The resource markets used to be more predictable. Seasonal cycles used to hold more sway. Time was, in the junior exploration sector anyway, when the dog days of summer gave way to the cool breezes of autumn, resource stocks firmed up. It was like clockwork – holidaying brokers’ folded up their beach gear, migrated back to the city and put resource stocks back on their client’s radar (I’m thinking back pre-2012 here).

Once Labour Day long weekend passed, resource stocks always seemed to catch. There was always money to be made. Or so it seemed…

A close study of a 5-year GDXJ chart shows anything but a proclivity for such speculations during the post-Labour Day periods of late. In some recent years, it was all gloom, despair, and agony (no Hee Haw reference intended).

This year might be different. We might see a sustained appetite for junior mining stocks this Fall. There are clues. Powerful clues in my estimation.

First clue: Discoveries are all the rage right now:

New discoveries, particularly those in the gold space, are getting bought up. Share prices are being stair-stepped higher. Volume spikes have been off-the-charts.

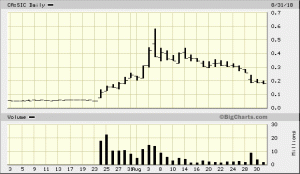

Three recent examples: Aben Resources, Great Bear Resources, and Golden Ridge Resources. Price appreciation is one thing… but the volume is what speaks, ahhhh, volumes to this humble observer. Note Sokoman Iron shares (chart below) in the days immediately after their Moosehead gold discovery was announced on July 24th. They turned over the equivalent of their entire float in only a handful of days. I haven’t seen this kind of action in years.

Second clue: ‘Smart Money’ is stepping up to the plate… real quick like:

Eric Sprott was spotted taking large ‘strategic positions’ in both Sokoman Energy and Aben Resources immediately after their discovery holes were announced.

Rob McEwen and his McEwen Mining (MUX.TSX) took an 18% chunk out of Great Bear Resources (GBR.V) immediately after the company announced 2 stellar hits out of their Hinge Zone in the Red Lake District of Ontario.

These are signs, clues that the appetite for junior exploration stocks – particularly those with discovery potential – are falling back into favor.

Most of the names we follow closely here at Equity Guru are poised to produce news in the coming days, weeks, and months. There could be ‘opportunity’ in any one of these names

The Junior Mining Companies we follow here (in alphabetical order)…

Aben Resources (ABN.V)…

… is due to report drill assays in the coming days from their North and South Boundary Zone discoveries… discoveries made only weeks ago. This is a very high-profile exploration play. A lot of eyes are fixed on this one as recent drilling success has prompted company management to accelerate their current drill program. The write-up linked below details the company’s most recent developments…

Aben Resources (ABN.V): Tags new discovery at ‘South Boundary’ zone

Blue Moon Zinc (MOON.V)…

… has begun drilling on their zinc-rich Volcanic Massive Sulphide (VMS) deposit in Mariposa County, California. Approximately 1,200 meters of drilling will target the northern and southern extensions of their upper Main and West lenses between 150 and 300 meters from surface. Drill hole assays and a Preliminary Economic Assessment (PEA) are due in the coming weeks and months. Equity Guru’s Lukas Kane offered up his insights on recent drilling-related news below…

Blue Sky Uranium (BSK.V)…

… boasts 19.1 million pounds of U3O8 and 10.1 million pounds of V2O5 at their Amarillo Grande Project located in the central Rio Negro province (Patagonia region) of southern Argentina. A PEA, regional exploration news, Ivana step-out drilling, and high-priority drill target testing are all potential price catalysts for the company in the weeks and months ahead. Insights into the company and their surficial deposit(s) can be gleaned below…

Blue Sky Uranium (BSK.V): Advancing Amarillo Grande to the PEA stage – Update

Boreal Metals (BMX.V)…

… is exploring a number of prospective projects in a number of different geological settings, any one of which could be a company-maker. This is a company which boasts a rare combination of attributes: a robust project portfolio in highly supportive mining-friendly jurisdictions, a super-tight cap-structure, a management team stacked with talent, an excellent and strategic relationship with EMX Royalty (EMX.V), and the resolve to create shareholder value. Greater insight into the company can be gained by leafing through the following piece by yours truly…

Boreal (BMX.V): Close Proximity Exploration to Europe’s Largest Historic Cobalt Mine

Cabral Gold (CBR.V)…

… is exploring their strategic land position in the Tapajos district of northern Brazil. Boasting a gold resource of one million ounces (indicated and inferred), the company is busy scouring their expansive property, uncovering new surface discoveries with each passing month. Ultimately, all of this detailed and methodical surface work will crescendo into a drilling program scheduled for later in the year. Greater details can be unearthed below…

Cabral Gold (CBR.V): continues to expand its mineralized footprint at Cuiu Cuiu

Canada Cobalt Works (CCW.V)…

Extensive coverage has been given to this cobalt explorer/developer/producer here at Equity Guru, and for good reason. CCW stands out as THE most advanced junior exploration company working in the prolific historic Cobalt Mining Camp in northern Ontario. Newsflow out of this dynamic company will be generated on multiple fronts in the days, weeks and months to come. On deck are potentially high-grade cobalt assays out of the first level of their Castle Mine. Broader insights can be uncovered below…

