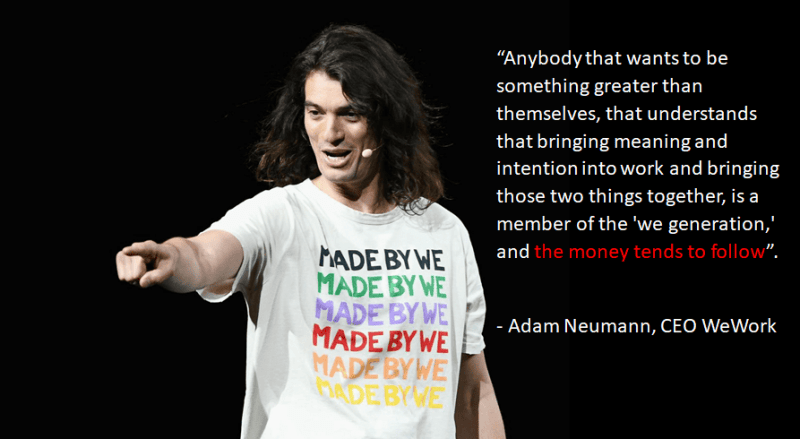

A recent article in The New Yorker, savagely attacked American Venture Capital (V.C.) culture – focusing on the billions of dollars wasted on WeWork’s bullshit business model.

The CEO of WeWork (an office-share company) was a self-aggrandizing, charismatic, pot-smoker named Adam Neumann who destroyed competitors by charging unsustainably low office rental rates.

The V.C companies who funded him, knew the model didn’t work.

But blowing the whistle on the scam would risk their own capital, so they dummied-up while luring in more investors.

Neumann was such a brilliant blow hard, one investor plonked down $4 billion after a 12-minute tour of the WeWork facilities.

“For decades, venture capitalists have succeeded in defining themselves as judicious meritocrats who direct money to those who will use it best,” stated The New Yorker, “But examples like WeWork make it harder to believe that V.C.s help balance greedy impulses with enlightened innovation.”

“Rather, V.C.s seem to embody the cynical shape of modern capitalism, which too often rewards crafty middlemen and bombastic charlatans rather than hardworking employees and creative businesspeople”.

Is Canadian V.C. culture any better?

The short answer is “Yes”.

Partly because it’s smaller.

“In 2019, the U.S. V.C. industry deployed $136.5 billion.

“In Q3, 2020, 138 financing rounds in Canada closed for total disbursements of $895 million,” reported CPE Analytics, “Q3 2020 disbursement level was the second lowest since 2017, just slight above the quarterly total of $847 million in Q3 2018.

One example of a smart, transparent, ethical Canadian V.C. company is Victory Square Technologies (VST.C) which “builds, acquires and invests in promising startups, then provides the senior leadership and resources needed to fast track growth”.

VST is targeting the 4th Industrial Revolution with a portfolio of 20 global companies using AI, VR/AR and blockchain.

“With real skin in the game, we’re committed to ensuring each company in our portfolio succeeds,” states VST. “Our secret sauce starts with selecting startups that have real solutions, not just ideas.”

Victory Square offers investors “early-stage access to the next unicorns before they’re unicorns”.

Victory Square CEO Shafin Diamond Tejani – blessed with a diabolically powerful name – is one of those rare capital market dudes who has a beating heart.

Google his name and you aren’t splashed in the face with the normal bucket of investor bile aimed at small-cap CEOs.

Through VST, Tejani and his team have donated over 7,500 volunteer hours, helped raise over $75 million for school programs and community organizations, and awarded over $250,000 in scholarships.

In the “Car Ride Confessions of a CEO” interview with PI Financial Investment Advisor Justin Hayek below, Tejani tells his origin story:

“I started in the mid-90s in the on-line dating space,” explains Tejani, “At the time there were classified sections in the back of newspapers where people would connect, or 1-900 toll free dating numbers.”

“I saw how the internet was gong to disrupt that. It was a borderless subject matter, in that dating was all over the world. And we became very good at driving customers”.

“Tying into Victory Square today, our model is buying, building or investing in companies that compliment out existing portfolio, or going and finding a business or a team that we already have customers for.” – End of Tejani.

On December 30, 2020 Victory Square provided a corporate update on the year.

