Rejoice Gold Bulls/Bugs!

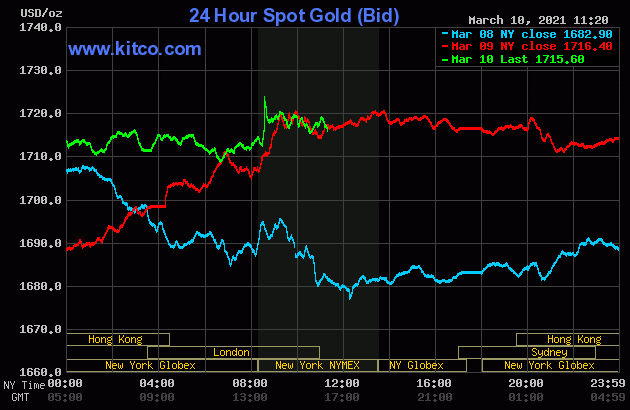

Gold printed a near 2% gain yesterday as equity markets bounced, bond yields remained stable, the US Dollar dropped, and a new round of Stimulus is forthcoming. What does this mean for Gold? Good things. I will analyze each of these points as the precious metal makes a very powerful technical case for going long.

![Live 24 hours gold chart [Kitco Inc.]](https://e4njohordzs.exactdn.com/wp-content/uploads/2021/11/1_gold.gif?strip=all&lossy=1&w=1920&ssl=1)

Something traders should consider is that the Gold price currently moves in tandem with the equity markets. When stocks moves up, Gold moves up. When stocks move down, Gold moves down. This correlation has been in place since the everything sell off back in February 2020. And a lot of it has to do with money running into the safety that is the US Dollar.

