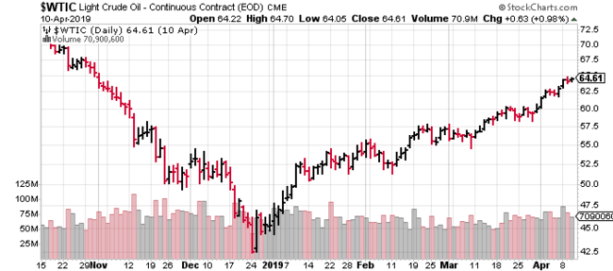

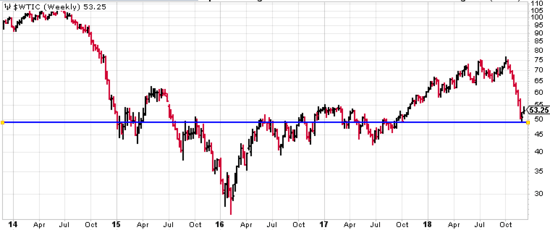

The volatility in oil continues. ‘Manic’ might best characterize trading in recent sessions

In a previous offering, we suggested that the $50 level, aside from being a nice round number with gravitational pull, looked to be a fairly solid support zone.

Close enough. The price of oil tagged forty-nine and change briefly before pushing higher. It’s been chopping sideways since registering those lows.

US producers have felt the pressure of weak crude prices, but the ride has been especially turbulent for Canadian producers – their heavy crude and oil sands bitumen, aka Western Canadian Select, have hit lows never before seen. Prices have firmed in recent days/hours after the Alberta government stepped in with a hefty 8.7% production cut.

What’s next?

All eyes will be on OPEC-plus at noon on Dec 6th as they hold a press conference in Vienna to table their decision on production cuts. Heaps of uncertainty surround this meeting of oil-producing nations. It appears that the Saudis would prefer to cut aggressively but risk pissing off president Trump in doing so. The Russians agree to cuts, in principle, but are less motivated to do so – that’s the talk anyway.

This just in: OPEC Cancels Press Conference – oil prices tumble.

Plumbing the lows – an opportunity…

Here at Equity Guru, we believe resource stocks warrant a serious look. The OILs we cover in our pages are currently plumbing absurdly low levels. This could be an extraordinary opportunity to pick up asset rich companies at or near multi-year lows.

The OILs…

This is a roundup style piece. We’ll start in Mexico and then work our way north.

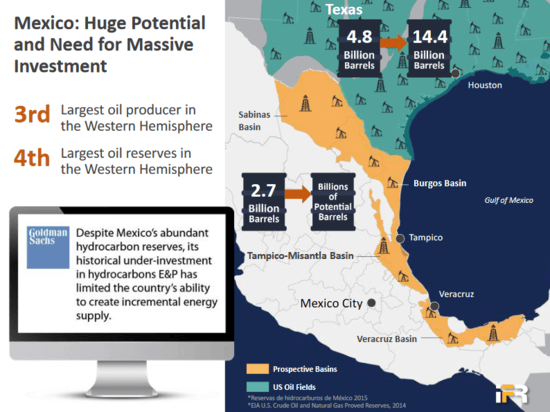

International Frontier Resources (IFR.V) is company boasting first-mover status in Mexico’s Energy Reform where it’s aggressively pursuing production growth.

IFR’s onshore block – Tecolutla – is an undeveloped mature field located on the Tampico-Misantla Basin, a prospective ‘Super Basin’ with huge unconventional oil and gas potential (source: IHS Markit).

IFR’s joint venture partner in Mexico is Grupo Idesa.

On November 13th, IFR updated us with drilling progress on their TEC-11 horizontal well at Tecolutla. Highlights from this important piece of news included the following:

- TEC-11 is planned to penetrate the El Abra reef at a vertical depth of approximately 2,310 meters with a horizontal leg of up to 1,000 meters.

- TEC-11 is the first horizontal well in a potential multi-well plan to develop the northern extension of the Tecolutla field that has been identified on Tonalli’s interpretation of the 3D seismic.

- Tonalli will deploy a LWD (Logging While Drilling) rotary steerable directional system to optimize hole quality and wellbore placement and to guide subsequent completion operations.

- Information gathered from Tonalli’s recently drilled TEC-10 vertical well, including permeability, porosity, and pressure data, indicate that the reef at Tecolutla is capable of high deliverability.

Additional insights into IFR can be gained here.

IFR has roughly 151 million shares outstanding giving it a current market-cap, based on recent trading patterns, of approximately $18.9M.

Renaissance Oil Corp (ROE.V) is another company boasting first-mover status in Mexico’s Energy Reform process.

