For the first time in seven years, a new nuclear reactor has started up in the United States. Uranium bulls have been calling for the eventual move to nuclear energy as government acceptance worldwide acknowledges nuclear is the cleanest source to handle baseload power. This new reactor is definitely a step in the right direction.

Because nuclear energy is generated without releasing carbon dioxide emissions, which cause global warming, the increased sense of urgency in responding to climate change has put nuclear energy on the map… and on investor’s watchlists.

On Monday March 6th 2023, Georgia Power announced that the Vogtle nuclear reactor Unit 3 has started a nuclear reaction inside the reactor. This ‘initial criticality’ is when the nuclear fission process starts splitting atoms and generating heat. The Vogtle Unit 3 will be fully in service in May or June.

“This is a truly exciting time as we prepare to bring online a new nuclear unit that will serve our state with clean and emission-free energy for the next 60 to 80 years,” Chris Womack, CEO of Georgia Power, said in a written statement.

The last time a nuclear reactor in the United States reached this milestone? Almost seven years ago in May 2016 when the Tennessee Valley Authority started splitting atoms at the Watts Bar Unit 2 reactor in Tennessee.

Including the newly turned-on Vogtle Unit 3 reactor, there are currently 93 nuclear reactors operating in the United States and, collectively, they generate 20% of the electricity in the country.

It should be noted that the costs of building new nuclear reactors still restricts the potential resurgence in nuclear energy. The construction of the two Vogtle reactors has seen cost overruns and delays. But with governments being serious in combating climate change, I am sure we will see them open up the coffers.

Before we look at what happened at the Athabasca Basin this week, I want to highlight the charts of the Sprott physical Uranium Trust (U.UN) and the Global X Uranium ETF (URA). Uranium bulls may not like what I am about to say, but hey, this will present an opportunity to accumulate uranium positions at a cheaper price.

Both of the charts are indicating a breakdown and a move lower. Sprott’s Uranium Trust broke below a major support zone this week, and the retests are seeing sellers jump in. We need a close back above the $16.50 to nullify further downside.

The Global X ETF has already broken down, confirmed a retest and printed the first lower high. Support comes in around the $19.50 zone.

Uranium Energy Corp (UEC)

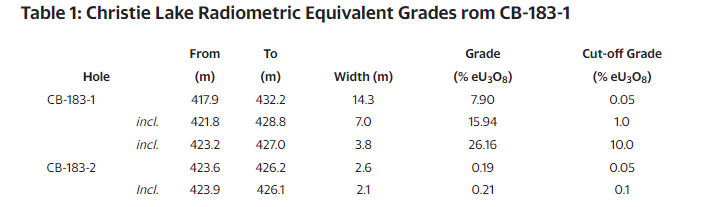

Uranium Energy Corp announced uranium mineralization in drill hole CB-183-1 that grades 7.90% eU3O8 over 14.3 metres, including a subinterval that grades 26.16% eU3O8 over 3.8 metres. This result expands the footprint of high-grade uranium mineralization at the Sakura Zone at the Christie Lake Project to the northeast approximately 14 metres from CB-178-1.

Chris Hamel, Vice President Exploration, Canada stated: “The continued success at the Sakura Zone demonstrates the potential of the Yalowega Trend at Christie Lake to host high-grade uranium mineralization. We are eager to continue with exploration along this trend in the 2023 program. The Yalowega Trend is the northerly extension of the McArthur River fault system onto the Christie Lake Project and gives UEC the opportunity to explore along this uniquely well-endowed mineralized trend that only Cameco and Orano otherwise have access to.”

Additional follow up with drill hole CB-183-2 also encountered uranium mineralization at the unconformity that grades 0.21% eU3O8 over 2.2 metres. This hole is interpreted to lie along the southern periphery of the Sakura Zone, defining the southern extent of the mineralization in that area.

UEC plans to drill at least 17,000 metres in 2023 through the Christie Lake winter and summer drill programs. To date, the company has drilled 7,500 metres in the winter program that is designed to continue through March. The summer program is planned to commence after the snow melts.

Many uranium stocks this week will look similar to the setups of U.UN and URA. UEC has broken below a support zone, printing a mini head and shoulders reversal pattern. Support comes in around $3.00.

