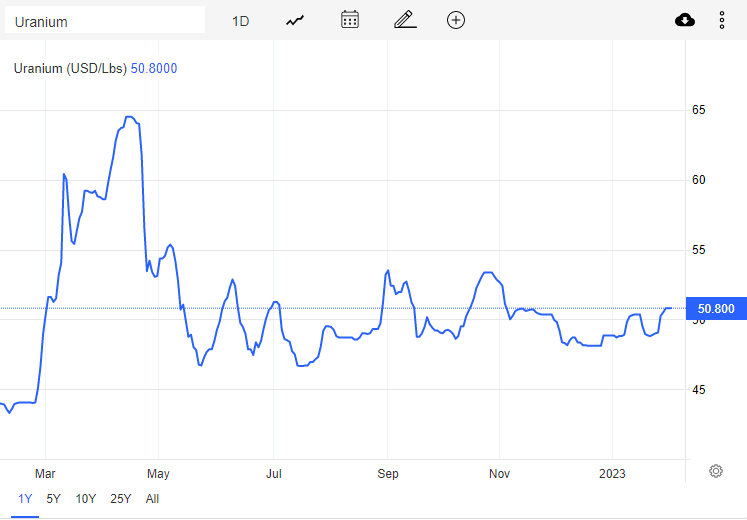

Uranium price has made a rally back over $50, and bulls are hopeful that this time the $50 zone will be strong support. Support which will be able to provide a platform for more upside momentum!

This past weekend was the Vancouver Resource Investment Conference, and uranium was a hot topic. A lot of bulls including President and CEO of Sprott US Holdings Inc Rick Rule. A lot of discussions about uranium price rising due to the ongoing Russia-Ukraine war and countries like Japan, France, South Korea, India, the UK, the US, and Germany recently announced new constructions and additional incentives and funding for nuclear power. Things which I outlined in my 2023 uranium outlook.

“I think the principal factor is the change of public opinion in Japan. With regards to the pace of Japanese restarts, the biggest source of new demand that you could have on the planet is from their 40 existing reactors,” said Rick Rule, CEO of Sprott US Holdings.

“They don’t have to be built, they just have to be restarted. That would raise the structural demand for uranium by between 10 and 12 million pounds a year.”

“When we talk about energy in the West, we talk about stuff like Teslas,” he pointed out. “Increasing the living standards of the poorest of the poor means that we’re gonna need more energy from all sources. Solar, sure. Wind, yeah. Coal, of course. But nuclear is a wonderful source of post-construction, cheap, reliable, non-carbon generating baseload power.”

Goviex Uranium CEO Daniel Major says demand is set to increase while supply remains tight:

“At the end of the day, we consume about 190 million pounds a year. Currently, we dig out of the ground about 130 million pounds,” said Major.

Here’s what happened this week with Athabasca Basin based uranium stocks. A relatively quiet week.

Cosa Resources (COSA.CN)

