Aristotle and Animal Studies

We need animal testing. Animal testing has been around for longer than you’d think. Believe it or not, animals have been used for biomedical research as early as the third and fourth centuries BCE. In fact, Aristotle, a famous Greek philosopher, wrote On the Generation of Animals, a book providing an account of animal reproduction, gestation, and heredity. In Chapters six and seven of Book II, Aristotle explains the process and order of embryo development.

Aristotle’s observations of a chicken’s egg concluded that the heart is formed first, then the internal parts, and finally the externals. Speaking of chickens, through his philosophy of potentiality and actuality, Aristotle concluded that the chicken came before the egg. The more you know. Aristotle also theorized the concept of telos, otherwise defined as “the end goal for which a being aims.” With this in mind, Aristotle believed that, like humans, animals have telos.

So, what is an animal’s purpose? In a literal sense, Aristotle claims that animal teloi are purposive, whereas human teloi are deliberative. In other words, animals exist to perform valuable functions that are not the result of planning or design, such as breeding. Ultimately, Aristotle believed that animals are ordered to rational human purposes through husbandry.

To summarize, Aristotle was convinced that all animals exist for the sake of humans. By his logic, this suggests that farm animals are able to fulfill their telos, or purpose, more effectively than wild animals. Fast-forwarding to the present, animal studies play a pivotal role in researching disease progression, genetics, and lifetime risks, among others, that would otherwise be considered unethical to perform in humans.

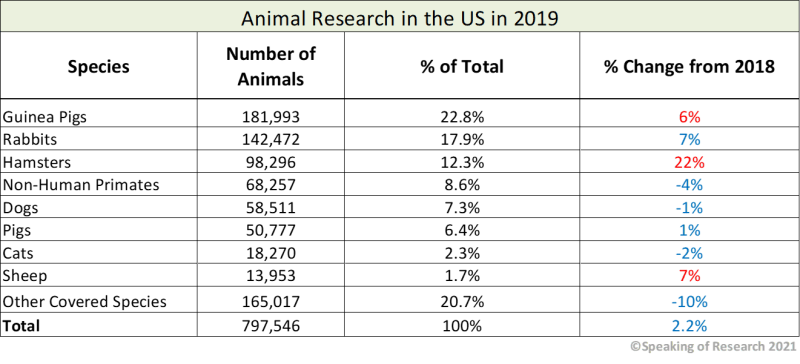

While I hate animal testing, I understand that it is a necessity in fields like biomedical research. However, a new study has revealed a potentially cheaper and faster method of screening for skin allergens that do not require animal testing. The study was conducted by researchers at the National Institute of Standards and Technology (NIST) in collaboration with the Consumer Product Safety Commission (CPSC) and Inotiv Inc.

The study was conducted in a government effort to reduce animal testing and evaluated 92 chemicals utilizing the new animal-free protocol. Results revealed that 77% of the compounds examined agreed with those of a common animal test method. With this in mind, these results could lay the foundation for standardization, thereby reducing animal testing. While only a small blip in a sea of animal testing, it’s a step in the right direction.

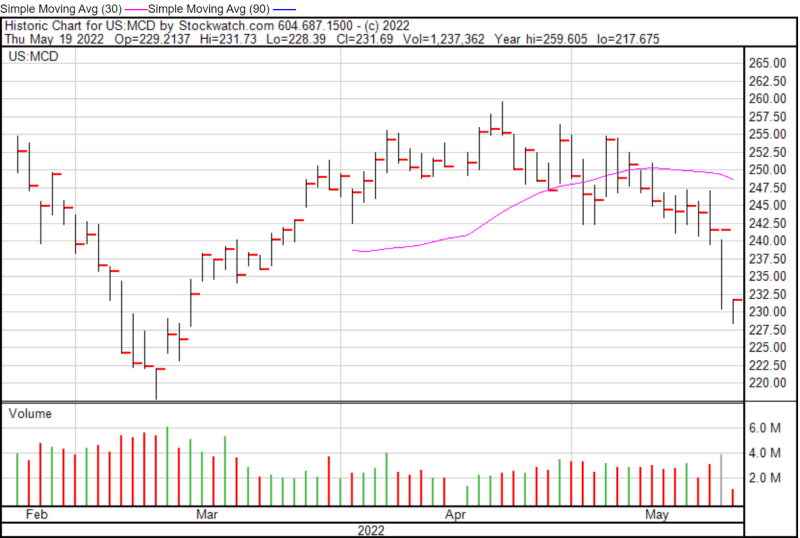

McDonald’s Corporation (MCD.NYSE)

