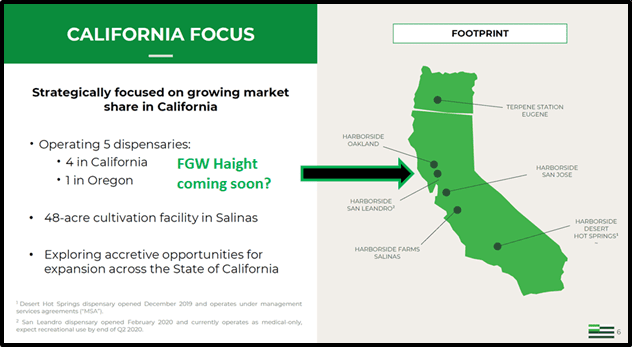

On December 21, 2020, Harborside (HBOR.C) closed a deal to acquire 50.1% of FGW Haight (FGW) – which has the conditional use approval necessary “to operate a cannabis dispensary and related businesses in the Haight Ashbury area of San Francisco, California”.

HBOR is a $36 million company that operates three big dispensaries in the San Francisco Bay Area (FGW Haight would be the 4th) a dispensary in the Palm Springs, a dispensary in Oregon and a cultivation/production facility in Salinas, California.

On November 18, 2020 HBOR reported its Q3,2020 financial results.

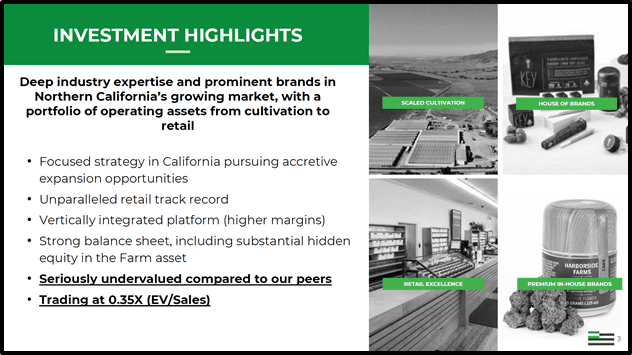

During Q3 2020, Harborside generated total gross revenues of approximately USD $19.6 million, representing a 21.2% sequential growth over Q2, 2020 and a 42.9% year-over-year increase when compared to the approximately $13.7 million of gross revenues reported in the period ending September 30, 2019 (Q3 2019).

Combined gross profit before excise taxes and adjustments for biological assets was approximately $10.7 million, an 85.8% year-over-year increase as compared to the $5.8 million reported in Q3 2019. On a year over year basis, combined gross margins increased from 42.1% in Q3 2019 to 54.7% in Q3 2020.

Growth in wholesale operations was more dramatic.

HBOR reported gross wholesale revenues of approximately $8.9 million, representing 70.7% sequential growth compared to Q2 2020 and a year-over-year increase of 169.4% as compared to the approximately $3.3 million in gross revenues reported for Q3 2019.

Wholesale Gross Margins are higher than Retail Gross Margins because the build-out for the whole-sale business does not require additional brick & mortar stores.

“I’m excited to continue to expand our footprint in California and look forward to serving consumers in Haight Ashbury,” stated Peter Bilodeau, Interim CEO of Harborside on December 12, 2020. “Together, we will work with the team from FGW to give back to the community and support initiatives to address the negative impact of past cannabis policies which have disproportionally impacted low income and minority community members.”

This summer, Harborside announced a $10,000 charitable contribution to Oakland-based Peralta Colleges Foundation which serves a diverse population of over 21,000 students largely consisting of African American, Hispanic American and Asian American students.

To close the FGW deal, Harborside paid USD $2,179,350 based on a post-build-out and proforma working capital enterprise value of USD $4,350,000.

Harborside has agreed to purchase an additional 29.9% of FGW to get to an 80% ownership of the Haight Ashbury enterprise, subject to regulatory approvals.

“The cost of these additional shares will be USD $1,300,650. Harborside retains the right of first refusal to purchase the remaining 20% of FGW.

Sales of Harborside Farms products have grown year-over-year by 229% at Harborside’s iconic dispensaries capturing 42% of its total retail flower sales through the end of Q3, 2020

At its retail dispensaries, clones (inclusive of seeds and seedlings) are expected to generate 5% of HBOR’s total annual retail sales, or approximately $2-million in annual net retail revenue in 2020.

HBOR’s 47-acre growing facility is located in Salinas, Monterey County, California.

Salinas (pop. 156,000) is in central California about 20 minutes drive from the ocean. It’s an hour south of San Jose, an hour and 45 minutes south of San Francisco.

Often referred to as the “Salad Bowl of America” (it produces 80% of U.S. lettuce), Salinas is becoming an important cannabis growing hub.

You can see the natural growing practices at HBOR’s facility in this video.

With the completion of the FGW Haight Acquisition, Harborside expands its retail dispensary footprint in the state of California to five and solidifies a strong presence in the historic and culturally-significant Haight-Ashbury district of San Francisco.

HBOR expects to complete the build-out, receive all necessary regulatory approvals, and open the social equity retail dispensary in Q3, 2021.

With HBOR’s track record operating dispensaries, the addition of FGW is likely to accelerate revenue growth.

- Lukas Kane

Full Disclosure: Harborside is an Equity Guru marketing client.