Friday was an epic day for Stock Markets. Red across the board, and many major support levels being taken out. Why? Fear of a new variant. Omicron out of South Africa, and has already spread to Hong Kong, Belgium, Netherlands, Israel, UK, Germany and Italy. I probably missed some countries, but the point is the markets are fearing more travel restrictions, or worse, another global lockdown. It is still early, but health experts are saying this is a ‘dramatically’ new strain, with ‘extremely high number’ of mutations.

It is still too early to determine how bad this variant is going to be, but from what I have been reading, the vaccines are ineffective against it. No worries though, Pfizer is saying they will have a new vaccine (or booster?) for Omicron sometime in early 2022.

A headline that caught my eye today was Bill Ackman saying Omicron might be bullish for Stock Markets. Immediately I thought he was going to say it means the Fed un-tapers their taper and kicks interest rate hikes way down the road. Instead, he said this:

“While it is too early to have definitive data, early reported data suggest that the Omicron virus causes ‘mild to moderate’ symptoms (less severity) and is more transmissible,” Ackman said in a tweet Sunday evening. “If this turns out to be true, this is bullish not bearish for markets.”

So the jury is still out regarding how deadly this variant is. It might take a few days or weeks to determine this. If cases begin to rise and winter lockdowns are discussed then we will have our answer.

So what are some ways to play the Omicron variant? Simple: the stay at home trade is back. These are the stocks I will be watching. Some with great technicals that we can act on right now, others that need some time to trigger a breakout. Let’s start with a quick overall market breakdown.

The S&P 500 broke below my support and moving average on Friday. This is extremely bearish. Just looking at market structure, I expect one more leg down to around 4520. Funnily enough, this was what I wrote that I wanted to see by November, and then the Santa Claus rally come December. My take is bullish like Bill Ackman, but I argue the Fed’s easy money policy will keep assets propped. Remember, we did not have this kind of Fed policy during the first global lockdown back in 2020.

Sellers are already rejecting the retest of the broken down support. This is typical breakdown price action. A close above this retest zone would neutralize the next leg down, and we can all go back to buy the dip mode.

On a positive note, the VIX gapped down, and so did bonds. Although bonds are green for the day. This is important because these two markets allow us to sniff out fear. With both gapping down, it appears as fear is subsiding for now. Keep your eyes on this.

Let’s start with the obvious picks for the Omicron variant impacting us worse than expected. The vaccine plays are a no brainer. Another booster or jab means more cash for these guys. NVAX is the one I have above which broke above $200. The jab stocks were green on Friday so that is telling you something. Pfizer is making new record highs. Merck could be a ‘bargain’ picker as it remains weaker than the rest. Astrazeneca is a major support play testing a support zone where it has bounced and rallied multiple times in the past. While Moderna could confirm a breakout with a close above $360 today. Something for everybody.

Food. As much as I hope this doesn’t happen, you all remember when people were hoarding canned foods at the grocery store. With supply chains under more pressure now than before, frequent empty shelves at the grocery store may be a common sight. Campbell’s Soup looks real good. The chart is basing after a long downtrend. I am just waiting for the breakout and close above $42 for the trigger. Note we have earnings on December 8th 2021. This could be the catalyst needed to give us that breakout. A very nice looking technical set up.

Sticking with the food theme, take a look at DoorDash. You can throw Uber in the mix too. We are testing a big support zone currently. Note the wicks on the previous few candlesticks. People are buying. I would love to see some basing here and then a break above $190 for a trigger.

Perhaps the quintessential stay, or should I say work, from home play. Zoom Video was a monster stock during the first global lockdown back in 2020. Went from below $80 to hit highs of $588.84! Crazy! Now the stock is under pressure post earnings. It has been selling off even with the Omicron news. Not the best play right now, but if more lockdowns are being discussed, this can see a bounce. Currently at a big psychological support zone, $200, which is seeing some buyers.

Another work from home play. Oh man, I like what I am seeing on Logitech (LOGI). These are the types of set ups I look for. You are all probably sick of me for saying this but: we have a long downtrend, with a basing at a support zone. If we get a strong daily close over $85.50, then this triggers. The stock looked like it was going to take off, but instead gapped down. Another example of why patience and waiting for the triggers are much better than FOMO chasing.

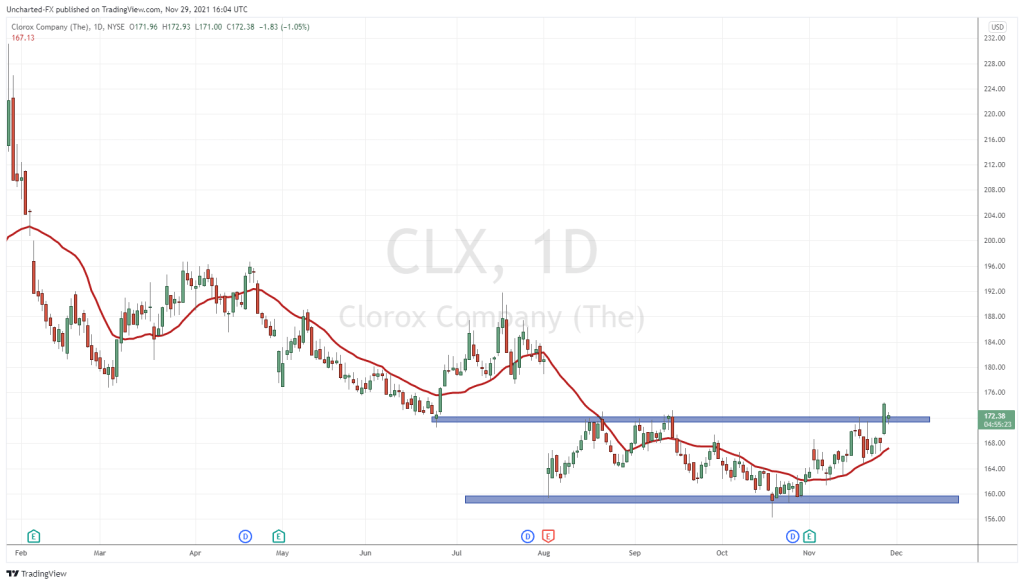

You all remember Clorox (CLX) during the first lockdown. The stock went from $150 to $240 in a few months. Since then, the stock has been slowly drifting downwards. Looks like descending steps. However, the stock found support at $160. This support zone is important, because it was once resistance. Resistance way back in 2020 just before Clorox broke out. We are back, and buyers are realizing the importance of this zone. We almost have an inverse head and shoulders pattern here. I must say the candle close on Friday was really strong. It was an Omicron play. Sold off a bit today as the market assesses how dangerous this variant could be. Let’s watch to see if Clorox can hold above $171. Truth be told, an entry on Friday is still valid with stops placed below the breakout candle right under $169.30.

I end with Roblox. Maybe not the first stock that comes to mind when you think of Omicron and lockdowns and restrictions, but it is a stay at home play. Especially if schools get affected. The stock has recently broken out into new territory after stellar earnings. We broke and closed above $100, and then rallied to hit record highs of $141.60. The stock is now contained with record highs being resistance, and the $114 zone being support below. Just need to wait for the break, but once again, Omicron news will impact the stock. Keep in mind that the retail crowd plays this stock too. I know it gets mentioned quite a bit over on WallStreetBets.