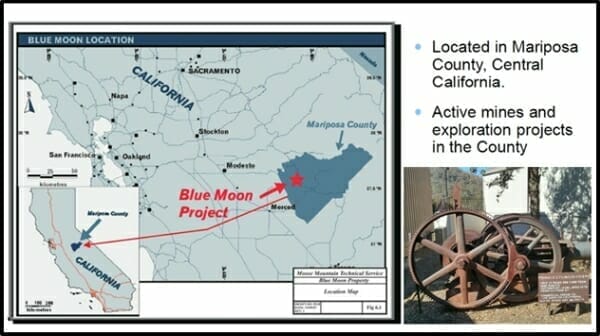

On August 29, 2018 Blue Moon (MOON.V) announced that its Phase 1 drill program has begun at the zinc-rich Volcanic Massive Sulphide (VMS) deposit in Mariposa County, California.

VMS deposits often contain multiple metals, functioning as single-deposit diversification investments. A solitary VMS deposit has been valued at half a billion dollars. Blue Moon’s market cap is currently about $8 million.

Mariposa Country, has a rich mining history. The local county government is a key influencer over the decision to build, or not build a mine.

This is the first drilling at this project in more than 25 years with new interpretations of the system providing strong potential for fresh discoveries to significantly expand the known zinc-copper-silver-gold resource.

“We are putting our extensive review of historical data to work to identify potential new zinc-rich massive sulphide zones that could dramatically change the scale and dynamics of this project,” stated Patrick McGrath, Blue Moon CEO.

Zinc’s primary use is in galvanised steel. Global zinc prices react to the health of China’s massive construction sector, and changes to the Chinese supply side.

Researchers from Berkeley Earth estimate that 1.6 million Chinese die every year from pollution-related health issues, with an annual economic cost of about $700 billion – from medical expenses, hospitalisation and lost productivity.

In 2017, 60% of zinc mines in Sichuan province were shut down after failing inspections from the Environment Protection Unit.

Over the last 12 months, Blue Moon’s share price has gone up and down, in tandem with sentiment about the direction of global zinc prices.

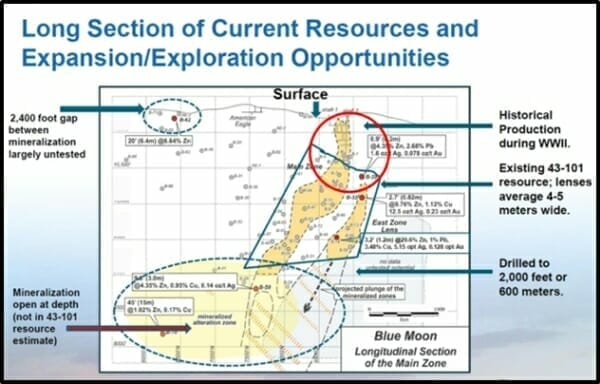

The initial 4,000-foot drill program will target north and south extensions of the upper Main and West lenses between a depth of 500 and 1,000 feet from surface.

Blue Moon geologists also recently reviewed historical data and identified new priority targets that could expand the current zones of interest.

Highlights:

- 600 feet of favourable untested stratigraphy immediately north of the East Zone;

- Down plunge extensions of the Main and West zones;

- Possible feeder zone points to a massive sulphide target to the south of the West zone.

- A 2,400-foot gap between mineralization in holes B-67, B-70 and B-66 is largely untested

- A 1,500-foot-long zinc-in-soil anomaly warrants further exploration drilling.

A review of drilling logs of the historical holes used in the NI-43-101 resource calculation revealed numerous intervals of massive and semi-massive sulphides that were not analysed. Blue Moon will systematically sample and assay these intervals as part of the current drilling program.

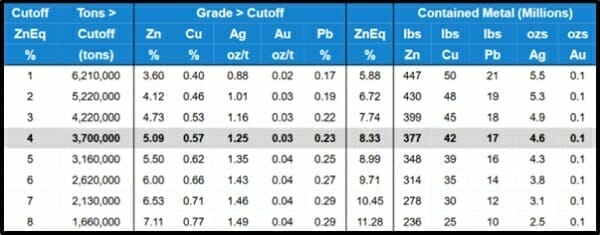

Equity Guru’s Greg Nolan recently stated, “the deposit currently sits at 3.7 million tons grading 8.3% zinc equivalent ZnEq (Zinc Equivalent) in the Indicated category and 4.1 million tons grading 7.8% ZnEq in the Inferred category, both at a conservative 4.0% ZnEq cut-off grade.”

That represents an estimated 377 million pounds of indicated zinc – worth about CND $560 million at the current spot price. Blue Moon has not yet demonstrated it can extract the zinc, copper, silver, gold and lead economically.

Indicated Zinc:

The Blue Moon zinc deposit had modest production during World War II with approximately 56,000 tons mined at 12% zinc. During the 1980s scoping, optimization studies, metallurgy testing and baseline work were completed.

In 1991 the local Californian County issued a permit to build a shaft for underground development. The permit has since lapsed but “past production and historical issuance of permits” signifies a history of pro-mining sentiment.

According to recent London Metal Exchange data, zinc inventories in Shanghai warehouses fell 11.8% last week to 30,800 tonnes, the lowest level since October 2007.

Blue Moon is up 14% (.01 to .08) on 510,000 shares traded by mid morning.

Full Disclosure: Blue Moon is an Equity Guru marketing client and we own stock.