Sector Review

In our last plant-based sector roundup we discussed a recent decline in plant-based meat sales. This decline can largely be attributed to consumers returning to restaurants as COVID-19 restrictions are raised. However, we must also consider other factors including consumer sentiment, consumer habits, and market oversaturation. It is also important to acknowledge that the plant-based sector is still growing despite outputting lower numbers. For example, according to SPINS, refrigerated plant-based meat sales were up 19.1% in the 52 weeks ending July 11. Similarly, frozen plant-based meat sales were up 9.2% in the same period.

With this in mind, the International Food Information Council (IFIC) found that approximately two-thirds of Americans consumed plant-based alternatives, with 20% consuming them at least weekly and another 22% consuming them daily. An additional 12% said they had not consumed plant-based meat alternatives over the past year but would like to try them in the future. That being said, there is a growing interest in plant-based alternatives, but how does this reflect on the companies themselves?

In this year alone, more than 40 new plant-based products have been launched. The number of companies in the sector offering plant-based alternatives has also grown, creating a competitive market. For this reason, investors and consumers alike have become more stringent, while plant-based companies have become bolder. Whether it’s creating an innovative plant-based product like liquid eggs or manufacturing cell-cultured meat, companies are looking to stand out in fear of falling to the wayside.

Presently, it feels as if the plant-based sector has stagnated or plateaued. Nowadays, it’ll take more than just another plant-based meat alternative to spark the interest of consumers. In this plant-based sector roundup, we will be discussing Feel Foods Ltd. (FEEL.C), Nepra Foods Inc. (NRPA.C), Vejii Holdings Ltd. (VEJI.C), and Impossible Foods. Let’s see what these companies have to offer.

Impossible Foods

Impossible Foods (PRIVATE) is a food manufacturer developing plant-based alternatives for meat, dairy, and fish. Normally I don’t cover private companies, however, Impossible Foods shows potential and has made some significant progress ahead of its upcoming IPO. Recognized for its popular Impossible Burger®, Impossible Foods is committed to reducing its carbon footprint, limiting global warming, halting the collapse of biodiversity, saving wildlife, and ensuring there is enough clean water. Truth be told, the same could be said about a lot of companies, but is Impossible Foods actually doing its part?

According to the Company, the production of some of its products require fewer resources. For example, the Impossible Burger® reduced environmental impacts across every impact category studied in a report evaluating water consumption, land occupation, global warming potential, and aquatic eutrophication potential. This study demonstrated that the Company’s Impossible Burger® consumes 87% less water, 96% less land, produced 89% less GHG emissions, and 92% fewer aquatic pollutants. Similarly, the Impossible Sausage® generates 71% less GHG emissions, requires 41% less land area in a year, has a 79% lower water footprint, and generates 57% less aquatic eutrophication.

Latest News

Most recently, Impossible Foods launched four of its own delivery-only fast-food restaurants in Arizona. However, these restaurants will operate as ghost kitchens out of the Dog Haus hot dog chain. Just last week the Company launched “The Impossible Shop” in nearly 40 locations across eight states in the United States. The Impossible Shop is available on major delivery platforms such as DoorDash, Postmates, Uber Eats, and GrubHub. Via The Impossible Shop, customers have access to a select menu featuring Impossible Foods’ “Shop Burger” and “Chili Cheese Shop Burger.”

Now for the real kicker. On November 23, 2021, Impossible Foods announced the closing of $500 million in new funding. With this in mind, the Company has now raised a total of approximately $2 billion, making Impossible Foods the fastest-growing plant-based meat company in retail. It is also worth noting that in 2020 alone, Impossible Foods raised more than the whole plant-based protein industry did in the year prior. Following Impossible Foods’ latest funding announcement, Bloomberg estimates that the Company’s valuation has increased to roughly $7 billion. Although no date is confirmed, it is speculated that Impossible Foods may go public at some point in early 2022.

