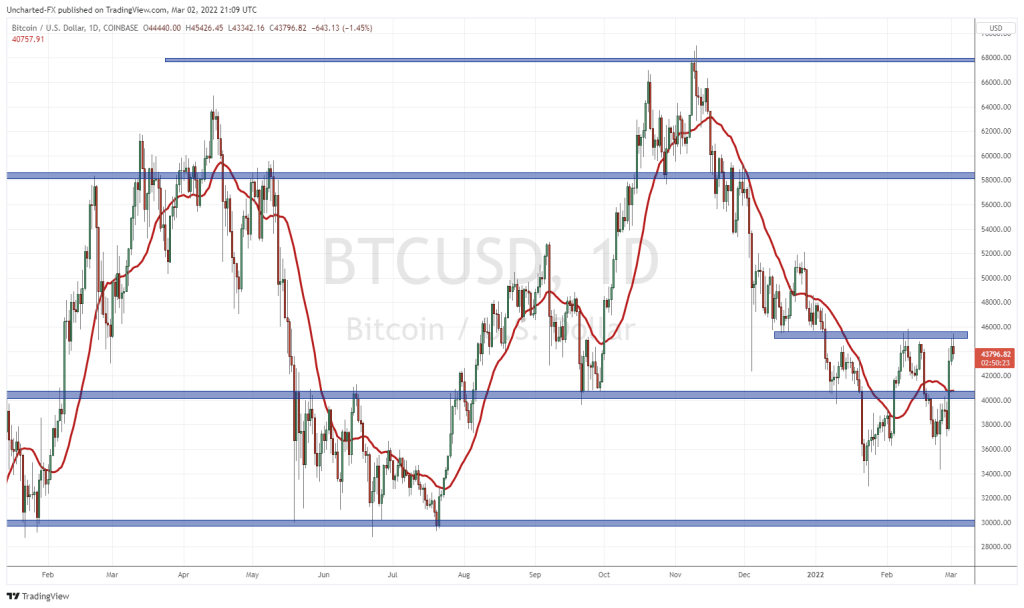

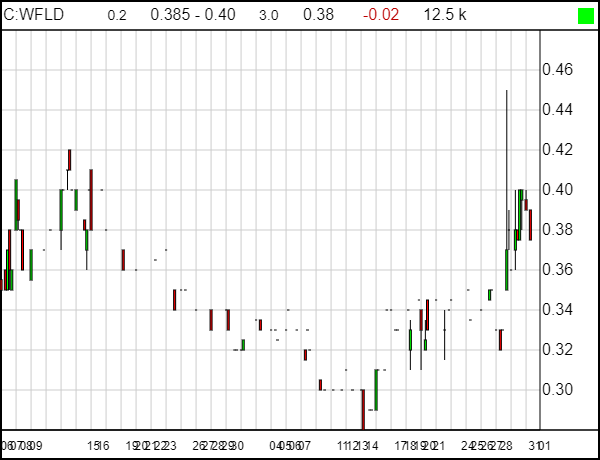

It’s been held underwater for some time on the back of negative cryptocurrency sentiment, but former Equity.Guru client Wellfield Technologies (WFLD.V) appears to be finally making a run against the tides, with CEO Levy Cohen pointing out a large spike in revenues this quarter (based off unaudited figures) as Wellfield’s new subsidiary Coinmama.com begins to fully integrate.

Wellfield bounced between a dollar and two dollars for some time after its market debut, but took a wild tumble when the crypto market at dirt, despite the fact their business model specifically aims to counter issues that were dragging bitcoin and ethereum down. Cohen points out that this revenue spike came despite the ‘crypto winter’ and points to good things ahead.

WFLD stock has run from $0.25 to $0.40 over the last two weeks.

The update in full:

Hello again investors,

It was a very busy summer for Wellfield, and I want to take this opportunity to provide some insights into the past quarter and a sneak preview into the future.

