Grocery Shopping Goes Virtual

According to the Mastercard Spending Pulse report, e-Commerce sales made up 20.9% of all retail sales in 2021, up from 14.6% in 2019. More recently, e-Commerce sales were up 11% in 2021 during the holiday season compared to the previous year. Following the onset of COVID-19, it didn’t take long before I started buying useless items off of Amazon out of sheer boredom. I imagine most people around the world shared the same sentiment seeing as e-Commerce sales hit a record $3.9 billion in May 2020, representing a 112% increase from May 2019.

Looking forward, total retail sales in the United States (US) are expected to increase 2.5% year-over-year (YOY) in 2022, reaching $6.624 trillion. In particular, e-Commerce sales will grow 16.1%, while growth for in-store sales will remain relatively stagnant. With this in mind, the e-Commerce sector is projected to have its first trillion-dollar year of sales in 2022 as people continue to shift their spending habits online relative to COVID-19 restrictions. While the e-Commerce performance of products like fitness equipment saw substantial increases during the pandemic, online grocery shopping stole the show.

In a study conducted by Acosta, a consumer packaged goods (CPG) sales and marketing firm, 45% of consumers reported shopping online for groceries more now than before the pandemic. Of this demographic, 46% indicated that they use online delivery more now, while 40% said they used online pickup more. Furthermore, data collected by Acosta suggests that approximately one in four shoppers expect to make this a permanent change. So why does any of this matter?

If you dig a little deeper, you will find that plant-based products experienced significant e-Commerce growth. More specifically, meat alternatives saw almost 200% YOY online sales growth, outpacing all other grocery categories from May 2020 through April 2021. According to 1010data, consumer pre-purchase search behavior when online shopping demonstrated a 163% increase in searches for the term “organic,” compared with 148% for “plant-based,” 99% for “gluten-free,” and 88% for “vegan.” With this in mind, let’s talk about Vejii Holdings Ltd. (VEJI.C), an online plant-based marketplace capitalizing on this lucrative opportunity.

Vejii Holdings Ltd.

- $22.06M Market Capitalzation

Vejii Holdings Ltd. (VEJI.C) is a North American, online plant-based, sustainable products marketplace, headquartered in Kelowna, British Columbia (BC). Vejii operates its online marketplace ShopVejii.com in both Canada and the US, along with VeganEssentials.com, an online vegan grocer. The Company is committed to providing its customers with easy access to thousands of plant-based and sustainable living products from hundreds of vendors through a centralized, online shopping experience.

By leveraging logistics infrastructure and distribution network technology integrations, Vejii is able to support its vendors and improve customer experience. Furthermore, Vejii utilizes technology to connect buyers with the products and brands they want. To be more specific, the Company uses the data gathered from its marketplace to inform every aspect of Vejii’s business, including expansion plans and investments.

Vejii is led by its President and COO, Darren Gill, a man who has held senior management positions, including board roles in public and private companies. Most notably, Darren served as the Chief Strategy Officer for a publicly-traded Canadian LP. Furthermore, he also led Deloitte’s BC M&A team specializing in Integration and Separation Advisory. Overall, Darren has directly and indirectly overseen more than $9 billion in deal flow over the last three years.

Vejii is also led by Kory Zelickson, the Company’s Chief Executive Officer and Director. Kory has more than 15 years of innovation and technology experience, launching successful eCommerce and technology startups. In particular, Mr. Zelickson is recognized for co-founding Namaste Technologies, a multi-vendor platform, which went public in 2014. By 2018, Namaste reached a market valuation of $1 billion, realizing 20x returns for its initial series of investors.