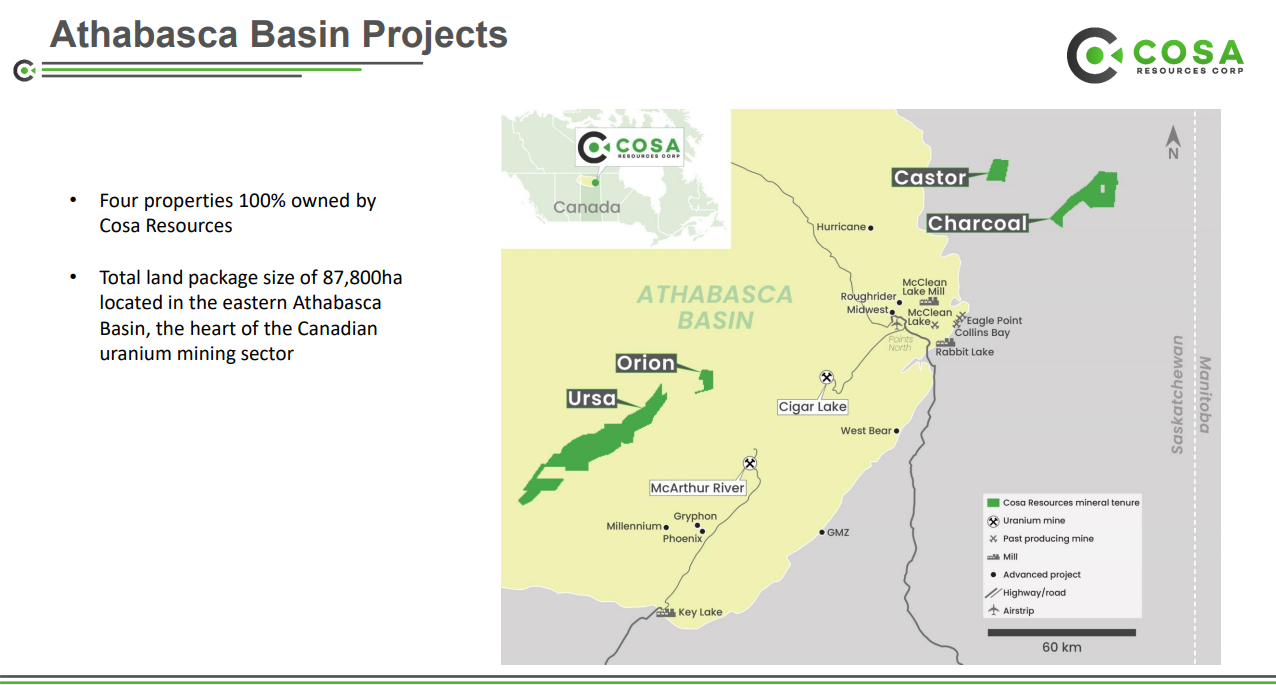

Cosa Resources is focused on the exploration of its uranium and copper projects in northern Saskatchewan. The portfolio includes four uranium exploration properties: Ursa, Orion, Castor and Charcoal totaling 87,800 ha in the eastern Athabasca Basin.

This week the company announced the appointment of veteran uranium geologist Andy Carmichael as Vice President of Exploration.

Andy Carmichael is a Professional Geoscientist with 19+ years in mineral exploration, of which 17+ have focused on exploring for uranium deposits in the Athabasca Basin, Hornby Bay Basin, Colorado Plateau, and Namibia. Most recently Andy served as Vice President of Exploration at IsoEnergy Ltd. (TSXV: ISO) where he was also a member of the team that discovered the Hurricane deposit, currently the world’s highest-grade Indicated Mineral Resource for uranium.

“I am extremely happy to welcome Andy Carmichael to Cosa’s industry leading uranium exploration team”, said Keith Bodnarchuk, President and CEO of Cosa. “Andy brings an outstanding track record of success and discovery in the Athabasca Basin including being directly involved with the discovery of the Hurricane deposit. Andy will immediately begin planning for exploration programs on our uranium properties, including the 100% owned Ursa project.”

The stock actually rallied over 14% on the news. A major reversal pattern, the type we like to trade and notify our readers here at Equity Guru, was triggered with the break above $0.175. Market structure said more highs were coming.

The stock is now at an important resistance zone. A gap up to $0.45 is here which tends to be resistance. If we fill this gap, expect new all time highs for the stock.

NexGen Energy (NXE.TO)

NexGen Energy announced the appointment of Ivan Mullany to the company’s board of directors.

Mr. Mullany has over 35 years in mining project management with broad international experiences. Most recently, with Newmont Corporation and its predecessor Goldcorp Inc. on the Senior Leadership Team, he led numerous major projects, collectively in excess of $18 Billion, during the engineering study, construction and execution stages.

Leigh Curyer, Chief Executive Officer, commented: “On behalf NexGen Energy’s Executive and Board of Directors, we are very pleased to welcome Mr. Ivan Mullany. Mr. Mullany has extensive knowledge and experience in the successful execution of global mining project construction and operational excellence. Mr. Mullany is joining an experienced team dedicated to the responsible development of the Rook I Project that will create significant generational benefits to Saskatchewan and Canada, while playing a leading role globally in the delivery of clean energy fuel. Mr Mullany’s skills and experience are an excellent complement to the Board and timely, as Rook I advances into Detailed Engineering in 2023.”

Price action on NexGen remains choppy after closing above the $6.30 zone. Price is back retesting this zone as support, and if bulls can defend this zone, more highs are on the cards.

Because it was relatively a quiet week for news on the Athabasca Basin stocks, here is a quick look at Cameco:

Another one of our famous reversal pattern criteria was met with a close above $31. Cameco has made one higher low at $33, and another one could be in the cards.

I want to point out that Cameco is very close to a major resistance zone. Resistance is where long traders tend to take profits, and where short sellers enter. They are zones of high importance and one where you can expect some sort of price action or battle.

This zone comes in at $40 and will likely be tested by next week’s uranium sector roundup. If we break and close above, it would be very bullish for the stock… and likely a sign that investors are very bullish on uranium and uranium price. A rejection would still be a pullback until we close below $33.