When I was a novice investor—a kid barely in his 20’s—the junior exploration arena was a fascinating landscape. It still is. There’s something about buried treasure, and the hunt that goes along with it.

Before I made my first trade, I approached the markets with lessons passed down by my old man, a very decent homicide detective in his day. I surveyed the terrain carefully before entering it. I kept an open mind but remained wary. I interviewed (interrogated) brokers in person and over the phone. I went through at least a dozen before settling on a person of interest. I also learned how to approach the management teams behind the companies that interested me.

I discovered right from the get that serious mining men and women love to talk about what they do—they love to talk about the discovery process. They love to talk about rocks.

Back then, with the internet in its infancy, maintaining regular telephone contact—and owning a fax machine that noisily belched out news releases in the middle of the night—was the only way to stay on top of time-sensitive developments.

I nurtured the contacts I made in the industry, and over the years, I developed a good feel for the terrain.

My point? If you’re new to the junior exploration arena, be a detective, learn as much as you can about the discovery process, and talk to management behind the companies on your due diligence shortlist. I can’t stress this enough.

Moving along…

WE cover three categories of mining companies in these Guru shortlist round-ups: the larger resource-rich Cos that are either in production or advancing their projects in that direction, the $20M to $80M Cos that are busy proving up economics and/or adding ounces to a well-established resource base, and the sub-$20M Cos that are positioned for a new discovery, or advancing a resource base that is either early-stage, or flying under the market’s radar.

A number of the sub-$20M companies we featured only a few short months ago have gone on a tear, pushing their market caps well above $20M, some well over $100M. I’ll highlight a few examples in part II.

It’s been the better part of a decade, but we are now in a market that rewards success with the drill bit.

The sub-$20M ExploreCos – Part I

Please note that this is not a comprehensive list. And some of these companies deserve more attention than I’m giving them.

- 116.67 million shares outstanding

- $14.58M market cap based on its recent $0.125 close

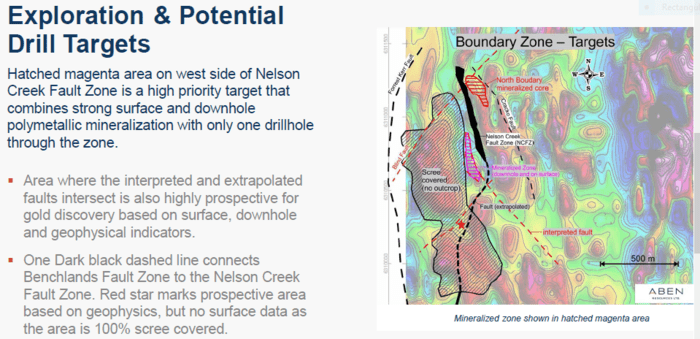

Aben’s 23,000 hectare Forrest Kerr Gold Project, located in the heart of the Golden Triangle, made headlines a couple summers back with an impressive hit in drill hole FK18-10: 331.0 g/t gold (9.65 oz/t) over 1.0 meter within a broader interval averaging 38.7 g/t gold (1.12 oz/t) over 10.0 meters.

The high-grade tenor of this hit was sufficient to attract the likes of Eric Sprott.

Since then, multiple zones of mineralization have been identified across the property, but thus far, similar high-grade results have proved elusive.

Forrest Kerr’s geology is complex. But don’t rule this one out as the geological sleuths here are among the best in the business.

On June 23rd, Aben tabled its 2020 plans for Forrest Kerr…

Aben Commences 2020 Field Program at Forrest Kerr Gold Project

The company states that this program will consist of mapping, prospecting, and soil and rock sampling “to better define existing targets and generate new targets for a potential drill program later in the season.”

The company states that this program will consist of mapping, prospecting, and soil and rock sampling “to better define existing targets and generate new targets for a potential drill program later in the season.”

To drill or not to drill. This is the question.

Corporate Presentation (middle right of page)

- 68.5 million shares outstanding

- $13.02M market cap based on its recent $0.19 close

The company has a good number of exploration and development projects in its portfolio along several of Nevada’s more productive gold trends.

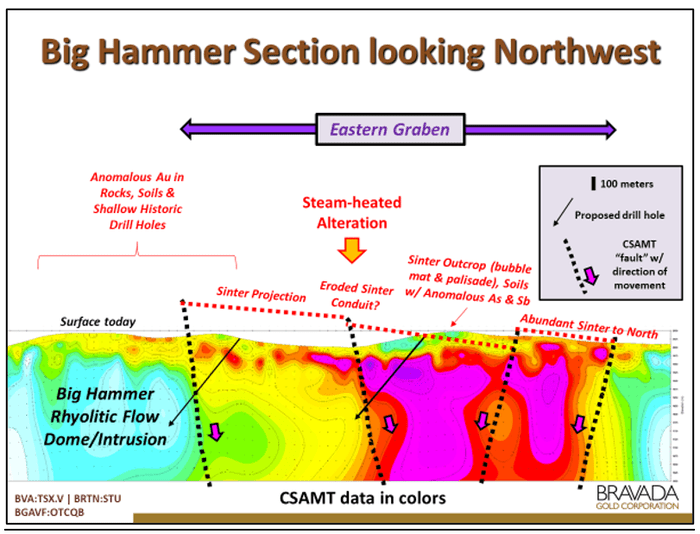

“Bravada believes these properties have characteristics of very large Carlin-type gold deposits or rich low-sulfidation gold/silver deposits.”

The company employs the prospect generator business model.

Its flagship Wind Mountain Project has an Indicated resource of 570,500 oz Au & 14,736,000 oz Ag + Inferred resource of 354,300 oz Au & 10,115,000 oz Ag).

A 2012 PEA for Wind Mountain shows an NPV@5% = $26.5 M (after‐tax) and an IRR of 21%. Commodity inputs = $1,300/oz Au & $24.42/oz Ag.

The company is also expected cash‐flow starting in 2021 from a barite deposit that is currently under development.

Earlier this spring, the company began fieldwork at its Highland Gold/Silver Project, located in Nevada’s Walker Lane Gold Trend, where OceanaGold (OGC.T) can earn a 75% interest by spending US$10million

Just last week, the company dropped the following Highland Project headline:

Bravada Fully Permitted for Drilling at the Highland Project, Nevada

“For the remainder of 2020, two core holes are planned for the Big Hammer Target. A drilling contract has been signed, and the drill is expected to arrive on-site in early to mid-August.”

Bluebird Battery Metals (BATT.V)

- 67.06 million shares outstanding

- $8.05M market cap based on its recent $0.12 close

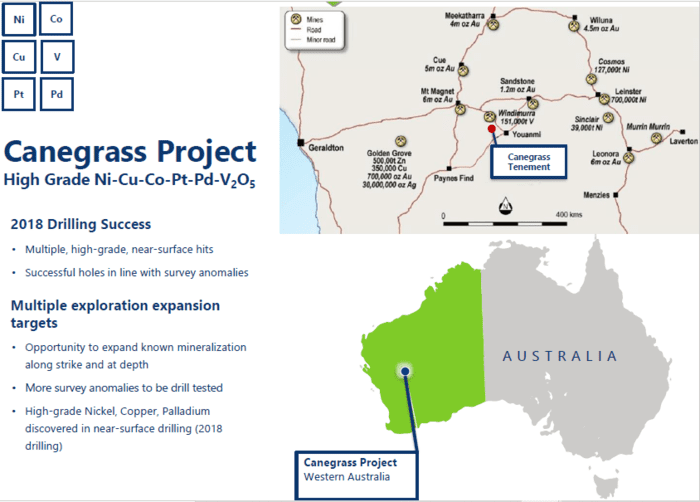

Bluebird’s 4,200-hectare flagship Canegrass Project lies within the prolific Windimurra Complex in mining-friendly Western Australia.

