Last week was dramatic. Big red days, and major support zones taken out. All to end with a spectacular recovery on Friday. Were the Stock Markets anticipating Stimulus from the government? Well we know that Fed chair Jerome Powell has been mentioning fiscal policy plenty of times at the FOMC minutes. Ask and you shall receive. The US Senate has passed a $1.9 Trillion Stimulus Bill on Saturday, and the Democratic held house aims to approve the Bill on Tuesday before sending it to President Joe Biden before March 14th.

The Senate approved the bill in a party line vote 50-49, with the Republicans questioning the need for another spending program.

The Bill includes:

The legislation includes direct payments of up to $1,400 to most Americans, a $300 weekly boost to jobless benefits into September and an expansion of the child tax credit for one year. It also puts new funding into Covid-19 vaccine distribution and testing, rental assistance for struggling households and K-12 schools for reopening costs.

The package also includes $14 billion in payroll support for U.S. airlines, the third round of federal aid for the industry, in exchange for not furloughing or cutting workers’ pay rates through Sept. 30. Airline contractors were set aside $1 billion.

Zerohedge broke it further down:

Separately, local governments to highlight include:

$1.2bn for the City of Los Angeles and $2.0bn for Los Angeles County,

$601mn for the City and County of San Francisco

$5.6bn for New York City (the city and its counties).

More highlights (via Axios):

$128.6 billion to help K-12 schools reopen.

$350 billion in state and local aid.

$25 billion in aid to restaurants and other food and drinking establishments.

$19 billion in emergency rental assistance.

$7.25 billion in funds for Paycheck Protection Program loans.

Extending the enhanced unemployment insurance of $300 per week through Aug. 29.

Long time readers of Market Moment knew this was coming. More cheap money. To be honest, I do not think we are done yet. More money will flow to prop assets up including the US Stock Markets.

Many are already mentioning the I word. Inflation. With all this money printing, surely inflation will hit us right? Yes… but not yet. The major requirement for inflation is money velocity. Once economies begin to fully re-open, then the inflation genie will be coming swiftly out of the bottle. However, many already say that inflation is hitting main street when it comes to food prices and housing that the government economics are not taking into account.

Now for the big question.

Will this money make its way to the real economy or the stock market economy? Regardless of what you think about the lockdowns, the facts are that over 70 million Americans have lost their jobs which accounts for over 40% of the total working population. We have surpassed Great Depression numbers. It will take some time for a recovery. I mean years.

What have we seen people do with these stimulus checks? Most of it has gone to pay for necessities. Money is not being spent in the real economy which is puzzling the economists as consumer spending numbers decline. This has always been the issue with ‘helicopter’ money. It is easy to give people money, but it is difficult to make them spend the money. With lockdowns still imposed, many places are not open, and consumers are not spending as much as they would.

Where is this money going? Yup. You guessed it. To the Stock Markets. These people who have lost their jobs are hurting. They are now investing in the Stock Markets and Bitcoin to try and get ahead and recoup losses. Many savings have had to be depleted, and with Stock Markets being at the forefront of Media and Social Media (think WallStreetBets), more and more people will be taking part of their stimulus checks to open trading accounts.

This is something to keep in mind, as we look at what the Stock Markets do for this week.

Technical Tactics

Overnight futures initially saw a dump on US Stock Markets, but then overnight they recovered.

At time of writing both the Dow and the Russell 2000 are up over 1%, while the Nasdaq and the S&P 500 are still green, but lagging behind.

The 10 year yield still hovers near 1.60% which is weighing in on equity markets. Keep your eyes on this.

