I am a contrarian. Many successful investors and traders tend to be. Following the crowd isn’t the best financial advice. Recently my contrarian spidey senses have been going off. If you have been following the Stock Markets, and particularly, the fundamentals, you have heard the word inflation be mentioned once or twice. Who am I kidding! That’s all everyone talks about!. The Fed is talking about it, the financial media is talking about it. And for good reason.

When I worry about recent inflation, and future inflation I look at it two ways. Firstly, inflation is about a weaker currency. If a currency is weak, it takes more of that weaker currency to buy something. Hence the rising price. Regular readers may recall my worry about the currency war. Nations want a weaker currency to keep assets inflated and to boost exports for economic recovery (mainly the Euro and the Yen on the export front).

The second worry regarding inflation is the current situation. With government checks and such, we are in a situation where there are people with more money competing for the same number of goods and services. Productivity is the key, and what we have to increase in order to warrant that extra money supply. Productivity will be a talking about in the near future, especially if we see more supply chain issues. I have heard that there are many young people on golf courses talking about how they will never go back to work. They have made more money trading stocks and crypto’s!

This macro look is a bit different than the Federal Reserve. The Fed is telling us that this inflation is temporary. “Transitory” is the word they use. This type of inflation is only occurring due to economies re-opening and people beginning to spend money. Money velocity is increasing. The Fed is NOT raising interest rates, even with inflation data coming above 5% and hitting decade highs, because they believe once consumers begin shifting purchases from goods to services, the inflation will come back below the 2% level.

The Fed is saying that interest rates will come by the end of 2023…although other Fed Presidents have warned that interest rate hikes might need to come sooner than that due to inflationary pressures.

Billionaire hedge fund managers (some still active) such as Ray Dalio, Stanley Druckenmiller, and Paul Tudor Jones have come out sounding the alarm bells on Fed policy and the inflation trade. The Fed will need to raise rates sooner rather than later to avoid major inflation. But, the markets seem to be calling the Feds bluff. Everyone knows the current market environment is all about speculation. Cheap money from the Fed helps. The party keeps going.

If the Fed was going to raise rates, many expect the stock markets would tank. They would take a big hit on the taper tantrum. This could be the reason the Fed does not want to raise rates, because of the potential financial crisis that could snowball. Leveraged trades, pension funds, major banks could be affected on a large stock market decline which would trigger a larger crisis. Some say the Fed is trapped, and transitory inflation is a way for them to delay rate hikes for as long as possible. Let’s not forget that there is more debt out there, so a rate hike would make payments more expensive for consumers and for government.

But now I want to turn all of this on its head. Pull a 180 turn. What if Deflation is the real threat and NOT Inflation?

Recently, I came across this video by Alessio Rastani. As my readers know, I look at Bonds, the US Dollar and Gold to determine market sentiment. These markets have been giving us mixed inflation signals, and the technicals add more drama to the story. More on this in a sec.

To summarize Rastani’s video, Inflation signals are:

- Rising Interest Rates (A Fall in Bond Prices)

- Rise in Foreign Currencies (Euro, Loonie etc) or another way to put it, a fall in the US Dollar

- Rising Gold Prices

Deflation signals are the opposite of above:

- Lower Interest Rates (A Rise in Bond Prices)