Bluebird’s 4,200-hectare flagship Canegrass Project lies within the prolific Windimurra Complex in mining-friendly Western Australia.

The Windimurra Complex is Australia’s largest, exposed, layered mafic intrusion complex measuring some 85 kilometers x 37 kilometers by some 11 kilometers thick.

This Archean-aged complex is geologically similar to the Bushveld Igneous Complex in South Africa, the source of much of our planet’s nickel, copper, cobalt, and platinum group elements.

Within the Windimurra Complex, the prospective Shepards Discordant Zone—a 600 meter thick sequence of magnetite-rich leucogabbro—can be traced for more than 50 kilometers and trends directly onto Bluebird’s Canegrass ground.

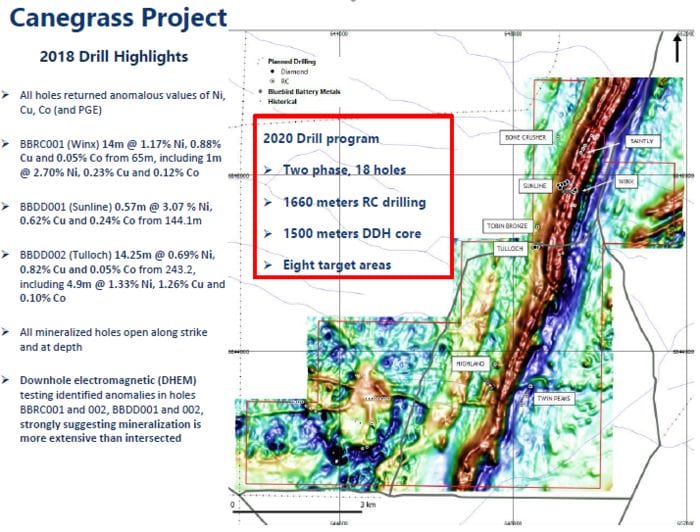

With drilling partner’ NEWEXCO—geological sleuths renowned for methodically planning and executing exploration campaigns in the region—the company is on the verge of an 18 hole drilling campaign: 3,160 meters of RC and DD to follow-up on a successful 2018 program, and also test high priority areas along 8.5 kilometers of magnetite-rich gabbro-norite paralleling a shear zone.

Highlights from the 2018 drilling campaign:

– All holes returned anomalous Ni, Cu, Co (and PGE) values, and included some of the highest grades intersected on the project to-date:

- BBRC001 (Winx) 14 meters @ 1.17% Ni, 0.88% Cu and 0.05% Co from 65 meters (including 1 meter @ 2.70% Ni, 0.23% Cu and 0.12% Co);

- BBDD001 (Sunline) 0.57 meters @ 3.07 % Ni, 0.62% Cu and 0.24% Co from 144.1 meters;

- BBDD002 (Tulloch) 14.25 meters @ 0.69% Ni, 0.82% Cu and 0.05% Co from 243.2 meters (including 4.9 meters @ 1.33% Ni, 1.26% Cu and 0.10% Co).

– All mineralized holes are open along strike and at depth.

– Downhole electromagnetic (DHEM) testing identified anomalies in holes BBRC001 and 002, strongly suggesting the mineralization is more extensive than the intervals tagged during the 2018 campaign.

Proposed drill targets for this upcoming campaign:

Interesting note: 80% of the company’s float is either insider or house controlled.

Interesting note: 80% of the company’s float is either insider or house controlled.

For more detail, the following Equity Guru offering will bring you up to speed:

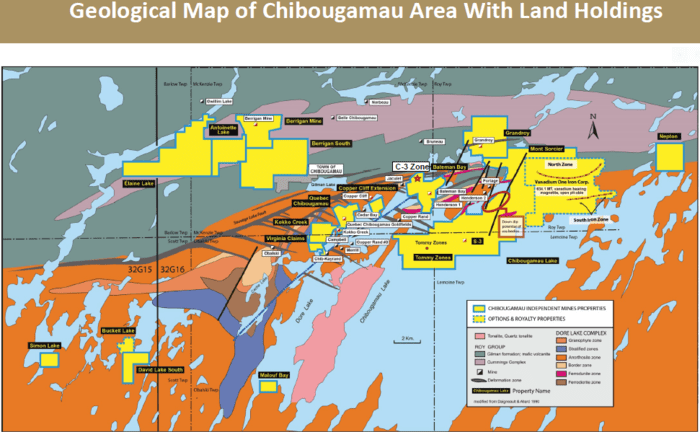

Chibougamau Independent Mines (CBG.V)

Corporate Presentation (middle right of page)

- 46.7 million shares outstanding

- $5.6M market cap based on its recent $0.12 close

The market may have forgotten about this one, but we haven’t.

CBG is focused on the Chibougamau region of Quebec along the north-eastern Abitibi, an area that has served up over 6.7 million ounces of historic gold production.

The company controls multiple projects in the region with the potential to convert historic resources into NI 43-1012 compliant numbers—roughly 3.3 million tonnes at an average grade of 1.78% Cu and 2.92 g/t Au.

The company controls multiple projects in the region with the potential to convert historic resources into NI 43-1012 compliant numbers—roughly 3.3 million tonnes at an average grade of 1.78% Cu and 2.92 g/t Au.

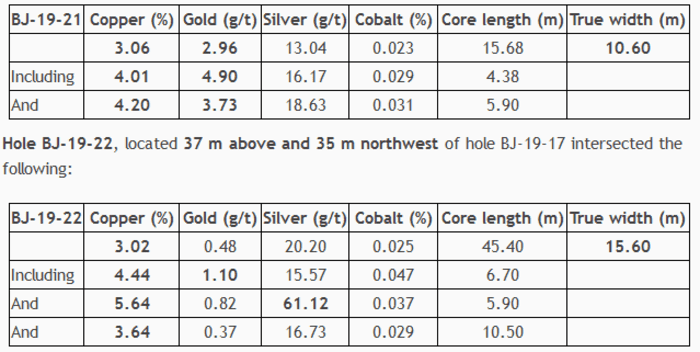

CBG generated excitement at its 100% owned Bateman Bay (C-3 copper/gold zone) last summer, tagging several respectable hits.