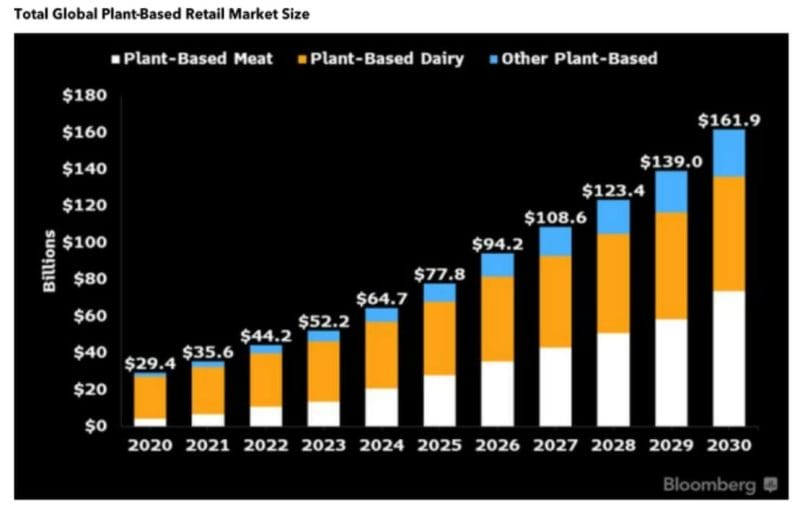

Backed by an experienced leadership team, Vejii intends to capitalize on the Plant-Based Food Market, which was valued at $29.4 billion in 2020. This market is expected to bloom, exceeding a value of $162 billion within the next decade. Keep in mind, the US plant-based food market alone increased 27% in 2020 to $8.7 billion due to growing plant-based diet choices and easier online access. It is worth noting that Vejii has secured its position as the largest online vegan marketplace in the US.

Let’s be real. When COVID-19 hit, we were all getting our shopping fix online. Hell, I dropped over CAD$3,000 on computer parts just because I had Amazon Prime. In fact, between March 2020 and March 2021, 45.3% of people were shopping more online. Moreover, 41.4% reported buying groceries online while 31.9% were purchasing more health and wellness products. Currently, Vejii offers a variety of health and wellness products, including:

- Grocery

- Protein and Sports Nutrition

- Vitamins and Supplements

- Personal Care

- Baby and Kids Products

- Vegan Wine

Additionally, the Company offers Vejii Express, a service whereby Vejii provides express shipping for its highest velocity SKUs. By picking, packing, and fulfilling all orders, Vejii is able to provide localized and same-day delivery while reducing its overall carbon footprint from shipping and materials. Vejii also provides non-perishable drop-shipping to customers through its distribution partners. In the future, the Company plans to expand its offering to include Home & Garden, Sports & Recreations, Sustainable Furniture, and Sustainable Fashion products.

Currently, Vejii has over 3000 products in stock and has onboarded 500 brands to date. With this in mind, the Company has more than 70 independent vendors fulfilling orders directly or through a partnership with Vejii Fulfillment Services. Boasting rapid quarterly growth as well as global and regional brands, Vejii has achieved an overall total addressable market (TAM) of USD$2.1 trillion.

Latest News

Most recently, on January 4, 2022, Vejii announced that it has completed the acquisition of VEDGEco, a leading online business-to-business (B2B) wholesale platform for plant-based products. This acquisition is expected to significantly augment the Company’s current offering of wholesale plant-based products. Moreover, with distribution centers in Hawaii and California, VEDGEco will be able to further expand Vejii’s distribution network, thereby reducing shipping costs and increasing the Company’s offering of regionalized same-day delivery. For more details regarding Vejii’s acquisition of VEDGEco, check out this article.

Additionally, on December 3, 2021, Vejii announced that it has entered into a 3PL agreement with a cold storage service provider in San Diego, California. This launch is expected to expand the Company’s distribution footprint on the west coast allowing for products to be stored even closer to California, one of Vejii’s largest consumer bases. Through this partnership, Vejii will be able to store and ship its full range of frozen, refrigerated, and dry products. Furthermore, with added distribution capabilities, Vejii will be able to more effectively onboard new brands and improve service for its existing brands. For more details, check out this article.

Prior to Vejii’s 3PL agreement, the Company announced on December 2, 2021, that Franklin Farms’ unique like of plant-based meat products will be launching on ShopVejii.com in the US this January. For context, Franklin Farms is a division of Keystone Natural Holdings, a leading manufacturer of healthy, plant-based protein products including tofu, soy milk, and plant-based meat alternatives like burgers and appetizers. Similarly, Franklin Farms is recognized for its extensive portfolio of plant-based protein options including plant-based burgers, seitan, tofu, tempeh, fusion tofu, and chickpea tofu.