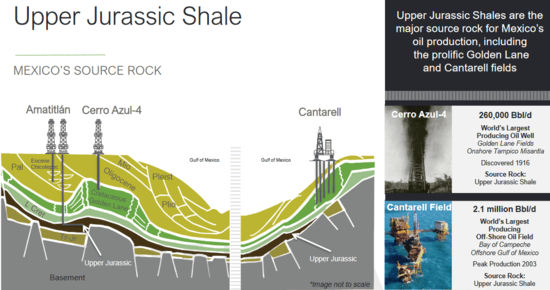

The company’s flagship asset is a massive 60,000-acre onshore block called Amatitlán – a chunk of terra firma estimated to hold over 6 billion barrels of oil within its subsurface shales.

Widely considered to be the ‘sweet spot’ of the Tampica Misantla Super Basin, Amatitlán was the first shale oil play to be acquired by a foreign company in Mexico.

Renaissance’s partner on Amatitlán is Russian oil giant LUKOIL, a monster in the oil space with global production of 1.7 million barrels per day. PEMEX, Mexico’s once powerful state-run oil monopoly, is also along for the ride via royalty interests.

The company boasts having just finished drilling their first shale well in Mexico – the first by an International OilCo. They’re currently evaluating the rock and oil quality of the 3 zones encountered for a targeted horizontal well scheduled for H1 of 2019. This will mark the beginning of an aggressive horizontal drilling program with 4 wells planned for 2019, and a further 12 wells in 2020.

The shale resource fairway at Amatitlán is wide open. Light oil, a highly coveted commodity in Mexico, is the target.

Renaissance reported 3rd quarter results last week. Highlights from the quarter as per the company website include:

- Revenue and operating netback in the third quarter of 2018 reached Company records of $7.1 million and $0.8 million, respectively.

- On the 60,000 acre Amatitlán block, Renaissance, with its partner LUKOIL, completed a 17 shallow well drilling program targeting the Chicontepec tight sand formations and additionally, spud a 3,550 meter well to evaluate important deeper zones.

- Strong crude oil and natural gas prices continued into the third quarter as sales of crude oil averaged $84.27/bbl, compared to $80.68/bbl in the previous quarter, and $54.09/bbl in the third quarter of 2017, while sales of natural gas averaged $5.03/Mcf compared to $4.51/Mcf in the previous quarter, and $4.24/Mcf in the third quarter of 2017.

- Production for the quater was 1,548 BOE/D.

ROE has roughly 278.3 million shares outstanding giving it a current market-cap, based on recent trading patterns, of approximately $47.3M.

A word on Mexico: Newly inaugurated president, Andres Manuel Lopez Obrador, aka AMLO, is suspending oil auctions for at least three years according to a recent Bloomberg article. He wants foreign companies to prove they can invest in the sector and move their projects along.

This development could actually bode well for companies like Renaissance and International Frontier. By aggressively pursuing production growth, their progress will not go unnoticed by the likes of PEMEX and AMLO. Operational success could put both companies on a short list of bidding candidates and potential partners – preferred status if you will.

Moving north, stateside…

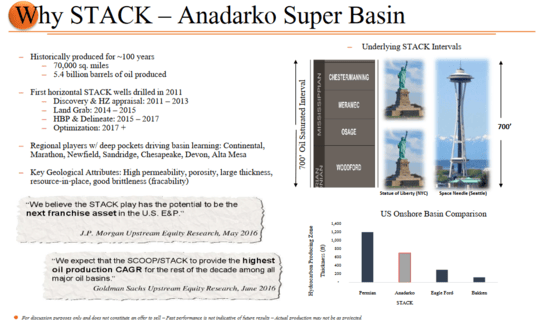

Jericho Oil Corp (JCO.V), a recent addition to our client list here at Equity Guru, boasts an enviable land position of some 55,000 acres, including 16,000 acres in the Anadarko basin ‘STACK’ play of Oklahoma. The envy level ratcheted higher in recent weeks when Encana took out neighbor Newfield Exploration in a deal valued at $5.5 billion.

Adding depth to the company’s asset portfolio, a newly released list from the Fraser Institute highlighted Oklahoma as THE best oil and gas exploration / production jurisdiction on the planet.

Backed by strong, deep pocketed investors, Jericho has shifted its focus from acquirer to developer. And the company has significant development runway to work with.