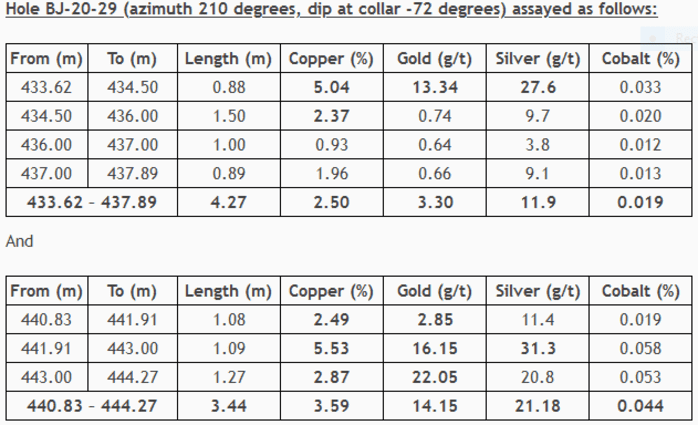

An August 7, 2019 headline—Assay Results and Update on the Current Drill Program of the C-3 Copper/Gold Zone on the Bateman Bay Property—delivered the following values:

More recently, along the same zone, the company dropped the following headline:

More recently, along the same zone, the company dropped the following headline:

Hole BJ-19-27 intersected two mineralized zones returning the following assays: 2.49% Cu, 4.24 g/t Au, 11.1 g/t Ag and 0.014% Co over a core length of 9.25 meters and the second zone returning 4.14% Cu, 0.55 g/t Au, 16.2 g/t Ag and 0.017% Co over a core length of 5.55 meters.

Then, on March 20, the company delivered some high-grade Au:

Chibougamau Intersects Highest Grade Gold To Date in C-3 Zone

Regarding follow-up drilling at Bateman Bay, the company stated, “We are currently planning our next drill program which, if undertaken, will most likely be from a barge on Lac aux Dorés.”

Regarding follow-up drilling at Bateman Bay, the company stated, “We are currently planning our next drill program which, if undertaken, will most likely be from a barge on Lac aux Dorés.”

Things have been pretty quiet over at CBG-Central since.

- 195.38 million shares outstanding

- $13.68M market cap based on its recent $0.07 close

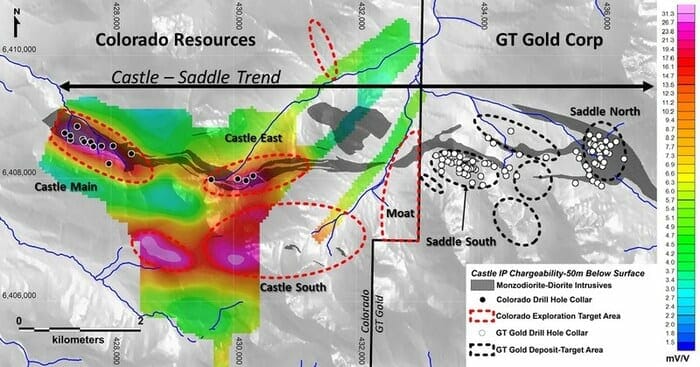

Colorado has a large portfolio of projects in the Triangle—the Golden Triangle of British Columbia.

The company’s 30,504-hectare KSP Project lies roughly 15 kilometers southeast of the past-producing Snip Mine (approx. one million ounces @ 24.5 g/t Au).

Like the Snip Mine and Pretium’s Brucejack Mine, the target here is high-grade gold.

There’s also the potential for bulk-tonnage copper-gold mineralization similar to Seabridge Gold’s (SEA.T) KSM Project.

The company’s 21.18K hectare North ROK Property lies 15 kilometers northwest of Imperial Metals’ (III.T) Red Chris Mine.

Inferred resources at North ROK currently stand at 142.3 million tonnes averaging 0.22% copper and 0.26 g/t gold for 690.3 million lbs of Cu and 1.189 million ounces of Au.

The company’s Castle Property currently bears flagship status.

Earlier this year, the company laid out plans for its 2020 field season.

Colorado Resources Announces 2020 Exploration Plans for the Golden Triangle and Toodoggone District

Just last week, the company dropped the following headline:

Colorado Resources Commences Exploration at Castle

The 2020 field program will be comprised of surface sampling, mapping, and an induced polarization (“IP”) survey at the highly prospective Castle Property where past exploration discovered two porphyry copper-gold systems. The two systems, Castle East and Castle Main, are located five and eight kilometres, respectively, along trend to the west of GT Gold Corp.’s Saddle North copper-gold deposit where GT Gold announced a maiden resource on July 7, 2020, which includes an Indicated Resource* of 1,809 million pounds (“Mlb”) copper (“Cu”), 3.47 million ounces (“Moz”) gold (“Au”) and 7.58 Moz silver (“Ag”), and an Inferred Resource of 2,982 Mlb Cu, 5.46 Moz Au and 11.64 Moz Ag.

The intent of the 2020 field program at Castle will be to define drill targets in anticipation of a 2021 drill campaign with the goal of discovering additional porphyry and high-grade gold deposits along the Castle-Saddle trend.

- 95.24 million shares outstanding

- $21.91M market cap based on its recent $0.23 close

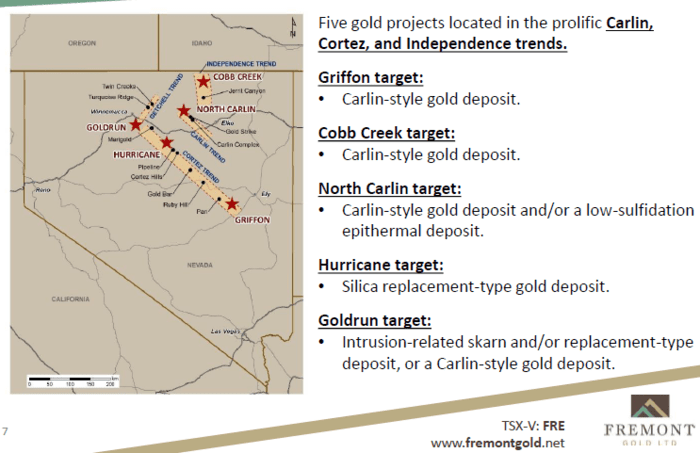

Contact’s extensive land holdings extend across the prolific Carlin, Independence, and Northern Nevada Rift gold trends. Their 212 square kilometers of target-rich terrain includes projects ranging from early-stage to the resource definition stage.

Pony Creek, the company’s 13,771-hectare flagship project, is strategically located immediately south of Gold Standard’s (GSV.T) Railroad-Pinion project.

The property hosts a Carlin-type system with a historic gold resource.

The past-producing Green Springs Project has produced a number of excellent headline assays over the past year or so, including:

- 5.05 g/t Au over 39.6 meters from 65.5 meters (hole GS15-06 – E Zone) including 9.01 g/t Au over 16.7 meters from 71.6 meters;

- 2.36 g/t oxide Au over 70.10 meters from 80.77 meters (hole GS19-07) including 4.26 g/t Au over 38.10 meters from 85.35 meters and including 8.05 g/t Au over 12.19 meters from 89.92 meters;

- 3.53 g/t oxide Au over 38.10 meters from 76.2 meters (hole GS19-09 – Echo) including 4.79 g/t Au over 25.91 meters from 79.25 meters and including 11.19 g/t Au over 6.1 meters from 89.92 meters.

On July 8th, the company tabled summer exploration plans for Green Springs:

Contact Gold Outlines 2020 Green Springs Drill Program

Key points:

– Planning for up to 9,000 meters of reverse circulation and diamond drilling.

– Fully permitted for all drilling plans.

