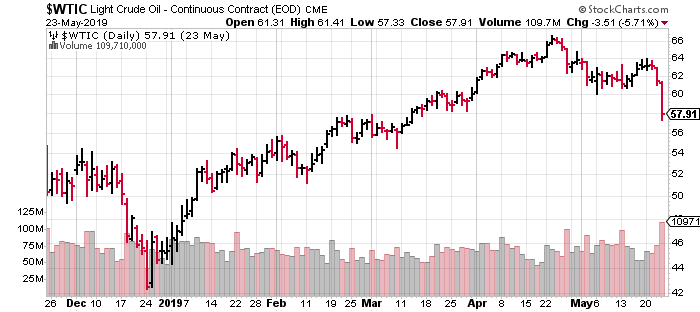

Today’s markets are nearly impossible to predict. Take oil for example: The Middle East is a ticking time bomb, and production out of Venezuela, Iran and Libya is plummeting. One would expect firmer prices, but, instead, we get a violent break to the downside.

The other side of the coin is the Trump-China trade war where an escalation in tarrifs, sanctions (and temper tantrums) may result in a global economic slowdown.

The two countries’ economic models are waaaay different. You have America’s brand of market capitalism versus China’s state-sponsored model and their extensive use of subsidies to support industry. China also has problems grasping the importance of intellectual property rights, a real thorn in America’s side.

If the global economy takes a hit, oil demand could fall off taking prices with it.

But let’s stick to the here and now. There is no mistaking that the current oil market is tight. Super tight. The market has moved into backwardation, a scenario where the nearby contracts (July, August, September (2019)) are trading at a premium to those further out (May, June, July (2020)).

This is not your typical market – the further out months normally trade at a premium to those along the front end of the curve. “Tight” is the only way to characterize the current situation. Recent volatility could resolve matters in any number of ways.

What was it Bill Shakespeare had to say about off-the-charts volatility? “Confusion hath now made his masterpiece“?

Ya… that could apply here.

A case for oils long term prospects

We need to remember that fossil fuels are finite – they take hundreds of millions of years to form, and once extracted from their subsurface reservoirs, they’re gone forever…

And global oil consumption is increasing. It’s not dropping off as one might expect what with the E-Mobility supercycle kicking into a whole new gear.

Quoting a recent Guru article authored by yours truly:

“Even with a universal shift towards electric vehicles, and our fossil fuel powered cars of today – infinitely more efficient than they were decades ago – we’re consuming 100M barrels of oil per day globally. That’s a dizzying number. And as a consequence, we’re going to extreme lengths to find new sources of the stuff.”

Quoting myself once again (how brazen is that?):

“It would seem that with this current rate of global consumption, and the fact that oil is becoming increasingly difficult to find and extract, all of the green initiatives that are currently in development will need to kick into high gear – FAST – in order to prevent the oil price from going parabolic in the not too distant future.”

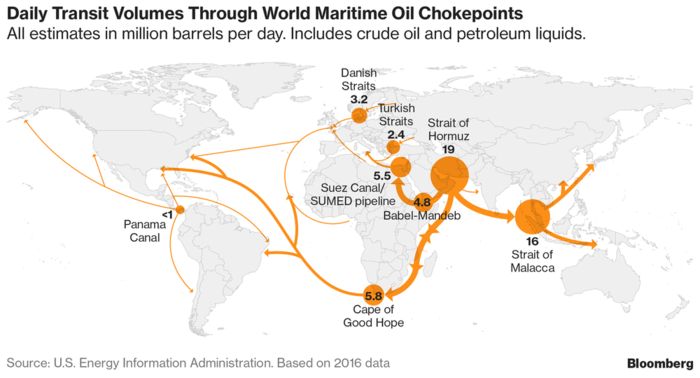

Oil is perhaps the most geopolitically sensitive commodity there is. And we haven’t experienced a serious geopolitical shock in over a decade.

If things heat up in the Middle East, or God forbid, another war breaks out and threatens any one of our major shipping channels, you might wanna clamp a boot on the family ride.

Three absurdly cheap junior oil plays with heaps of upside potential

Jericho Oil (JCO.V)

128.67 million shares outstanding

$43.75M market cap based on its recent $0.34 trading range

Jericho management had the foresight to stoke the company coffers while the going was good, before the market imploded several years back, and amassed a portfolio of distressed and undercapitalized assets at rock bottom prices.