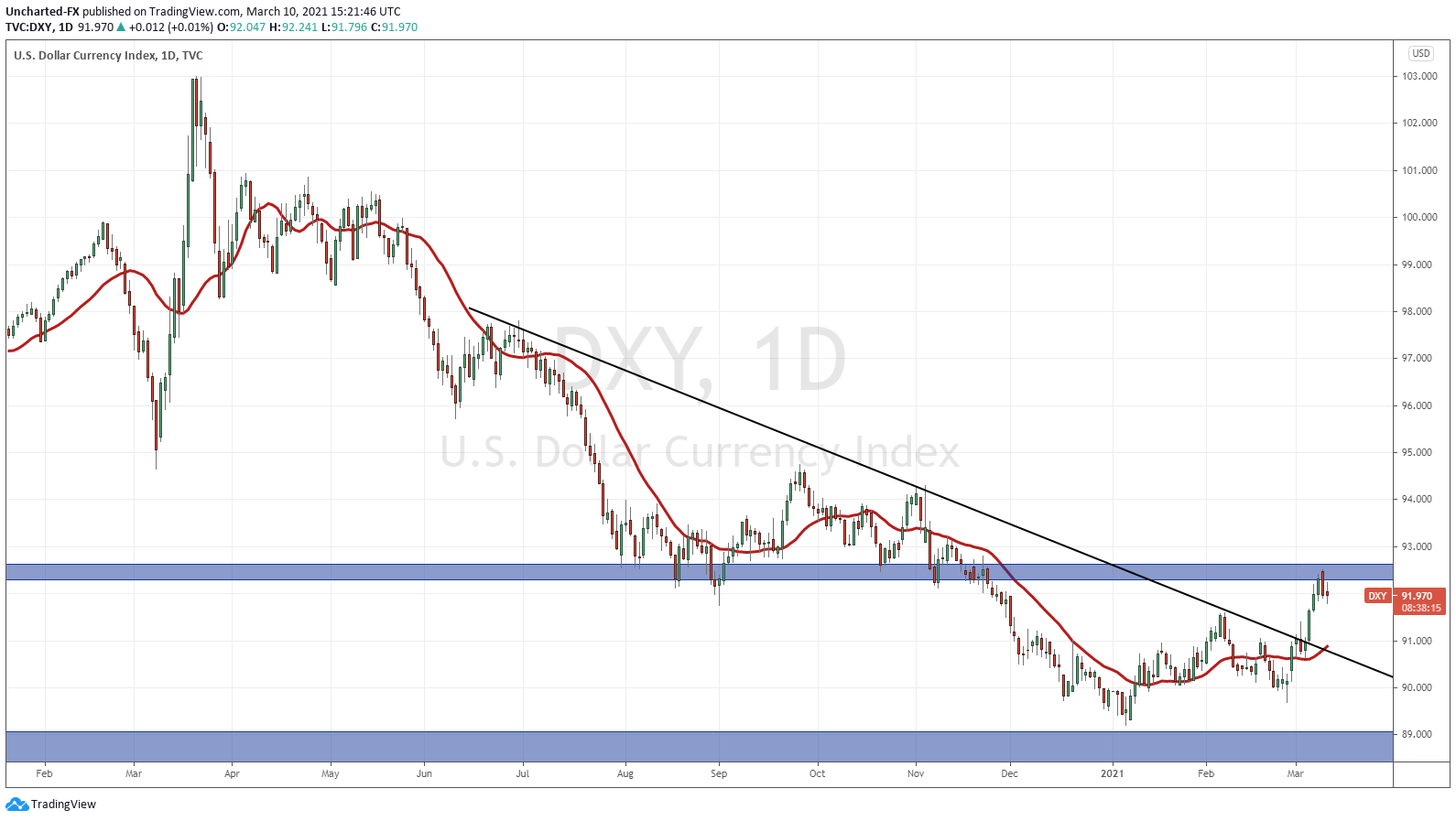

The US Dollar is a point of contention for our Gold long case going forward.

