Place Your Bets

According to a new market study published by Global Industry Analysts, the global market for gambling was valued at USD$711.4 billion in 2020. This market is expected to expand at a compound annual growth rate (CAGR) of 3.6%, reaching an estimated valuation of USD$876 billion by 2026. Don’t even get me started on online gambling. Valued at USD$64.13 billion in 2020, the global online gambling market makes up a large proportion of the global gambling market. Moreover, this market is projected to reach an impressive CAGR of 12.3%. Why so much growth? Following the onset of COVID-19, the online gambling market was positively impacted. A study conducted by Lund University, Sweden, revealed that due to restrictions surrounding live sports events, consumer interest in online gambling platforms increased substantially.

When it comes to traditional gambling, I am a novice. I can’t play poker to save my life, I am a laughing stock when it comes to Wizard, and I could probably find a way to lose in a game of Russian Roulette using an empty clip. Put me behind a screen and it’s a completely different story. From gacha games to esports betting, I am in my element when it comes to virtual gambling. With this in mind, online betting is expected to be the fastest-growing segment in the global gaming market. Furthermore, operators are creating a variety of tournaments and promotions, which might be enticing for newbies like myself.

The Company

- $101.053M Market Capitalization

FansUnite Entertainment Inc. (FANS.C) is a global sports and entertainment company, focusing on technology related to regulated and lawful online gambling and other similar products. The Company is on a mission to be a leader in the gaming industry. How? By providing its partners and players with the industry’s most versatile and vertically integrated platforms. From esports, sports betting, and casinos, FansUnite is creating a portfolio of products for the next generation of bettors. Additionally, the Company operates multiple growing business-t0-consumer (B2B) brands in global jurisdictions.

The Company first began trading on the Canadian Securities Exchange (CSE) on May 5, 2020, after completing a $3,131,918 financing on March 18, 2020. Shortly after, on August 11, 2020, FansUnite completed a merger with Askott Entertainment, a leading provider of esports first software for the iGaming industry. Through this acquisition, the Company also obtained Chameleon, Askott Entertainment’s esports iGaming platform.

Chameleon is a complete business-to-business (B2B) sports and esports white label iGaming platform offering turn-key and API solutions. Currently, Askott Games, Askott Entertainment’s newest division, is responsible for the development of exclusive casino-style RNG games with esports and video game themes. In addition to offering its solutions to partners via the Chameleon platform, Askott games also licenses its games to external casino aggregators, connecting the division with hundreds of online casinos and sportsbooks.

Let’s not forget about FansUnite’s acquisition of McBookie, a leading provider of regulated betting services in the United Kingdom (UK). McBookie has been operating in the UK market since 2009 and is recognized for its sports betting, casino, and virtual sports offerings. At the time of acquisition, McBookie boasted approximately 10,000 active members and handled a total of CAD$340 million in betting since its inception. Additionally, in the last three years, McBookie has taken over CAD$135 million in betting volume onto its platform.

Latest News

In September 2020, through Askott Entertainment, FansUnite signed an agreement with Las Vegas-based GameCo LLC (“GameCo”), a pioneer in skill-based iGaming products, to introduce its Chameleon platform to the US regulated market. Keep in mind, GameCo holds gaming licenses in almost thirty jurisdictions, providing FansUnite with a unique and advantageous presence in the lucrative US esports iGaming market. More recently, on September 14, 2021, FansUnite announced that it had negotiated and signed multiple strategic vendor agreements for its Chameleon platform, fortifying the Company’s position as a provider in the European and North American gambling markets. Most notably, FansUnite has signed agreements with:

- Pariplay – a globally recognized casino aggregator recognized for its Fusion™ platform, which includes over 12,000 games from over 100 third-party suppliers. Additionally, Pariplay has its own library of more than 120 innovative slots

- Sports IQ – possesses a full suite of player props, including both pre-game and in-play betting across all US sports for both B2C and B2B. The company’s products leverage automation and minimal suspension to provide the highest quality product

- Pythia Sports – Utilizing the latest AI technologies, Pythia is a leader in predictive modeling and trading of Global Horse Racing markets

- Algo Sports – has created proprietary algorithms to offer same-game multiples across a variety of sports, both pre-game and in-play, with cashout supported as standard

On October 27, 2021, FansUnite announced that it had signed a strategic agreement with Sportradar Group AG (SRAD.Q), the leading global sports technology company creating immersive experiences for sports fans and bettors. According to the terms of the agreement, Sportradar will provide FansUnite with its Managed Trading Service (MTS), which includes pre-match betting services, live odds, and betting stimulation services. This will enable the Company to deliver an array of odds on some of the world’s premier sports and sporting events as well as register end-users and settle tickets. For context, Sportradar’s MTS is a 360° solution intended to boost margins and profits while cutting down costs.

