Bank of America (BofA) securities has upped its bullish case on the prospects of nuclear power and a subsequent bull market for uranium. The reason? Recent surveys showing a growing acceptance from governments and the people that nuclear power will be a significant contributor to decarbonization. A recent Gallup poll found that 55% of Americans support the construction of new reactors, the highest number in over a decade.

BofA’s Research Investment Committee (RIC) outlined two reasons for higher uranium prices in their monthly research report titled, ‘The nuclear Necessity’.

- Russia’s invasion of Ukraine underscored European nations’ dependence on Russian gas and commodities leading to an increased demand for national energy security.

- Uranium demand due to 60 new reactors under construction and 100 more approved. Tied to this is China’s drive to increase nuclear power capacity with Beijing looking to build 150 new reactors by 2035. BofA mining analyst Michael Widmer believes uranium supply will lag demand. This shortage will push uranium prices higher by between 20-40% in the relatively near future.

In the short term, sanctions on Russian uranium would limit supply, and nuclear power will become more prevalent as that plays out.

In terms of investment plays, BofA listed Cameco Corp, Constellation Energy Corp, Vistra Energy Corp, and BWX Technologies as the stocks that will benefit the most from the trend. The Global X Uranium ETF (URA), which I have covered, is also mentioned for investors looking for a diversified uranium play.

Price target for uranium? BofA estimates the price of uranium will hit $75 per pound by Q3 2024.

With the current state of geopolitics, we have heard that the largest uranium miner, Kazatomprom, is preparing to boost production to fulfill orders from new customers as European countries move their supply chains away from Russia and Russian state-owned nuclear power company, Rosatom.

Just recently, Ukraine announced a nuclear deal with Canada’s Cameco. A 12 year deal has been signed which will see Ukraine buy enough uranium from Cameco to power all of its nuclear reactors albeit giving each party the right to change sales volumes with two years notice. The unusual flexibility of the deal reflects the uncertainties caused by Russia’s war with its neighbour and underlines the high stakes for both parties.

“There’s a lot of flexibility” in the deal, Energoatom CEO Petro Kotin told Reuters in an interview. “The agreement is up to 2035, but two years prior to supply of the uranium, we are to (give) them an indication of what we will need, what volume of uranium we will require.”

For Cameco, the risks are financial as this deal is worth at least $4 billion at current prices. Also a risk that Ukraine may require less uranium should Russia capture or damage more Ukrainian reactors. For Ukraine, the reliance on a single provider leaves it with few alternatives to maintain power supplies.

Uranium prices surged to above $53.5 per pound in early May, the highest in one year, amid optimistic demand and persistent concerns of threats to supply. When we zoom out (which I have done above), the uranium chart looks even more interesting. We are testing a resistance zone. This is where one would expect some stalling, sell off or retracement. However, there is a chance we get a breakout instead. If so, uranium is then on track to test the previous recent highs from April 2022 around $65. Potential extremely bullish breakout is in play.

But just wait… I did just say uranium is at a resistance zone. Other uranium charts are also at major resistance. If these charts sell off from here, it is likely uranium prices will do the same.

The Global X Uranium ETF is still below our major resistance zone of $21.50. A neckline in the head and shoulders pattern which I have outlined in recent ‘bearish’ uranium articles. However, an interim resistance at $20.25 was taken out, and this recent pullback has taken us straight down to retest this zone once again. Let’s see if buyers will step in to defend this zone by watching the price action on the intra day charts.

A very important recovery has occurred on the Sprott Uranium Trust (U.UN). A head and shoulder pattern was formed and triggered on the Sprott Physical Uranium Trust back on March 7th 2023. Recently, we have crossed back above the $16.50 zone. This means the head and shoulders reversal pattern has been nullified, thus the bullish trend is back in play. We are seeing a retracement, but now what was once resistance becomes support. Watch to see if buyers jump in here. The next resistance comes near the $17.50 zone.

In summary, very good price action on uranium. While other energy commodities take a hit, uranium is holding strong due to fundamentals. Watch to see if uranium can breakout on the spot price leading to more momentum. If not, another pullback would be in store.

Here is what happened with the Athabasca uranium plays this week.

NexGen Energy (NXE.TO)

NexGen this week announced that the Saskatchewan Ministry of Environment has approved the commencement of the 2023 Site Infrastructure and Confirmation Program (SI&CP) at the Company’s 100% owned, Rook I project in the Athabasca Basin, Saskatchewan. The SI&CP comprises a comprehensive field program focused on infrastructure upgrades to support increased activity and continued engineering data confirmation for the Project.