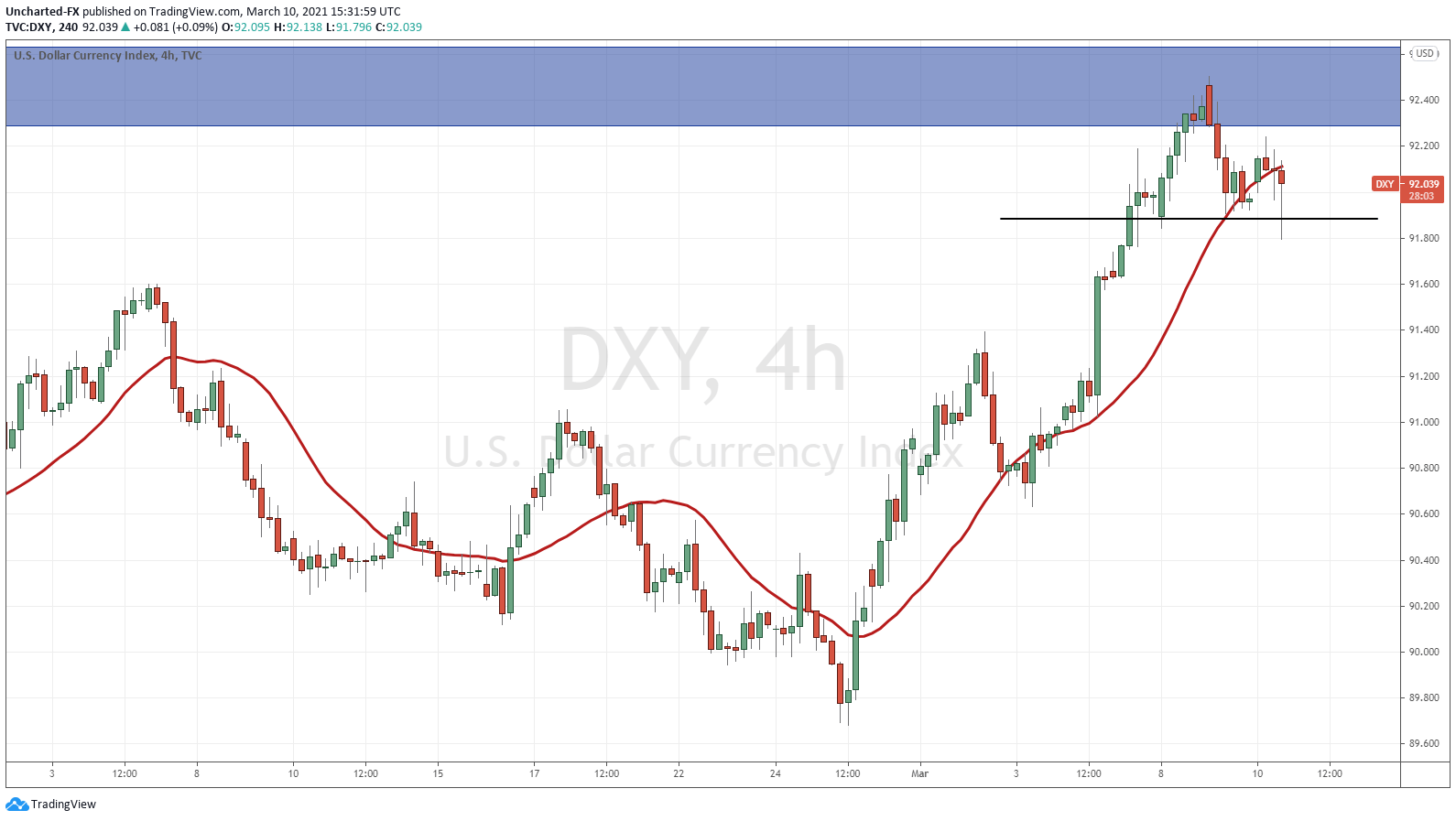

The US Dollar has made a major technical breakout. A downtrend line going back to July 2020 has been penetrated. After breaking out, Gold had a nice run up to the major resistance (price ceiling) zone at 92.50 on the Dollar Index (DXY). I did expect some profit taking, and was not surprised by yesterday’s large red candle at this resistance zone. But I do not think it is safe to say that this Dollar bull move is over.

We should expect to see multiple higher lows in this uptrend, and the US Dollar has not made one yet since breaking out. If this occurs, we should expect to see the Dollar break above 92.50, and hit 94.00. To nullify this we would need to drop back below the trendline break, comfortably back below ~91.00. Until then, the Dollar could create a higher low on pullbacks.

At time of writing, the US Dollar is getting a bid as equity markets fall.

I will be watching to see the 91.90 zone being taken out for more Dollar decline.

Many people view Gold as the anti-dollar. That there is a negative correlation between Gold and the Dollar. When one goes up the other goes down and vice versa. Sure, this turns out to be the base most of the time, but in periods of uncertainty, which I believe we are not only heading into but are already in it, we can see both Gold and the US Dollar rise. We saw this at the beginning of the Great Financial Crisis of 2007-2008. As someone who looks at Gold as a currency, and tends to favor classical economic views, Gold does well during a confidence crisis; when people run out of confidence in the government, the central banks and the fiat currency.