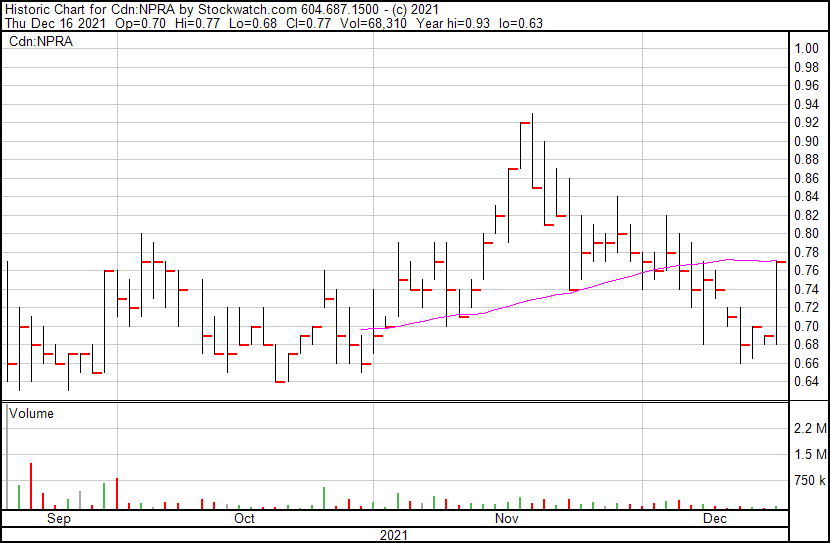

Nepra Foods Inc.

Nepra Foods Inc. (NPRA.C) is a multi-category market leader in allergen-free and plant-based food ingredients and consumer products. The Company is credited for assisting several national brands to take products from concept to market with Nepra’s ingredients and plant-based expertise. In addition to selling its proprietary ingredients to other food producers, Nepra also manufactures its own plant-based foods for consumers. The Company’s products are high in protein and fiber, low in carbohydrates, and are packed with nutrients. Some of Nepra’s products include tortilla chips, pretzels, and dips as well as plant-based alternatives for meat, eggs, and dairy.

Nepra has established a business-to-business (B2B) portfolio with food producers across North America. Additionally, the Company recently established consumer distribution via direct-to-consumer (D2C) and traditional retailers. Nepra completed an IPO led by Canaccord Genuity raising gross proceeds of CAD$7,474,629. The Company’s offered shares listed on the Canadian Securities Exchange (CSE) on September 15, 2021. Furthermore, Nepra recently announced its commitment to Environmental, Social, and Governance (ESG) practices. That’s great, but how does the Company look on paper?

Latest News

On December 2, 2021, Nepra reported sales of $4,262,350 for the nine-month period ending September 30, 2021. This represents an impressive 242% increase over the same period last year, which had sales of $1,759,370. Nepra attributes its revenue increase to new customer acquisition and a higher volume of the Company’s specialty ingredients sold. Of Nepras products, the increased production of the Company’s N-50 hemp flour, which rose 400% over output earlier this year, drove sales for the Company. With this in mind, Nepra’s working capital has increased to $5,283,147 as of September 30, 2021, up from a working capital deficit of $324,656 as of December 31, 2020.

“We are very pleased to see our third-quarter results reflected in our commitment to expanding Nepra’s best-in-class product offerings to the burgeoning plant-based and allergen-free food markets. The quarterly results, alongside our current order book, shows that our growth remains strong compared to last year – a trend we expect to continue through the remainder of the year.

This past quarter does not yet include revenue contribution for our soon-to-be-launched consumer products goods division. Further, led by PROPASTA™, we expect to add new product categories and customers across our multiproduct and multi-vertical divisions in the next several fiscal quarters,” said Nepra CEO David Wood.

Most recently, on December 16, 2021, Nepra announced the launch of its new D2C eCommerce platform utilizing Shopify, a global leader in eCommerce software. This launch represents a critical step in Nepra’s consumer products strategy, which will include the rollout of the Company’s ready-to-eat PROPASTSA™ line of frozen foods in early 2022. Nepra’s new website will feature detailed product descriptions, photos, testing information, ingredients lists, and in-depth nutritional information.

“Consumers are increasingly health-conscious, ingredient-conscious, and eco-conscious, so one of our goals with this new e-commerce shop is to provide them with the same transparent product and process information we share with our wholesale clients…And by offering healthy recipe ideas along with an integrated purchasing process, our products are more accessible to everyday consumers,” commented David Wood.