“Online shopping has become a key part of so many consumers’ routines after the COVID-19 pandemic, and now, with new COVID variants continuing to emerge – online grocery options are likely to continue to hold strong and even grow in popularity, with our nationwide distribution, and ability to deliver items contact-free, cold packed within 2-3 days, we are proud to be able to support large brands like Franklin Farms with their online strategy during this time of transition,” said Kory Zelickson, CEO of Vejii Holdings.

Recently, on November 5, 2021, Vejii announced that it has closed its acquisition of Vegan Essentials LLC (“Vegan Essentials”) effective October 28, 2021. Founded in 1997, Vegan Essentials has been awarded the best online vegan store by VegNews from 2005-2018, as well as the best online vegan grocer from 2018-2021.

“Our database of consumer buying insights now goes back to 1997 and this will allow us to look at strategic acquisitions, new brands, and growth within new markets. The access to additional capital from the financing will also allow the Company to focus on future growth,” said Kory Zelikson, CEO of Vejii.

With this in mind, Vejii’s acquisition of Vegan Essentials will provide the Company with access to a second strategically located warehouse in the US, as well as over 20 years of consumer insight, data, and buying power. Additionally, Vegan Essentials brings over CAD$3.5 million of revenue to Vejii based on its 2020 Unaudited Financials. Most recently, on November 12, 2021, Vejii announced that it is now trading on the Canadian Securities Exchange (CSE) under the ticker symbol VEJI.

“We are thrilled to have investors welcome Vejii to the public markets. After an extensive period preparing to be publicly traded, we have successfully completed the first major step as a newly public company. We look forward to executing on the vision of the Company and continuing to make plant-based and sustainable living products widely accessible and convenient.

Not only have our shareholders recognized that consumers’ demands and expectations for how products are made are changing, but they acknowledge our unique and competitive position in the industry as we leverage our technology and extraordinary customer service. We are thankful for their enthusiasm and support and look forward to providing value to our new and old investors as Vejii continues to grow,” stated Kory Zelickson.

It is of the opinion of Vejii that plant-based and sustainable living products have become a leading consumer trend with both well-established and new, innovative companies. That being said, as a company focused on plant-based and sustainable brands, Vejii will be reliant on trends in the online sales industry, which has grown substantially due to the COVID-19 pandemic.

Keep in mind, online sales increased 39% year-over-year (YOY) in Q1 2021, nearly triple the 14% increase in Q1 2020, and faster than both Q3 2020 and Q4 2020. As a whole, in 2020, more than 2 billion people purchased goods or services online. During the same year, e-retail sales surpassed USD$7 billion.

Moreover, plant-based products like grocery items are a key driver of sales growth at retailers nationwide, growing almost twice as fast as overall food sales. According to SPINS’ retail sales data released April 6, 2021, grocery sales of plant-based foods that directly replace animal products have grown 27% in the past year to USD$7 billion.

Through its robust online marketplace with its multi-vendor application, Vejii is well-positioned to capitalize on the Sustainable Products Market, which is expected to reach somewhere between $142.4 billion and $150.1 billion by 2021. Furthermore, Vejii has its foot in the US, which ranked the highest in terms of leading average eCommerce revenue per shopper. To put things into perspective, 14.1% of global retail sales were eCommerce purchases in 2019. By 2023, this number is expected to increase to 22%.

Commentary

Looking forward, Vejii plans to expand globally and is currently working towards a launch in the United Kingdom, which is planned for Q1 2022. With this in mind, Equity Guru had the privilege of communicating directly with Kory Zelickson, Vejii’s CEO and Director. When asked if Vejii was still on track to meet this goal, Mr. Zelickson stated that “the company is in the process of finalizing warehousing, supply agreements, and fulfillment,” reaffirming that the Company’s timeline has not changed.