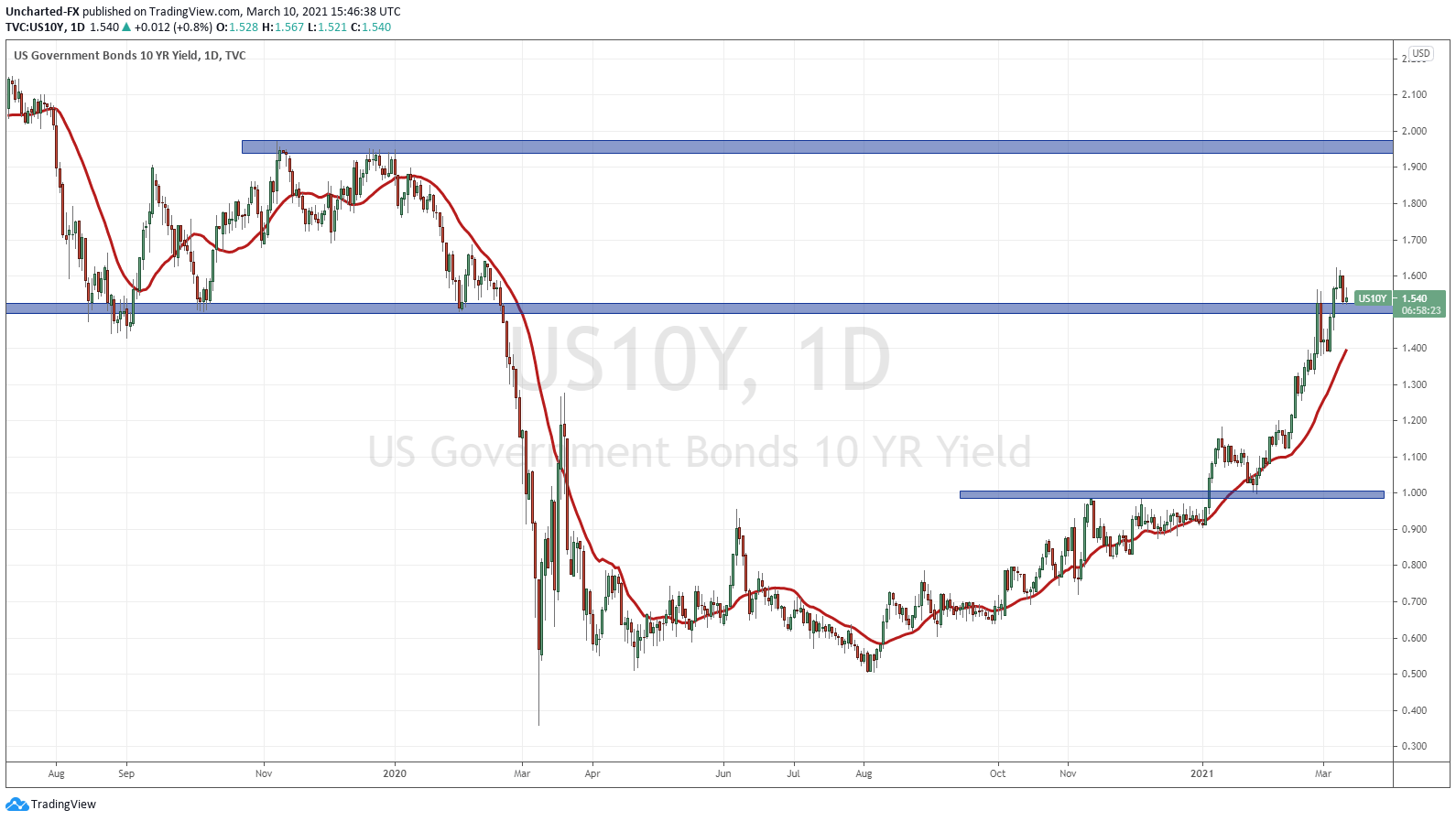

We must now shift to what has been front and center on the financial media: the 10 year yield.

Many are now beginning to understand the importance of the bond markets, and how they impact equities. Our readers and members of Equity Guru’s Discord Trading Room, have been ahead of the curve. Pardon the pun.

This yield increase to 1.50% was predicted by me in one of my 2021 outlook articles. Purely from a technical and market structure viewpoint.

Rising rates have been weighing in on markets. So much so that just a 4% probability on Fed Fund Futures indicating the Fed will hike rates, freaked the market out. Fedchair Jerome Powell had to come out for damage control and maintained a dovish stance when testifying to congress. He kept saying that inflation expectations will not be met, so there will be no rate hikes for a very long time.

There is too much debt in the system, that any rate hike could make servicing the debt an issue. This is where we bring in the $1.9 trillion stimulus.

With more debt and cheap money coming…and it is not done, more will come, where do you think interest rates will have to go in order to service this debt? Higher or lower?

I think lower, hence why I predict the Fed will announce some sort of Yield Curve Control perhaps as soon as next week (FOMC meeting on the 16th and 17th).

If you have been following Gold, then you will know that these rising rates have put pressure on Gold. Gold offers no yield, so it was attractive when bond rates were lower. The whole Ray Dalio case of Gold being a better safe haven than Bonds. But with yields expected to drop due to Fed manipulation, things look good for Gold.

I am watching for 1.50% to be taken out. As you can see, this 1.50% zone is a major flip zone (has been both support and resistance in the past). We could potentially see a bid here taking us even higher, but for Gold’s sake (and the stock markets!), let’s hope we close below!