- A Fall in Foreign Currencies, or a Rise in the US Dollar

- Falling Gold Prices

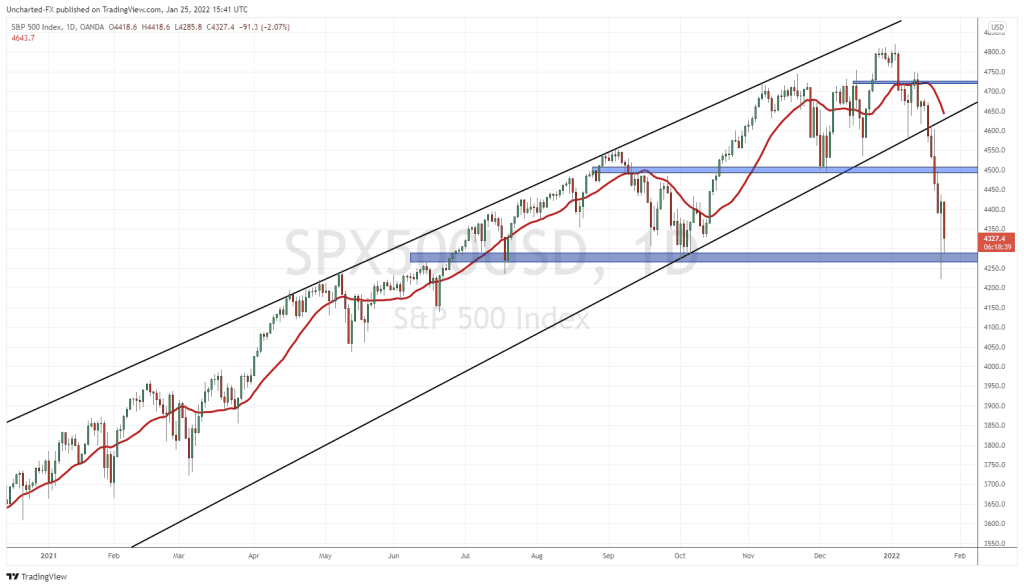

