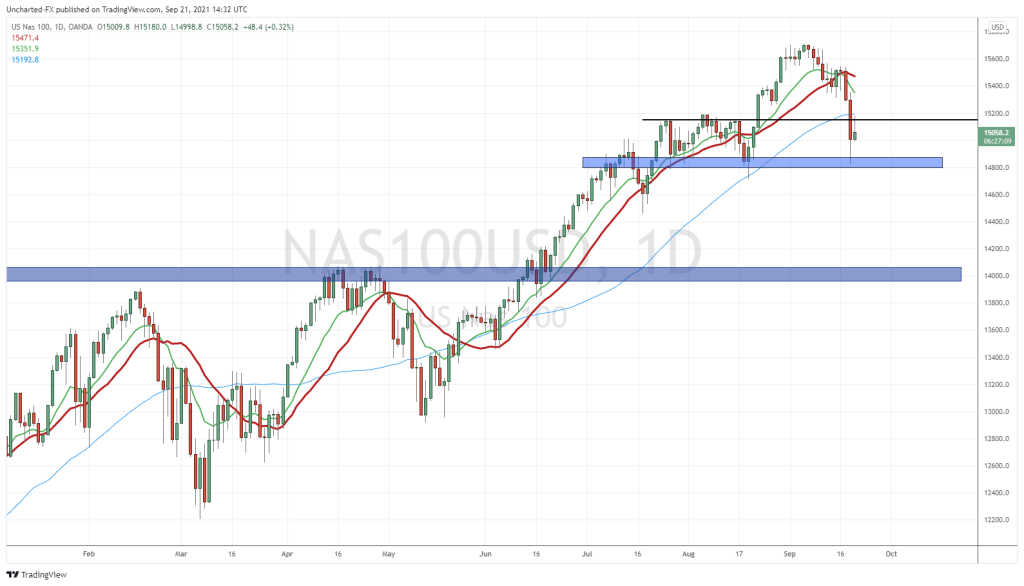

The Nasdaq and other US markets are selling off. Some of you reading my title might be saying, “what’s he saying! The markets are already totally breaking down!”. Lot’s of support has been taken out, so it looks bad, however, we have one more glimmer of hope on the technicals.

Before we look at the chart, a few fundamental things to go over. Fear is back, and back in a big way.

The VIX is back up. Crossing over my moving average which means another leg higher is possible. But a lot of this depends on the daily close.

Money is running into the US Dollar here. A risk off and safe haven currency. The Dollar has been in a range since early December 2021, and we are just waiting for a breakout in either direction. One would think the Dollar may move higher on a hawkish Fed.

The 10 year yield is the chart I have been highlighting all of last week. Interest rates are rising because the market expects 3-4 rate hikes by the Fed this year. Let’s wait and see. Markets have been propped by cheap money, but with that cheap money seemingly looking to taper off, we are now finally seeing that taper tantrum. But I have to say anything can change from now until March 2022, when the Fed is expected to hike 25 basis points. I think they do hike 25 basis points, but it might be a one and done rather than 2 to 3 more hikes this year.

If the 10 year yield begins to sell off, we’ll have some stability in stock markets and a potential reversal.

We have Powell testifying tomorrow which could see him curb his hawkishness in terms of Fed monetary policy. The market would love that. Some people are wondering if the Fed can even hike in a weak economy. Last week’s NFP employment numbers for December missed by a long shot. This week we have US retail sales and US CPI data. Both of these could change the market’s probability of rate hikes if the economy appears weaker. I am interested in the retail sales data which comes out Friday as they are for the month of December…when people tend to shop a lot for Christmas and the holidays.