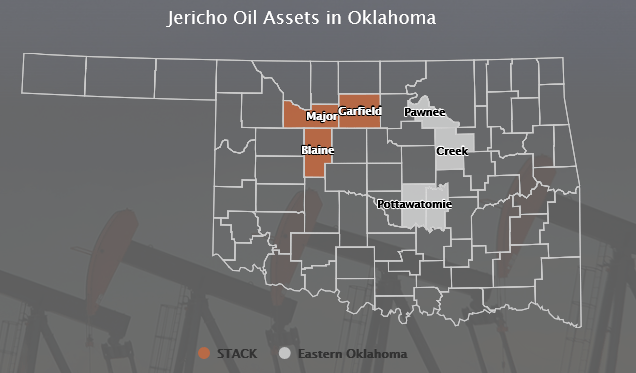

Today, the company boasts an enviable land position of some 55,000 acres, including 16,000 acres in the Anadarko basin STACK play of Oklahoma.

Oklahoma, according to the venerable Fraser Institute, is currently ranked THE best O&G destination on the entire planet.

Wedged between some of the biggest players in the oil arena, the company’s acres in the STACK represent tremendous latent value for Jericho and its shareholders.

Earlier this year, the company announced a 33% total production growth in 2018 – a record high – and a 30% reduction in operating expenses.

The real value creation will come when the company decides it’s time to resume drilling.

The company stopped drilling last November when oil prices collapsed. The horizontal wells Jericho is drilling in the STACK are extremely sensitive to spot prices due to the huge volumes of oil produced in the first six months.

Timing is everything. JCO is currently waiting for evidence that the lows are in for oil.

Importantly, the company’s Oklahoma acres are all held by production (HBP), meaning, they have no punitive clock ticking down forcing their hand – they can sit tight and wait for the opportune time to sink the bit back into the ground (HBP acres are held in perpetuity, as long as there is some form of production on the property).

A continued improvement in the oil price will see Jericho move back into a development mode.

There are a lot of moving parts to this company. I highly recommend the following Guru articles, and podcast, to help bring you up to speed:

Jericho Oil (JCO.V): a Moneyball play in the STACK – Anadarko Super Basin

Jericho Oil (JCO.V) unveils Valkyrie – a 725 BOE per day STACK well

EQUITY.GURU Podcast: Jericho Oil (JCO.V)

Jericho Oil (JCO.V): deep value in the STACK, a contrarian play

Permex Petroleum (OIL.CN)

40.02 million shares outstanding

$5.6M market cap based on its recent $0.14 trading range

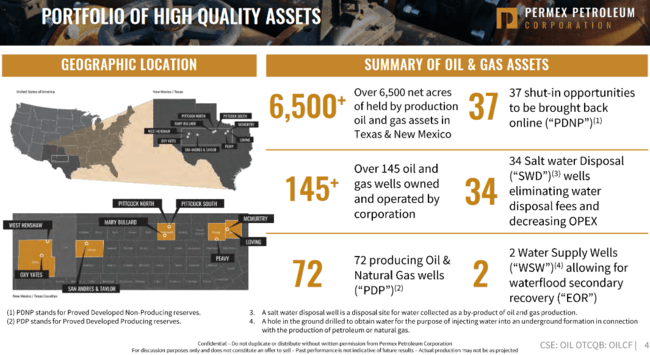

Permex is a deep value O&G play with acres and operations in the Permian Basin of West Texas and the Delaware Sub-Basin of Southeast New Mexico.

Slide number four from the company’s i-deck:

In a recent Guru offering, I unholstered my calculator and went to work breaking down what Permex’s New Mexican acres alone are worth, conservatively:

Just for fun, let’s take the company’s 2,650-acre position in New Mexico and multiply it by one-quarter of the ($95K) land values witnessed recently:

25% of $95,000 = $23,750 per acre.

$23,750 x Permex’s 2,650 New Mexico acres = $62,937,500

Based on its 35.97 million shares outstanding and recent $0.14 share price, Permex is currently valued at a little over $5,000,000.

In a news release dated May 9th, the company added $607,554.90 to its treasury.

In connection with the Offering, management and insiders participated by contributing a total of $185,300.00 to acquire 1,235,333 Units.

It’s a hugely positive sign when management participates in its own private placement (PP). Skin in the game demonstrates that management’s interests are aligned right alongside those of its shareholders.

Speaking of skin in the game:

“Prior to the issuance of the Units, Mehran Ehsan, President, CEO and a director of the Corporation held 3,096,974 Shares and stock options of the Corporation (the “Options”) exercisable to acquire 675,000 Shares. Following completion of the Private Placement, Mr. Ehsan now has control and direction over an aggregate of 3,826,974 Shares, Options exercisable to acquire 675,000 Shares and Warrants exercisable to acquire 730,000 Shares. If the Warrants and Options held by Mr. Ehsan are fully exercised, Mr. Ehsan would own 12.6% of the issued and outstanding Shares on a partially-diluted basis.”