Having now listed its common shares on the CSE, we asked Mr. Zelickson what was next for Vejii, to which he responded:

“At Vejii, our decisions are inspired by the data which we’ve been fortunate enough to collect since 1997 via the acquisition of VeganEssentials.com. We plan on using that data to make informed choices on targeted growth in new regions and acquisitions.”

Furthermore, Vejii has a new product under development branded HeyVita, the first all-in-one vegan vitamin pack. HeyVita is intended to be a single serving daily vitamin pack for people on or transitioning towards a plant-based diet. With this in mind, when asked if he could provide any updates related to Heyvita, Mr. Zelickson responded:

“HeyVita will be the first brand inspired by our website AI and search insights. The marketplace model allows us to understand what consumers need and alert us to emerging trends before anyone else in the space. Our anticipated launch for this brand is Q1 2022.”

Financials

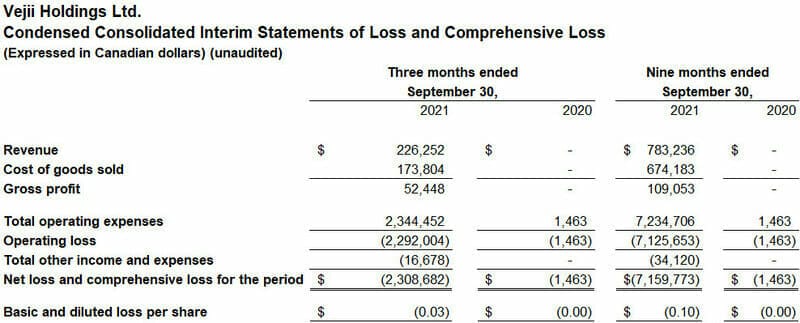

According to Vejii’s Q3 2021 Financial Report, the Company had cash of CAD$339,436 on September 31, 2021, compared to CAD$97,193 on December 31, 2020. In the same period, Vejii’s total assets and total liabilities both increased substantially to CAD$1,309,637 and CAD$1,587,752, respectively. For the three months ended September 30, 2021, Vejii reported a gross profit of CAD$52,448 and a gross margin of 32%. For the nine months ended September 30, 2021, the Company reported a gross profit of CAD$109,053 and a gross margin of 14%.

Overall, Vejii reported a net loss of $2,308,682 for the quarter ending on September 30th, 2021, or $0.03 per common share and $7,159,773 and $0.10 for the 9 months ending September 30th, 2021. Compared to the Company’s operating expenses on September 30, 2020, which totaled CAD$1,463, Vejii’s operating expenses for the three months ended September 30, 2021, were CAD$2,344,452. Following the Company’s acquisition of Vegan Essentials LLC on October 28, 2021, Vejii expects fourth-quarter consolidated revenues to be in the range of $1.1 million to $1.2 million.

Additionally, on November 29, 2021, Vejii announced that it has entered into an agreement with Research Capital Corporation in respect of a brokered private placement offering of unsecured convertible debentures of the Company. Each debenture will be offered at $1,000, up to an aggregate principal amount of $5,000,000 or such other amount as the parties may agree upon.

Vejii will also grant Research Capital Corporation an option to offer additional debentures up to an aggregate principal amount of $750,000 by giving written notice to the Company at any time up to 48 hours prior to the closing date, which was anticipated to be December 23, 2021. Vejii intends to use the proceeds from the offering to support M&A, customer acquisition, marketing, and general working capital purposes.

Referring back to Vejii’s Q3 2021 Financial Results, as of September 30, 2021, the Company had a total of 30,000,000 exercisable and outstanding warrants. 20,000,000 of these warrants were issued on September 2, 2020, at an exercise price of $0.001 and an expiry date of September 2, 2025. The remaining 10,000,000 warrants were issued on September 11, 2020, at an exercise price of $0.01 and an expiry date of September 11, 2025.

Vejii’s share price opened at $0.21 on January 5, 2022, up from a previous close of $0.20. The Company’s shares were up 5.00% and were trading at $0.21 as of 1:26 PM EST on January 5, 2022.

Full Disclosure: Vejii Holdings Ltd. (VEJI.C) is a marketing client of Equity Guru.