Canada Cobalt Works (CCW.V): Accelerating its activities in a prolific Cobalt Camp

Ceylon Graphite (CYL.V)…

… is an explorer and developer of graphite mines in Sri Lanka. The government of Sri Lanka has granted the company exploration rights to a land package of some 120km². These exploration rights cover areas of historic graphite production from the early twentieth century and represent a majority of the known graphite occurrences in Sri Lanka. SriLankan graphite is known to be some of the purest on our planet, and currently accounts for less than 1% of world graphite production. Price catalysts may come on the exploration and development fronts. Recent insights can be extracted from Equity Guru’s Lukas Kane in his offering below…

Here’s the real reason Ceylon Graphite (CYL.V) just spiked 20%

E3 Metals Corp (ETMC.V)…

… boasts some 6.7 million tonnes of LCE (lithium carbonate equivalent). This massive resource lies within the prolific Leduc Reef Trend in South-Central Alberta. The company is also developing a concentration and recovery process which has demonstrated recent success in concentrating raw brine from 75 mg/L to 1206 mg/L Li in less than 3 hours. This is another company which will be generating newsflow on multiple fronts. Equity Guru’s Ethan Reyes recently offered up some of his insights in the following piece…

E3 Metals (ETMC.V) expands R&D with $100,000 of government funding

Equitorial Exploration (EXX.V)…

… is exploring its 100%-owned (high-grade) Cat Lake Lithium Property in southeast Manitoba. The company has discovered high-grade lithium in spodumene (spodumene is a pyroxene mineral found in granite pegmatites). Lithium sourced from spodumene is high in purity… and highly sought after by the battery industry. The company is about to embark on a 5,000-meter drill program to further define a resource that appears to have scale. A recent write-up by your truly can be examined here…

Equitorial Exploration (EXX.V): assays up to 3.57% Li2O at Cat Lake

Nexus Gold (NXS.V)…

… is a gold exploration and development company whose primary focus is Burkina Faso, West Africa. The company’s goal is to establish a resource at one or more of it’s three active projects. The company’s Bouboulou project boasts five gold zones contained within three separate five-kilometer long gold trends. The adjacent Rakounga gold concession extends the potential strike at Bouboulou with three mineralized zones. Their Niangouela gold concession features high-grade gold occurring in and around a primary quartz vein and a one km long associated shear zone. Price catalysts could come via success on the exploration front. Lukas Kane tabled his insights on recent exploration developments in the following piece…

Zinc One (Z.V)…

The company has just finished drilling off their Bongarita, Mina Chica, and Mina Grande Sur zones at their Bongara Project in the mining friendly jurisdiction of north-central Peru. This might be THE highest grade zinc deposit on the planet. Certainly, it sits a table shared by few others. Assays are due from the Mina Grande Centro and Mina Grande Norte zones in the short-term. A highly anticipated resource estimate is due in Q4 of this year, as is a Preliminary Economic Assessment (PEA). Greater insights into the company can be mined in the following piece…

Zinc One (Z.V): continues to deliver high-grade zinc. Resource estimate on deck

Honorable mentions:

Golden Ridge Resources (GLDN.V) has made headlines with its recent alkalic Cu-Au porphyry discovery at its Williams Zone, located on the company’s Hank project in BC’s Golden Triangle. GLDN currently has 2 drill rigs in operation, one on the Williams Zone, the other probing its highly prospective Kaip Zone. A third target (the Boiling Zone) will be tested with the drill bit later in the season. The company was highlighted in a recent piece here at Equity Guru (below)…

Aben Resources (ABN.V), Golden Ridge (GLDN.V): a red line and an accumulation groundswell

Granada Gold Mine (GGM.V) boasts a global resource of nearly 5 million ounces in mining friendly Quebec. Led by Canada Cobalt Works CEO Frank Basa, the company is busy expanding its mineralized footprint, one which has the potential for 5.5 kilometers in strike length. The company also has a ‘fast track’ plan to production. A fairly recent write-up can be perused below…

Granada (GGM.V) probes unexplored mineralized structures along strike

All of the companies summarized above represent decent value in this authors humble opinion. New discoveries have received a fair amount of attention of late. This recent flurry of activity could signal a shift in sentiment. It could portend better days ahead for the resource sector as a whole.

We stand to watch.

END

~ ~ Dirk Diggler

Full disclosure: Aben, Blue Moon, Blue Sky, Boreal, Cabral, Canada Cobalt Works, Ceylon, E3 Metals, Equitorial, Nexus, and Zinc One are Equity Guru clients. Golden Ridge and Granada are not Equity Guru clients.

Postscript: the first session of this post Labour Day long weekend ended with a resounding thud. There’s always the old adage, “success delayed is not success denied”. Let’s go with that.

Feature gif courtesy of Giphy

Is anyone else very worried about how low EXX has gone? Am I the only one who hasn’t abandoned ship? I wonder how management is handling this. I heard no news is bad news when it comes to mining…