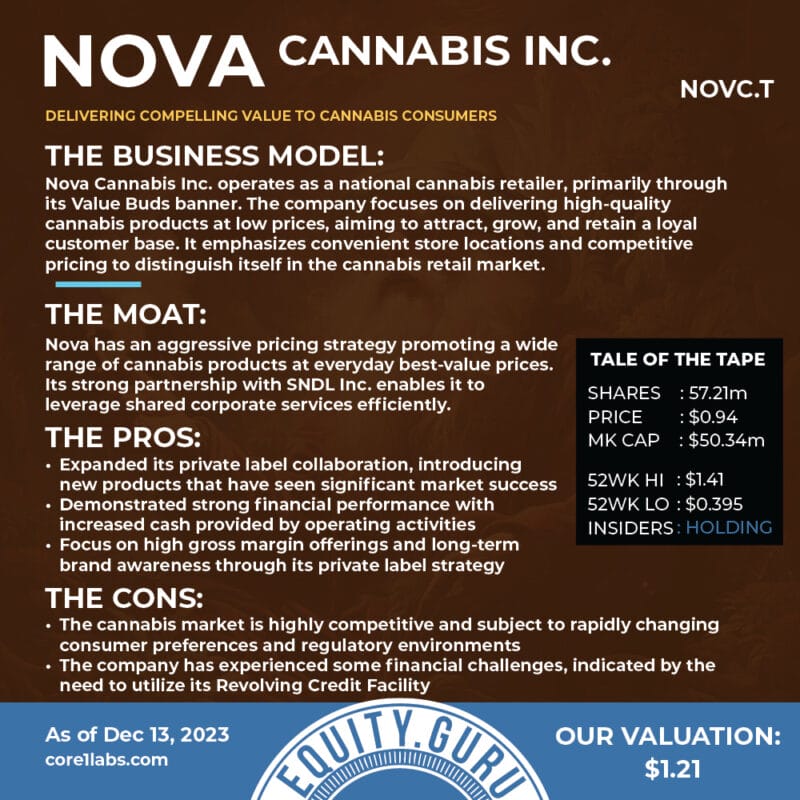

In the times of yore before COVID-19 sent us scurrying back to our caves for self-reflection and Overlook Hotel style shenanigans, the brass here at Equity Guru sent me on a mission to the snowy wastes of Pemberton, British Columbia. The company I was visiting was Pure Extracts Technologies (PULL.C), a cannabis and hemp biomass extractor on the verge of going public on the Canadian Securities Exchange. They had just jumped through their final regulatory hoop with Health Canada and were looking to onboard investors.

It was half business trip and other half employee perk. My wife and I would stay overnight in Whistler, where we’d eat tasty Mexican and look up at white hills I wouldn’t dream of skiing down. Because seriously—I’d die.

Before that, though, I had lunch at an Earls where I met the PR and financial side of the PULL’s team. These kinds of lunches are grin-and bear-it affairs for me. Let’s kick this off by saying that I’m not a fan of politicians, public relations types and other sorts of professional dissemblers, and my bullshit detector is a well-oiled machine. I put on the smile. Answer the questions. Accept the compliments and don’t push back. Play the game. But these aren’t my people.

Under the hood

The ride up to Pemberton is beautiful. Snowy-peaks. Bumpy roads. Blue skies and clean air. The Pemberton facility looks like someone bought a storage lot, kicked down the walls, added doors and shiny equipment. I’m there with a handful of other present and potential investors for a walkthrough and presentation and I’m already in a bad mood from fending off people trying to blow smoke up my ass when all I wanted to do is eat my fettuccine.

The first person we’re introduced too is the founder and chief operating officer, Doug Benville, and the difference between Doug and our handlers is immediately apparent. There’s no button-down smiley gladhands about this guy. He carries himself like the benevolent lead hand at a factory job—the guy with the most experience, and the fixer for when you push the wrong button and stop production.

He has twin sleeve tattoos and wears jeans and a short-sleeve T-shirt in a sea of slacks and collars. Even though he’s the founder of Pure Extracts, he prefers the operations job for the same reason I prefer to write—because I’m not a fucking salesmen, and neither is he. On the car ride up, the boys told a story about slotting Doug in for fundraising prior to onboarding their present CEO, Ben Nikolaevsky, and I could relate.

If my handlers left a bad impression, Doug fixed that.

Here he is in a company produced explainer on YouTube:

We walked through the plant and Doug laid out how production works with all the ease and confidence of someone with more than a decade of experience doing the job. Because he has it. Pure Extracts is what they called a ‘legacy’ company. A term I learned that weekend, actually. It’s a cute little euphemism for a company that’s been around longer than cannabis has been legal, and ended up grandfathered in after getting all the appropriate licenses and successfully completing Health Canada’s regulatory song and dance competition.

The learning curve on extractions is steep. A company that’s been digging for rare earth metals outside of Prince George B.C. for the past two or three years before the pivot is going to take a lot of wrong turns before they start getting it right. Pure Extracts doesn’t have that problem.