The SI&CP will generate an increase in NexGen’s on-site workforce by more than 60 full-time equivalent personnel, with the majority of the workforce including contractors and service providers representing the Local Priority Area. NexGen is budgeted to spend approximately $35M on SC&IP activities during 2023.

Leigh Curyer, Chief Executive Officer, commented: “The commencement of the 2023 Site Infrastructure and Confirmation Program represents another exciting advancement for NexGen and the surrounding communities in Saskatchewan’s Athabasca Basin. The work reflects NexGen’s ongoing commitment to ensuring elite standards in Health, Safety, Environment, and Quality while expanding infrastructure to support long-term economic and social activity in the region. As the Company transitions into this next exciting phase of project execution, we are pleased to be building on the success of NexGen’s 2022 geotechnical program as we confirm our understanding of the site conditions of the future production and exhaust shafts which will optimize Project development and shaft sinking activities.”

The 2023 Site Infrastructure Program includes expanding and upgrading existing infrastructure as well as constructing new infrastructure to support increased activities on the Project in the coming years. The 2023 site infrastructure upgrades are focused on supporting increased personnel at the Project while maintaining NexGen’s elite Health, Safety, Environment, and Quality (“HSEQ”) standards.

- Expansion and Upgrade of Temporary Camp Facilities

- Site Access Improvements

- Patterson Creek Bridge Upgrades

The stock has broken out above a range taking out the $5.30 zone. Just like the other two uranium charts mentioned above, NXE is now pulling back to retest the break out zone. Expect to see this similar technical play on other uranium sector charts. Going forward, traders will want to see evidence of buyers stepping in around the $5.30 zone on the intraday charts. This would indicate the recent move is a retracement, and buyers are stepping in for the continuation higher.

Forum Energy Metals (FMC.V)