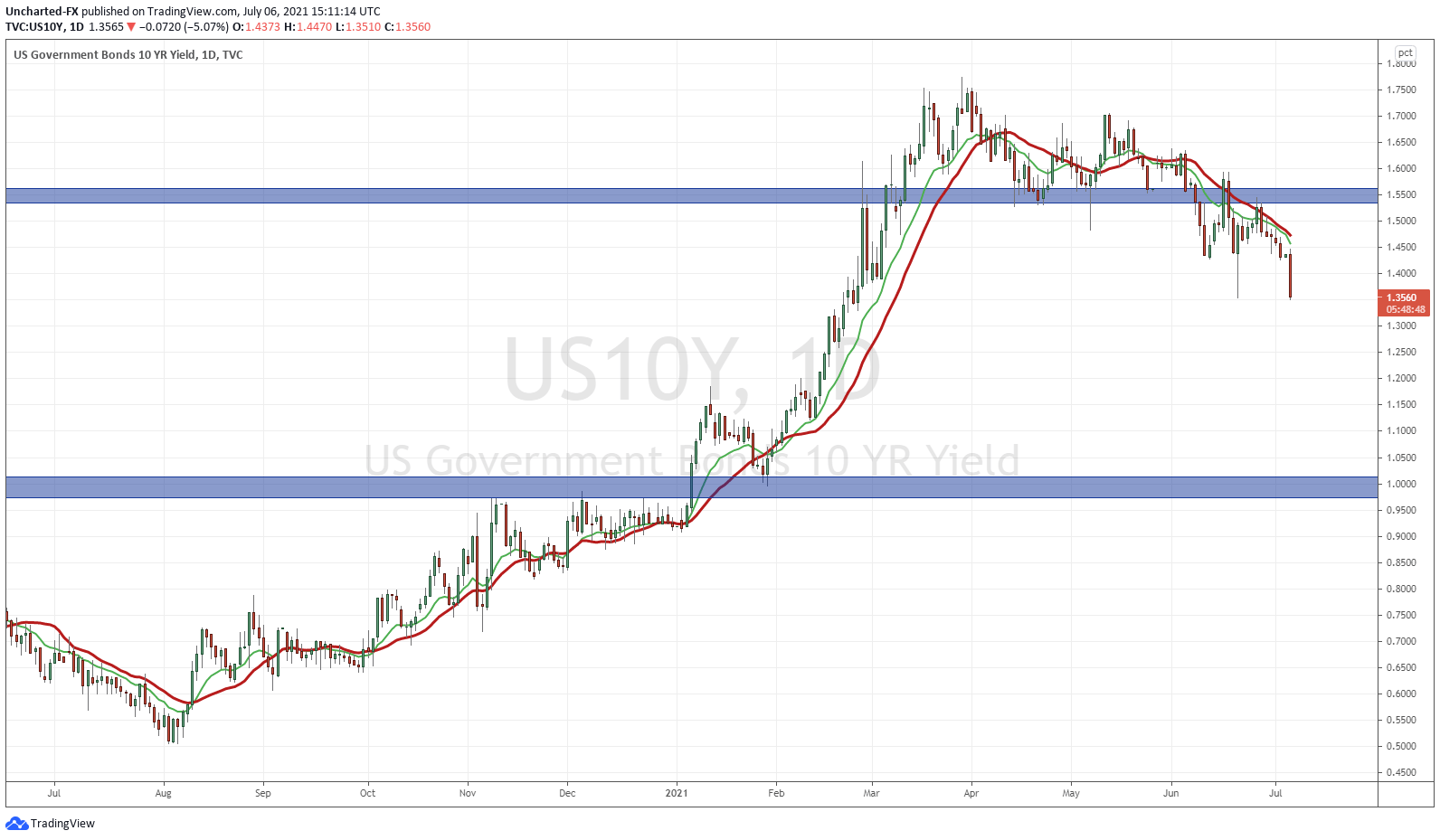

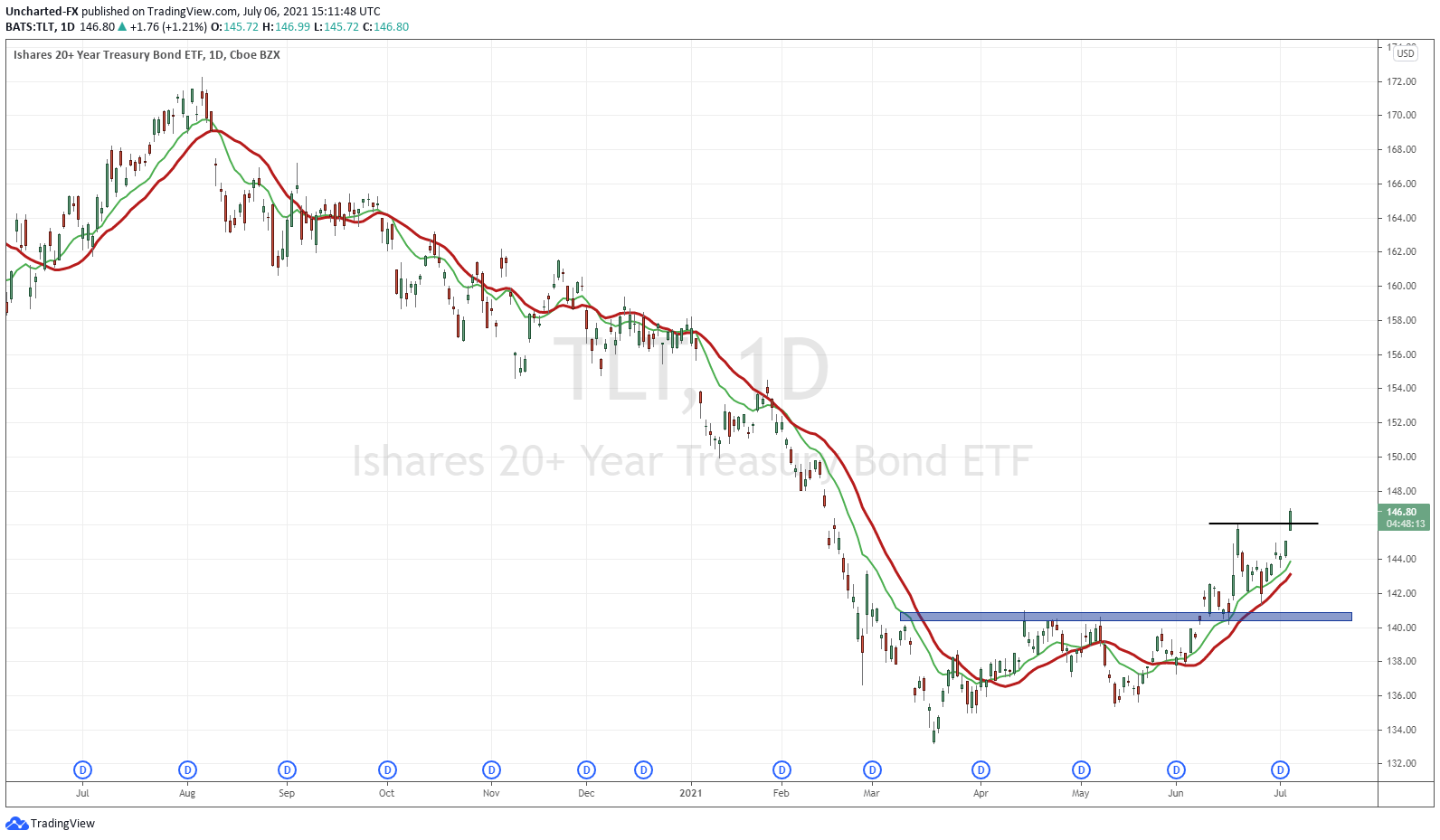

Now, let’s assess the charts and see where team inflation stands.

