Our major technical support levels were taken out on US stock markets last week. This week we watch for continuation lower, or a reversal to confirm a false breakdown. A major week for the US stock markets highlighted by one major fundamental event. Circle Wednesday May 4th on your calendars traders. The Federal Reserve FOMC meeting press conference is due that day.

Before we delve into the Fed, let me bring up the major breakdowns I am referring to on the S&P 500 and the Nasdaq.

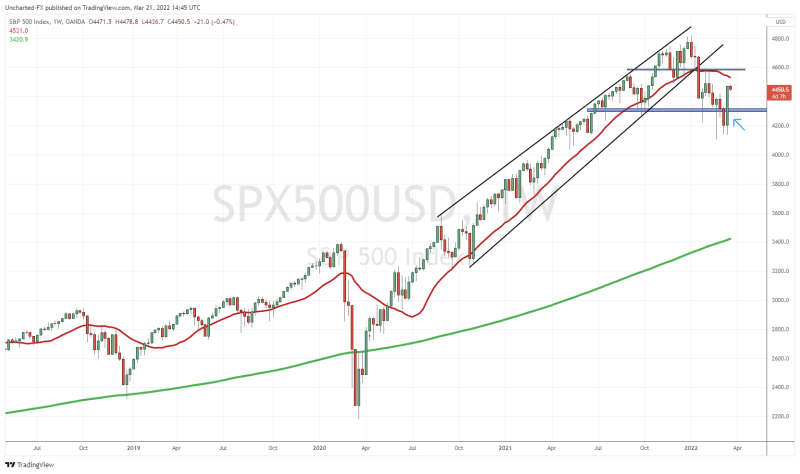

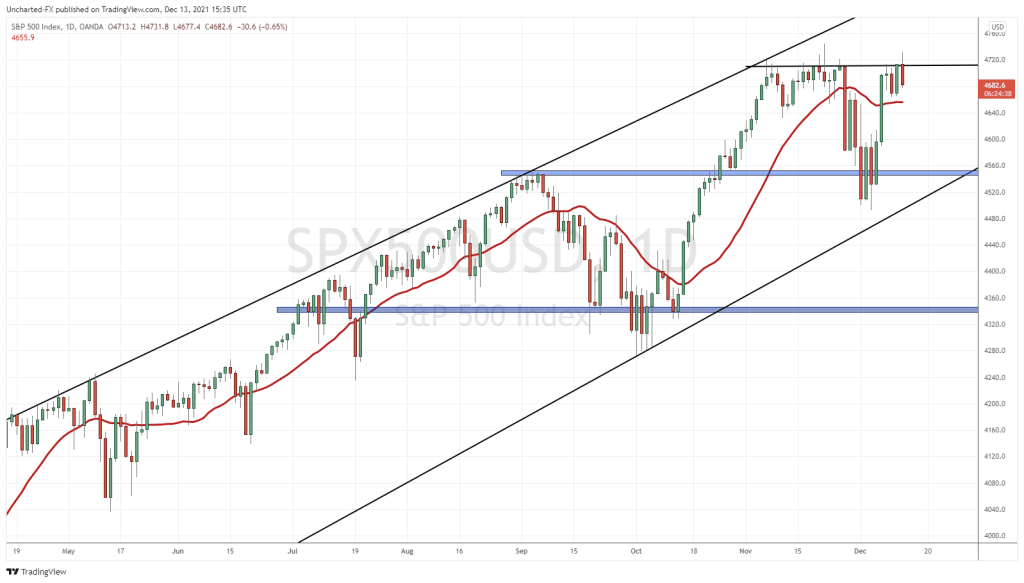

We have been watching the 4150 support zone on the S&P 500. Regular readers and members of our Discord channel know all about this support, and the chart above. I have posted the weekly chart of the S&P 500. Each candle represents 1 full week of price action.