- $170.055B Market Capitalization

McDonald’s Corporation (MCD.NYSE) is an American fast-food company, founded in 1940. McDonald’s sells an average of approximately 75 burgers a second and serves about 68 million people every day, which is approximately 1% of the world’s population. Needless to say, McDonald’s is a fast-food titan, dominating sales in the US and globally. Out of 14,000 locations in the US, the average McDonald’s rakes in about $7,000 daily.

On a global scale, there are over 38,000 McDonald’s locations in over 100 countries. In terms of dollar value, McDonald’s brought home $23.764 billion in revenue for the twelve months ended March 31, 2022. That’s a 21.13% increase year-over-year, supported by a gross profit of $12.962 billion. Although I never thought I would see the day, McDonald’s has recently set foot in the plant-based market following an agreement with Beyond Meat Inc. (BYND.Q). More info can be found here.

Latest News

As someone who is currently intermittent fasting, writing this week’s plant-based sector roundup has been a nightmare. To make matters worse, I am writing about McDonald’s, one of my many weaknesses when it comes to junk food. That being said, let’s get this over with. Earlier this week, McDonald’s United Kingdom (UK) announced that it will be lowering the cost of its vegan McPlant burger by more than 70% in celebration of National Vegetarian Week.

With an original price tag of £3.49, on May 18 and May 20, 2022, McDonald’s UK will offer the McPlant at just 99p. As for the burger itself, the McPlant features a Beyond Meat patty, dairy-free cheese, onions, pickles, lettuce, tomato, ketchup, mustard, and a vegan secret sauce. Unfortunately for my Canadian readers, McDonald’s has not announced plans to bring the McPlant to Canada.

Following a successful limited release in the UK, McDonald’s announced on January 5, 2022, that it would be rolling out the McPlant to every restaurant across the UK and Ireland. This includes all 1,300 McDonald’s UK locations, signifying the permanent inclusion of a vegan menu item. While I am a tad jealous of our UK friends, I can see why McDonald’s would favor the UK.

It is worth noting that Great Britain’s vegan population has increased 400% over the last two years, with 14% of the UK identifying as vegetarian and an additional 31% actively attempting to eat less meat. In 2018, there were a total of 600,000 vegans in GB, representing 1.16% of the population. With this in mind, if you are in the UK and would like to get your hands on a McPlant for 99p, you’d better move fast.

McDonald’s share price opened at $229.50 on May 19, 2022, down from a previous close of $231.05. The Company’s shares were up 0.21% and were trading at $231.52 as of 11:52 AM EST.

Blender Bites Ltd.

- $27.977M Market Capitalization

Blender Bites Ltd. (BITE.C) is a Vancouver, Canada-based consumer packaged goods (CPG) company founded in 2016. The Company develops and markets a line of premium frozen food products, namely its pre-portioned frozen smoothie pucks, to provide customers with organic, nutritious, and convenient solutions. Currently, the Company boasts strong Canadian distribution partners, including Tree of Life and Horizon.

Blender Bites is the first company to produce a pre-portioned smoothie puck in the Canadian market. In addition to being certified organic, non-GMO, and plant-based, the Company’s pucks are available in more than 850 retail stores across Canada and the US, including Loblaws, Sobeys, and Costco. Moreover, Blender Bites possesses strong mass production capabilities through the Company’s large-scale manufacturing facility.

