Let’s face it. Plant based and vegan food is going to be a huge trend in the future. Some would disagree with me and say “no Vishal, not the future. Now”. I was raised in a family of vegetarians all my life, and been vegetarian most of my life. A few years back, it would be difficult to get some veggie options (always the veggie burger, linguini alfredo, or Margherita pizza). Not anymore. Most restaurants now have plenty of vegetarian and vegan options. It’s a great time to be a vegetarian or a vegan.

A lot of people in my generation are opting for vegan meals. The food tastes good (I’ve heard sometimes it tastes just like meat), and people feel they are doing something good for the environment. I think this trend will increase. The one sticky point is the price of vegan food at supermarkets. With oil prices rocketing, and agricultural commodity prices shooting higher, this will translate to higher food inflation. In fact, food prices have hit all time highs. Combine the fact that the Bank of Canada is raising rates, the middle class is being pinched on two sides, and may begin to save more than spend. And when they do spend, they might try to spend the least amount possible, which means cheaper meals. I have found vegan/organic food tends to be more on the pricier side of things, which is where consumers might cut back to save some money.

To read my opinions on the plant based sector as a whole, check out my plant based 2022 outlook, and be sure to read tons of our plant based content written by Kieran Robertson. His articles will be linked and quoted below.

Today’s idea is one I fully can get behind. Vejii Holdings (VEJI.CN). Vejii is a digital marketplace offering thousands of plant-based and sustainable-living products, from hundreds of vendors in a centralized, online shopping experience. If you watched our Investor Roundtable on Vejii, I like to call them the Etsy of plant based and sustainable living. I make that comparison because of the niche both companies have carved out.

You can check out the world’s largest plant-based marketplace at shopvejii.com.

The company has been making moves. Vejii announced a couple of acquisitions. Vejii acquired Veg Essentials LLC, a leading online retailer of vegan grocery products. The acquisition provides Vejii with access to a second strategically located warehouse in the US, as well as over 20 years of consumer insight, data, and buying power. The companies have a combined subscriber list of over 130,000 across North America and Europe. The Company plans to consolidate its logistics, marketing and buying with Vegan Essentials to increase efficiencies and margins between the two companies.

Vejii kicked off the year with the acquisition of VEDGEco USA Inc, a leading online B2B wholesale platform for plant-based products. Vejii is growing, and onboarding new customers and products. Management really deserves a round of applause for proving they can execute their plans and objectives.

Vejii announcing the launch of Planet Based Foods hemp-protein products including the HEMP Burger, HEMP Crumble, and the HEMP Sausage Patty product ranges on the Company’s US platform. This will enable Planet Based Foods to reach national exposure via Vejii’s existing infrastructure of data, tech, marketing, and logistics. Planet Based Foods will also have access to the Company’s growing 200,000 social media followers, brand ambassadors, and email marketing lists.

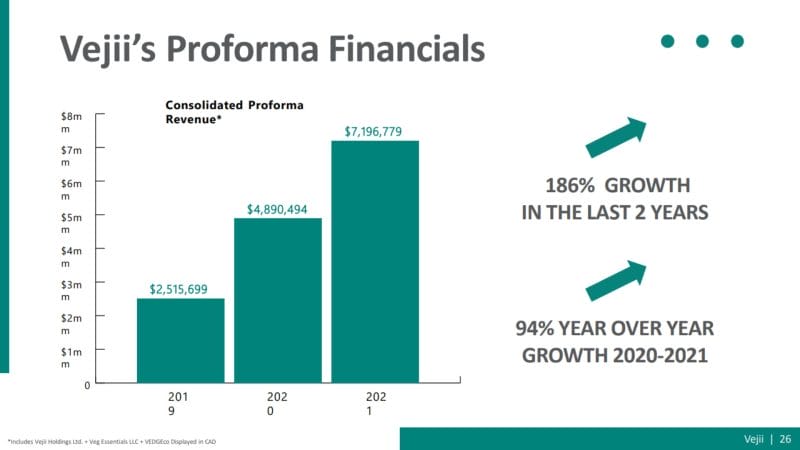

On May 3rd 2022, Vejii released Q4 2021 and full year financial results. A transformational period for the company including accomplishing several milestones integral to the long-term strategy of the company.

“The 4th quarter shows significant improvements in unit economics and gross margins based on just two months of efficiencies gained from integrating with Vegan Essentials, with our planned initiatives and the additional scale the VEDGEco brings, we expect to continue seeing significant improvements on unit economics, gross margins, selling and distribution, and G&A as management focuses on demonstrating a clear path to profitability,” said Darren Gill President and COO of Vejii.