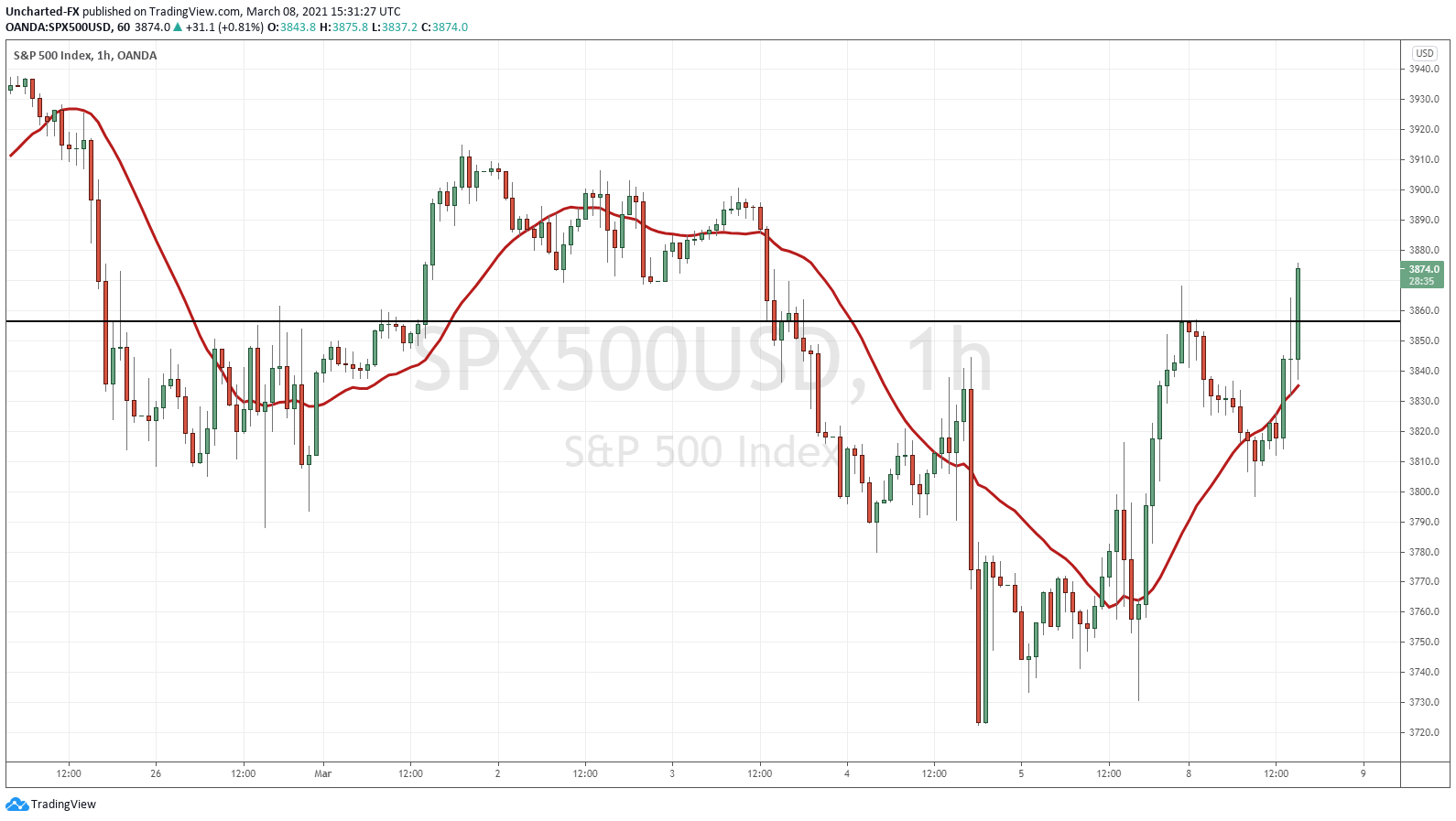

The S&P 500 is currently breaking above the highs of Friday, and a daily close by the end of today above 3860 would give us more technical momentum. The intraday is strong though, and we are scoping this over on our Discord Trading Room.

The Nasdaq and the Dow is where it gets super interesting.

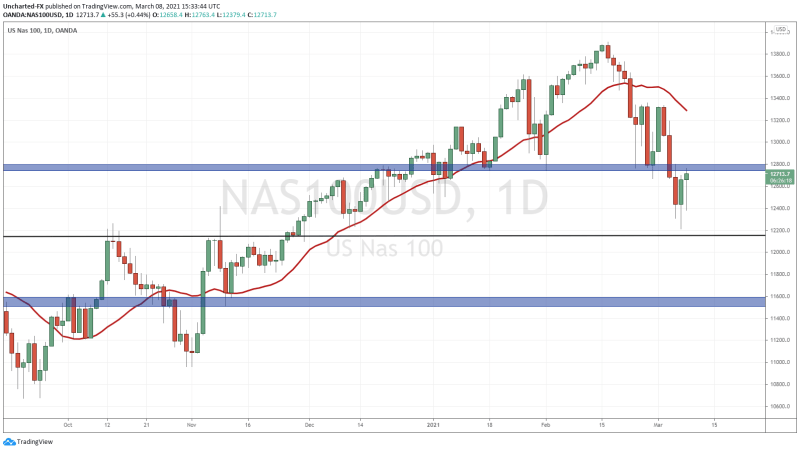

Last week, I spoke about the reversal pattern which has triggered on the Nasdaq. Check this Market Moment post out for the pattern and the broken trendline.

We are not out of the danger zone just yet, and the Nasdaq can make another leg downwards. What I will be watching for the end of today is if the Nasdaq can give us a daily close ABOVE the 12,800 zone. If this happens, technically the downtrend is nullified and the reversal pattern will have lost a lot of steam.