Nepra’s initial product offerings will include the Company’s Extra Virgin Hemp Oil and its assortment of gluten-free Baking Mixes. In the future, Nepra’s online ordering will also include the Company’s ProCell egg replacement in early 2022.

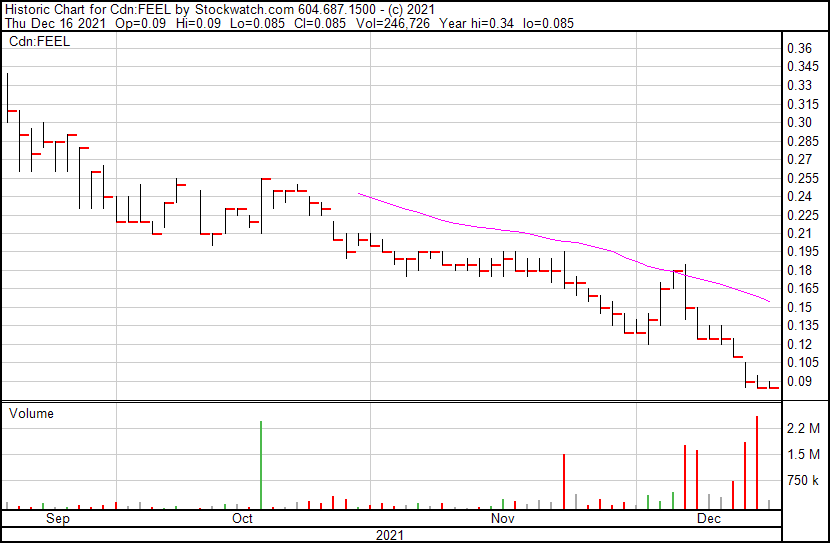

Feel Foods Ltd.

Feel Foods Ltd. (FEEL.C) is an agri-food holdings company focused on developing innovative products and technologies in the foodservice industry. This includes the Company’s wholly-owned Be Good Plant-Based Foods Ltd. (“Be Good”), a food company dedicated to designing, developing, producing, licensing, distributing, and selling a variety of plant-based meat and other food alternatives.

Feel Foods acquired Be Good on March 31, 2021, by issuing 22,050,000 common shares of the Company at a fair value of $7,166,250. Some of Be Good’s products include plant-based chicken, pork, and beef products. Ultimately, Feel Foods is on a mission to provide a unique offering of plant-based food products intended to make it easy for carnivores, flexitarians, and vegans alike to incorporate less meat into their diets.

Latest News

On December 6, 2021, Feel Foods announced that it has received approval to begin marketing and distribution for Black Sheep Vegan Cheeze and Be Good Plant-Based Products across Canada, beginning with Alberta. Shortly after, on December 7, 2021, Feel Foods announced that it has been granted a ‘Safe Food for Canadians’ license from the Canadian Food Inspection Agency (CFIA). Having obtained this license, Feel Foods is now able to sell its plant-based food products throughout Canada in addition to being able to export its products to other countries, including the United States.

“This license is a vital step as we systematically build a strong Canada-wide distribution network with a presence at over 70 grocery, restaurants, and marketplaces in BC, marketing beginning in Alberta, and now Feel Foods has the way cleared for U.S. product roll outs and sales,” stated Feel Foods CEO, David Greenway.

In order to be licensed by the CFIA, companies must have a strict food safety program based on Hazard Analysis and Critical Control Point (HACCP) principles. Through the Safe Food for Canadian Regulations (SFCR), the CFIA has the authority to certify all foods for export, thereby streamlining systems and making export easier for Canadian companies like Feel Foods.

Additionally, on December 9, 2021, Feel Foods announced that it is developing plant-based eggs and bacon products. More importantly, on December 14, 2021, the Company announced its latest purchase order for its Black Sheep Vegan Cheeze products from Summit Speciality Foods. This order represents an overall increase of 2,288% in four months from the Company’s initial order from Speciality Foods.