Standard Uranium (STND.V)

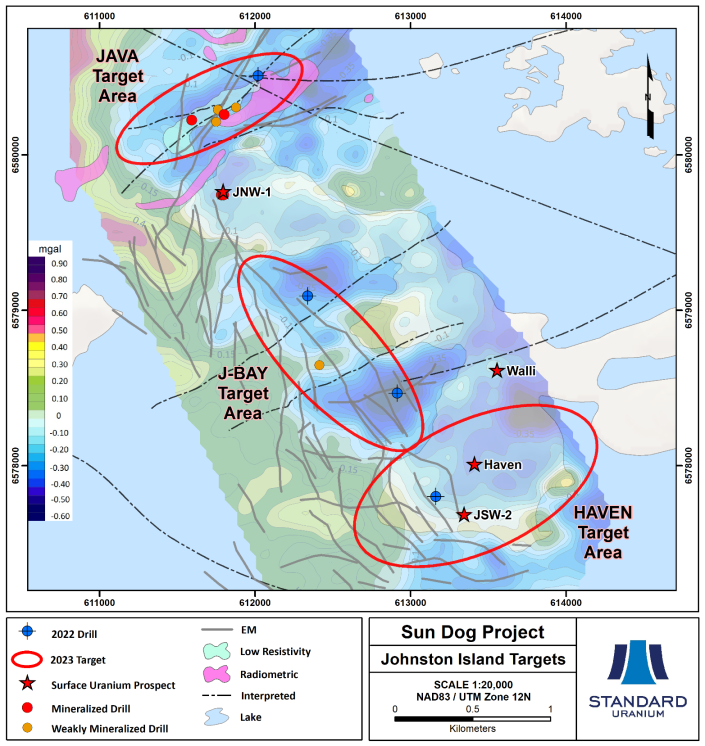

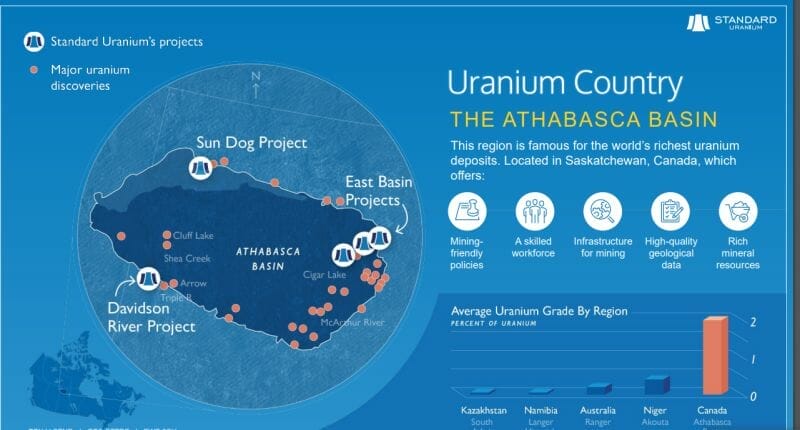

Standard Uranium (STND.V) announced last week (Friday March 3rd 2023) that it had begun diamond drilling at its 100% owned Sun Dog Project located at the northwestern edge of the Athabasca Basin.

High priority uranium drill targets across the 15,770 hectare property were refined after diamond drilling and geophysics from the Winter 2022 program. Several gravity-low and resistivity anomalies have been identified and coincide with breaks or flexures in electromagnetic (EM) conductors under Athabasca sandstone cover, providing compelling unconformity-related uranium targets. The perched uranium mineralization present in the Athabasca sandstone outcrop on the Project remains to be properly drill-tested at depth, and during the 2023 winter drill program, the Company aims to discover the high-grade “roots” of these mineralizing systems in the basement rocks underlying the sandstone.

The Standard Uranium team arrived at the Project on February 27th, and drilling commenced at the first Java target drill hole on March 3rd, 2023. This season’s drill targets will focus on the Java, Johnston-Bay (“J-Bay”), Haven, and Skye target areas following up on known high-grade uranium mineralization and prospective alteration including dravite and clay alteration.