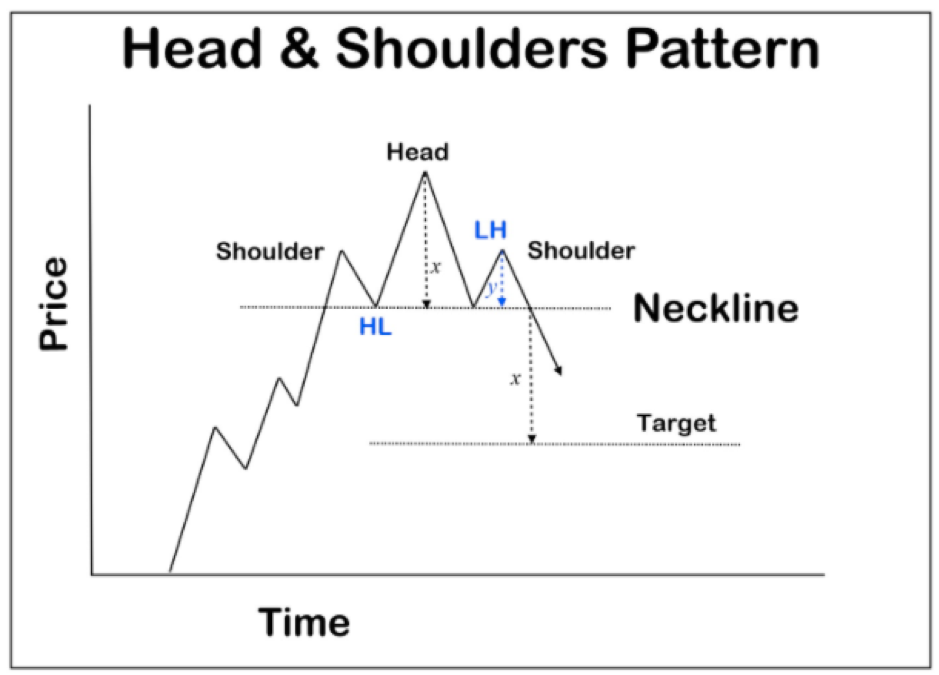

The last few days of last week were crucial because we were testing the support or price floor on the weekly chart. This floor came in at 4150. Not only that, but this 4150 acted as the neckline of a famous and powerful reversal pattern known as the head and shoulders. No, not the shampoo, but one of the most popular reversal patterns which we haven’t seen printed on the S&P 500 since 2007. And we all know what happened then.

Honestly, there is a lot of room to the downside. There is some interim support at 3800, but I am looking at around 3400 for a proper support bid.

Similar looking pattern on the Nasdaq. Tech could take a larger hit on rising interest rates. There is some interim support here at 12,000, but I will be watching 11,000.

As a technical trader, what adds more danger to the downside is this chart:

Above is the weekly chart of the US small caps index, the Russell 2000. Note the large weekly breakdown confirmed last week. The Russell is often seen as the leading index. Meaning it leads the S&P 500 and other large US indices. The Russell could fall further with support at 1700. For me to turn positive on all markets, I would want to see the Russell close back over 1940 on the weekly chart.

Two weeks ago, I wrote an article titled, “Stock market sell off explained“, which called the ongoing situation in the markets. I don’t want this to come off as me bragging, but I must say, our macro and technical analysis here on Equity Guru is second to none. We avoid the noise so we can make good probability plays. Price action is key, and has done well for us and our readers.

In that article I mentioned the big predicament the Federal Reserve is in. Let me remind you of that:

If you recall, for many months the Fed has been telling us that this inflation is only transitory and temporary. That inflation will disappear on its own. Essentially, markets believed because of this transitory nature, the Fed would not need to raise rates as much. 6-7 rate hikes would take us to around 3%, but that’s okay if inflation magically reduces on its own back to around 2% as the Fed said it would. Many in the markets believed this. But this has changed.

If you are versed in classical economics, or just followed my work here on Equity Guru, then you knew this was coming ever since the Fed began printing boat loads of money. Money supply growth is fine as long as productivity expands too. It did not. Now we are in a situation where there are people with more money competing for the same number of goods and services.

Let’s call this ‘permanent’ inflation as opposed to transitory. If inflation is permanent as us contrarians have been saying, this means the Fed will have to raise interest rates multiple times. And I mean higher than 8.5% which was the last CPI print. The stock markets are beginning to understand the Fed is behind the curve. The stock markets are beginning to understand that the Fed will need to bring down stock markets and other assets to tame inflation.

The Federal Reserve has to either tame inflation, or keep assets propped. They will not be able to do both. We will get hints of what they choose to do this Wednesday.

