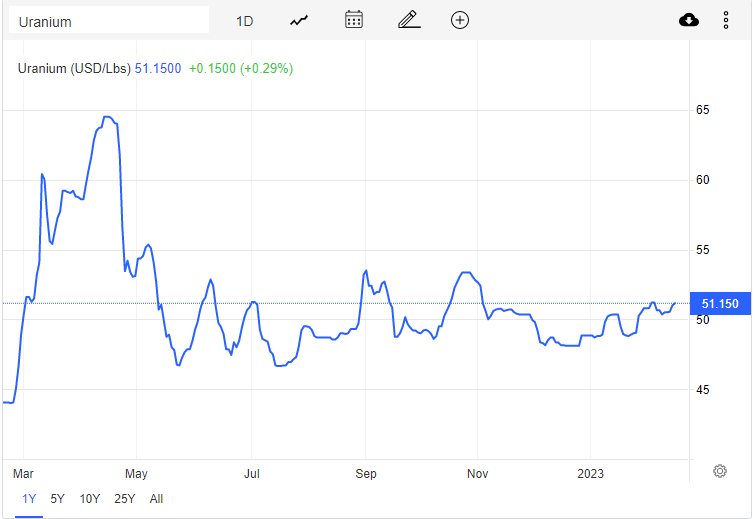

Shifting investor sentiment is leading to an environment for more strength ahead in the uranium sector. And it may not be the factor you are thinking about. Some analysts believe uranium will be an inflation hedge:

“January marked a pivotal month in shifting investor sentiment and diminishing headwinds for equity markets, which supported the surge in uranium mining equities,” the report said. “A combination of the ‘January Effect’, lessening fears that the U.S. economy is heading toward recession and declining inflation, buoyed markets. Markets began their move higher on January 6 when the December U.S. Jobs Report showed wage growth was below expectations, and indication that inflation pressures may be weakening.”

The wide expectation is that the U.S. Federal Reserve will eventually get inflation under control, producing a risk-on sentiment that contrasts with last year’s risk-off. Uranium presents an ideal inflation hedge, especially given that inflation could stay around for quite some time. The Fed realizes that getting inflation under control won’t be an overnight phenomenon, so appreciating assets in time of relatively high consumer prices could help shield an investor’s portfolio.

Uranium prices have had a good start to 2023. January was a strong month and after a brief pullback post the $50 break, it appears as if uranium is about to break above recent yearly highs and continue its uptrend. The next level comes in at the $53.50 zone.

“January was a strong month for uranium markets, along with the broad equity and bond markets, but a mixed month for the commodity complex overall,” the Sprott report noted. “The U3O8 uranium spot price rose from $48.31 to $50.75 per pound in January, a 5.05% increase, while uranium mining equities gained 14.65%.”

“In 2022, the fundamentals for uranium and nuclear energy significantly strengthened and were bolstered by a continuous flow of endorsements from global governments,” the report added. “Despite this, uranium mining equities were dragged down in 2022 by their systemic risk to the overall markets, not surprising given last year’s bear market in which the S&P 500 Index fell 18.11%.”

We know that the retail crowd loves the uranium sector. But let’s not forget the institutional crowd. Many analysts have come out bullish due to the move to clean energy and supply constraints. Analysts at Citigroup also see a bullish case. They believe uranium prices are set to become “significantly higher“.

The investment bank said disruptions in nuclear supplies because of the war in Ukraine and a potential embargo on Russia’s supplies could send prices higher. Citigroup believes the probability of a ban on Russia’s uranium supply “drastically increased” this week following discussions in the US Congress and European Union parliament.

Citigroup projects uranium prices will move higher over the next five years.

Here is what happened with Athabasca uranium stocks this week.

F3 URANIUM CORP (FUU.V)

F3 Uranium Corp, formerly known as Fission 3.0, announced results from the first eight drill holes of the 20 hole winter drill program at the JR zone on the Patterson Lake North Property. Continuity of high grade mineralization has been established along strike towards the south with hole PLN23-048 on line 030S, which hit 14.0m total composite mineralization with 4.0m of >40,000 cps, including 0.5m of “offscale” or >65,535 cps, a 30m stepout from the discovery hole. Out of the eight reported drill holes, seven are mineralized and five have high grade mineralization with radioactivity >10,000 cps.

Raymond Ashley, Vice President Exploration, commented:

“The drill program started by testing the depth extent of the zone, while also testing it along strike from the discovery area on line 00N. The team is becoming familiar with the geology and controls on mineralization on the JR Zone which is currently defined over an area measuring approximately 45m by 50m and have identified strong continuity of high grade mineralization along strike towards the south as the program continues to explore that direction to increase the total mineralized strike length. Additionally, we are continuing to drill test further towards the unconformity, with the objective to test the intersection of the A1 main shear zone at the unconformity.”

The full table of drill results can be seen.

The Patterson Lake North Property is located just within the south-western edge of the Athabasca Basin in proximity to Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade world class uranium deposits which is poised to become the next major area of development for new uranium operations in northern Saskatchewan.