Here are highlights:

- The Company obtained its public listing on the Canadian Securities Exchange

- The Company closed an offering of Subscription Receipts and Special Warrants for gross proceeds of $4,098,459

- The Company continued to gain traction with onboarding brand partners

- Improved operational efficiencies and unit economics for orders

- Completed acquisitions of Veg Essentials LLC (“Vegan Essentials” or “VeganEssentials.com“) and VEDGEco USA Inc. (“VEDGEco” or “VEDGEco.com“)

- Reported revenue of $938,404 for the quarter ended December 31, 2021, as compared to $25,441 for the quarter ended December 31, 2020.

- Gross margin percentage for the quarter ended December 31, 2021, was 44.0% compared to (68.3%) for the quarter ended December 31, 2020.

On May 5th 2022, Vejii announced a partnership with Plantable Health Inc with the launch of a prepared meal delivery program via ShopVejii.com. Through Vejii’s latest partnership, the Company will offer a curated selection of Plantable’s clinically supported SKUs across the US through Vejii’s frozen logistics and fulfillment program.

“We’re very excited to announce the launch of Plantable’s health and clinically backed premade, frozen meals on Vejii’s platform. Launching a meal delivery program has been a stated objective of the Company, and we could not be more pleased to work with an industry-leading partner like Plantable.” Said Kory Zelickson, CEO of Vejii.

“Plantable’s unique offering and meal-plan programs make transitioning towards a healthy, sustainable, and plant-based diet simple. We’ve been working on activating this offering for some time and look forward to positive feedback from our customers.” Said Darren Gill, President and COO of Vejii.

Frozen and chilled prepared meals holds a strong place in the prepared meals market which was valued at USD $143.86 Billion in 2021 and is expected to grow on a compound rate of 5.1% from 2022 to 2030. One can make the case that with food inflation, frozen foods are going to see a larger demand than expected.

Vejii’s latest news deals with a launch in the UK market. Vejii announced a non-binding letter of intent with Frozenly Limited Inc. Through this LOI, Vejii is contemplating the acquisition of all of the issued and outstanding shares from the shareholders of Frozenly. If completed, this will expand the Company’s footprint in the United Kingdon (UK), representing a significant milestone for Vejii.

“Launching into the UK market has been a stated objective for Vejii since our inception. We believe that the acquisition of Frozenly and the leveraging of Frozenly’s digital platform and distribution network in the UK would be a critical and exciting milestone for the Company as we plan our continued expansion into the European Union and other key strategic geographies,” commented Darren Gill, President and COO of Vejii.

Frozenly has established itself as a marketplace for plant-based foods in the UK. Additionally, the company has built a cold chain distribution platform similar to Vejii’s existing business in both the United States (US) and Canada. More importantly, Frozenly owns and operates MightyPlants.com, an e-commerce platform and marketplace.

Big numbers in the UK. Sales of meat-free products in the UK saw a 40% growth rate from approximately £582 million in 2014 to approximately £816 million in 2019. By 2024, this segment is expected to reach a value in excess of £1.1 billion, demonstrating a growing preference for meat-free alternatives in the UK. In particular, the UK plant-based milk alternatives market was valued at £260 million in 2019 and is projected to more than double, reaching roughly £565 million by 2025.

The stock broke a major support at $0.625, and the stock has been going downhill ever since. There was some signs of bottoming at $0.50, but that did not hold. The stock made new record all time lows on March 16th 2022 hitting $0.16. We have ended up printing new all time record lows (by $0.005) by hitting $0.09 on May 13th 2022. Since then, the stock has been ranging here with low volume.

So is this the bottom? Well a few thing I would want to see as a technical analyst. First of all, a few days of range is okay. It tells me that the selling pressure has exhausted. The longer the range, the more we can confirm a base is being formed. In terms of important price levels, I really would like to see the resistance (price ceiling) at $0.17 be taken out. If we get above this, we can begin to say with some strong confidence that the reversal is beginning. This would also take us over my moving average, another strong reversal indicator.

Vejii is definitely one to keep on your radar and watch list. There are way too many plant based companies coming out with market caps in the hundreds of millions. Vejii currently has a market cap of around $2.5 million. Some plant based companies I have seen only have one product…or none at all, and have a much larger market cap. Yes, the overall stock market drop is hitting many small caps, but now is the time to pick up some stocks on sale. Vejii actually has a real business and has shown real growth potential.