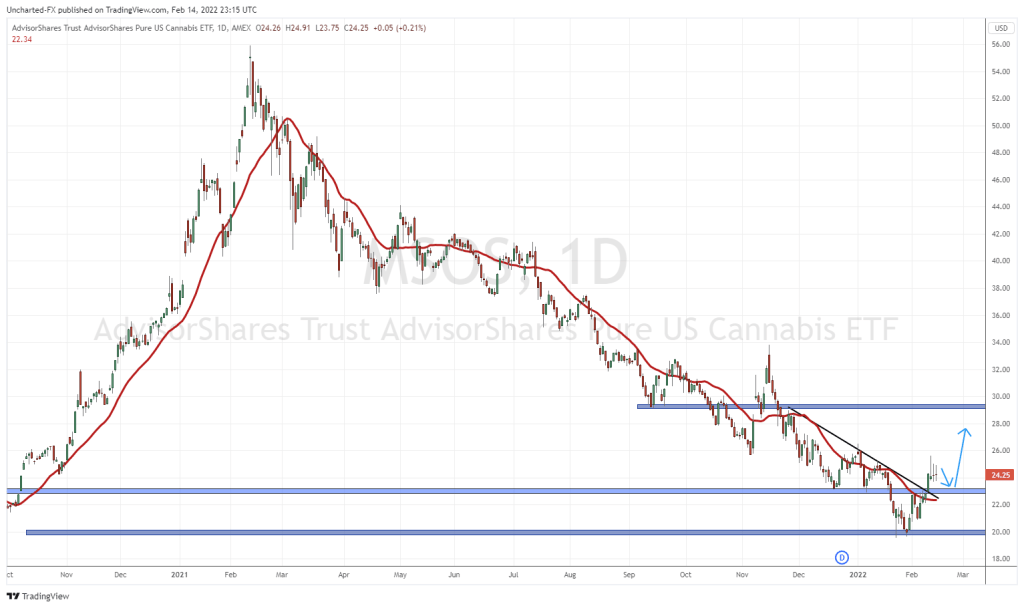

The legal cannabis revolution was expected to create successful billion-dollar cultivators and retailers. After all the black market for weed was massive, why wouldn’t that convert over to the lawful side? Companies like Canopy Growth (WEED.T) and Tilray (TLRY.T) should be rolling in it by now, but they continue to lose money. How are they still in operation?

Let’s focus on Tilray, by its own admission, the Canadian ‘success story’ is in first place when it comes to international cannabis revenue with $10.4 USD noted for Q1 2023. The cannabis company is also number one in the Canadian legal cannabis market, controlling an 8.5% share.

Still with a reported net Q1 2023 revenue of $153.2 million, Tilray came away with a $66.0 million net loss. This after having realized $95.0 million in cost cutting measures by the end of the quarter. The company still plans more belt-tightening and intends to realize an aggregate $130.0 million in cost reductions for fiscal 2023.

Even with the expected additional $40.0 million in revenue and interest rates from the Hexo transaction, Tilray’s bottom line will still drip red at the end of the year.

So, what does management do? They cling to a $13.5 million positive EBITDA with a forward-looking guidance of $70 to $80 million in adjusted EBITDA for the year and an expectation to be free cash flow positive by that time.

Since its inception in the 1970s, EBITDA has wormed its way into financial reporting so deeply, that it has become a veritable staple of earnings calls. If you didn’t know already, EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

Initially this fluid metric was used by analysts for merger and acquisition purposes and by banks to determine a company’s ability to repay debt.

Then Silicon Valley reared its ugly head. Growth companies with vaporware became all the rage and EBITDA reigned supreme as a reporting tool. Why produce a profit when you could promise one in an indefinite future while moving the goalposts each quarter to make it look like you weren’t losing armloads of cash trying to do business?

When the dot com bubble burst, EBITDA remained to promote whole new generations of unprofitable businesses slithering their way onto the public market.

Don’t get me wrong, every company must start somewhere and for the first few years, a loss is to be expected as it finds its financial feet and profitability, but are we just supposed to let it go on forever?

EBITDA isn’t a GAAP-recognized metric for good reason, as it can paint a fanciful picture of a company’s performance, but an adjusted EBITDA takes that financial literary license to a whole new level, because the reporting entity can pick and choose what costs and income to exclude and include in their report.

Warren Buffett famously said that EBITDA wasn’t a good measure of a company’s performance as costs were integral to the fundamental makeup of a business.

I tend to agree, if you produce a product or provide a service and at the end of the day, you continue to lose money doing it, perhaps it isn’t a good business. Which brings us back to Tilray.

Tilray is the result of the cannabis market bubble, excess liquidity, and investor naivete. The company continues to power its existence through a financial reporting flaw. Will it ever be taken to task?

Currently the cannabis giant trades at $4.44 CAD per share for a market cap of $1.12 billion.

–Gaalen Engen