Rarely a month goes by without Westleaf (WL.V) turning heads with another major news release. On Wednesday, Western Canada’s cannabis blue-chip updated us on The Plant, a new state-of-the-art production facility that has entered the final stages of the government approval process.

Just a little more paperwork is needed until Westleaf has the throughout capacity of 65,000 kilograms of dried flower and trim per year. And that’s just “phase I.”

In an official press release, Westleaf announced that it’s in the final stages of finalizing a new large-scale marijuana production and extraction facility. The new facility has an annual throughout capacity of 65,000 kilograms (and we’re not talking potatoes).

Westleaf says it is expected to secure final Health Canada approvals for The Plant sometime this quarter, with full-scale production to commence shortly thereafter. Once licensed, The Plant will give Westleaf the production pipeline to create its own branded cannabis products and provide white-label opportunities to other companies.

Scott Hurd, Westleaf’s president and CEO, says the new facility marks a “significant milestone” for his company as it shifts focus from construction to operations and execution. The end goal: Become a leading vertically-integrated cannabis company that can scale up to meet growing demand for marijuana and its derivatives.

“Once licensed, this facility will produce the current suite of legal cannabis derivative products, and as we move towards additional cannabis product legalization in the fourth quarter, we will expand our product lines to include vapes, edibles and other derivative cannabis products,” he said.

Once finalized, The Plant will offer at least four operational advantages:

- Position Westleaf for future growth: Marijuana is big business, and pent-up demand means producers will struggle to keep up with the consumer palette. Westleaf is already ahead of the curve.

- Scalability: The 15,000 square-foot facility comes with an additional 45,000 square feet available for future expansion. Westleaf can scale to meet consumer demand.

- Multiple revenue streams: The Plant will not only produce Westleaf’s brands, but will serve as a processing and extraction facility for third-party companies.

- U.S. industry expertise: The Plant was designed by Xabis, a leading U.S. marijuana consultancy (more on that below). The facility was designed to maximize R&D, extraction and product formulation.

Can you keep up with Westleaf?

2019 is shaping up to be an epic year for Westleaf. In addition to bringing prairie focus, first nations connections and novel ideas to the cannabis space, the company has onboarded a leading consulting service to help scale its commercial operations.

As we reported last month, Westleaf has retained the services of Xabis, a Colorado-based consultancy with more than 75 years of combined experience in the cannabis industry. Xabis’ scientists and logistics experts are helping Westleaf maximize its Calgary production facility and expand its catalogue of derivatives products.

The timing is perfect.

As Deloitte recently reported, Canada’s consumer market for edibles and other alternative cannabis products is likely valued at $2.7 billion annually.

Recognizing these trends, Westleaf has expanded into Manitoba, launched an online store in Saskatchewan and teamed up with Pineapple Express Delivery to overcome Canada Post’s piss-poor delivery service.

Westleaf’s discount

Can you handle short-term volatility for the potential of long-term growth? That’s the key question marijuana shareholders should ask themselves.

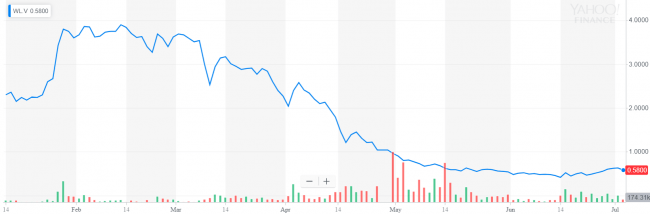

Since peaking at CAD$3.73 a share in February, Westleaf’s stock has declined sharply. Call it irrational exuberance or the ebb and flow of the marijuana industry, Westleaf’s share price has experienced turbulence in its first six months. That’s not entirely unexpected given the current state of the marijuana industry.

In fact, the boom-and-bust isn’t unlike what we saw for marijuana investments as a whole. Just take a look at the Canadian Marijuana Index over the past six months:

Despite trading for less than CAD$0.60 a share, Westleaf has a market cap of more than $93 million. The stock recently graduated from Tier 2 to Tier 1 issuer status on the TSX-Venture exchange, which is a testament to its financial performance, development and resources.

– Sam Bourgi

Full Disclosure: Westleaf is an Equity.Guru marketing client.