As a side note, I never actually met Nikolaesky. My only exposure to him is through one of our podcasts from last year:

If you’re among the group that prefers to invest based on who’s at the helm, he’s the face of the company and I’ve seen nothing to indicate he’s anything less than 100% competent. But if you’re in a rare place where you can see past the captain to who’s operating in engineering and make your decisions based on that—then you’ve got Doug. Too stretch the nautical metaphor a little further—the captain is only as useful as the engineer making sure the engines run. No engine means no propulsion.

Choppy waters

Let’s fast forward a few years.

Pure Extracts rolled into a shell and went live on the CSE and started pushing out product. They picked up what remaining licenses they needed and got the ball rolling on their Good Manufacturing Practices license for the European Union (EU-GMP), which had a later completion date. They diversified their offerings to include functional mushrooms and psychedelics, including the licenses required to export and sell to regions where they were legal. Later, they inked some white labelling deals and were well on their way to pushing their own Pure Pulls brand out to market.

Then the pandemic forced us all inside for the better part of two years. Even though technically cannabis was “essential”—nobody was spared.

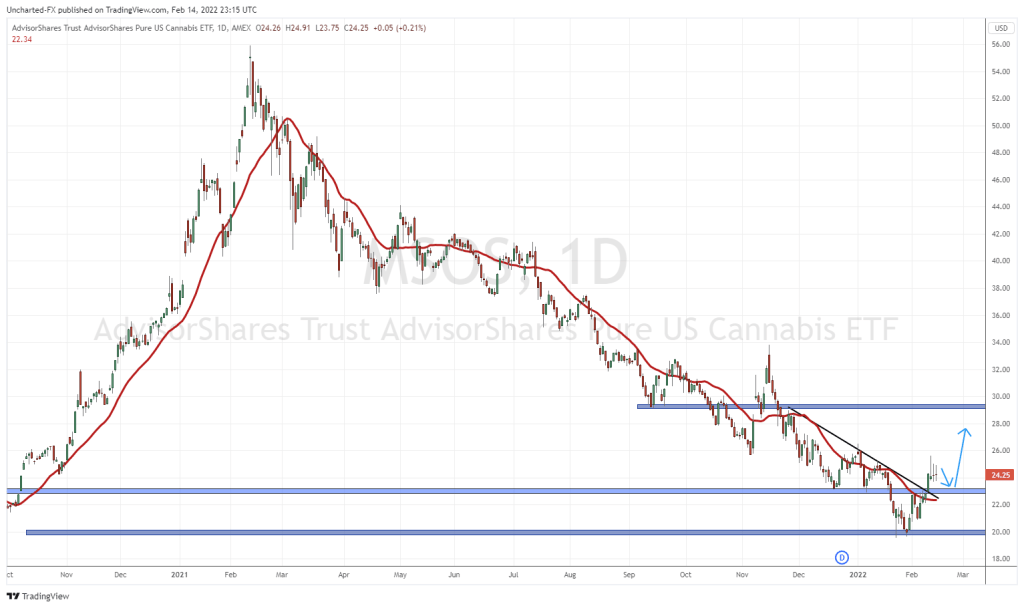

Beyond the COVID-19 pandemic, though, PULL may be suffering from a case of bad timing. Cannabis has been a graveyard since Canopy Growth’s (WEED.T) meltdown in mid-2019 dragged the rest of the sector into the dirt, functional mushrooms are a niche product at best with narrow appeal and questionable (read: not scientifically tested) efficacy, and while psychedelics show promise, they’re still a year or two away from being a viable product. Let’s not also forget that the cannabis and hemp

extractions sub-category isn’t exactly lacking for competitors, and PULL may have come a little late to that party.

Add the pandemic, a few olives and a spritz of lime and you’ve got the recipe for a suck-martini.

Granted, they have all the necessary licenses to hold, manufacture, ship and sell psilocybin products to places in the world where it’s legal, but I question if that’s really a lucrative practice or if it’s an offloading avenue for a product they can’t sell locally until the psilocybin goes legal here. If so, the revenue stream can’t be a good one. Moving into markets where the plant is legal likely means that they’re competing with local, established distributors and maybe even other pubcos, which might explain some of the poor revenue showing. We’ll get into the revenue in a bit.

On the positive side of that equation, this company will have all the kinks and bugs ironed out of their psilocybin production supply and distribution chains when mushrooms finally do go live, but that doesn’t exactly help them today.

There’s even been talk about blending CBD extractions into functional mushrooms, which actually sounds like an excellent idea given how big demand is for CBD and CBD-infused products, and the growing visibility of functional mushrooms. Timing wise, it’s early but getting in early on a company that shows promise isn’t necessarily a bad thing—especially in a market where the prospects of doubling or tripling your money overnight are stronger than with larger, more established companies.