“The partnership enables us to receive the best-in-class trading solutions from renowned sports data provider Sportradar, which will elevate the quality of our betting offering…We will be able to provide optimal real-time odds, adding more value to our wagering platform. Overall, our proprietary technology equipped with Sportradar’s services will create a competitive betting solution that appeals to B2B customers in the global sports betting industry,” said Scott Burton, CEO of FansUnite.

Financials

According to FansUnite’s Interim Financial Statements for the periods ended June 30, 2021, and June 30, 2020, the Company had a cash position of CAD$14,481,980 on June 30, 2021, compared to CAD$4,431,139 year-over-year (YOY). In the same period, FansUnite has total assets and total liabilities of CAD$33,852,530 and CAD$1,239,788, respectively. For the six months ended June 30, 2021, the Company reported a net loss of CAD$5,418,324 compared to CAD$8,746,706 YOY. As of June 30, 2021, FansUnite had net working capital of CAD$14,645,011 and an accumulated deficit of CAD$25,641,377.

Recently, on July 15, 2021, FansUnite completed a public offering, pursuant to which the Company issued 27,547,100 units of the Company at $0.90 per unit for gross proceeds of $24,793,390. Each unit is comprised of one common share of FansUnite and one-half of one common share purchase warrant. Each whole purchase warrant entitled the holder thereof to purchase one common share at a price of $1.30 per share for a period of 36 months following the closing of the offering. Overall, FansUnite is still relatively small, with a market capitalization of $101.053 million. However, the Company boasts an impressive average trade volume of 1,418,197 shares.

Ultimately, through its various platforms, FansUnite has positioned itself well in the profitable online gambling market. Furthermore, the Company has established licenses with the Malta Gaming Authority and the United Kingdom Gambling Commission (UKGC). FansUnite also has a notable presence in North America via its partnership with GameCo. Additionally, the Company is well-positioned to capitalize on Canada’s gambling market following the passage of Bill C-218, which legalized single-event sports betting in the country. Looking at FansUnite through a broad lens, it’s clear to see that Askott’s B2B Chameleon platform is the Company’s golden goose egg, so to speak.

Although FansUnite did not report revenue as of June 30, 2021, the Company’s growth has been significant. In particular, FansUnite’s revenue for the six months ended June 30, 2021, was CAD$2,043,291 compared to CAD$328,884 YOY. In total, the Company’s gross margins increased to CAD$950,600 from CAD$92,833 in the same period. With this in mind, FansUnite has a lot of potential revenue streams, all producing significant B2C and B2B growth. Furthermore, With Askott Games’ RNG games in the oven, FansUnite could see significant growth in the future. If you’re interested in FansUnite, the Company will be hosting an Investor Webinar on November 4, 2021, at 3:00 PM ET.

If you’re looking for technical analysis of FansUnite’s financials and structure, check out Vishal’s and TK’s articles! If you’re more of an auditory/visual learner, we also have an Investor Roundtable out today!

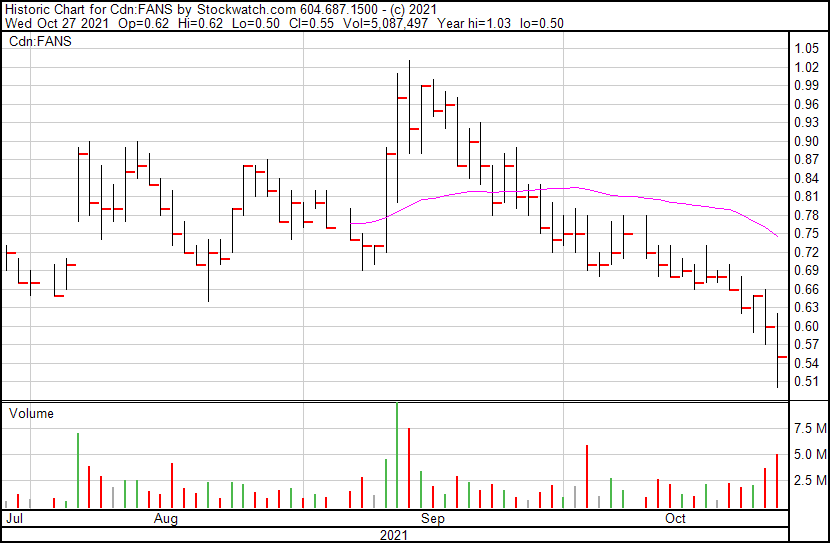

FansUnite’s share price opened at $0.62, up from a previous close of $0.61. The Company’s shares are down -9.84% and were trading at $0.55 at close on October 27, 2021.