Q3 – PROGRESS AGAINST KEY GOALS

REVENUE GROWTH

As you have seen in the press release from last week, we are on path to grow our revenue and have achieved $19 million preliminary unaudited revenue in Q3 2022. This compares to revenue of $5.7 million in Q2 2022 (including Coinmama results for June only) and was generated against the backdrop of a “crypto winter” – which has been balmy from our perspective.The website version of our consumer facing brand Coinmama enjoys strong organic user traffic which is converting to new paying customers. Our activities to accelerate user growth and revenues in Q4 are showing good results and will continue into 2023.

Q4 – SEVERAL INITIATIVES TAKING PLACE

1. CANADIAN & U.S. OPERATIONS LAUNCHING:

We already have a significant presence in North America but to date have been using international payment processing and banking solutions. Moving these operations locally to both Canada and the U.S. will improve efficiency. Stay tuned for more updates from us in the coming weeks.2. COINMAMA MOBILE FINANCIAL APP LAUNCHING:

One of our first priorities after acquiring Coinmama was to create an ambitious product expansion strategy, starting with a mobile self-custody wallet. We have been hard at work integrating the existing MoneyClip team and mobile technology into the Coinmama brand and are excited to share that the app’s public release is expected to take place in Q4.3. WELLFIELD CAPITAL BRAND LAUNCHING:

Wellfield has a clear strategy to build profitable business lines on our decentralized technology. Coinmama is our brand and platform for consumers, and we expect to launch our institutional and sophisticated investor solutions under the Wellfield Capital brand in Q4.Together, these three activities will result in:

> Accelerating the growth of our existing base of 3.5 million registered users;

> Substantially increasing user retention and monetization on the consumer and institutional services;

> Further accelerating revenue growth and margins by introducing decentralized services to institutions and consumers.It’s exciting to see these results and know that our dedication is paying off and will continue to do so because our solutions are resonating with customers that want true blockchain-based financial services. Our differentiation is our strength.

COMMENT ON CURRENT LANDSCAPE

Market sentiment has been negative given increasing inflation, burdensome debt, and a repricing of the cost of capital. However, we are as optimistic and excited about the future of blockchain as we have ever been. The blockchain ecosystem continues to grow and we are watching it evolve into the perfect environment for Wellfield’s solutions and therefore success.

While blockchain innovation is moving forward at breakneck speed, the traditional market is struggling with inherited deficiencies from the past several decades. We watched this play out in real time as blockchain lending protocols effortlessly managed risk and liquidated Three Arrows Capital without any losses at the same time that a handful of centralized exchanges suffered billion-dollar losses from the same counterparty. We believe that blockchain ubiquity in finance is inevitable because it creates new pathways to resolve systematic issues that can never be addressed by the same tired tools that cause recurring crisis and blame shifting.

“Let us not seek to fix the blame for the past – let us accept our own responsibility for the future”. – JFK

To be bearish on blockchain is to ultimately be bearish on human ingenuity, freedom, software, and the power of the internet. Which is why despite current market conditions, we believe that more people and institutions will come to accept this technology’s place in the future of finance.

THE BLOCKCHAIN REVOLUTION IS A PROCESS

We have not seen the impact of true blockchain technology in finance. The last wave of financial technology (Fintech) innovation doesn’t compare.

Fintechs are to finance, what the initial version of Netflix was to home video renters when they offered to mail DVDs to home. Valuable and convenient. Not revolutionary. After all, the medium was the same – DVDs – as was the delivery infrastructure – the postal system. The true innovation was to come – streaming.

Blockchain represents a revolutionary change. At its core, blockchain is an infallible record of transactions tabulated in cryptocurrency (tokens) and maintained across computers that are linked in a peer-to-peer network. Implemented correctly, it is WHOLLY DIFFERENT INFRASTRUCTURE that has the power to drastically alter legacy ecosystems making all transactions faster, cheaper and safer for users.

Blockchain technology in the financial world is akin to the revolutionary change that Netflix brought to entertainment. Blockchain is finance’s “streaming moment”, which the technology that Wellfield has developed will help usher in.

I am proud of what we’ve achieved thus far and hope you see the opportunity in front of us. We expect the coming months to be very active for our company and an exciting period of value realization for Wellfield shareholders.

Please contact me with questions and comments. I like to hear from our investors and appreciate your enthusiasm and interest.

Thank you,

Levy Cohen

CEO/ Co-Founder

Wellfield Technologies Inc.