Jon Bey, President and CEO, commented “Our team of geologists have done a great job of extracting value from the historical exploration reports on the Project and coupling that information with our modern understanding of how these high-grade uranium systems work. Armed with the invaluable data collected from our inaugural drill program in 2022, we are poised for a very exciting drill program this winter.”

The stock is testing a very important support zone here. If we break below, Standard Uranium would be printing new all time record lows. Watch for some bids at this support. However, the overall weakness in uranium might see us breakdown.

CanAlaska Uranium (CVV.V)

CanAlaska this week announced that joint venture partner Denison Mines has started a 3,600 metre drilling program at the Moon Lake South JV project.

The drill program is designed to evaluate the strike extent of known uranium mineralization, identified in 2021, by testing conductive anomalies from the 2022 geophysical program. The project is operated by Denison and CanAlaska holds a 25% ownership in the project. CanAlaska will fund the Company’s share of the 2023 exploration program.

CanAlaska CEO, Cory Belyk, comments, “The Moon Lake South project located in the heart of the eastern Athabasca Basin near Denison’s Wheeler River property is well positioned with critical infrastructure nearby. The results from the first ever drilling program under the new joint venture with Denison resulted in several new mineralized intersections. This program will follow up those results further testing this mineralized corridor for the presence of an economic uranium deposit.”

Breakdown. The stock failed to gain a bid at the $0.46 support zone and the next support comes in at the $0.36 zone.

Skyharbour Resources (SYH.V)

Skyharbour announced this week that its partner company, Basin Uranium Corp., intersected significant uranium mineralization from the three-hole phase 2 drill program at its Mann Lake project which is located 25 km southwest of the McArthur River Mine and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit. A total of 6,279 metres of drilling was completed on the Mann Lake Property in the 2022 season.

The Mann Lake project is also adjacent to the Mann Lake Joint Venture operated by Cameco (52.5%) with partners Denison Mines (30%) and Orano (17.5%).

The phase 2 program consisted of 2,776 metres of drilling over four holes. The first hole MN22-006 was wedged and re-started at 572 metres serving as a follow up hole to MN22-002 which was drilled during Phase 1 and hosted prospective uranium mineralization. The following two holes MN22-007 and MN22-008, targeted the southeastern portion of the tenure which had previously been untested.

Hole MN22-0007 intersected the unconformity at 671.8 metres and returned anomalous boron (dravite) and uranium mineralization at and above the unconformity. Dravite is a boron rich clay mineral, often found in association with uranium mineralization and is considered an important pathfinder in uranium exploration.

Skyharbour was testing support and was consolidating in a flag/wedge pattern. Unfortunately for bulls, we have a breakdown of support and the lower portion of the trendline. Both are bearish signs, and the stock may now find support at the $0.35 zone.

Fission Uranium (FCU.TO)

Fission Uranium recently announced that it has filed a technical report for its PLS Project in the Athabasca Basin, pursuant to National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) on SEDAR. The Report summarizes the Feasibility Study (“FS”), which outlines a high-grade mine and mill scenario for PLS.

Here are the highlights:

- Construction timeline of 3 years with an estimated initial capital cost of $1.155B

- Increased mine life to ten years with LOM production of 90.9 million lbs of U3O8

- Addition of R840W orebody into the FS mine plan contributing to increased Mineral Reserves

- Average unit operating cost of $13.02/lb U3O8

- Robust post-tax economics:

Resource Growth Highlights

- Mine Life and Zone Expansion: Both the R780E and R840W zones are open at depth and along the plunge to the east. Further opportunity exists to grow the resource in those directions, potentially extending the underground mine life even further.

- Additional Zones: The FS mine plan has a future opportunity to accommodate the potential conversion of Inferred Resources to Indicated Resources at two high-grade, on-strike zones – R1515W and R1620E – that are not yet part of Mineral Reserves.

- Mineralization Upgrade: The FS mine plan does not include areas of Inferred Mineral Resources in the R00E, R840W and R780E zones. An opportunity exists to upgrade to Indicated Mineral Resource with future planned drilling.

The stock has broken below major support and is currently in the retest portion. With uranium looking weak based on U.UN and URA, I would expect sellers to enter here and we get another leg lower. Support comes in around the $0.65 zone.