Drill targets in order of priority include:

- Echo Zone where 2019 drilling returned 2.36 g/t Au over 70.1 meters;

- The never drilled Tango Target where gold-in-rock and gold-in-soil sampling have identified a brand new 500m x 200m target;

- Expanding the Alpha, Bravo and Charlie Zones, where drilling returned broad intervals of gold mineralization in 2019 (1.68 g/t Au over 35.05m and 1.02 g/t over 22.86m);

- Zulu, Whiskey, and Foxtrot targets which have never been drilled.

On July 9th, the company updated progress at Pony as it continues advancing and de-risking this flagship project:

Contact Gold Reports Excellent Gold Recoveries from Bottle Roll Tests at Pony Creek

Corporate Presentation (middle left of page)

- 45.69 million shares outstanding

- $8.45M market cap based on its recent $0.185 close

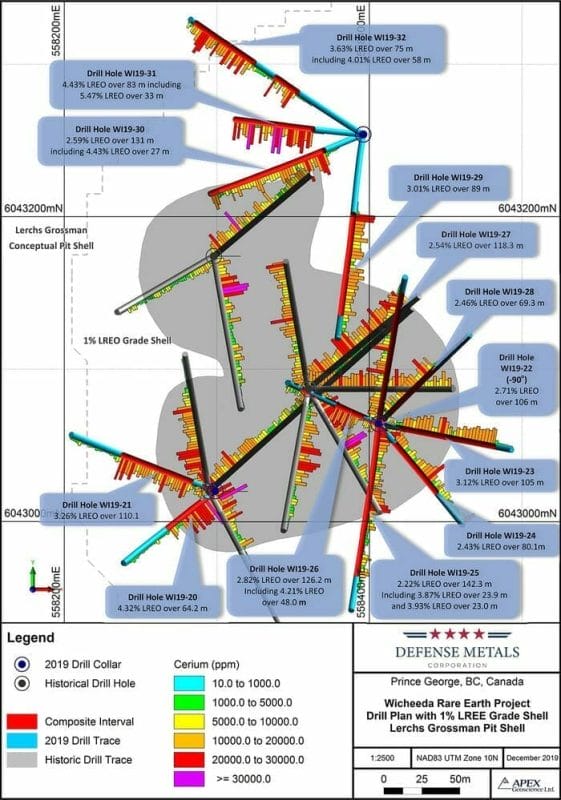

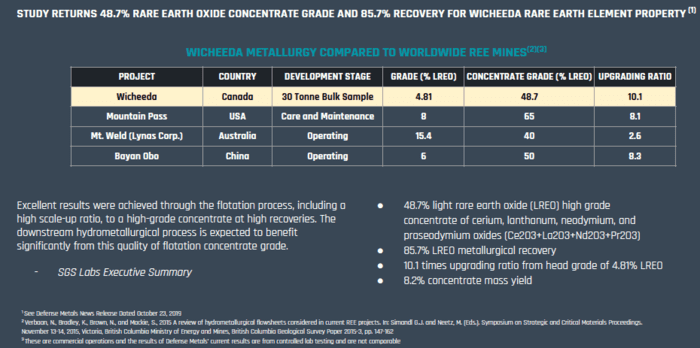

Defense Metals is doing solid work, advancing (and de-risking) its 1,708-hectare Wicheeda Rare Earth Element (REE) Project in mining-friendly British Columbia.

The company boasts the following REE resource at Wicheeda:

- An Indicated Mineral Resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements);

- An Inferred Mineral Resource of 12,100,000 tonnes averaging 2.52% LREE;

- All reported at a cut-off grade of 1.5% LREE (sum of cerium (Ce), lanthanum (La), neodymium (Nd), praseodymium (Pr), and samarium (Sm); in addition to niobium (Nb) percentages).

Funds from a recent raise are currently being used to construct an REE flotation pilot plant, a phase-2 proposal recommended by SGS Canada Inc.

Funds from a recent raise are currently being used to construct an REE flotation pilot plant, a phase-2 proposal recommended by SGS Canada Inc.

Completion of the pilot plant is expected by the end of this month. Initial results are expected in August.

The objectives of this phase-2 testing:

- Confirm metallurgy in a pilot plant environment;

- Generate data to support engineering;

- Produce a large amount of concentrate for downstream hydrometallurgy testing.

This is a big leap forward.

Superior metallurgy…

… and a strategic resource—China controls the REE refining market, and tensions between East and West are escalating—make this REE play the most strategic of all the deposits we follow. But the market is a little slow on the uptake.

… and a strategic resource—China controls the REE refining market, and tensions between East and West are escalating—make this REE play the most strategic of all the deposits we follow. But the market is a little slow on the uptake.

The West is currently scrambling to secure REE supply in its own back yard.

U.S. Falters in Bid to Replace Chinese Rare Earths

Our most recent Defense coverage was < two weeks ago—Defense (DEFN.V) commences baseline studies at Wicheeda REE deposit in mining-friendly B.C.

- 104.96 million shares outstanding

- $14.17M market cap based on its recent $0.135 close

With two highly prospective projects located in a country boasting truly spectacular Tier-1 deposits—Grasberg’s 67 million-plus ounces in gold reserves being the standout—East Asia’s Indonesian ounces-in-the-ground are beginning to attract a much broader audience.

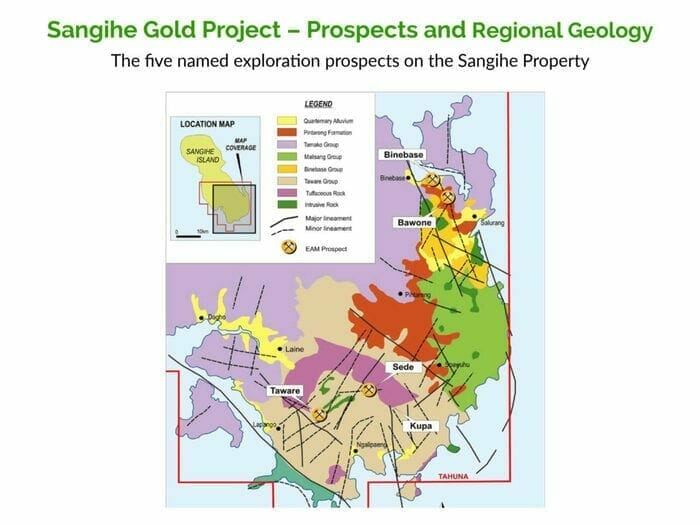

The 42,000-hectare Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—currently bears flagship status.

The company has its sights set on a modest heap leach production scenario at Sangihe and last week the company updated us with progress on that front:

The company announced that the final environmental assessment study (AMDAL) has been submitted to the relevant environmental gov’t office—approval is expected within the next two weeks.

This news sent the stock on a high-volume tear—a trajectory that tagged multi-year highs.

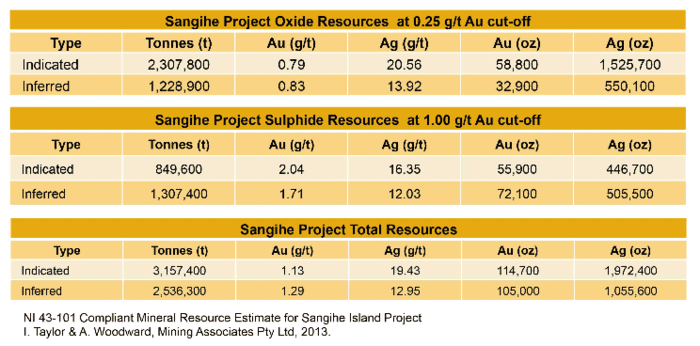

Sangihe’s near-surface, easily exploitable resources are as follows:

Stage one will see 1,000 ounces of gold per month when the production plant is fully operational (roughly 12 months from gov’t approval and project funding).

