So Many Options, So Little Dairy

Apparently, yesterday was World Milk Day. To be truthful, I had no idea milk was held in such high regard, but I digress. World Milk Day was first established by the Food and Agriculture Organization (FAO) of the United Nations in 2001. Since then, World Milk Day has been used to promote the benefits of milk and dairy products in the dairy sector.

The event started with the Enjoy Dairy Rally this year, which ran from May 29th to May 31st, 2022. For each day of the rally, a specific theme was promoted. The theme was Health and Nutrition on the first day, followed by Community and Enjoyment on the second and third days, respectively. Similar to the Enjoy Dairy Rally, World Milk Day also had an overarching theme.

This year’s theme focused on accelerating climate actions as well as reducing the dairy sector’s impact on the planet. Ultimately, World Milk Day is a rallying cry from the global dairy community to achieve dairy net-zero. To be more specific, this initiative builds on current efforts to reduce dairy emissions over the next 30 years.

To date, more than 80 organizations representing 30% of global milk production are in support of dairy net-zero pathways. For example, Fair Cape Dairies in South Africa operates 100% off the electrical grid. However, World Milk Day isn’t limited to the celebration of traditional dairy-based milk. We now have oat milk, almond milk, sesame milk, and coconut milk, to name just a few plant-based alternatives.

While the retail milk market is still dominated by dairy products, the plant-based milk segment accounts for 15% of all dollar sales of retail milk in 2020. According to Future Market Insights, the plant-based milk market is expected to reach USD$30.79 billion by 2031, expanding at a compound annual growth rate (CAGR) of 8.8% between 2021 and 2031.

Personally, if I had to pick one plant-based milk to support, it would be sesame milk. In addition to containing several vitamins and minerals, sesame milk is also quite sustainable. In fact, the production of sesame requires less water than almonds. To put things into perspective, an estimated 15 gallons of water are needed to produce 16 almonds.

Oatly Group AB

- $2.403B Market Capitalization

Oatly Group AB (OTLY.Q) is a Swedish food company that produces alternatives to dairy products using oats. Oatly is the largest oat milk company and has an extensive lineup of dairy-free products including ice cream, yogurt, cooking creams, spreads, and on-the-go drinks. To summarize, oat milk is a plant-based milk derived from whole oat grains by extracting the plant material with water.

With this in mind, Oatly is a food company focused on developing expertise around oats. In doing so, the Company stands at the forefront of the oat milk market, which was valued at USD$251.57 million in 2019. Looking forward, this market is projected to reach a value of more than USD$490 million by 2026, expanding at a compound annual growth rate (CAGR) of 10.2% between 2020 and 2026.

Latest News

On May 25, 2022, Oatly announced that it has begun offering some of its oat-based products in Los Angeles and New York City through popular food delivery apps like Postmates, UberEats, DoorDash, and Grubhub. The Company’s latest development was made possible through a partnership with REEF Technology, the largest operator of mobility real estate and NBRHD kitchens in North America.

“Oatly is a fan-favorite brand that delivers a diversity of plant-based alternative options, from frozen desserts to their delicious staple oat milk…We believe our partnership will give diehards and new consumers alike a more convenient way to enjoy Oatly’s products,” said Kenneth Rourke, President of Kitchens and Retail, REEF Technology.

NBRHD kitchens are a REEF-exclusive model that handles all aspects of food preparation and delivery at zero capital expense to restaurant owners. As for the company’s mobility kitchens, these are basically glorified food trucks. With this in mind, Oatly is utilizing REEF’s delivery kitchens to bring its products to Los Angeles and New York City. These kitchens then fulfill orders via delivery apps like Uber Eats.

Products offered via REEF will be available for one-hour delivery. This includes Oatly’s Frozen Novelty Bars, Frozen Dessert Pints, Chilled Oatmilk, and Chilled: Barista Edition. Later this year, the Company intends to launch one-hour delivery in Los Angels and New York City directly via its own Oatly.com.