Getting that extracts money

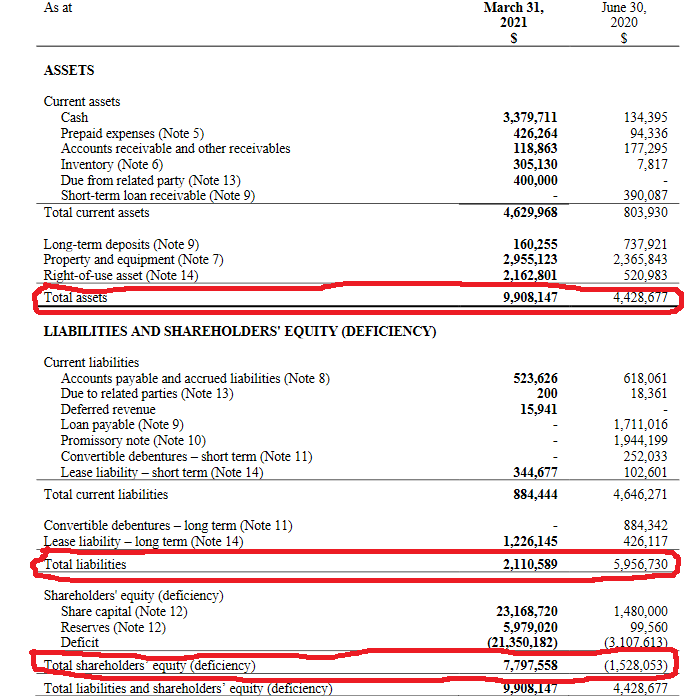

There are both good and bad elements to this balance sheet, especially for a company of this size and development level.

First, they’re not even two years old and they’re debt free. Junior companies are debt magnets and usually not at favourable prices as lenders boost interest to cover their risk. Pure Extracts carried a full load of convertible debentures and leftover debt from their reverse takeover but they spent some of their cash and tossed out some paper and got that monkey off their back before their May 28th financial release. They also have some outstanding warrants, but they’re far from being in warrant trouble.

Normally when looking for a suitable investment one of the metrics I’d look at is price to earnings ratio, or the PE ratio. Basically, it’s the ratio of a company’s share price to the company’s earnings per share. But with a company this size and development level, you’re not going to find that information. Nobody looks at a company this size for PE ratio or potential dividend yield to determine viability. What they’re looking for is whether or not they’re going to grow, and grow fast. And by that I mean double or triple in share price overnight, and there’s no market metric for that.

But there are certain elements that might suggest it could be a good place for your cash—depending on your tolerance for risk.

Here’s one:

The three circled points in my badly Paint3D augmented financial statement image represent significant improvements. The company’s total assets have shown increases while the total liabilities have shown decreases, and the difference between them is the shareholder equity. That’s one way of measuring trajectory, and the general trajectory looks good.

What the image doesn’t show is that while this company has a $3 million cash position, it only pulled in roughly $14,000 in revenue during the time period. Those aren’t good numbers. The cash position, under normal circumstances wouldn’t be horrible. You could keep the lights on, keep everyone paid regularly, and have some left over to buy a new Vitalis extractions device. You might need to mix it up by throwing out a few shares into a deal, but it’s do-able until your next private placement, or your revenue picks up.

But coupled with not enough money actually coming in and the drain becomes apparent.

This is probably a short term problem, though, and not necessarily a reflection of anything the company’s doing wrong. CBD products don’t exactly fly off the shelf when people are worried about contracting a respiratory disease that might kill their grandma. If this waterwings in the shallow end variety of analysis has left you thirsty for more of a deep dive into the shark-infested deep end, then you’re going to have to check EG’s analysis guru Taku Ndachena’s piece on Pure Extracts, where he gets into the grit. If you’ve noticed a distinct lack of charts and would like to get into the technicals, then check out our chart-wizard, Vishal Toora’s piece.

How do you like me now?

Here’s Nikolaevsky from a recent press release:

“Our business model is rapidly growing both in terms of revenue and through the advancement of product and partner development. Here in Canada, with over 75 per cent of the eligible population having received at least one vaccination shot and caseloads dramatically decreasing, a sense of optimism is growing daily. Dispensary rollouts are ramping up in the key Ontario market, and our products are making their way to the shelves in four provinces. We have received some new equipment, and there is more on the way that will subsequently make us one of the most efficient, lowest-cost producers of cannabis extracts in North America. Our hard work and commitment to excellence were never a part of the problem over the past year and a half, and with the health restrictions receding, we are now ideally positioned to unlock the value those efforts have created.”

Products and partner developments last month included: a license application to Health Canada for a blended functional mushroom wellness product; a license amendment so they can sell cannabis extracts products to provincial distributors; a manufacturing deal, and their first order from a Saskatchewan distributor.

Right now the pandemic has everything up in the air. We don’t know if the Delta variant is going to cause another national lockdown where we cloister ourselves in our apartments to keep our grandparents safe. To that effect, PULL is doing the right things. My grandmother has an idiom: “make hay while the sun shines” which basically means do the necessary work when you can to prepare for the times you can’t.

Straight talk there. No dissembling required.

—Joseph Morton