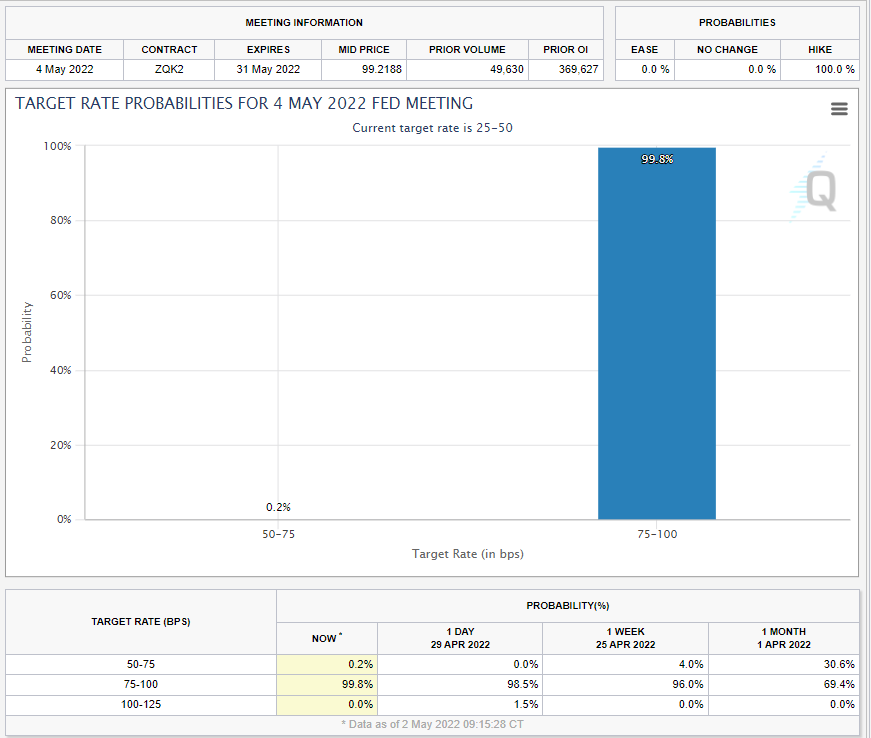

Currently, the market is expecting the Federal Reserve to hike interest rates by 50 basis points on Wednesday. This hike is already priced in. What the markets are fearing is more rate hikes as I highlighted in my stock market crash article and quoted above.

Recall that Fed Presidents have been quite hawkish. We have had Fed Williams come out saying he wanted 50 basis point hikes for some time. We also had Fed Brainard come out stating the Fed will need to sell off the balance sheet to the tune of $95 billion per month. Fed Powell did promise to address this at the next FOMC meeting so we will get a timeline this Wednesday. If Powell comes out very hawkish come Wednesday, I believe the market continues this downtrend with more lower highs and lower lows.

The hope comes in the form of US Q1 GDP that was released last week. We found out that the US economy shrank by 1.4% instead of growing by 1% as expected. If Q2 GDP also comes out negative, then the US is officially in a recession. Something the inverted yield curve hinted at.

Many believe the Fed now has to tread carefully. Raising rates too quickly will put pressure on an indebted consumer and middle class. They are getting squeezed by both rising inflation and rising interest rates. If consumers are more likely to save money rather than spend, the probability of a Q2 negative print and recession increases. This is why some contrarians now believe that the Fed may come out with a somewhat dovish statement come Wednesday. Powell may say the Fed acknowledges the slowdown and might need to hike rates slowly to avoid a slowdown.

This could get markets to reverse. As long as the cheap money continues, markets will run into equities for real yield. But this would be a dangerous game. People would come to realize that the Fed might not be able to raise rates significantly more because of all the debt in the system. That the Fed is essentially trapped.

However, it is more likely the Fed chooses the path to bring down assets and continues to raise interest rates to tame inflation. Confidence is very important for this fiat money system, and the Fed cannot let it be known that they are stuck. Would this cause a recession? Most definitely. But expect the Fed to hike more than 25 basis points more than once. If they know a recession is coming, they could be hiking fast and in larger amounts just so they have enough basis points to cut to combat a recession without going into negative interest rates. Usually, a central bank needs to cut between 200-300 basis points to combat a recession. This means the Fed will need interest rates between 2-3% before they reverse policy.

We have our technical breakdown on the charts. Now we wait to find out if the Fed continues the pain, or chooses to help keep assets propped.