Wellfield Technologies (WFLD.V) closed their acquisition of New Bit Ventures, a cryptocurrency exchange doing business as Coinmama, late last week.

Based in Israel, Coinmama was founded in 2013 and has grown through sales of approximately $130 million in 2021 through the development of a global platform for buyers and sellers of digital currencies using everyday payment methods.

“With the addition of Coinmama, along with the launch of our Decentralized Finance products and services later this year, Wellfield is positioned for significant growth over the next 12 months. The Coinmama team has built a solid business based almost entirely on organic web traffic, without any active promotion or active expansion of products or services to its substantial user base. We see several readily achievable opportunities to enhance monetization of the Coinmama user base to grow sales beyond the current ~US$130 million annually, while introducing Wellfield’s transformative technologies to further drive growth as we launch later this year. On behalf of the Wellfield team, I would like to personally welcome the entire Coinmama group to the Company and express my excitement regarding what we can achieve together both immediately and over the next several years as we continue to build this business and create new fintech solutions powered by blockchain,” said Levy Cohen, CEO of Wellfield.

Wellfield is a fintech company that uses blockchain technology to build a bridge between the worlds of decentralized finance and traditional finance. The company comes with a board and advisors bearing a strong academic and business pedigree, especially regarding the DeFi sector, and it’s busy building branded applications and infrastructure solutions on public blockchains like Bitcoin and Ethereum. Adding a cryptocurrency exchange seems like a logical next step.

Presently, Coinmama has grown to more than 3.5 million registered users, each of whom has undergone the standard regulatory verification requirements for platforms of this nature. Coinmama’s team, including 50 full time personnel, including senior management, have now all joined Wellfield, adding the depth and experience required to manage expected growth for the next two years as the company scales.

This coincides with Wellfield’s recent release of their financial data.

Here’s some of the highlights:

- Cash balance of $12.8-million at March 31, 2022;

- Net loss of $4.7-million in Q1 2022 compared with $500,000 in Q1 2021, prior to the company becoming an operating business;

- The acquisition of Coinmama will be reflected for approximately one month of the company’s Q2 2022 financial results, and for the full quarter, in its Q3 2022 financial results.

The acquisition of their own platform with an already entrenched user-base is a real boon for Wellfield, which before this had only two interesting, but not well known products to rely upon. Now Coinmama will give them the revenue boost they need to advance to the next stage of their development, and beyond.

“With a strong balance sheet and the acquisition of Coinmama completed, Wellfield is well positioned for significant growth. The addition of Coinmama’s 3.5 million registered users gives Wellfield an immediate head start on user acquisition, with an engaged audience that will enable both rapid launch of our Decentralized Finance technologies in 2022, as well as facilitate additional launches through next year. We see readily achievable opportunities to optimize the existing Coinmama platform and grow off its existing revenue base by harnessing its millions of unique visitors and taking proactive measures to increase awareness with our distinctive products and services,” said Cohen.

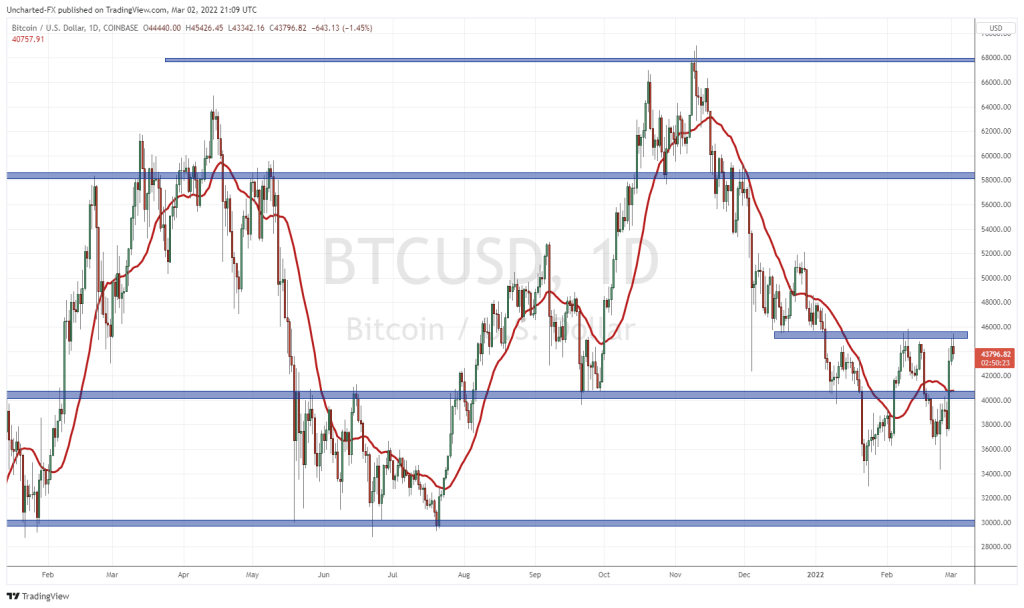

The crypto-markets may have taken a hit recently, especially with the Terra-Luna fiasco and the subsequent bearish hits to Bitcoin and the alts, but consider for a moment that we’re in the middle of Bitcoin’s halving cycle which is traditionally a low point for Bitcoin (and crypto in general). It won’t be long before the bulls are running again, gearing up for another Bitcoin halving.

Right now Wellfield is trading at $0.50 and sports a market cap $44 million. The addition of the new platform and the prospect of better months ahead leading up to the halving (and remember, Bitcoin is truly the tide that lifts all boats in this market) are probably going to make $44 million look cheap quite soon.

—Joseph Morton

Full disclosure: Wellfield Technologies is an equity.guru marketing client.