Latest News

On May 19, 2022, Blender Bites announced Canada’s largest chain of retail grocery stores, Loblaw Companies Limited. (L.TO), has expanded the number of banner stores that will carry the Company’s smoothie pucks. Originally, Loblaws commenced its launch of Blender Bites’ smoothie pucks in the Fall of 2021 at 59 of its banner stores, as well as 107 of its high-volume discount banner stores. However, commencing in August 2022, all Loblaws banner stores will carry Blender Bites’ SKUs.

“Customers of this grocery retail chain are very much aligned with our target market, and I think their customers will greatly benefit from our one-step smoothie innovation; saving them time and hassle in their busy mornings,” stated Chelsie Hodge, the Company’s Founder and CEO.

Additionally, on May 18, 2022, Blender Bites announced that, in consideration of a potential uplisting to the Toronto Stock Exchange (TSX), the Company is planning a consolidation of its outstanding common share capital on the basis of 10 pre-consolidation shares for every one post-consolidation share. At the time of Blender Bites’ official press release, the Company had 39,966,710 common shares issued and outstanding.

“Our recent growth has raised interest in graduating our listing. Graduation will hopefully give us access to larger capital pools as well as a broader investing audience. I believe this move could significantly increase the growth potential of this already rapidly growing company.” stated Chelsie Hodge.

As such, the Company will have an estimated 3,996,671 common shares outstanding once consolidation is complete. However, it should be noted that while Blender Bites is considering an uplisting to the TSX, an application has not yet been submitted nor has the Company made an official decision. On May 7, 2022, Blender Bites provided a summary of some of its milestones since going public in September 2021, including:

- record sales revenue

- an upward trend in consumer demand

- Canadian expansion and entrance into the US market

- a strong female-led management team

- product awards

The plant-based sector as a whole has seriously begun to wilt, however, Blender Bites is one of the few companies that has demonstrated some growth despite the market’s current condition. Whether or not the Company is able to keep its momentum as it continues to expand will be a testament to its capabilities. In the meantime, let’s see if Blender Bites pursues graduation, or even qualifies.

Blender Bites’ share price opened at $0.66 on May 19, 2022, down from a previous close of $0.67. The Company’s shares were up 4.48% and were trading at $0.70 as of 11:36 AM EST.

The Yumy Candy Company Inc.

- $45.08M Market Capitalization

The Yumy Candy Company Inc. (TYUM.C), formerly Yumy Bear Goods Inc. (YUMY.C), is an affordable health-conscious, low-sugar, plant-based confectionery company based in Vancouver, British Columbia (BC). The Company announced that it had received approval from the Canadian Securities Exchange (CSE) to change its name on December 29, 2021. Yumy has developed a portfolio of healthier gelatin-free candies, named Yumy Bear, made from non-GMO ingredients with its proprietary recipes.

In addition to being gelatin-free, all of Yumy’s products are free of soy, gluten, nuts, dairy, eggs, sugar, alcohols, artificial sweeteners, and GMOs. Furthermore, every pack contributes to supporting local community initiatives, charities, and animal rescue centers. The Company prides itself on using 100% natural colors to make candy that has up to 92% less sugar than traditional candy. For a closer look at Yumy Bear’s specs, click here!

Latest News

On May 10, 2022, Yumy Candy received a commitment of placement and pilot run from the world’s largest convenience retailer operating over 78,000 locations across 19 countries. In North America alone, this retailer has 12,000 stores, with a focus on healthier food options. One of the most distinguishing features of this convenience retailer is its 24/7 availability.

“Launching with this Retailer is a dream come true for our company and a significant sign of growth. This Retailer is not just a nationally recognized convenience store, but a global entity with a reach across 19 countries. Being able to get our Yumy products onto their shelves is a signal that our Company is on the cusp of being a mainstay confectionery brand,” said Erica Williams, CEO and Founder.

Although it is not disclosed in the Company’s press release, 7-Eleven fits this bill to the tee. If this is the case, Yumy Candy’s latest news represents a significant milestone for the Company. In 2020, 7-Eleven was able to push its systemwide sales by 3.1% up to $91.8 billion. Overall, this convenience store chain ranked second in terms of sales growth by dollar, second only to McDonald’s.