Technical Tactics

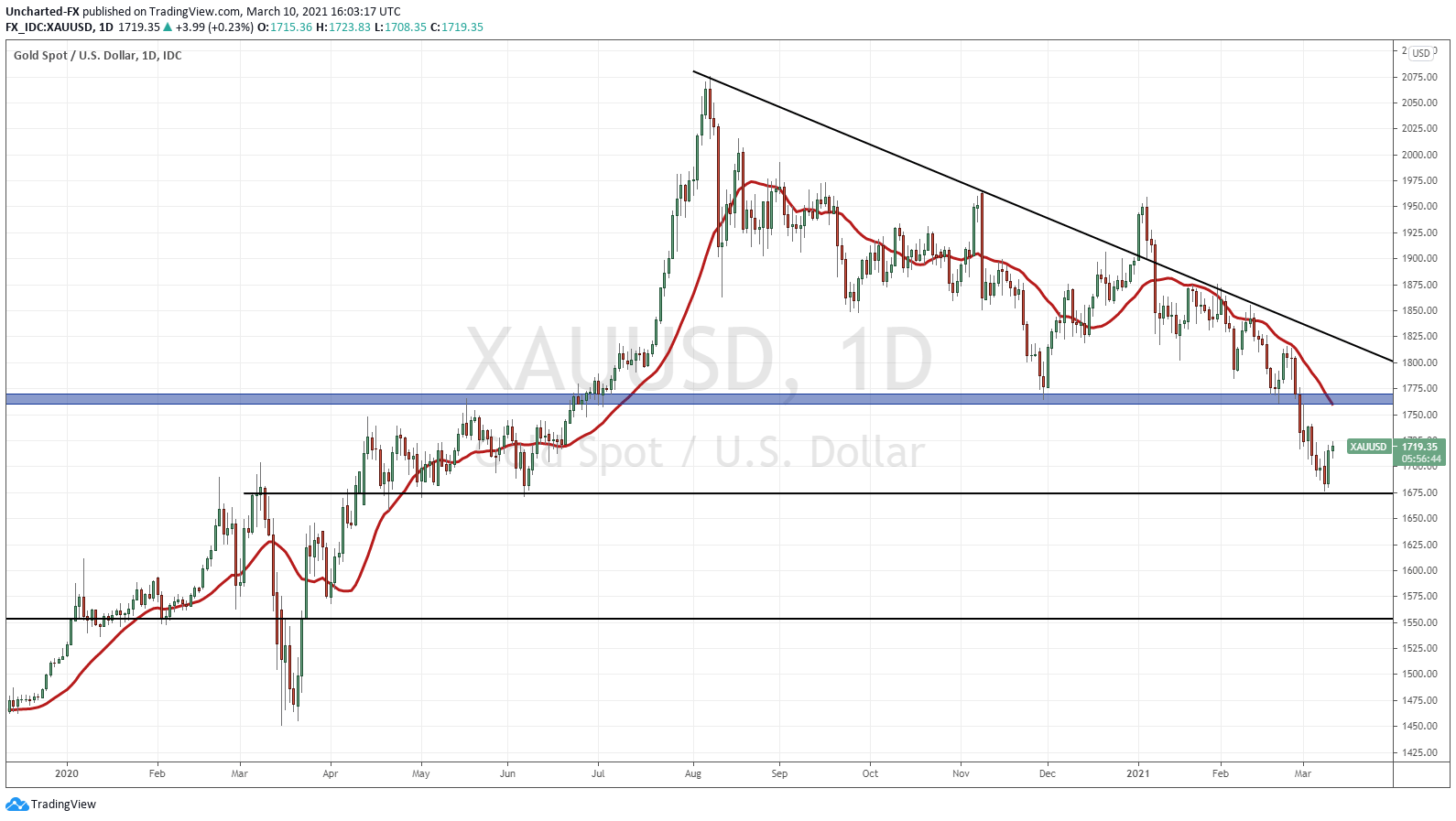

Gold has hit my first major downside target, which I outlined in a Market Moment post at the beginning of March.