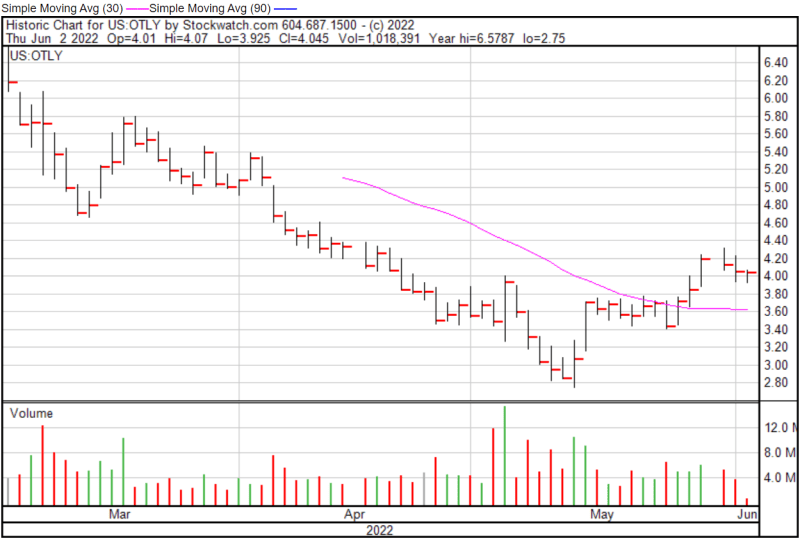

Oatly’s share price opened at $4.02 on June 2, 2022, down from a previous close of $4.05. The Company’s shares were up 0.12% and were trading at $4.055 as of 11:05 AM EST.

Restaurant Brands International Inc.

- $29.689B Market Capitalization

Restaurant Brands International Inc. (QSR.TO) is one of the world’s largest quick-service restaurant companies in the world, with more than $35 billion in annual system-wide sales. The Company boasts more than 28,000 restaurants across over 100 countries. If RBI isn’t ringing any bells, that’s likely because you are more familiar with its brands.

RBI owns four of the world’s most popular quick-service brands, including Tim Hortons, Burger King, Popeyes, and Firehouse Subs. Aside from Tim Hortons’ latest privacy violation scandal, each of these brands is top-notch. It should be noted that RBI was birthed from the grease and processed fats of Tim Hortons and Burger King on December 12, 2014. Since then, RBI has operated as a parent company to both.

Latest News

Normally, I wouldn’t bother covering a parent company, however, RBI encompasses Burger King, which is no longer publicly traded following the creation of RBI. That being said, late last month, Burger King France announced that it had partnered with La Vie Foods, a vegan pork startup, to add bacon to the Veggie Steakhouse Burger.

Pretty self-explanatory, but the Veggie Steakhouse Burger is intended to mimic Burger King’s original Steakhouse Burger, which features two beef patties, cheese, bacon, crispy onions, mayo, and steakhouse sauce on a toasted sesame seed bun. On the contrary, the Veggie Steakhouse Burger is composed of plant-based meat, onions, flame-grilled vegetable mince, and, of course, La Vie’s vegan bacon.

La Vie’s vegan bacon is made using a mixture of soy, konjac, and sunflower oil. With this in mind, La Vie’s bacon is now available at 550 Burger King locations across France. In addition to Burger King France, Burger King UK has committed to converting 50% of its menu to meatless by 2030. If that wasn’t enough to pique your interest, maybe Natalie Portman will.

Earlier this year, in January 2022, La Vie raised approximately $20 million in a funding round supported by Natalie Portman to fund the company’s European expansion. Having secured a strong presence in Europe, La Vie is now hoping to raise an additional $53 million to fund its expansion into the United States (US).