It is also worth noting that Feels Foods is working with Tony Waters Agencies Inc. (TWA), a national natural food broker. In cooperating with Feel Foods, TWA will assist the Company in bringing on additional distributors as well as provide sales representation in the Canadian natural foods market via full-service sales, administration, and marketing support.

Most recently, on December 16, 2021, Feel Foods announced the launch of its new eCommerce-enabled website, developed by Able & Howe. The Company’s new website features full eCommerce capabilities and state-of-the-art inventory control, ensuring operations are efficient, effective, and uninterrupted. Although Feel Foods Black Sheep Vegan Cheeze is currently available through various websites, the Company intends to increase production further in anticipation of increased demand.

“Nasdaq predicts more than 95% of ALL purchases will be done online through e-commerce by 2040. With this new e-commerce sales channel now open, Feel Foods is poised to rapidly drive new, direct-to-consumer sales while continuing to expand on our existing distributor/broker and traditional sales team with our recent entry into Alberta and CFIA export license,” commented David Greenway.

Needless to say, Feel Foods has been keeping busy lately. With a variety of diverse brands under its belt, the Company is well-positioned in the plant-based market. Keep in mind, the Company is now able to export outside of Canada and is in the process of increasing its brand presence through TWA. Financials aside, Feel Foods is a well-rounded company with a refreshing assortment of plant-based alternatives.

Vejii Holdings Ltd.

Vejii Holdings Ltd. (VEJI.C) is a North American, online plant-based, sustainable products marketplace, headquartered in Kelowna, British Columbia (BC). Vejii operates its online marketplace ShopVejii.com in both Canada and the United States (US), along with VeganEssentials.com, an online vegan grocer. The Company is committed to providing its customers with easy access to thousands of plant-based and sustainable living products from hundreds of vendors through a centralized, online shopping experience.

By leveraging logistics infrastructure and distribution network technology integrations, Vejii is able to support its vendors and improve customer experience. Furthermore, Vejii utilizes technology to connect buyers with the products and brands they want. To be specific, the Company uses the data gathered from its marketplace to inform every aspect of Vejii’s business, including expansion plans and investments.

Latest News

On December 3, 2021, Vejii announced that it has entered into a 3PL agreement with a cold storage service provider in San Diego, California. Vejii’s latest agreement is intended to expand the Company’s distribution footprint. In doing so, this will allow products across Vejii’s offering to be stored even closer to one of the Company’s largest consumer bases. Furthermore, the Company will be able to store and ship its full range of frozen, refrigerated, and dry products in its strategically located 3PL distribution center in San Diego.

Having access to additional space will allow Vejii to further expand and onboard new brands as well improve service for its existing brands with added distribution capabilities. This agreement will also allow Vejii to capitalize on California’s lucrative plant-based market through the expansion of its Vejii Express program. For more details related to Vejii’s 3PL cold storage agreement, check out this article.

Most recently, on December 7, 2021, Vejii announced that it has achieved record unaudited consolidated net revenues of approximately $461,000. This represents growth of over 100% for November sales compared to the entirety of Q3. During November, the Company’s cost of goods sold was approximately $329,000 and gross margins were approximately 29%. Vejii attributes its revenue growth to the closing of the acquisition of Veg Essentials LLC. on November 5, 2021.

“The acquisition of Veg Essentials LLC is also something that has been incredibly rewarding for the Company, giving us not only a second digital asset for our brand partners to leverage, but a second distribution point to get products to more customers, more effectively. Now brands looking to join Vejii Fulfillment Service (VFS) have a second distribution point to better service the East Coast and support continued growth and improved efficiencies,” commented Darren Gill, President and COO Vejii.

Black Friday and Cyber Monday promos, improved ROI on ad spend, targeted marketing campaigns and the growth of Vejii’s online offering with new brands also contributed to the Company’s revenue growth. In fact, Vejii’s digital presence has grown substantially, reaching over 89,000 Instagram followers across its digital platforms. If you’re interested in Vejii, check out Equity Guru’s exclusive interview with Kory Zelickson, Vejii’s CEO, above. Furthermore, a closer look at Vejii’s Q3 2021 Financial Results can be found here.