Technical Tactics

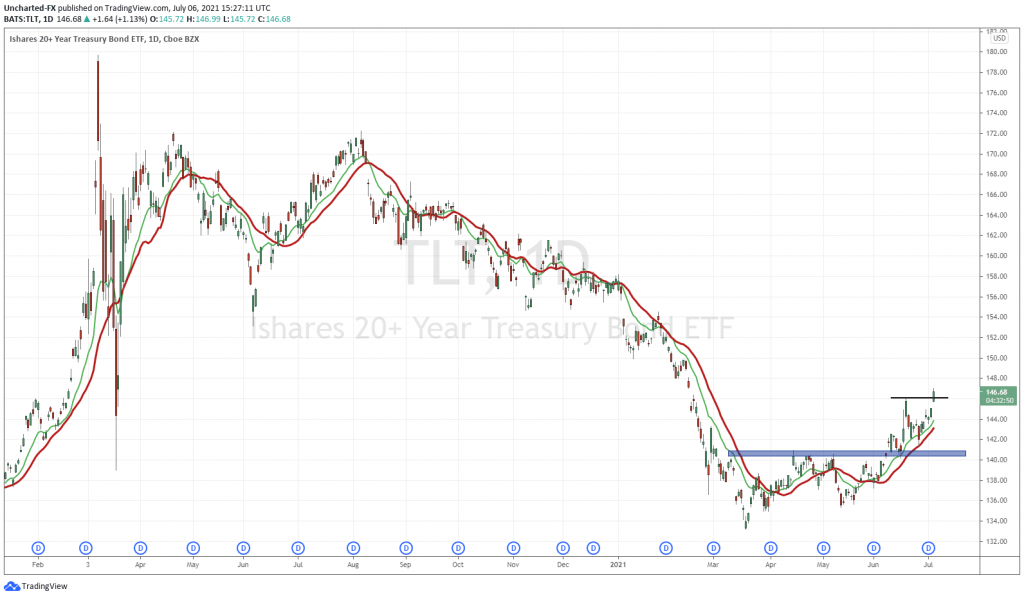

Above are the daily charts of the US 10 year yield, and bonds. I have chosen TLT, but you can see the same on BND. Just remember: there is an inverse correlation. When bond prices rise, yields drop and vice versa.

Looking at the 10 year first, do you all remember when the rising 10 year yield was spooking financial markets? Interest Rates were rising, fueling perma bear doomsday market crash scenario’s. Now, we hardly hear about that. And for a good reason. The 10 year yield had to hold above 1.50% for further upside momentum. This did not happen. We have not closed below 1.50%, and it looks like yields are heading LOWER. In today’s trading, yields are puking. A 5% decline at time of writing.

TLT might be the important macro chart for the next few months. We have triggered an Equity Guru Market Structure pattern. Members of the free Equity Guru Discord channel were given the heads up on this weeks ago. We would be going long, and expect more upside as long as TLT remains above 140. This means higher bond prices, which is big for two reasons. First, it ticks a deflation criteria box. Secondly, it will test the asset allocation model. Money tends to run into bonds when there is a risk off environment. Meaning money will LEAVE stocks for bonds. Perhaps this is signaling an event in the near future which will cause money to run into bonds. Deflation anyone?