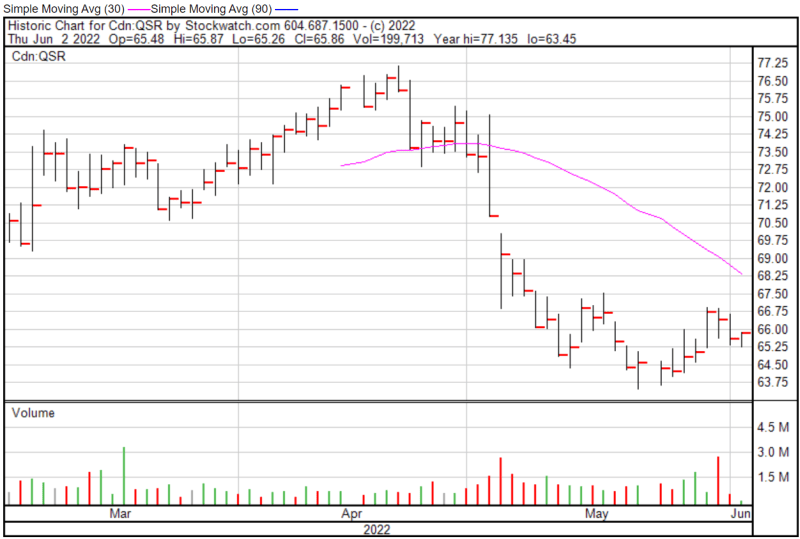

RBI’s share price opened at $65.48 on June 2, 2022, down from a previous close of $65.61. The Company’s shares were up 0.08% and were trading at $65.66 as of 12:16 PM EST.

GURU Organic Energy Corp.

- $324.36M Market Capitalization

GURU Organic Energy Corp. (GURU.T) is a fast-growing beverage company launched in 1999 when it pioneered the world’s first natural, plant-based energy drink. Since then, the Company has marketed its organic energy drinks across Canada and the US through a distribution network of more than 21,000 points of sale, guruenergy.com, and Amazon.

GURU is focused on the 64% of millennials that consume energy drinks, fueling the market’s growth. The Company’s products contain no synthetic caffeine, artificial sweeteners, or taurine. Moreover, the Company’s products are certified organic, boasting 140 mg of caffeine per 12 oz can. GURU has secured itself as the largest organic energy drink brand in Canada, with over 35% CAGR revenue growth.

Latest News

On May 31, 2022, GURU announced that it has partnered with CTV’s The Amazing Race Canada as a sponsor. This partnership will involve showcasing unique activations for racers throughout the season and offering the winners a trip for two around the world. Following the Company’s latest partnership, GURU is hosting a contest online and in-store.

“We are extremely excited to partner with CTV’s THE AMAZING RACE CANADA for the upcoming 8th season. This is a new way for us to reach a national audience that aligns with our brand’s core values, as we continue to build our profile across the country,” said Carl Goyette, President and CEO of GURU.

This contest will allow Canadians to win a trip anywhere in the world, for a value of up to $10,000. GURU’s latest partnership is part of the Company’s recently announced summer event sponsorship program. Through this program, GURU will take part in a variety of summer festivities such as music festivals and art exhibits. This is intended to promote the GURU brand from May through September.

“We are proud to launch one of our most exciting national summer event programs yet, bringing good energy to over 30 cultural, artistic, sporting and lifestyle events throughout the country,” said Carl Goyette.

Those who are interested can expect to see GURU at the Calgary Folk Music Festival, Festival NORR, and Santa Teresa, among others, this summer. GURU will also be present at Spartan Races across Canada, including Mud Hero, Sea Otter, KitsFest, Vegandale Festival, and JACKALOPE.

Additionally, on June 1, 2022, GURU announced that it will report its financial results for the second quarter ended April 30, 2022. The Company expects to report its results on June 14, 2022, before markets open. Management will also hold a conference call to discuss GURU’s financial results the same day at 10:00 AM EST. Investors can access the webcast here.

GURU’s share price opened at $10.03 on June 2, 2022, down from a previous close of $10.27. The Company’s shares were down -2.34% and were trading at $10.03 as of 10:45 AM EST.

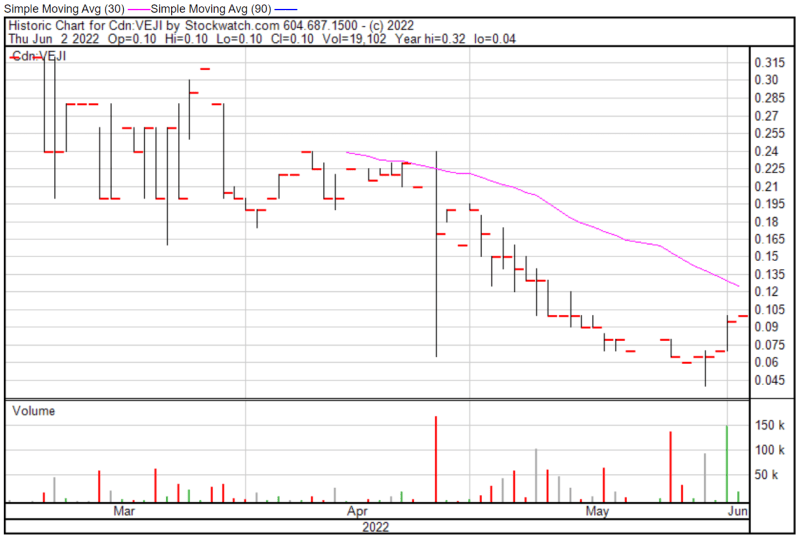

Vejii Holdings Ltd.