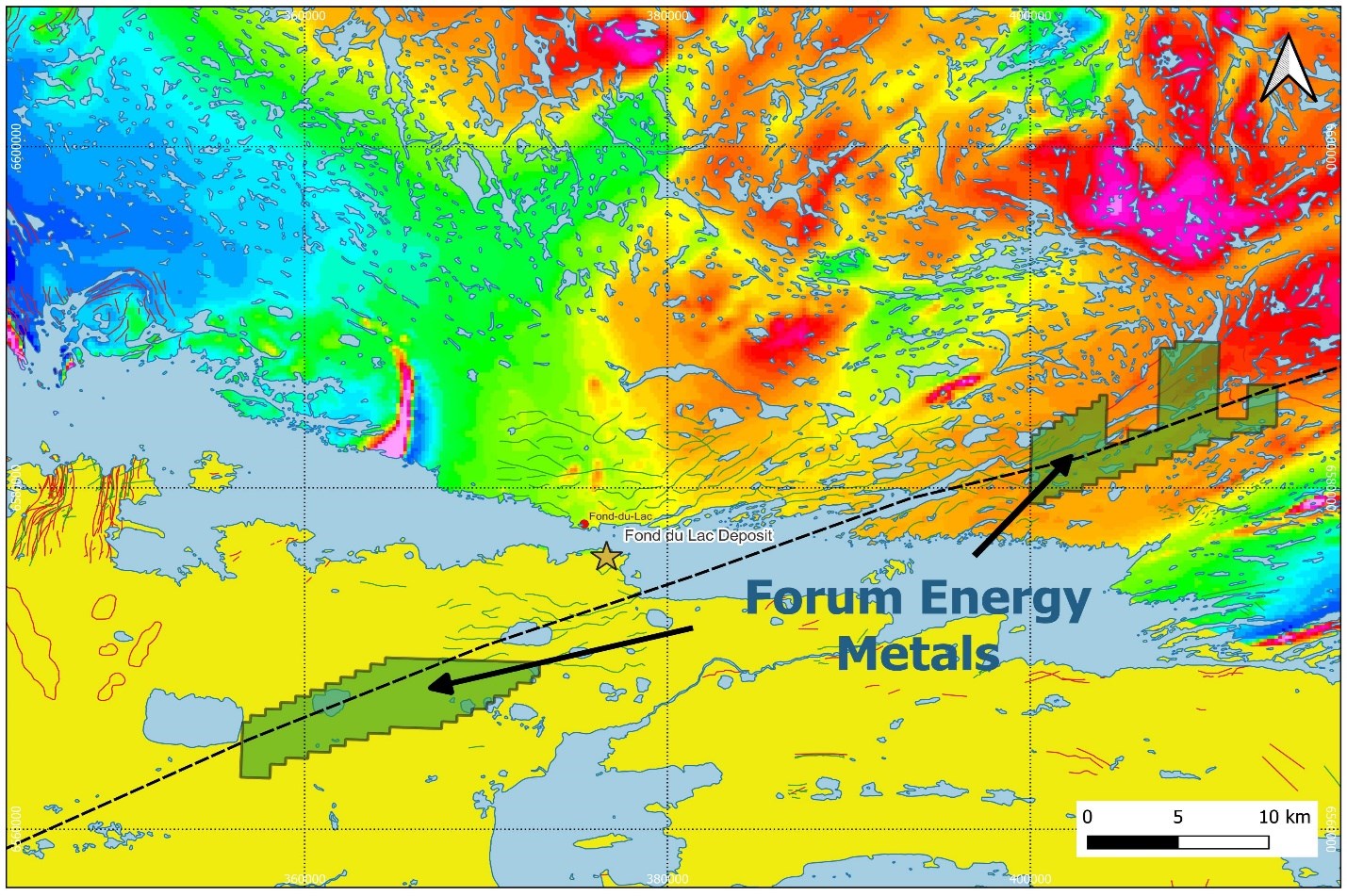

Forum Energy Metals and Traction Uranium Corp (TRAC.CN) announced that they have commenced an airborne magnetic, electromagnetic (EM) and radiometric survey on Forum’s 100%-owned Grease River Project, located along the north rim of the Athabasca Basin, Saskatchewan.

The helicopter-borne survey will be conducted using a New Resolution Geophysics specially designed Xcite™ Time Domain Electromagnetic System. The 1,290 line-km survey will be conducted at a 100 metre line spacing over the entire Grease River claims totaling 10,528 hectares along the Grease River Shear Zone.

Traction entered into an option agreement with Forum whereby Traction is entitled to acquire a 51% interest in the Property by paying an aggregate of $250,000, issuing an aggregate of 1,625,000 common shares and funding an aggregate of $3 million in exploration expenditures on the Property by December 31, 2025. Forum is the Operator during this First Option Period. Traction has the further option to earn up to 100% interest in the project by making $1.7 million in cash payments, 5.5 million share payments and $6 million in exploration up until December 31, 2028.

The stock recently broke below a major support zone around $0.09, just below the psychological $0.10 zone. The stock may find a range here as at time of writing, the stock is holding above recent lows.

Denison Mines (DNN)

Denison Mines filed its condensed consolidated financial statements and management’s discussion & analysis for the quarter ended March 31st 2023. Documents can be seen on the Company’s website, SEDAR, and EDGAR.

Highlights for the quarter include:

- Completed an internal Concept Study examining the application of the ISR mining method at Midwest

- Discovered high-grade uranium mineralization at Moon Lake South

- Feasibility Study for Wheeler River Phoenix deposit on track for completion by mid-2023

- Released 2022 ESG report, highlighting progress on environmental, social and governance initiatives

David Cates, President and CEO of Denison commented, “Our Q1’2023 operational highlights showcase the multiple facets that make up our dynamic company. During the quarter at our flagship Wheeler River project (‘Wheeler River’), we progressed our efforts on the Phoenix deposit (‘Phoenix‘) Feasibility Study (‘FS’), incorporating results from the highly successful leaching and neutralization phases of the Feasibility Field Test (‘FFT’) completed in late 2022. With the FS nearing completion, and the environmental assessment for Phoenix progressing in parallel to our technical de-risking efforts over the last several years, Phoenix remains squarely positioned to become the next new uranium mine in the eastern portion of the Athabasca Basin region.

The stock has the similar set up to other charts covered in this article. A breakout and now retest… although at time of writing, the daily candle is showing a break below support, meaning that the buyers are not stepping in with enough strength to bid prices up. The candle close will confirm this. If we do confirm this kind of close, then prices would return back to its range, with a potential retest of the support around $0.95.

Please could you send me your latest uranium report

Here it is!

https://equity.guru/2023/11/27/uranium-the-rocket-has-been-launched/