As always, watch both Tesla (TSLA) and Apple (AAPL) for clues on how the Nasdaq will move. Currently Tesla is green for the day, while Apple is red.

This is where things get spicy.

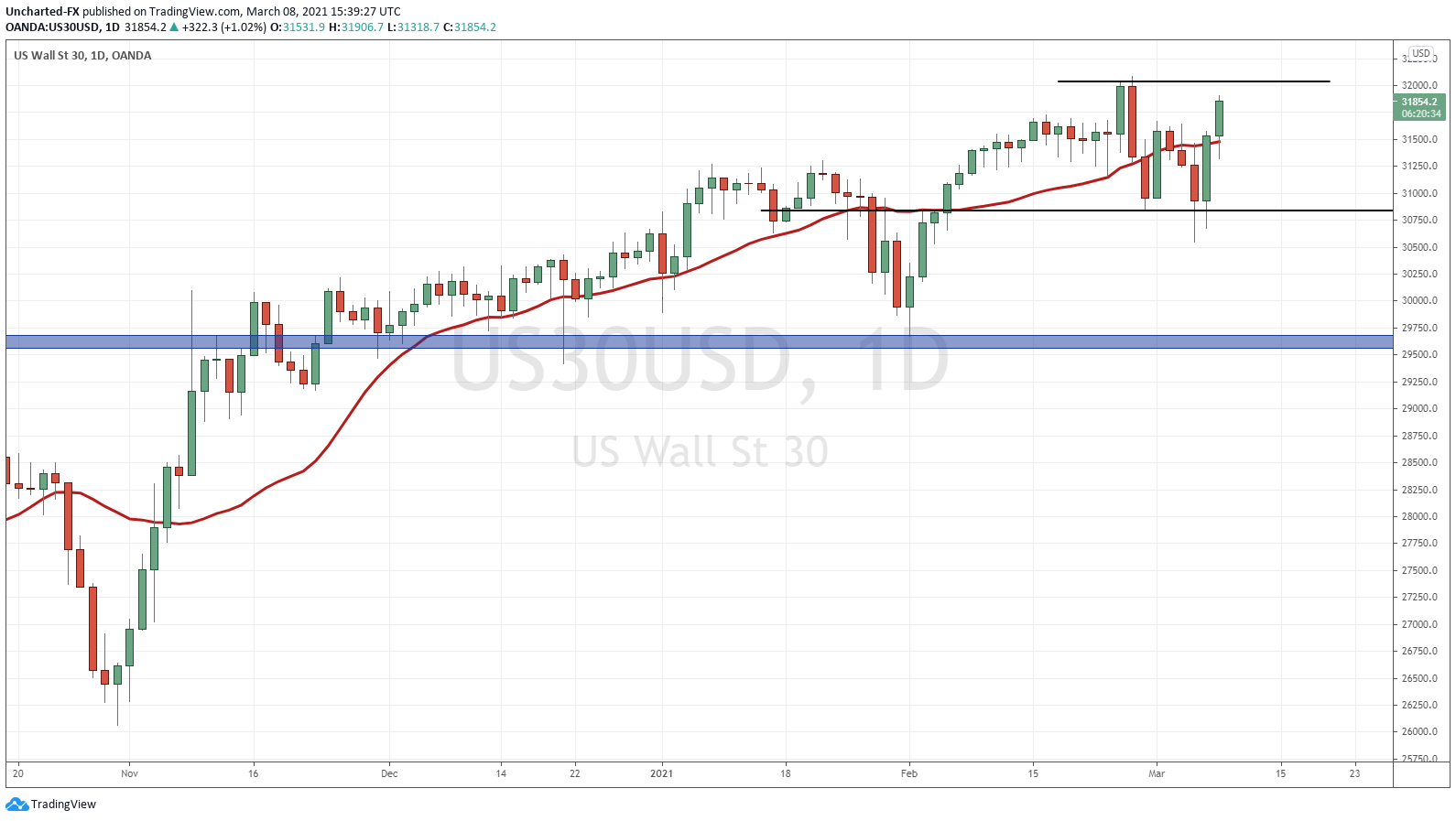

Last week, we observed that the Dow was not moving down as its peers. We hypothesized that perhaps this is now a move into value stocks. Funnily enough, the financial media is now discussing the rotation into value.

The thinking is simple: Has technology moved too fast in a short period of time? Do the Tech stocks need to pullback and get a dose of reality? If so, expect pressure on the Nasdaq and a rise in the Dow. Which is actually only a few percentage points away from making record new highs!

In summary, I am awaiting the daily closes, and honestly, it is probably prudent to wait to see how the House votes turn out tomorrow. It should pass without too much of a hassle, but you just never know. Markets are still choppy and it is tough to gauge what direction they want to go. The Dow still remains the strongest of the bunch.