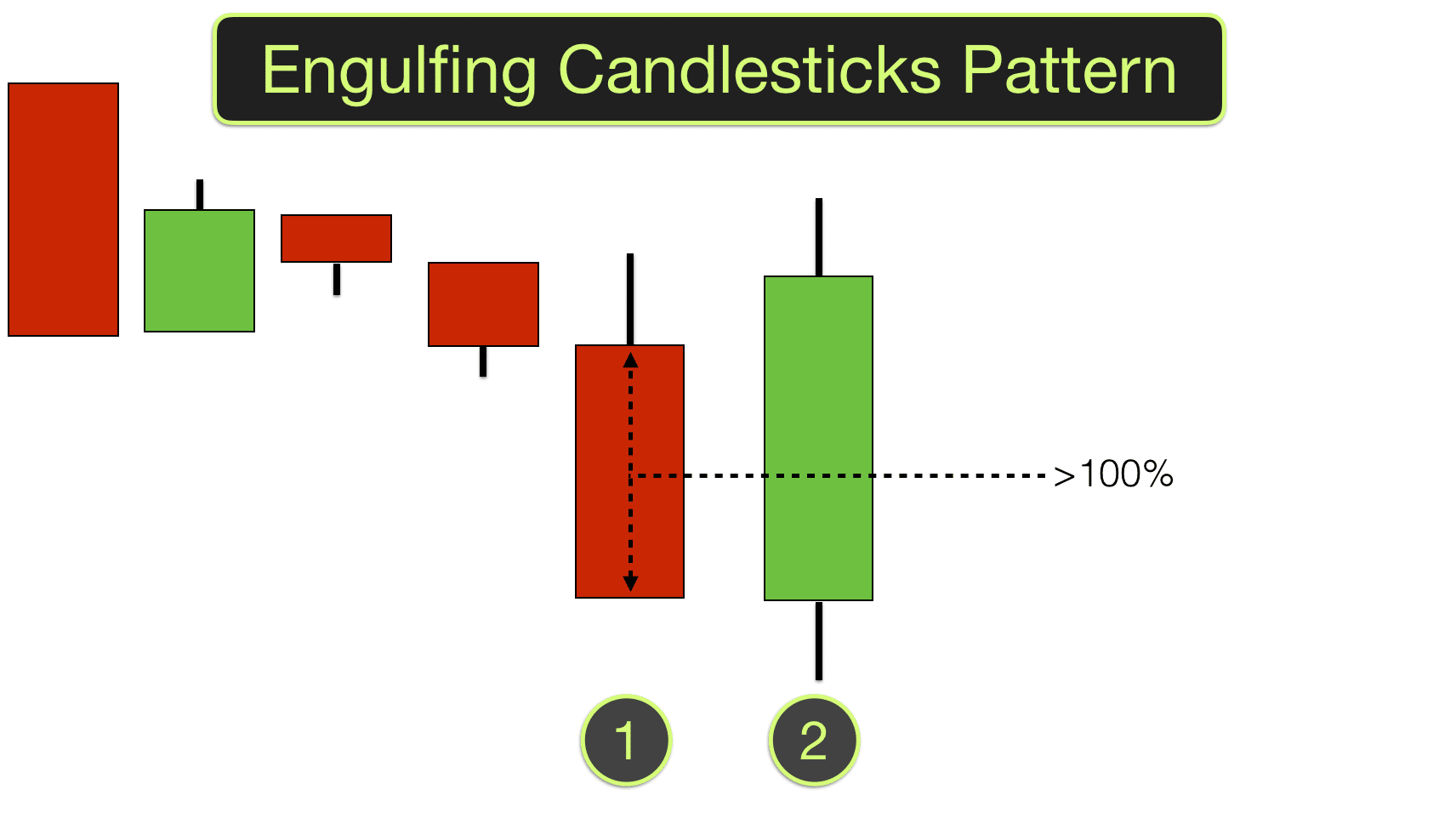

The engulfing candle printed indicates that there is a strong presence of buyers at 1680. For those unfamiliar with an engulfing candle, it really looks just as it sounds like. In a downtrend, we get a large green candle which ‘engulfs’ the previous red candle. The key is the body of the green candle must be large. We have this on Gold.

The KEY level for Gold remains $1770. We MUST close back above that for any chance of printing new record highs, and to sustain this momentum. I can see this correction take us there, but whether we break back above, we will just have to assess the price action once we get there. But for the long term, given the printing and where yields are likely going, I like Gold.