Stage one will see 1,000 ounces of gold per month when the production plant is fully operational (roughly 12 months from gov’t approval and project funding).

Estimated all-in costs = roughly $700 per ounce.

This will throw off free cashflow of roughly $1,100 per ounce, or $1,100,000 per month once in Stage one (based on current spot Au prices).

The goal is to self-fund exploration and add to the project’s ounce count.

There are 25,000 hectares of prospective terrain where company geologist, Frank Rocca (former Barrick,) estimates the potential for at least 2,000,000 ounces of Au.

On that note, the company anticipates three phases of exploration:

- A phase one drilling campaign to upgrade the 835,000 Inferred ounces along the Binebase-Bawone Corridor;

- A phase two drilling program to test the mineralization potential from Bawone to the south of Salurang;

- A phase three exploration and drilling campaign designed to test the remaining 20,000-plus hectares of geologically prospective terrain surrounding Taware, Sede, and Kupe.

It’s conceivable that the gov’t could step in for a piece of the action, at the local level, as the company finalizes its license upgrade to Operation Production status.

The Miwah Gold Project is a high-level, high sulphidation epithermal gold prospect where gold and copper mineralization is contained in andesitic/dacitic lavas and tuffs, with gold hosted mainly in andesite.

The project currently boasts a resource of 3,140,000 ounces of gold (in 2011, East Asia stormed to a market cap of some $600M based solely on the strength ofMiwah).

Though Miwah is idle at the moment, it could see a monetizing event once Sangihe is pushed far enough along the development curve.

- 60.44 million shares outstanding

- $7.25M market cap based on its recent $0.12 close

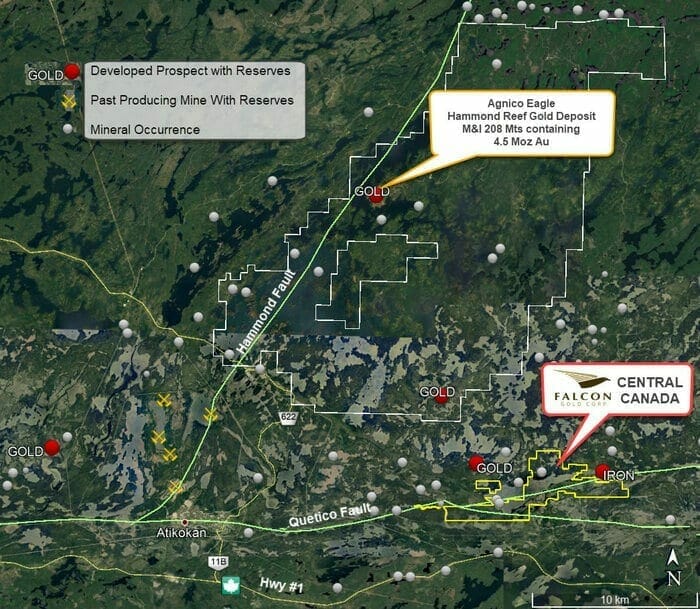

The company’s flagship property is its Central Canada Gold Project (CCGP).

Updating developments at CCGP, the company dropped the following headline on June 2nd:

Updating developments at CCGP, the company dropped the following headline on June 2nd:

History at the Central Canada Gold Mine:

- 1901 to 1907 – Shaft constructed to a depth of 12 meters and 27 oz of gold from 18 tons using a stamp mill;

- 1930 to 1935 – Central Canada Mines Ltd. deepened the shaft to 40 meters with about 42 meters of crosscuts and installed a 75 ton per day gold mill;

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft;

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840 m in which a 3.8 ft intersection showed 30.0 g/t Au;

- 2010 to 2012 – TerraX Minerals Inc. – conducted programs that included line cutting, geological surveys, and drilled 363 meters.

Just last week, the company announced the conclusion of its summer CCGP drilling campaign.

Falcon Completes Summer 2020 Drill Program on the Historic Central Canada Gold Mine Project

Highlights from the final two holes:

- CC20-06 intersected the mine trend @ 30.36 meters to 40.89 meters and intersected the potentially gold-bearing second zone @ 113.0 meters to 139.68 meters.

- CC20-07 intersected the mine trend at 80.10 meters to 103.88 meters and discovered a new mineralized shear zone from 142 meters to 177.46 meters with sulphide bearing veins intersected throughout the interval and continued through until 200.86 meters of depth.

On July 14th, Equity Guru’s Lukas Kane delivered an update on other developments in Falcon’s project portfolio:

Falcon Gold (FG.V) boosts land package at Camping Lake, Ontario

- 81.45 million shares outstanding

- $12.22M market cap based on its recent $0.15 close

As per the company’s website…

“Fremont’s advanced-stage gold projects include Griffon, a past-producing gold mine located at the southern end of the Cortez Trend, Cobb Creek, which hosts a historical resource, and Hurricane, where past operators intersected near-surface gold mineralization in a number of drill holes. Fremont’s early-stage gold projects include Goldrun and North Carlin. Fremont is particularly excited by North Carlin, located at the northern end of the Carlin Trend, where several drill targets have been outlined.”

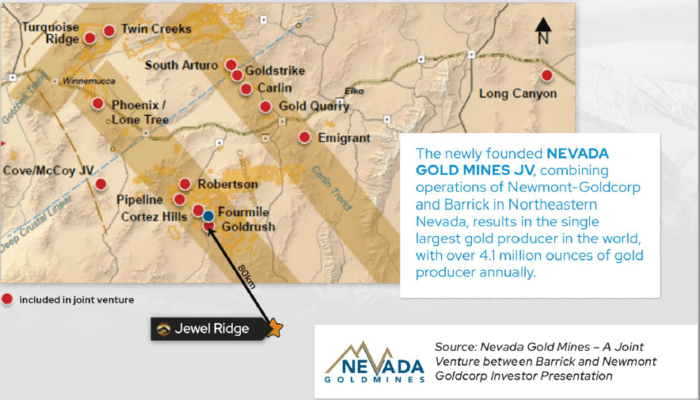

Fremont owns real estate in a very upper-class neighborhood. This is Nevada Gold Mines (NGM) neighborhood.

Fremont owns real estate in a very upper-class neighborhood. This is Nevada Gold Mines (NGM) neighborhood.

NGM is a joint venture between Barrick (61.5%) and Newmont (38.5%), whose combined assets in the region represent the single largest gold-producing complex on the planet. These assets—Pipeline, Cortez Hills, and Goldrush—also make up NGM’s lowest-cost assets with over 26.8 million ounces of gold reserves & resources.