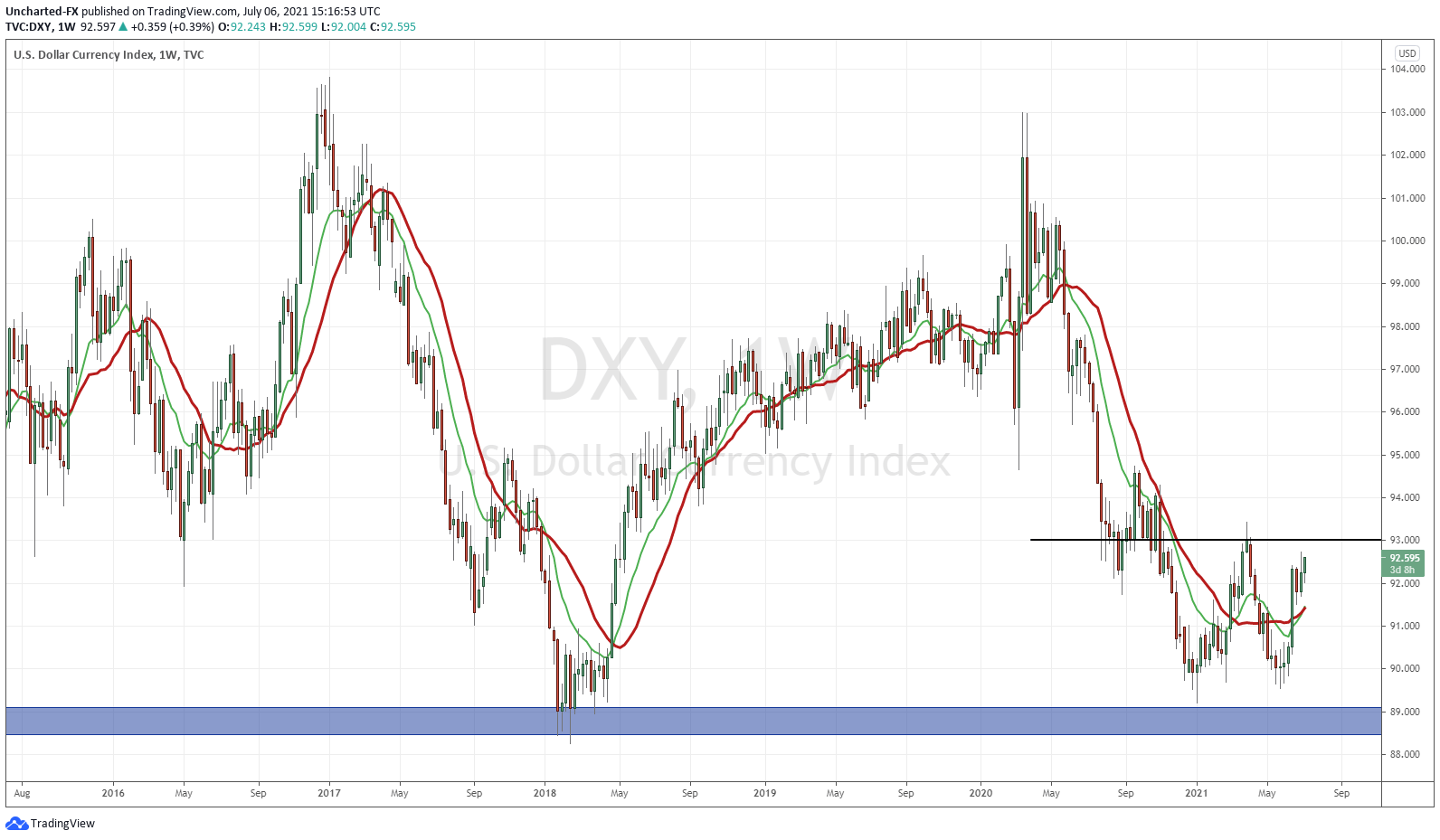

Now let’s look at the weekly chart of the US Dollar Index, the DXY. Currently, we are in some Dollar long trades based on the daily chart meeting Equity Guru Market Structure criteria. But the weekly chart is hinting at further US Dollar strength.

The 89 zone is major support. The Dollar found support there and ranged for weeks, before shooting higher. It seems like a double bottom pattern is in the works. Once again a bit worrying as Dollar strength generally means something is coming down the pipeline. Money flows into the Dollar when things are uncertain. It is a safe haven currency. OR, the Dollar can finally be playing out as I have said months ago. In this currency war, the Dollar is the best fiat out of the bunch. The other way to look at this is through the lens of interest rate differential. If the Fed is going to raise rates sooner than other central banks, money would flow into the greenback.

This week and month will be big for the US Dollar. If we close below 90.50 on the DXY, then the deflation criteria for the Dollar becomes challenged. But as of now, the new uptrend is still in play meaning another tick in a deflation criteria box.

