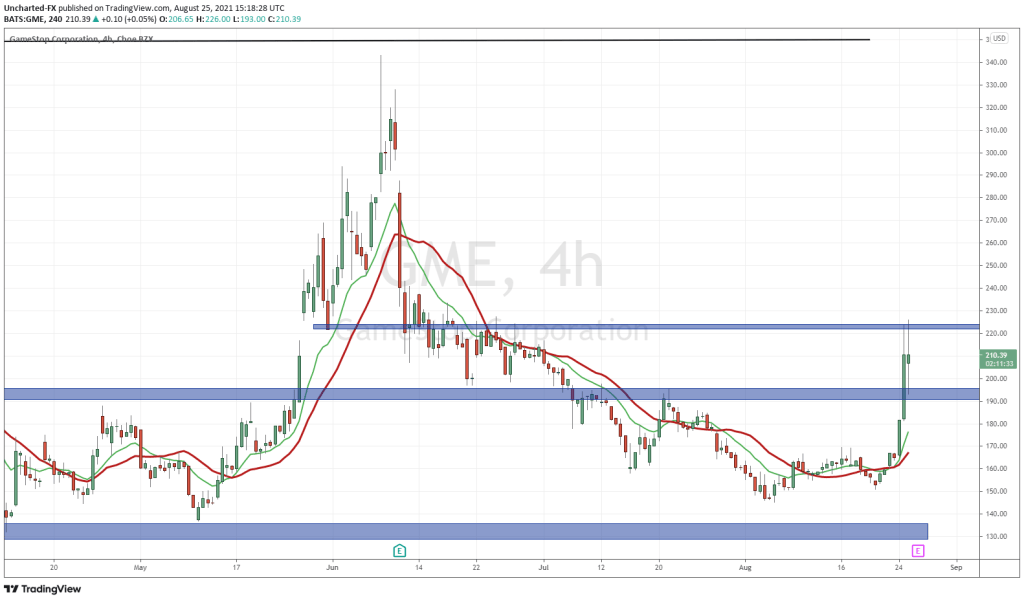

As I wrote in an earlier article about meme stocks, the arc of Gamestop is a precipitous disaster. The stock gained fame when Flaming Kitty sold a bunch of investing newbs who found the internet more interesting than the real world, that Gamestop, despite obvious fundamental weaknesses, was going to the moon. The whole venture gained momentum under the guise that retail investors were finally going to stick it to the Street and break the shackles of stock market servitude.

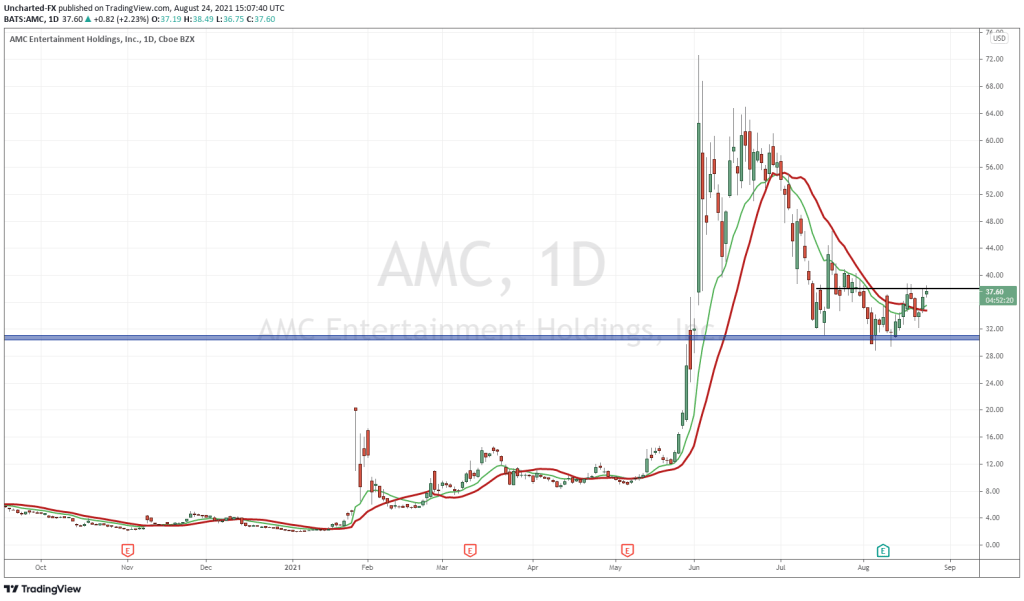

The plan paid off for Flaming Kitty who absconded with his winnings before the bubble burst, but his insane predictions left a sizeable contingent of bag holders still dreaming of a blue sky that would never come. Unfortunately, instead of his borderline fraudulent optimism triggering a one-time calamitous event, it fueled a trend and soon other keyboard warrior shysters focused the internet’s attention on another short target, AMC (AMC).