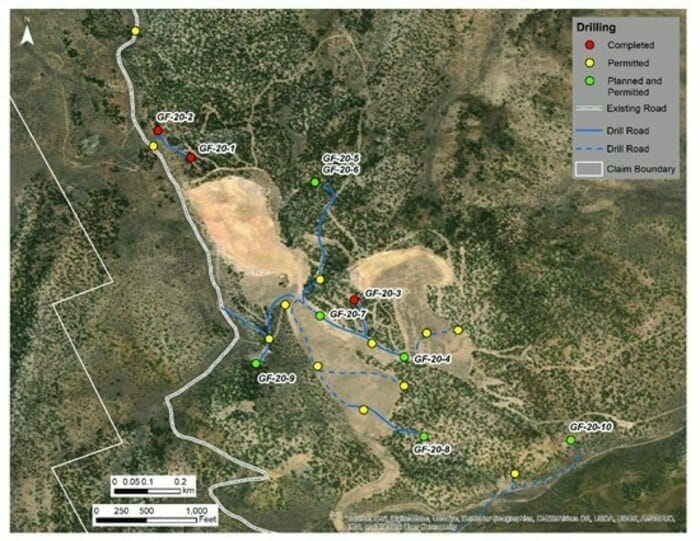

Recent news out of the company’s Griffon Project was good for a tidy 50% boost in the company’s stock in recent sessions.

“Fremont has submitted samples from the first three drill holes for rush analysis and expects to report the results in approximately two weeks. Drillers are now back from their break and drilling resumed today. The remaining seven holes at Griffon should be completed by the end of July.”

A description of the first three drill holes:

- Drill hole GF-20-1: A vertical drill hole drilled to a depth of 165 meters. Located 50 meters north of the Discovery Pit, between the pit and a historic drill hole that encountered gold mineralization.

- Drill hole GF-20-2: A 45-degree angle drill hole drilled to the northeast and to a depth of 170 meters. Located beneath gold in soil and rock chip anomalies and where gold mineralization was encountered in historic drilling.

- Drill hole GF-20-3: A vertical drill hole drilled to a depth of 280 meters. Located in the area of unmined mineralization southwest of the Hammer Ridge Pit. The site is set midway between two historic drill holes that returned broad gold intercepts in the Joana Limestone.

Assays for these first three could drop any day.

Assays for these first three could drop any day.

- 114.09 million shares outstanding

- $11.41M market cap based on its recent $0.10 close

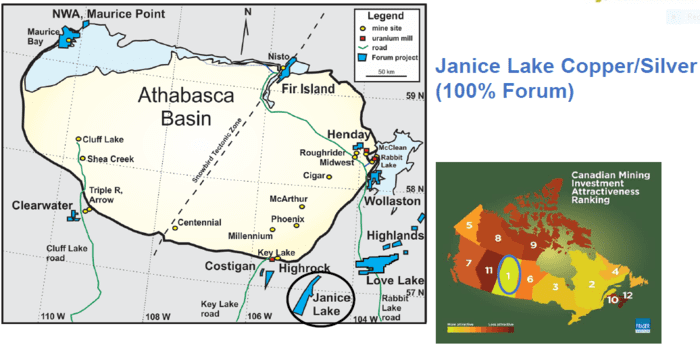

Janice Lake is Forum’s flagship project.

Janice Lake is Forum’s flagship project.

The project’s 38,250 hectares are located in north-central Saskatchewan within the Wollaston Domain, “a northeasterly-trending belt of metamorphosed lower Proterozoic supracrustal rocks deposited upon Archean granitoid basement.”

Forum controls the entire Wollaston Copper belt—all 52 kilometers.

The property boasts over 20 sediment-hosted copper showings.

These sedimentary settings hold the potential for multiple layers of copper mineralization.

Though largely unexplored, a 1993 drilling campaign by Noranda tagged an interval of 0.77% Cu over 33.0 meters (including 1.6% Cu over 6 meters) within 35 meters of surface.

A modest drilling program by Phelps Dodge cut 0.72% Cu over 26.0 meters (including 1.33% Cu over 5.83 meters) in a separate zone.

More recently, a surface sampling campaign by Transition Metals (XTM.V) yielded grab sample values ranging from 0.34 to 9.35% copper, and 0.7 to 61.7 g/t silver.

A first pass, four-hole drilling campaign conducted by Forum in the summer of 2018 tagged copper mineralization in all four holes, all within 80 meters of surface.

The highlight interval of this 2018 program: 18.5 meters grading 0.94% Cu and 6.7 g/t Ag (including 5.2 meters grading 2.22% Cu and 16.5 g/t Ag).

That’s a solid hit.

This success with the drill bit succeeded in attracting mining giant Rio Tinto in a JV worth $30M, where Rio stands to earn an 80% interest in the project.

The work commitments spelled out in this JV agreement are substantial—it puts Forum in an enviable position.

Rio’s involvement at Janice Lake adds tremendous validity to the geological merit (and scale) of the project.

It’s important to understand that Rio does NOT mess around with small stuff. They’re only interested in projects that hold world-class potential.

Rio didn’t waste any time putting boots to the ground at Janice Lake. Within three months of signing the deal, Rio performed an airborne magnetic survey over the property, then mobilized a drill rig.

Their first pass with the drill bit tagged the following values.

- 0.41% Cu and 4.2 g/t Ag over 57.1 meters (from 78.9 meters to 136 meters), including 0.95% Cu and 9.7 g/t Ag over 13 meters (from 89 meters to 102 meters);

- 0.57% Cu and 1.50 g/t Ag over 51.8 meters (from 116.2 meters to 168 meters), including 1.09% Cu and 1.39 g/t Ag over 9.1 meters (from 118.9 meters to 128 meters) and 1.32% Cu and 3.42 g/t Ag over 5.0 meters (139.0 meters to 144.0 meters).

Rio liked the drill core.

The mining behemoth spent $3.7 million at Janice Lake in 2019 and is accelerating work on the property projecting to spend $7 million during a multiple-phase drilling campaign.

Drilling over the next year will be carried out in two phases (summer 2020 and winter 2021). The first phase will take on a regional approach (Rio will drill multiple targets spread out across the 52-kilometer long sedimentary basin).

This regional approach opens up the possibility of multiple new discoveries.

Rio’s proposed 2020/2021 program details:

- A 110-kilometer winter haul road was completed to the site of the Burbidge Lake Drill Camp on the Janice Lake property in March. Permits are in hand for the construction of a 50 person drill camp this summer.

- The 2020 exploration program will commence as soon as practical and will be based out of the same camp as in the 2019 program.

- A 2,000-meter diamond drill program this summer will test regional drill targets prioritized by the permitted Mapping and Orientation programs. The permit application for the 2020/2021 RAB and diamond drilling program has been submitted to the Saskatchewan Ministry of Environment.

- A Rotary Air Blast (RAB) drill rig will be used as a prospecting tool to drill short holes into the bedrock on copper showings, structural, geophysical, geochemical, and boulder train targets developed by the mapping and prospecting program.

- A mapping and prospecting team will systematically map the 52km extent of the property (see map below) initially on 2km wide traverse lines this summer with more detailed follow-up in prospective areas.

- Orientation surveys over the Jansem and Janice targets will be completed this summer including downhole logging of the 2019 holes, an Induced Polarization survey, vegetation, and soil surveys and a regional AMT survey to understand basin architecture.

- Engagement with local communities is well advanced and ongoing.

On June 23rd, the JV fine-tuned its plans and updated progress at Janice Lake:

On June 23rd, the JV fine-tuned its plans and updated progress at Janice Lake:

Rio Tinto Commences Exploration at Janice Lake Sedimentary Copper/Silver Project, Saskatchewan

The company has two additional projects in its portfolio worthy of flagship status:

- The 14,205 hectare Fir Island uranium project, located along the northeast edge of the prolific Athabasca Basin, where Orano Canada can earn a 70% interest by spending a total of $6,000,000 on or before December 31, 2023.