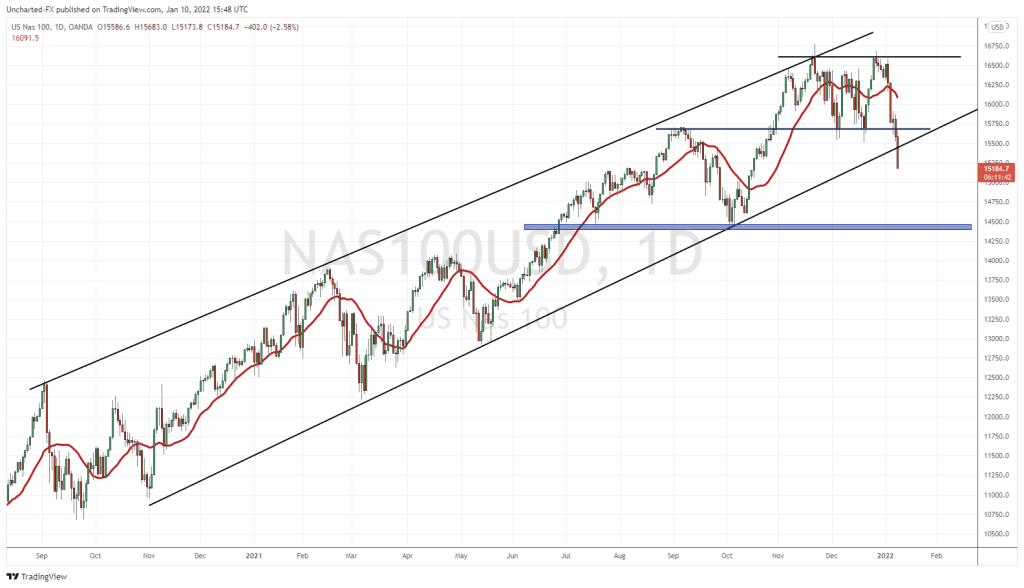

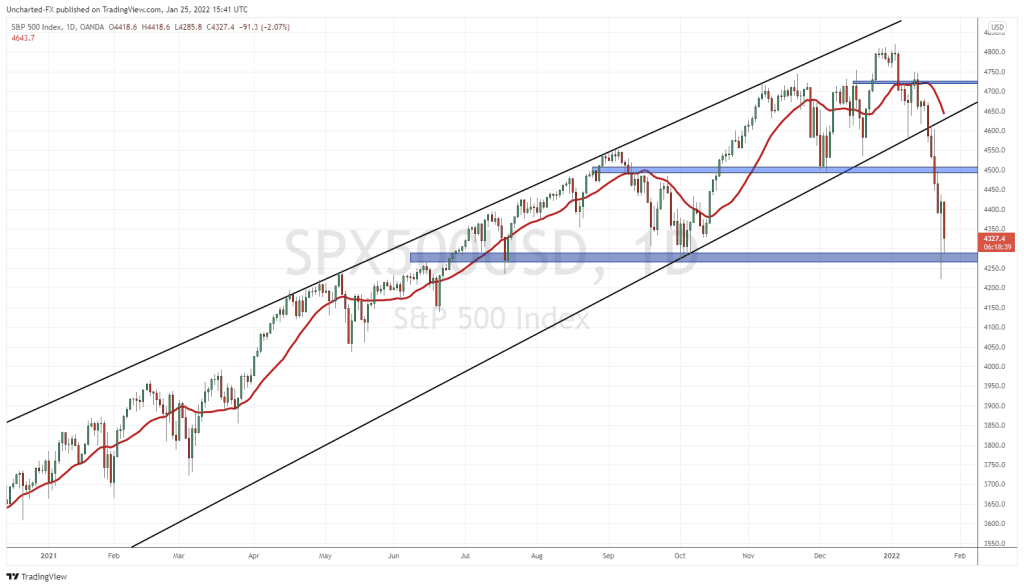

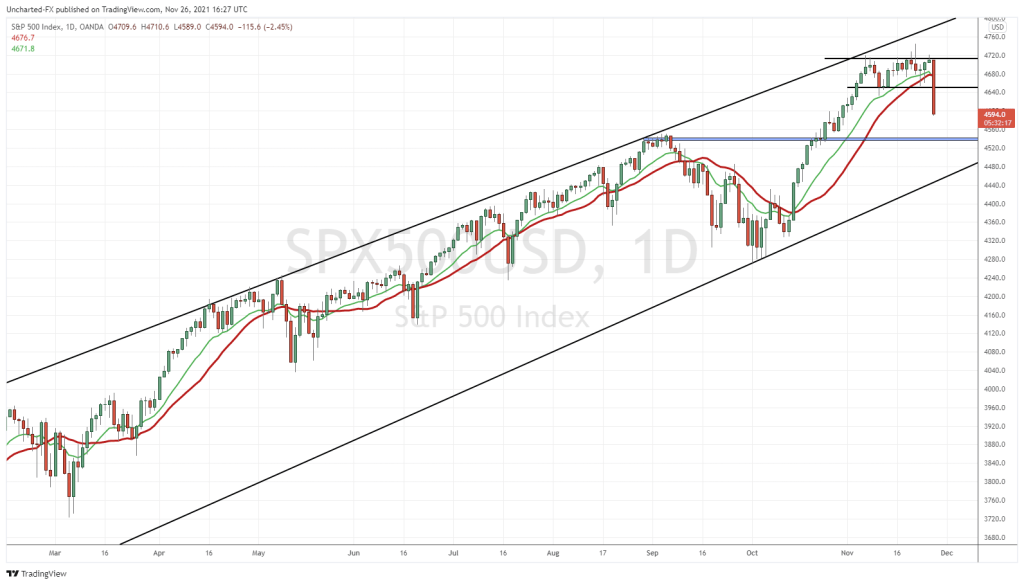

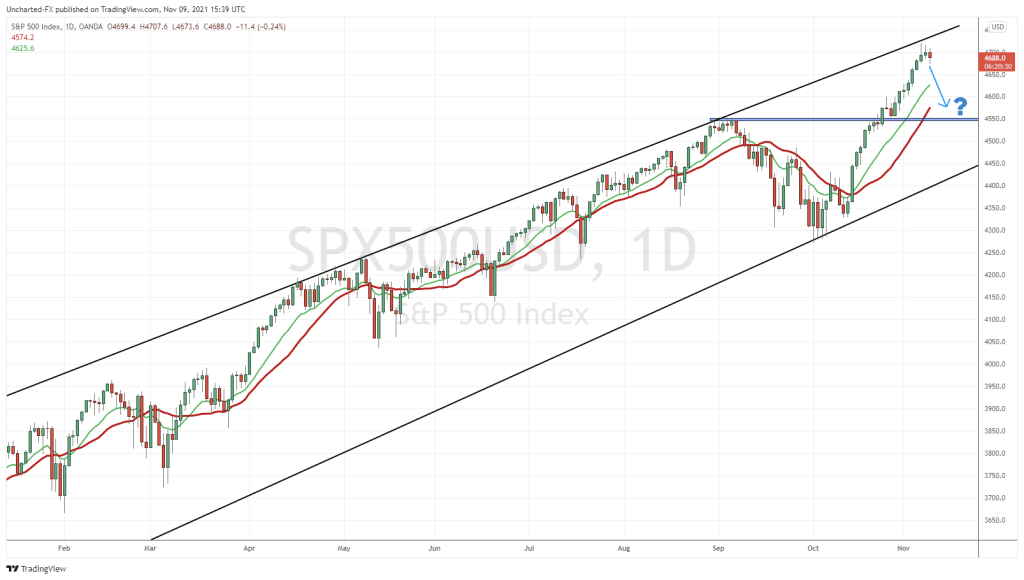

Yikes. Very ugly chart. When I began writing this article, the Nasdaq looked a tad bit better, but we are now down 2.57% for the day. The S&P and the Dow are following with the former nearing the 2% level.

On Friday, the Nasdaq closed below our major support zone. We had support breakdowns on the S&P 500 and the Dow Jones as well. The hope for the Nasdaq was the lower uptrend channel trendline. If we were to close just like this, the trendline has broken and we would be in a new downtrend and potentially bear market. Still a lot of time before trading ends, but we would need to see a spectacular reversal with buyers jumping in and dragging the price higher in order to close above the trendline. Doesn’t look likely but crazier things have happened.

We traders can short the markets. Honestly, a great trade right now. We’ll just have to play the lower highs and lower lows going forward. Selling the rips instead of buying the dips. Let’s see if Fed Chair Powell changes his hawkish stance tomorrow. Keep an eye out on CPI data out Wednesday, and Retail Sales out on Friday.