Financial Highlights:

- Net income for the nine-month period ending September 30th, 2020 was $13,617,124 and earnings per share of $0.18

- Completed an oversubscribed $6.1 Million private placement

- Significant growth by Victory Square companies in key sectors: Digital Health, eSports, Gaming, Crypto, AR/VR, Cybersecurity, Cloud Computing and Plant-based Sciences

- Upcoming Catalysts: Victory Square to spin-off V2G/GameOn and Immersive Tech for public listing; and launch of one-stop-shop virtual health care platform (telemedicine, virtual pharmacy, at-home point-of-care diagnostic testing) in 35 U.S. States with over 10,000 Health Care Professionals

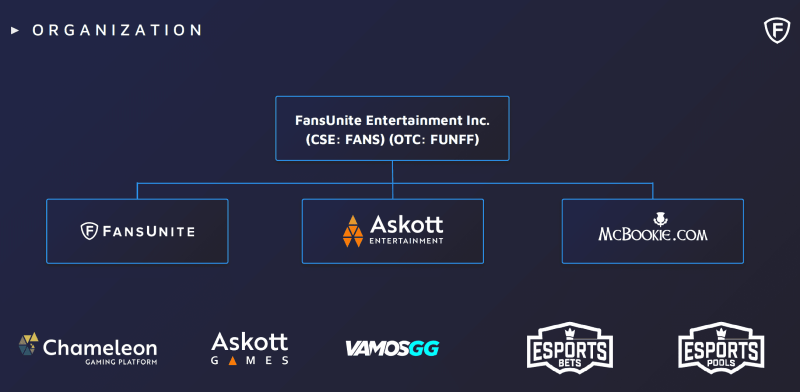

- Victory Square spin-off, FansUnite Entertainment Inc., reached $150 Million CAD market cap

“FansUnite Entertainment (FANS.C) subsidiary Askott Entertainment will supply its iGaming platform, Chameleon, for an esports sportsbook soon to be formed by its FANS partner GameCo and US Bookmaking and Sky Ute Casino,” reported Equity Guru’s Joseph Morton on December 16, 2020.

“FansUnite will be the first iGaming solutions provider to get considerable exposure to the U.S. esports betting market through GameCo’s partnership with Sky Ute Casino and Bookmaking”.

“In an announcement that will have surprised many, FansUnite (FANS.C) announced Monday their Askott Entertainment and E.G.G. subsidiaries have received approval from the Malta Gaming Authority for a Gaming Service License and Critical Gaming Supply license, allowing the group to provide online casino games, fixed odds betting, pool betting, and controlled skill games across Europe,” wrote Equity Guru’s Chris Parry on December 7, 2020.

“FANS stock rose 16.4% on the news to $0.78,” added Parry, and is up nearly 300% over the last month”.

Editor’s Note: On December 31, 2020 – FANS is trading at $1.13.

On November 5, 2020 FANS 100%-owned subsidiary McBookie released October, 2020 numbers, reporting “the highest increase in monthly revenue and gross margin in the company’s 10-year history”.

Two months ago, FANS announced that the Scottish-based McBookie had increased year-over-year turnover for the months of July and August by 108% – from CAD $3 million to $6.3 million, with 78% of the turnover growth led by the return of live sports.

“Online gambling is set to be worth over 60 billion dollars and is expected to hit $94 billion in 2024,” stated Bit Rebels who cite various modernizations including Augmented & Virtual Reality making their way into the gambling world.

“WeWork CEO Mr. Neumann had a talent for imbuing “Animal House” antics with a larger meaning,” reported The New York Times, “In his view, WeWork didn’t simply sublease office space to workers; it supplied them with kombucha, cold-brew coffee and an ecstatic sense of community. ‘They’re coming to us for energy, for culture,’ Mr. Neumann would say.”

After WeWork’s IPO imploded, Neumann was fired but walked away with a $1 billion golden parachute.

“You can’t blame We Work’s CEO Adam Neumann for being Adam Neumann,” stated Jeremy Neuner in the New Yorker article, “It was clear to everyone he was selling something too good to be true. He never pretended to be sensible, or down to earth, or anything besides a crazy optimist. But you can blame the venture capitalists.”

Canadian V.C. culture isn’t perfect.

But Victory Square Technologies (VST.C), lead by Shafin Diamond Tejani, is an example of Canadian V.C company that is intent on providing value to its client companies, investors – while improving the world they live in.

That’s not nothing.

- Lukas Kane

If you’d like to learn more about FansUnite, here is an interview from our First Glance with Jody Vance video series. Tune in!

Full Disclosure: FansUnite is an Equity Guru marketing client.