- The 27,896 hectare Love Lake Ni-Cu-PGM project located 60 kilometers northeast of the company’s Janice Lake project.

On the subject of Love Lake, the company dropped the following headline on June 18:

- 43.21 million shares outstanding

- $13.18M market cap based on its recent $0.305 close

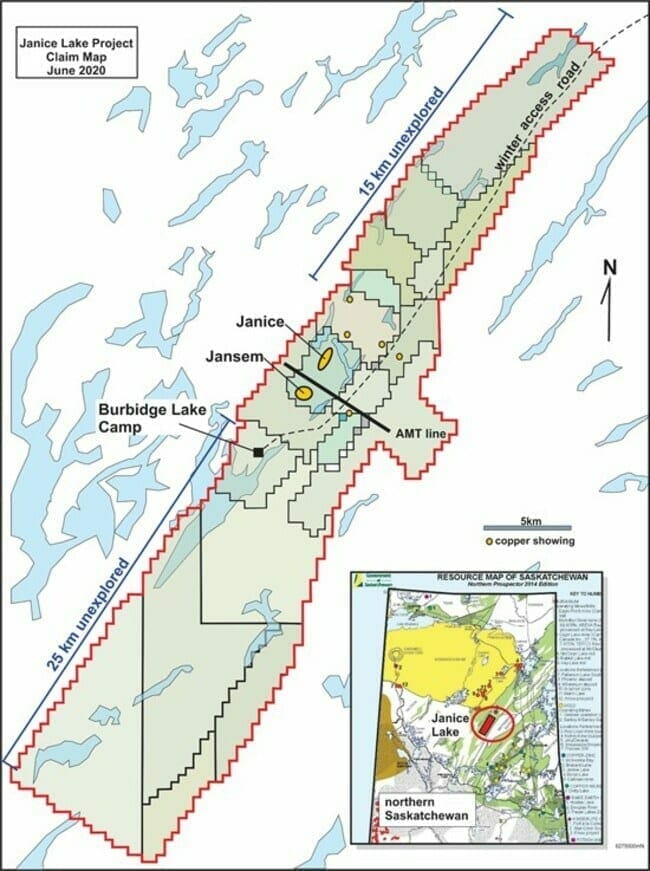

Genesis is exploring its 100% owned Chevrier Gold Property located in the Chibougamau region of Quebec.

The current resource at Chevrier stands at 395,000 ounces of gold averaging 1.45 g/t Au in the Indicated category, and 297,000 ounces of gold averaging 1.33 g/t Au in the Inferred category.

Earlier this year, the company launched an aggressive 8000-meter drilling program at Chevrier, focused on “improving definition and expanding the volume of higher-grade domains which form of plunging “shoots” within the Chevrier Main deposit.”

This is a resource that could see significant expansion. There are also a number of regional targets the company plans to test during this drilling campaign.

After shutting down due to C-19 restrictions in late March, the company announced that its Phase I ~2,500 meter drilling program had recommenced and that the Genesis team was busy completing logging and sampling of the remaining core previously drilled.

On June 2nd, we got our first look at phase-one assays.

Genesis Metals Reports Initial Phase I Drilling Results from Chevrier Gold Project, Quebec

Drill Results Highlights:

- 8.92 g/t gold over 1.0 metre in hole GM-20-59 starting at 223 metres downhole, within a wider zone assaying 1.79 g/t gold over 7.35 metres;

- 3.99 g/t gold over 3.0 metres in GM20-61starting at 98.85 metres downhole;

- 10.20 g/t gold over 1.15 metres in GM-20-62 starting at 88.75 metres downhole, within a wider interval assaying 1.36 g/t gold over 19.7 metres starting at 74.6 metres downhole.

On June 24th, the company put boots to the ground for a detailed surface campaign.

Genesis Metals Commences Surface Program at Chevrier Gold Project, Quebec

“The initial phase of the surface program involves follow-up till sampling grids and detailed soil grids to refine the six priority targets identified from the 2019 glacial till survey. In addition, the work will include surface prospecting, sampling, and geological mapping, as well as application of geophysical tools such as detailed drone/helicopter magnetic surveys. The aim of this work is to delineate discrete gold targets for trenching and drill testing later in the year.”

Then, on July 7th, the company dropped the following headline:

Then, on July 7th, the company dropped the following headline:

Highlights from this batch of assays include:

- 9.71 g/t gold over 3.65 metres in hole GM-20-63 starting at 89.5 metres downhole, within a wider zone assaying 1.93 g/t gold over 76.00 metres;

- 9.73 g/t gold over 4.5 metres in GM20-64 starting at 113.5 metres downhole, within a wider zone assaying 1.65 g/t gold over 84.00 metres;

- 9.64 g/t gold over 2.3 metres in GM20-64 starting at 162.5 metres downhole;

- 14.40 g/t gold over 2.20 metres in GM20-64 starting at 182.50 metres downhole;

- 5.57 g/t gold over 3.20 metres in GM20-65 starting at 143.00 metres downhole;

- 5.14 g/t gold over 3.95 metres in GM20-65 starting at 213.30 metres downhole;

- 7.88 g/t gold over 3.10 metres in GM20-65 starting at 227.5 metres downhole.

The Genesis technical team has recognized a previously under-appreciated and poorly defined higher-grade component to the Chevrier Main gold deposit. A new 3D model has been constructed to better understand the distribution and controls on higher-grade gold mineralization which was utilized to plan and execute the Phase I drilling program.

Plans for a second phase of drilling will be announced in the near future. A surface exploration program is underway and the objective is to further assess target areas identified through a 2019 property wide glacial till survey and a comprehensive review of all available data on the +290 square kilometer project. The Company remains fully funded for the planned work in 2020.

Golden Lake Exploration (GLM.C)