Getting the word out

Permex Petroleum Corporation to Present at the 9th Annual LD Micro Invitational

“Permex today announced that it will be presenting at the 9th annual LD Micro Invitational on Tuesday, June 4, 2019 at 9.40 AM PST. President and CEO Mehran Ehsan will be presenting and meeting with investors.”

I’ve barely scratched the surface here. The following Guru articles, and podcast, detail the deeply undervalued nature of this dynamic junior O&G company:

Permex Petroleum (OIL.CN): an enviable position in the booming Permian Basin

Permex Petroleum (OIL.CN): a deeply undervalued Permian Basin focused oil and gas opportunity

Renaissance Oil (ROE.V)

279.98 million shares outstanding

$42M market cap based on its recent $0.15 trading range

Renaissance, a first mover in Mexico’s recently reformed energy sector, is focused on developing the country’s considerable untapped shale potential.

Slide number five from the company’s i-deck:

The Upper Jurassic Shales Renaissance are tapping are the major source-rock for the largest offshore oil field on the planet – Cantarell – not to mention THE most prolific oil well – Cerro Azul-4 – ever put into production.

- The Cantarell oil field peaked in 2003 producing 2.1 million barrels of oil per day.

- The Cerro Azul-4 well topped out at an astounding 260,000 barrels of oil per day.

On May 1st, the company released 4th quarter and full year 2018 results.

Highlights from that press release included:

- Revenue and operating netback in the fourth quarter of 2018 were $5.9 million and $0.2 million, respectively.

- On the 60,000 acre Amatitlán block, Renaissance, with its partner LUKOIL, completed a 17 shallow well drilling program targeting the Chicontepec tight sand formations and additionally, drilled and cored a 3,550 meter well to evaluate important deeper zones.

- Evaluation of the cores acquired from the Upper Jurassic formations at Amatitlán confirms the presence of the critical characteristics of a commercial play.

- Strong crude oil and natural gas prices resulted in record annual revenue of $25.0 million for 2018 compared with $22.7 million in 2017. Crude oil sales averaged $80.77/bbl in 2018 compared to $58.23/bbl in the previous year while sales of natural gas averaged $5.19/mcf compared to $4.26/mcf in 2017.

With its partner LUKOIL, the company completed its US$45.5 million work commitment on the Amatitlán block with the drilling of 17 wells (intersecting the shallow Tertiary Chicontepec formations), all of which have undergone completion operations and have been brought into production.

This program also included the drilling and coring of a 3,550 meter well testing the deeper Upper Jurassic formations.

Evaluation of the cores and cuttings taken from four Amatitlán block wells that penetrated the Upper Jurassic Shales “confirmed the presence of the critical characteristics of a commercial play.”

This is where things get interesting. Quoting our recent coverage on the company:

Renaissance management is being conservative in their language here. My read, fwiw (and please take this with a grain of salt): oil and gas are bubbling and oozing out of these Upper Jurassic Shale drill cores.

Renaissance and LUKOIL are planning an aggressive horizontal drilling program in the near future. The 1,417 BOE/D of production highlighted in this report represent very decent numbers, but it’s the horizontal drilling that’s really going to move the needle for this company.

The following Guru articles offer a much deeper delve into Renaissance’s compelling fundamentals:

Renaissance Oil (ROE.V): developing the world’s next premier shale play

Closing thoughts

Admittedly, these are contrarian plays. They are currently underappreciated, unloved, and as a consequence, extremely undervalued. Herein lies the opportunity.

A contrarian approach is, arguably, one of the most profitable for the medium to long term. It’s where I prefer to tuck in.

All three of these companies are capable of producing market-moving news. All three of these co’s are poised to pounce on new acquisition and or development opportunities when they feel the time is right. All three of these co’s are trading at extremely modest market caps.

And it’s only a matter of time before the “smart money” recognizes this latent potential and begins mobilizing funds into this under appreciated sector. When that happens, things could move quickly.

From a recent Guru offering on the subject:

When you’re scanning the stock universe attempting to home in on real value, real fundamentals, you need to peer inside the resource arena. Historically, O&G (Oil and Gas) has generated A LOT of profits for its shareholders. It has produced a lot of nest eggs.

Buying these asset rich companies at fire-sale prices, before the rest of the market catches on, is a no-brainer for us contrarian types. It’s a sure-fire way of getting the biggest bang for your hard-earned buck.

Tick-Tock. Don’t be this person:

END

~ ~ Dirk Diggler

Full disclosure: Jericho, Permex and Renaissance are Equity Guru marketing clients. We own their stock.