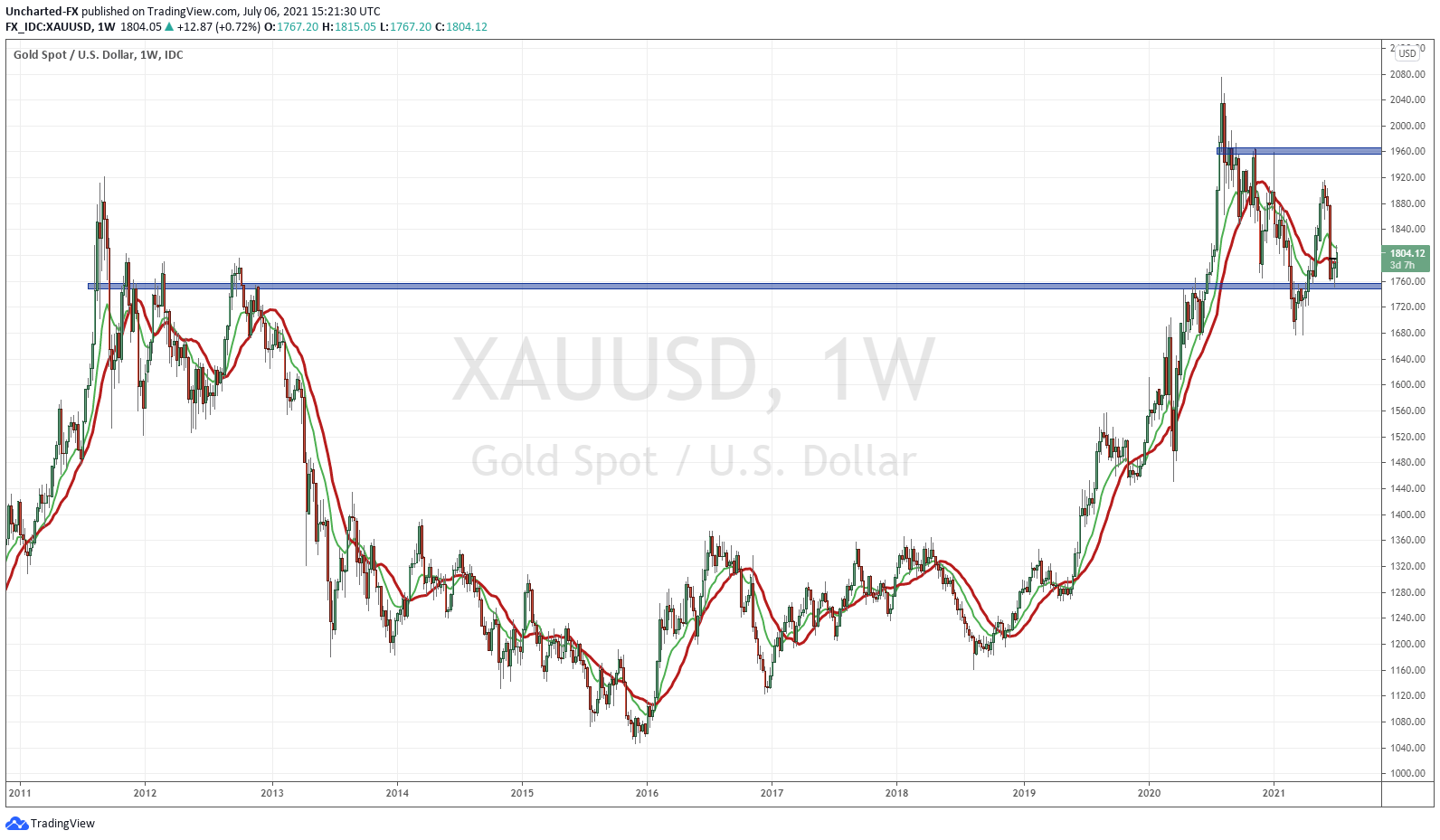

Last but not least, Gold. This is where things get a bit murky. As a trade, I think there is some upside for Gold that could occur this week. But we want to focus on the longer term. If interest rates drop, this is positive for Gold. But conversely, the prevailing thought is that a stronger dollar is negative for Gold. I still believe money can run into both the Dollar and Gold if there is a confidence crisis (people begin losing trust in government, central banks and fiat currency). Everything macro is pointing to higher Gold prices even with a rising Dollar.

Looking at the weekly chart, Gold is a bit tough to analyze. It looked great with us breaking a flag/pennant pattern, but we have closed below on the retest, so the pattern is now invalid. You can see I have a major flip zone where Gold is currently. This 1775 zone is key. I will be watching this weeks close closely to determine whether Gold continues to move higher.

In summary, the deflation claim by Alessio Rastani has technical support. When I see bonds and the US Dollar rising, I automatically think a run into safety. Fear. Perhaps this fear has to do with the pandemic and future variants (the Lambda variant which is deadlier than Delta was recently announced), or maybe big money is pricing in deflation.