- 27.8 million shares outstanding

- $5.28M market cap based on its recent $0.19 close

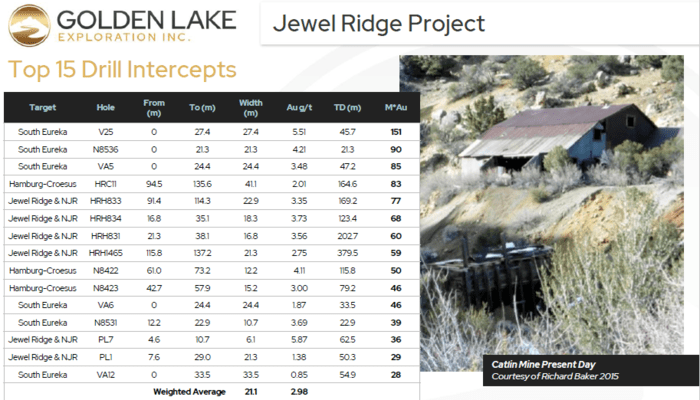

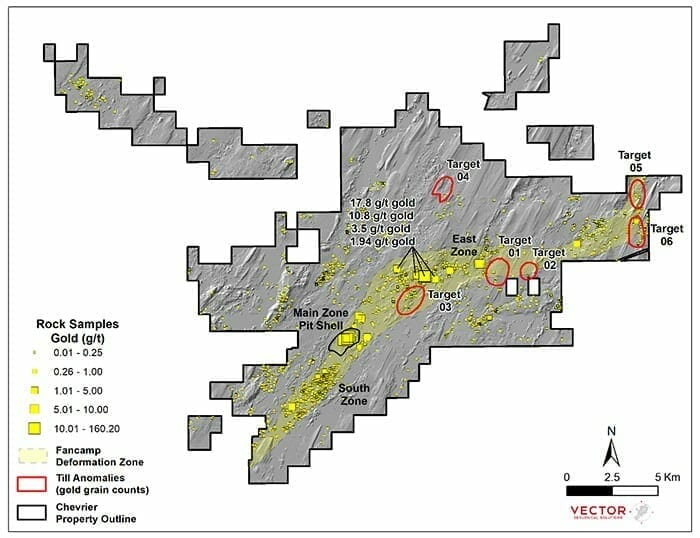

Golden Lake’s flagship Jewel Ridge Project is located at the south end of Nevada’s prolific Battle Mountain–Eureka trend, strategically along strike and contiguous to the Barrick Gold’s (former) two million ounce Archimedes/Ruby Hill mine to the north, and Timberline Resources’ advanced-stage Lookout Mountain project to the south.

The project is located within close proximity to Nevada Gold Mines’ (NGM) Pipeline, Cortez Hills, and Goldrush deposits. As noted further up the page

The project is located within close proximity to Nevada Gold Mines’ (NGM) Pipeline, Cortez Hills, and Goldrush deposits. As noted further up the page

Nevada Gold Mines (NGM) is a partnership between mining behemoths Barrick Gold (61.5%) and Newmont-Goldcorp (38.5%).

Pipeline, Cortez Hills and Goldrush represent three of the largest Carlin-type gold deposits in the world. They make up NGM’s lowest-cost assets with over 50 million ounces of gold reserves & resources.

Nevada Carlin-type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated along four main trends: Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

“The deposit types of interest at Jewel Ridge are Carlin-type, sedimentary rock-hosted, gold deposits and carbonate replacement deposits. Carlin-type deposits include many deposits that occur in the Battle Mountain-Eureka Trend, Carlin Trend and other well-known mineral trends in north central Nevada. Jewel Ridge is located adjacent to, and south of, the former Ruby Hill gold property, which was operated by Homestake Mining Company from 1997 until 2002 and produced about 680,000 ounces of gold from the Archimedes open pit. In February 2007, Barrick Gold Corp. commenced production on a 1.1-million-ounce gold resource from the adjoining East Archimedes deposit. From 1976–2012, production from these Carlin-type deposits in the Eureka district was approximately 44.9 tonnes (1.38 million ounces) of gold (NBMG, 2014).”

The following slide highlights some of the higher-grade historic intercepts encountered to date:

We covered Golden Lake with a fair bit of detail back in early June—Golden Lake Exploration (GLM.C) targets Jewel Ridge in Nevada’s prolific Battle Mountain–Eureka trend

Since that coverage, the company has been busy on the geochemical front, prioritizing drill targets for an upcoming drilling campaign, one that could begin any day.

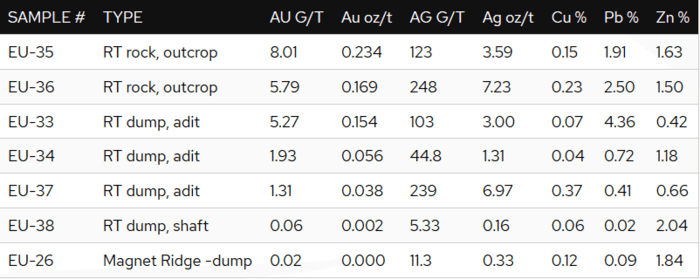

The Radio Tower Target returned the following values:

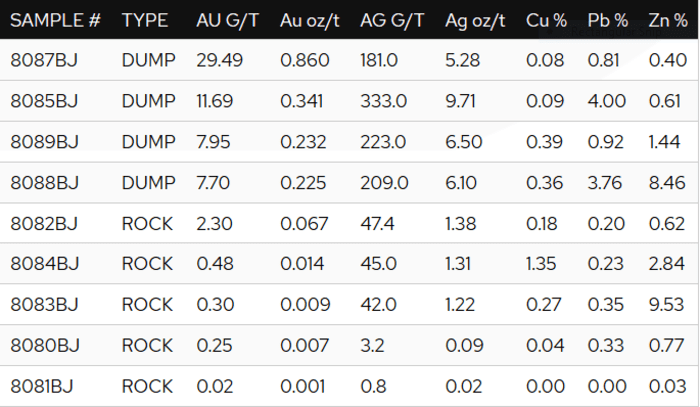

The A&E Target—a compilation of a historic third-party rock chip database, and recent geological reconnaissance by the company—generated the following values:

The A&E Target—a compilation of a historic third-party rock chip database, and recent geological reconnaissance by the company—generated the following values:

Then, just last week, the company dropped the following headline:

Then, just last week, the company dropped the following headline:

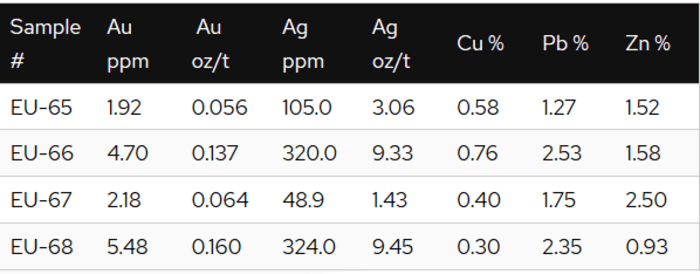

The A&E Target again—four rock grabs returned the following values:

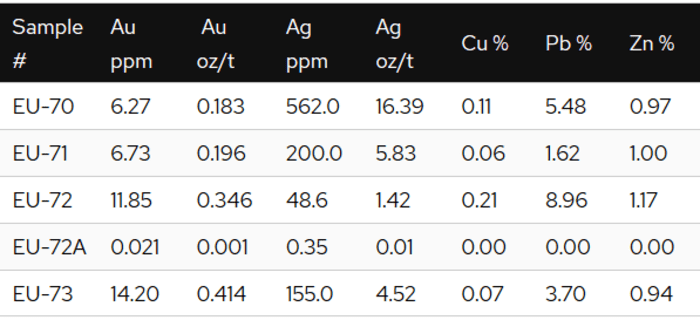

Along the Croesus and Connelly Mine targets, five rock grabs collected over an area of 200 by 200 meters returned the following values:

Along the Croesus and Connelly Mine targets, five rock grabs collected over an area of 200 by 200 meters returned the following values:

On deck… a phase one, 1,500-meter drilling campaign aimed at tagging Carlin-type, oxide gold mineralization.

On deck… a phase one, 1,500-meter drilling campaign aimed at tagging Carlin-type, oxide gold mineralization.

That’s it for Part I of our sub-$20M ExploreCo shortlist.

Part II is on deck.

—Greg Nolan

Full disclosure: Of the companies featured above, Bluebird, Defense, Falcon, and Golden Lake are Equity Guru marketing clients. Forum Energy Metals is a Highballer marketing client.