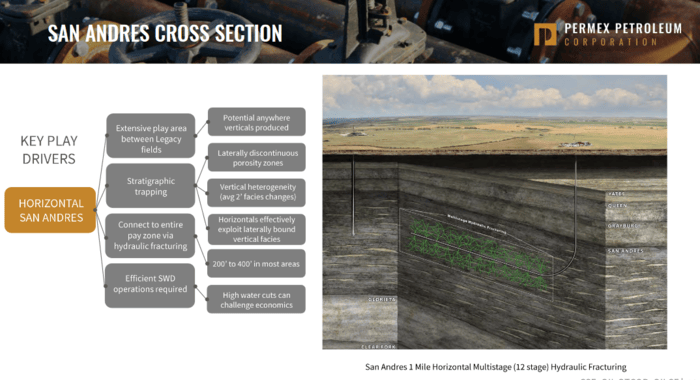

Permex Petroleum (OIL.CN) is our deep value O&G play with acres and operations in the Permian Basin of West Texas and the Delaware Sub-Basin of southeast New Mexico.

The company applies low-cost development strategies to its ‘held by production‘ assets for sustainable growth while it waits for the right opportunity to scale growth via an aggressive horizontal leg conversion program.

These lateral wells are what’s really going to move the needle for this company.

Having recently added cash to the company coffers, Mehran Ehsan, Permex CEO, is busy spreading the word.

June 3rd news: Permex Petroleum Corporation to Participate at Montreal Capital Investment Conference

And word will eventually get out on this ridiculously undervalued O&G junior. It’s only a matter of time.

Additional Equity.Guru insights:

Permex Petroleum (OIL.CN): an enviable position in the booming Permian Basin

Permex Petroleum (OIL.CN): a deeply undervalued Permian Basin focused oil and gas opportunity

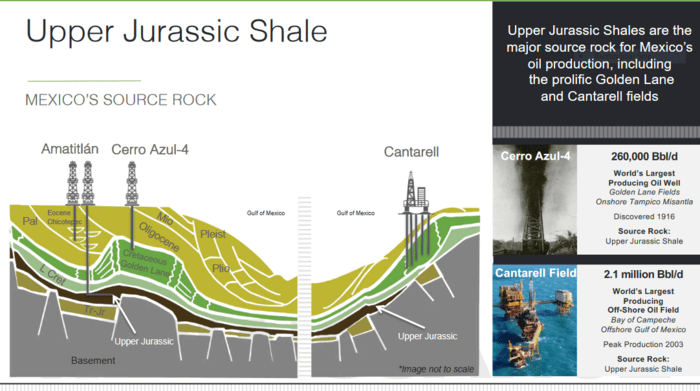

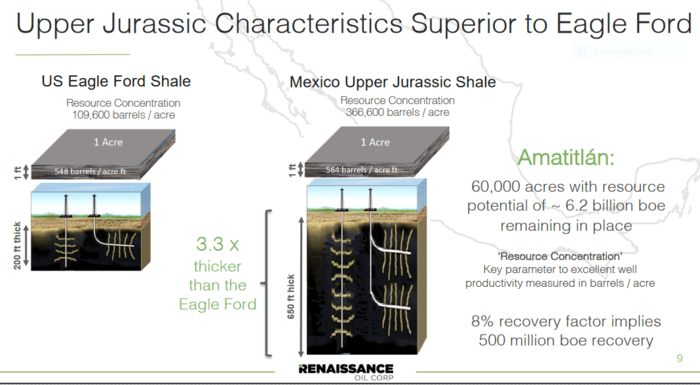

Renaissance Oil (ROE.V) is our Mexican O&G developer and producer. Its sights are set on developing the untapped shale potential of one of the last onshore super basins.

IHS Markit identified the Tampico-Misantla Basin as one of 24 global onshore ‘Super Basins’, much like the Permian, with multiple reservoirs and source rock

There are distinct advantages in being an early mover in a new shale play. Just ask Nick Steinsberger, Renaissance’s drilling engineer, the architect of the shale revolution in the U.S. when he was with Mitchell Energy.

The Tampico-Misantla basin bears similar characteristics to the Eagle Ford basin in the U.S., except it’s three times thicker.

Mexico’s Upper Jurassic shales sport compelling economics. That’s why the dream team from Mitchel Energy is on board.

Recent news

On May 30th, the company dropped Q1 results and an update:

Renaissance Reports First Quarter Results and Corporate Update

HIGHLIGHTS:

- Revenue and operating netback in the first quarter of 2019 was $4.8 million and $0.7 million respectively;

- Renaissance received a 20-month extension to December 27, 2020, from the Comisión Nacional de Hidrocarburos (“CNH”) to complete the work programs on the Company’s 100% held producing properties in the state of Chiapas.;

- Evaluation of the cores acquired from the Upper Jurassic formations at Amatitlán confirms the presence of the critical characteristics of a commercial play;

- Renaissance has entered into an agreement for the transfer of its non-core Ponton license to a Mexico based oil and gas company for consideration of US$1,000,000, upon closing, plus a gross overriding royalty of 10% on future oil and gas revenue from Ponton for maximum aggregate royalties of US$3,000,000.

President’s message

During the first quarter of 2019, Renaissance and its partner LUKOIL continued to negotiate a development plan on the Amatitlán block for the commercialization of all prospective zones, with particular emphasis on the Upper Jurassic formations.

Negotiations include the migration of the Amatitlán CIEP into a contract of exploration and extraction, pursuant to the constitutional amendments of December 20, 2013 reforming the Mexican Energy Industry.

I suspect that once the migration of the Amatitlán CIEP into a contract of exploration and extraction is finally tabled, Renaissance and LUKOIL will kick things into a whole new gear.

Renaissance produced an average of 1,209 boe/d at the Mundo Nuevo and Malva blocks in Chiapas during the first quarter of 2019. First quarter production from in the Chiapas blocks was reduced due to a temporary shut-in of the Topén-3 well while the Company prepares for the upcoming drilling and work-over activities and negotiates further land access requirements for this work program.

Sale of Ponton Block

Renaissance has entered into an agreement for the transfer of the Ponton block, no longer considered a strategic asset, to a Mexican O&G company for US$1,000,000 plus a gross overriding royalty of 10% on all future oil and gas revenue, for maximum aggregate royalties of US$3,000,000.

Craig Steinke, Renaissance CEO:

“As a result of winning all three of the Company’s targeted producing oil and gas blocks in the state of Chiapas, in Round 1.3, and entering into a partnership with PEMEX and LUKOIL to develop the 60,000 acre Amatitlán block, developing the Ponton property has become less of a strategic priority. The transfer of this property to a competent third-party operator will be the fastest path for Ponton’s field development and with the GORR in place, Renaissance will participate in the upside of any future development success.”

Additional Equity.Guru insights:

Renaissance Oil (ROE.V): developing the world’s next premier shale play

Closing thoughts

The prices of all three of our Oils are in bargain basement territory. Could they go lower yet? Of course they could, especially if oil begins flirting with lows tested late last year.

But if your bias is for the long term, current prices offer a compelling risk-reward setup.

END

~ ~ Dirk Diggler

Feature gif courtesy of Giphy.

Full disclosure: Jericho, Permex and Renaissance are Equity Guru clients. We own stock.