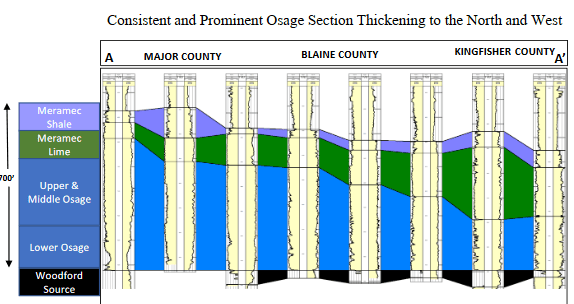

Jericho’s two recent producing wells include Wardroom (Meramec formation), producing at 220 gross barrels of oil per day (BOE/D) and Swordspear (Osage formation), currently producing 330 gross BOE/D.

Swordspear is targeting the Lower Osage formation specifically. This is the same zone being probed by Alta Mesa (AMR.NAZDAQ) to the south in Major County, and to the southeast by Chisolm (backed by private-equity group Apollo), in Kingfisher County.

The company is also very encouraged by results from surrounding Upper Osage wells to the west, by private equity-backed Fairway Resources, and to the east, by Chaparral Energy (CHAP.NYSE).

Both Osage formations, Lower and Upper, combine to form a 700 foot thick oil-bearing section.

Jericho’s technical team, through extensive petrophysical work, believe they will be able to productively and economically exploit both targets over time. Achieving similar production profiles as their neighbors is the goal.

We’re only scratching the surface of Jericho’s upside potential here. Greater insights re Jericho’s development runway can be gleaned via a recent Guru write-up on the company, and in a recent article by one oil-savvy Keith Schaefer, publisher of Oil & Gas Investments Bulletin.

JCO has roughly 128.7 million shares outstanding giving it a current market-cap, based on recent trading patterns, of approximately $65.6M.

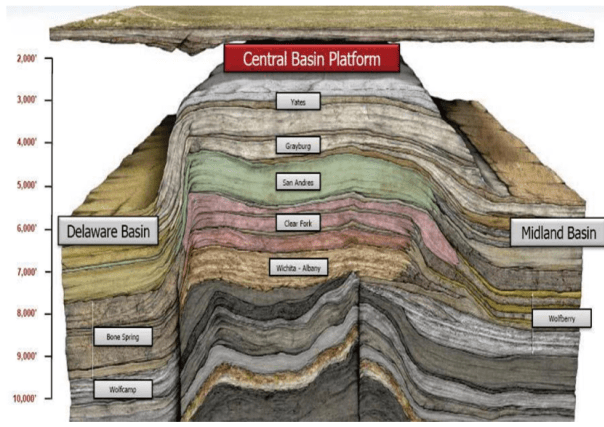

Permex Petroleum Corp (OIL.CN) is a junior oil & gas company with an extensive portfolio of assets and operations spread out across the Permian Basin of west Texas and the Delaware Sub-Basin of southeast New Mexico.

The Permian Basin holds the distinction of helping push US oil production to 11.6 million barrels per day, a total that exceeds both Russia and Saudi Arabia’s output.

Having shrewdly acquired these assets – some 6,500 “held by production” acres – for mere pennies on the dollar when times were lean, the company is now in development mode boasting 72 producing wells, and over 145 oil and gas wells owned and operated by the company.

At the time of this writing, the company is readying themselves to bring online yet another shut-in well at their West Henshaw property. This well is #105 and will produce from the Grayburg pay within the Deleware Basin of southeast New Mexico.

Speaking of production, it’s doubled since the company went public in early 2018. It now stands at roughly 240 barrels of oil equivalent per day (BOE/D) due largely to re-entry and ongoing stimulation programs.

Production is expected to stairstep higher – up to 400-500 BOE/D within the next few months, and up to 3,000 BOE/D by the end of 2019.

The company has even bigger plans going forward: on June 5 of this year, Permex announced a strategic San Andres Formation acquisition and an alignment with a world-class large-cap operator in Occidental Petroleum.

For the uninitiated, the Permian Basin has produced over 30 billion barrels of oil over the past 90 years. The San Andreas Formation is responsible for 12 billion barrels of that impressive total (plus 2 trillion cubic feet of natural gas).

What management is considering is a five well horizontal-leg conversion program with a one mile lateral 12 -20 stage frac. Such a move has the potential to dramatically accelerate production growth. We look forward to hearing more on this development scenario.

For a more thorough probe into this fast evolving junior producer, the following link will offer greater detail…

OIL has roughly 35.97 million shares outstanding giving it a current market-cap, based on recent trading patterns, of approximately $7.9M.

Final thoughts…

All of the junior Oils featured here offer value – deep value in my estimation. The prices currently rolling across our computer screens, the product of rabid oil price volatility and year-end tax loss selling, are unlikely to endure much longer.

We stand to watch.

END

~ ~ Dirk Diggler

Full disclosure: IFR, ROE, JCO and OIL are Equity Guru clients.

Feature image courtesy of StockyardPhotos