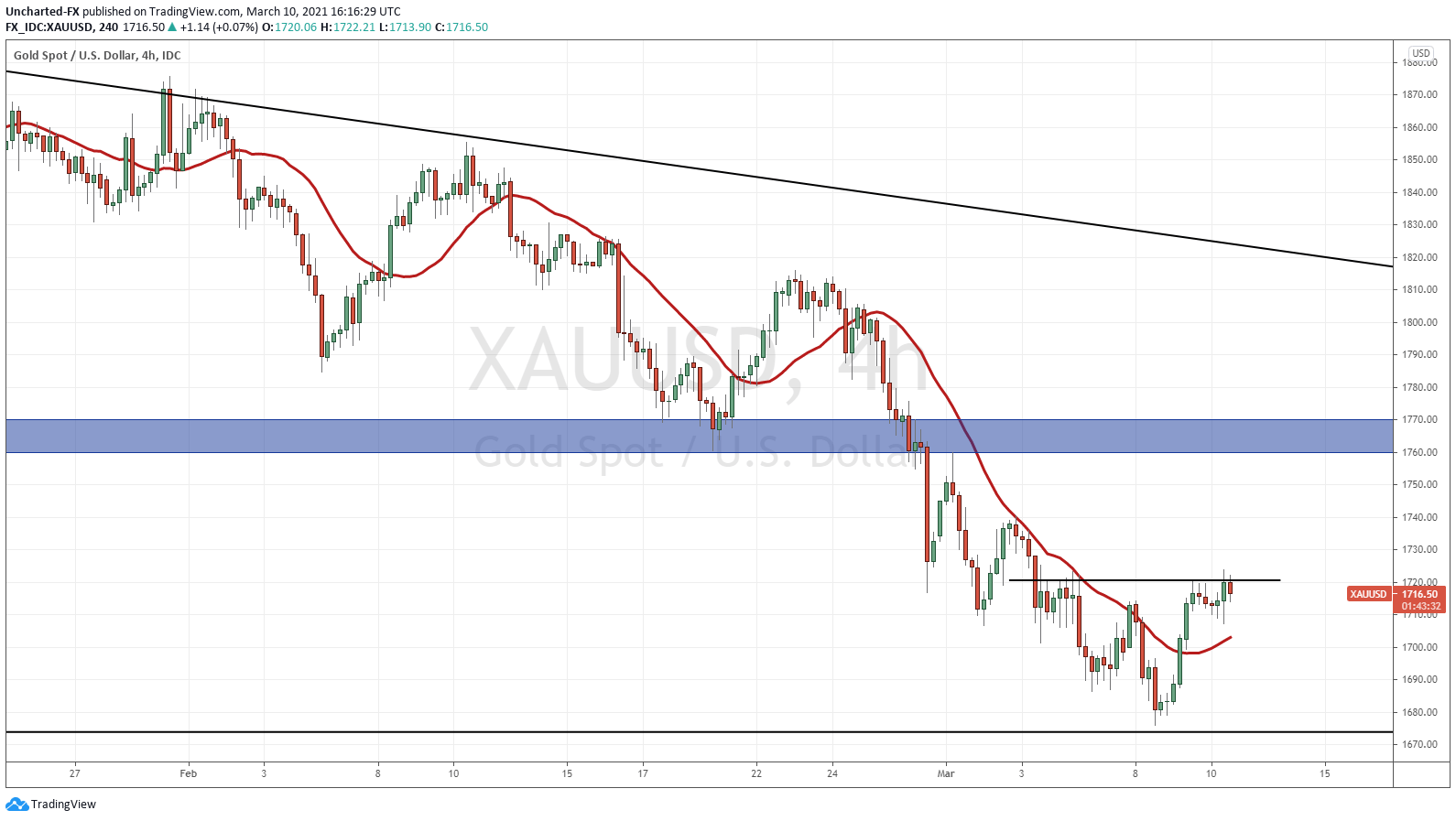

For those wanting to trade Gold, we have a very nice set up on the 4 hour chart. I would say this is a head and shoulders reversal pattern. We just need the break above $1720.50 to trigger. So far, the US Dollar strength is weighing in on Gold.

Need more Gold? Be sure to take a look at our most recent pieces on Falcon Gold (FG.V), Delta Resources (DLTA.V), Tocvan Ventures (TOC.C), Nomad Royalty (NSR.TO), and the best jurisdictions for mining.

And just for fun for us Gold Bulls, this video is trending #2 on Youtube. The Gold Apocalypse!