Again, the refrain of sticking it to the establishment and catching a ride to financial freedom, drove those with more greed than brains to flood into the stock. And again, the plan worked for the instigators, but sadly once more left a host of bag holders in their wake to pick up the pieces with a stupid grin. Astoundingly, the rubes keep the faith, even loading up as AMC leadership continues to scheme and flounder against an inevitable future.

A sad case in point: the pandemic quickened what was already a foreboding trend as moviegoers migrated from theatres to home theatres and the wonder of streaming entertainment. Comparatively speaking, between 2001-2007, Americans averaged 4.8 movies in a theatre per year with 32% of those polled not going to the theatre at all during that time. A further breakdown of these numbers shows that 39% saw between 1 and 4 movies in a theatre while 29% saw 5 or more. By 2021, a significant shift made itself apparent. Americans now saw an average 1.4 movies in theatre per year with 61% of those polled staying home, 31% seeing between 1 and 4 and only 9% watching five or more.

Yes, the pandemic made a difference, but only in the immediate severity of the culture change. Before the pandemic, in 2017, North American box office numbers had already hit a 25-year low. What was once an all-encompassing film entertainment endgame, theatres are now relegated to big budget outlets as moviegoers stay home for streaming dramas and comedies on their 40-inch flat screens.

Now before you call me Chicken Little, I am not saying that movie theatres are dead, but this growing vacancy cannot be ignored and theatre chains like AMC are not destined for expansive greatness, but a fundamental re-tooling to focus operations and cut costs.

Sure, we have 4D, comfy chairs, reserved seating and booze, but that’s like adding a long-lost cousin at the end of a comedy series; nothing new, just an extension of what was. The whole experience needs to change to accommodate modern mobile distracted theatregoers. How will this look? Holograms, creative interactivity? Noone knows. But what is sure, the road ahead will be strewn with bankruptcy and consolidation.

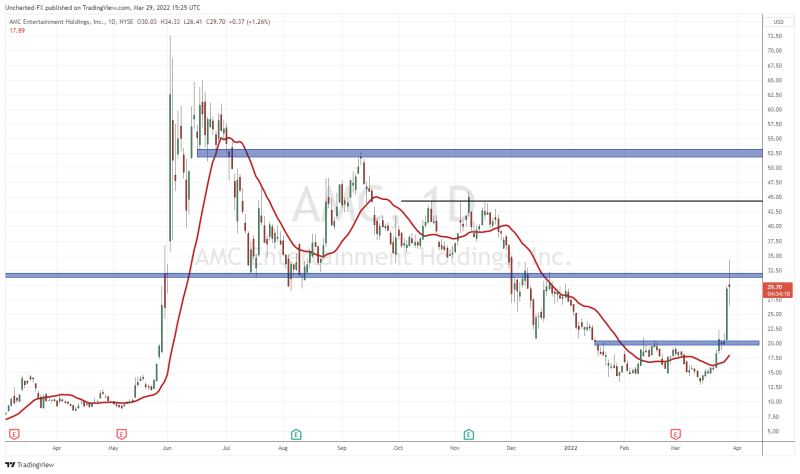

So, popular opinion among uneducated meme stock investors driven by a Don Quixote complex and the inventive forecasts of a CEO who is wholly out of touch with his industry are nothing against the cold hard reality of fundamentals. Just look at AMC’s stock trajectory. The company dove 95% from its meme-fueled artificial high. Now, as the the company flails below its 50-day moving average, it announces some “sucker” slipped it $26 million USD for 3.3 million subordinated notes, adding to the company’s debt sheet and coming due in 2026.

What is odd about this transaction, is the deal was done at a 23% premium to the company’s current share price. Now the company did experience a business boost in October with the release of Taylor Swift’s latest tour film, but it lost all that it had gained in the market during November and is currently at an all-time low.

The next two years AMC will see an improvement, sure, but nowhere near the value that would justify this private deal, so it makes me wonder what hoops it will have to jump through to make good on its debt which currently sits at $9.5 billion with $3.1 billion of that maturing in 2026.

Meme stocks are basically a feel-good scam which has become endemic in the market as rainmaker capitalists, like Elon Musk, leverage investor ignorance and psychological weakness to fleece the masses. The true democratization of the stock market will only occur when retail investors wake up to reality and stop letting the latest craze pull them around by the nose. Fundamentals never lie and can only be ignored at your peril. Good luck to all.