The stock hit highs at $0.50 after a major rally. Now the stock is showing some signs of pulling back. $0.30 is a major support zone which did hold. The stock is now ranging below the $0.375 zone for the past 7 trading days. Watch for a breakout here which would also get us back above my moving average. If so, we can retest previous highs just above $0.50.

CANALASKA URANIUM (CVV.V)

CanAlaska announced the completion of the temporary work camp and mobilization of drill crews and equipment to the Key Extension Project in the southeastern Athabasca Basin. The 2023 Key Extension drill program will focus on phase-one exploration of newly defined exploration targets generated through a series of geophysical programs completed in 2022.

CanAlaska CEO, Cory Belyk, comments, “The CanAlaska team has generated several very intriguing drill targets defined by multiple geophysical surveys. Results from these surveys closely resemble results commonly found in association with major basement-hosted uranium deposits in the Athabasca Basin region, namely NexGen’s Arrow deposit and Cameco’s Eagle Point deposit. This maiden drilling program is designed to test several of these targets where they are associated with the interpreted location of the large Key Lake fault, host to the nearby Deilmann and Gaertner ore bodies that together produced over 150 million pounds of uranium. I am very excited about the potential for this project to be among the front-runners for new discoveries in the eastern Athabasca Basin right next to all the critical infrastructure of Cameco’s Key Lake mill.”

The Company completed a ground gravity survey on the project that defined three high-priority gravity anomalies. These ground gravity anomalies are associated with historically mapped conductors in areas where these conductors bend or flex.

The stock is seeing some rejection at the $0.60 resistance zone, and is forming what appears to be a reversal pattern. I would watch the major psychological $0.50 zone. Watch to see if bulls step in at that zone, and can keep the bullish momentum going.

NEXGEN ENERGY (NXE.TO)

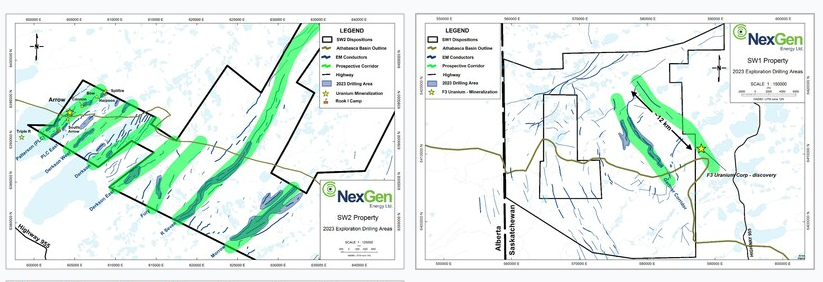

NexGen announced the commencement of an expanded 2023 exploration program designed to follow up positive results for the 2022 exploration drill program and to test prospective areas that have been highlighted by detailed 2022 geophysical surveys.

NexGen has planned a substantial geophysical program in 2023 for drill target generation across high priority areas of NexGen’s mineral tenure (SW1, SW2 and SW3) in the southwest Athabasca Basin, Saskatchewan. It’s an exciting time at NexGen with the permitting and licensing of Rook I advancing.

2023 exploration drilling will systematically test priority conductors that have been highlighted by encouraging 2022 drilling results, as well as geophysical survey results that identified drill-ready stacked anomalies. This drill program – targeting nine (9) conductive trends – has a planned total of 22,500 metres with up to three (3) drill rigs in operation.

Drill target areas:

- SW2 – 2023 drilling is planned for the fertile Patterson Corridor and seven (7) additional prospective conductive trends of which the majority have not been drilled to date by NexGen (listed below from west to east) that are parallel to the conductor hosting the Arrow Deposit.

- SW1 – 2023 drilling is planned on the SW1 portion of the fertile trend hosting F3 Uranium Corp’s PLN discovery as well as on the prospective and underexplored Gartner Corridor.

Leigh Curyer, Chief Executive Officer, commented: “Through exploration drilling and strategic geophysical surveys, NexGen is progressing high priority targets to advance towards the discovery of additional material mineralization. The focus of this expanded exploration program is to test for new “Arrow-type” mineralized zones across our dominant land position in the southwest Athabasca Basin. The application of muon tomography in 2022 is another example of NexGen’s identification and application of industry leading techniques which focuses on further optimization of drilling time, cost, and elite environmental management.

Grant Greenwood, Vice President, Exploration, commented: “The 2022 exploration program has highlighted numerous areas for follow-up drilling in 2023 and speaks to the systematic testing of NexGen’s vast and many prospective targets across NexGen’s land tenure. The 2023 drill program builds upon previous drill results and the 2022 geophysical program has elevated numerous targets for further investigation where pronounced stacked anomalies are now drill-ready. Also, with the recent discovery of high-grade mineralization by F3 adjacent to NexGen’s SW1 property, we are excited to refine approximately 12 km of strike length along this trend which exists on our property as just one component of the 2023 program.”

The stock continues its choppy price action as it battles at the $6.50 resistance zone. Our uptrend still remains intact with the trendline and the structure showing higher lows and higher highs. A breakout here would do wonders. The downside risk would be triggered with a close below $6.00 as it would confirm a reversal pattern known as the head and shoulders.