Additionally, on April 30, 2022, Yumy Candy announced that it has received a purchase order from Canada’s largest food retailer. Again, while not disclosed in Yumy Candy’s press release, the Company is likely referring to Loblaws. With this in mind, Loblaws boasts over $51 billion in revenue via 2,400 stores, according to the Company’s press release. More recently, on May 4, 2022, Loblaws announced its Q2 2022 financial results.

“This order symbolizes just the start of our relationship with Canada’s largest food retailer. We are very pleased with our initial order, but we recognize the potential this lays ahead as we expect order sizes to multiply based on our past performances with other retailers,” said Erica Williams.

In the first quarter of 2022, Loblaws reported revenue of $12.262 billion, an increase of $390 million. Similarly, the company’s retail segment sales also increased by $375 million to $12.045 billion, representing a growth of 3.2%. With this in mind, Yumy has potentially secured a spot on the shelves of two of North America’s leading retail giants, namely 7-Eleven and Loblaws.

Yumy Candy’s share price previously closed at $1.64 on May 18, 2022. The Company has not yet seen any trade volume today (May 19, 2022).

Vejii Holdings Ltd.

- $2.001M Market Capitalization

Vejii Holdings Ltd. (VEJI.C) is a unified marketplace and fulfillment platform featuring more than 3,500 plant-based and sustainable living products and over 500 brands. The Company’s platform offers an easy-to-use, omnichannel experience for both buyers and vendors, leveraging big data and Artificial Intelligence (AI). In doing so, Vejii is able to connect brands with targeted consumer bases through organic and specialized marketing programs.

To be more specific, Vejii runs a brand and product agnostic marketplace that allows the Company to onboard vendors at a rapid rate. This allows Vejii to expand into new and growing product categories. The Company’s current product categories include grocery, nutrition, vitamins, supplements, personal care, baby & kids, and vegan wine. However, the Company intends to add home & garden, sustainable fashion, sustainable furniture, and sports & recreation products to its offering in the future.

Latest News

On May 9, 2022, Vejii announced that it has signed a non-binding Letter of Intent (LOI) with Frozenly Limited Inc. According to the terms of the LOI, Vejii is poised to acquire all of the company’s issued and outstanding shares from Frozenly’s shareholders. More importantly, Frozenly is a UK-based company with a similar business model to Vejii. With this in mind, this acquisition will expand Vejii’s footprint into the UK, representing a significant milestone for the Company.

“Launching into the UK market has been a stated objective for Vejii since our inception. We believe that the acquisition of Frozenly and the leveraging of Frozenly’s digital platform and distribution network in the UK would be a critical and exciting milestone for the Company,” said Darren Gill, President and COO of Vejii.

If you’d like a complete look at the Company’s latest acquisition target, check out this article. Shortly prior, Vejii announced on May 5, 2022, that it has entered into a partnership with Plantable Health Inc. This partnership will enable Vejii to offer Plantable’s prepared meal delivery program via ShopVejii.com. Furthermore, Plantable offers a unique selection of plant-based meal programs, including the company’s clinically-supported Reboot program.

“We’re very excited to announce the launch of Plantable’s health and clinically backed premade, frozen meals on Vejii’s platform. Launching a meal delivery program has been a stated objective of the Company, and we could not be more pleased to work with an industry-leading partner like Plantable.” Said Kory Zelickson, CEO of Vejii.

According to Vejii’s Q4 2021 and FY 2021 financial results announced on May 3, 2022, Vejii reported revenue of $938,404 in Q4 2021, up 3589% compared to the same quarter in 2020. Similarly, the Company’s gross profit increased to $412,802 in Q4 2021, up 2274%. If you would like to know more about Vejii’s latest partnership with Plantable, check out this article. A complete look at Vejii’s Q4 2021 and FY 2021 financial results can also be found here.

Vejii’s share price opened at $0.07 on May 19, 2022, down from a previous close of $0.08. The Company’s shares were down -12.50% and were trading at $0.07 as of 12:53 PM EST.