- $2.858M Market Capitalization

Vejii Holdings Ltd. (VEJI.C) is a unified marketplace and fulfillment platform featuring more than 3,500 plant-based and sustainable living products and over 500 brands. The Company’s platform offers an easy-to-use, omnichannel experience for both buyers and vendors, leveraging big data and Artificial Intelligence (AI). In doing so, Vejii is able to connect brands with targeted consumer bases through organic and specialized marketing programs.

To be more specific, Vejii runs a brand and product agnostic marketplace that allows the Company to onboard vendors at a rapid rate. This allows Vejii to expand into new and growing product categories. The Company’s current product categories include grocery, nutrition, vitamins, supplements, personal care, baby & kids, and vegan wine. However, the Company intends to add home & garden, sustainable fashion, sustainable furniture, and sports & recreation products to its offering in the future.

Latest News

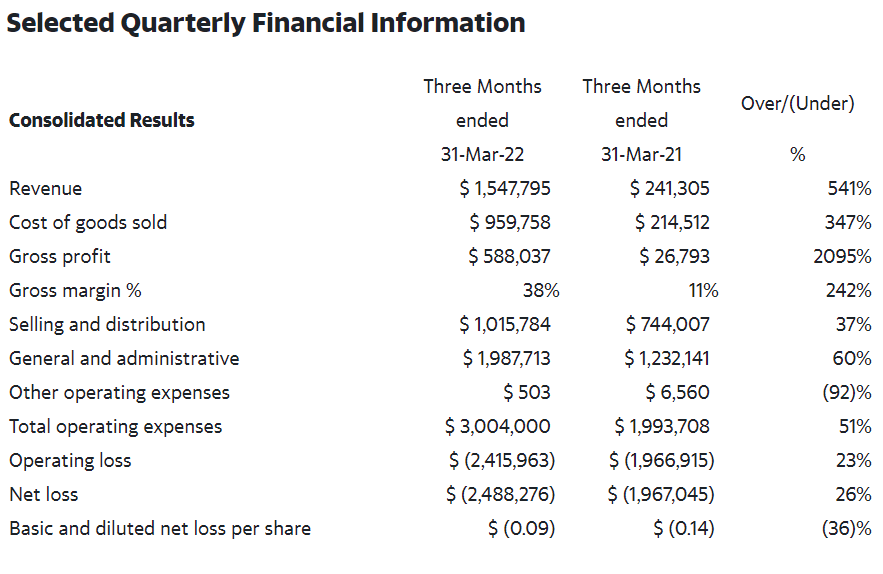

On May 31, 2022, Vejii announced its consolidated, unaudited financial results for the first quarter of 2022. This represents the Company’s first quarter of financials including the completed acquisitions of Vegan Essentials and VEDGEco USA Inc. With this in mind, Vejii spent Q1 2022 primarily focused on realizing synergies between the Company and its latest acquisitions.

“We are very pleased with our performance in the first quarter of 2022, with revenues and gross margins increasing, and costs proportionately decreasing, we anticipate being able to build a sustainable business,” said Kory Zelickson CEO of Vejii.

Some of Vejii’s key financial highlights for the quarter ended March 31, 2022, include total revenue of CAD$1,547,795, representing an increase of 541%. Similarly, the Company’s gross margins increased 242% from 11% to 38% on March 31, 2022. Vejii also highlighted several improvements with regard to its Key Performance Indicators (KPI). For full details, check out this article!

Vejii’s share price opened at $0.10 on June 2, 2022, up from a previous close of $0.095. The Company’s shares were up 5.26% and were trading at $0.10 as of 12:06 PM EST.