Vejii Holdings Ltd. (VEJII.C) announced the filing of its interim unaudited and consolidated financial statements for the three months ending September 30, 2021.

“We are particularly happy with our results this quarter, we were able to generate improved gross margin, lower cost of customer acquisition and improved returns on ad spend right before going public in November of 2021. Now that we have dialed in our processes and business model, we can more efficiently deploy capital in ramping up customer acquisition in a more sustainable manner…

We believe partners are increasingly seeing the value we provide through our marketplace, with brands having the ability to either ship products directly to the consumer for orders received through Vejii, or leverage Vejii’s established distribution network and take advantage of the fulfilled by Vejii service, where we handle pick, pack, and ship to the end customer via Vejii Express,” commented Vejii’s CEO, Kory Zelickson.

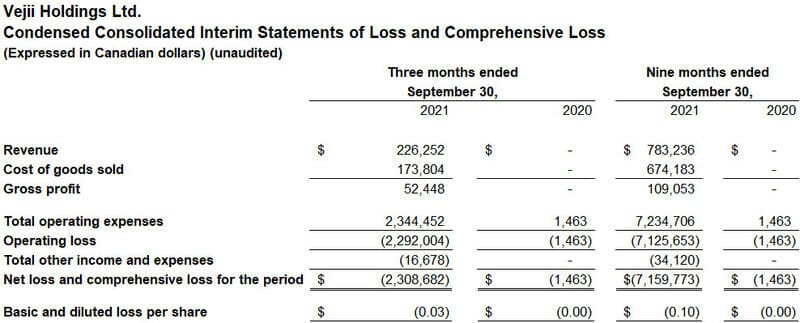

For starters, let’s quickly go over Vejii’s unaudited interim consolidated financial statements for the three months ended September 30, 2021. According to the Company financial results, Vejii had cash of CAD$339,436 on September 30, 2021, up from CAD$97,193 on December 31, 2020. In the same period, Vejii’s total assets and total liabilities both increased substantially to CAD$1,309,637 and CAD$1,587,752, respectively. Keep in mind, Vejii only just recently began trading on the CSE.

Prior to listing on the CSE, Vejii achieved a major milestone via the launch of its Canadian platform, at ca.shopvejii,com, an online marketplace for vegan and plant-based products. The Company initially launched its shopvejii.com platform on November 19, 2020, however, the establishment of a Canadian platform has provided the Company with access to Canada’s approximately 2.3 million vegetarians and 850,000 vegans.

Getting back to Vejii’s financials, for the three months ended September 30, 2021, the Company reported revenue of CAD$226,252 and a gross profit of CAD$52,448. In the same period, Vejii’s gross margins were 23% and 14% for the nine-month period ended September 30, 2021. In total, Vejii reported a net loss of CAD$2,308,682 for the three months ended September 30, 2021, and CAD$7,159,773 for the nine months ended September 30, 2021. Following Vejii’s recent acquisition of Veg Essential LLC. on October 28, 2021, the Company expects Q4 consolidated revenues to be somewhere between $1.1 and $1.2 million.

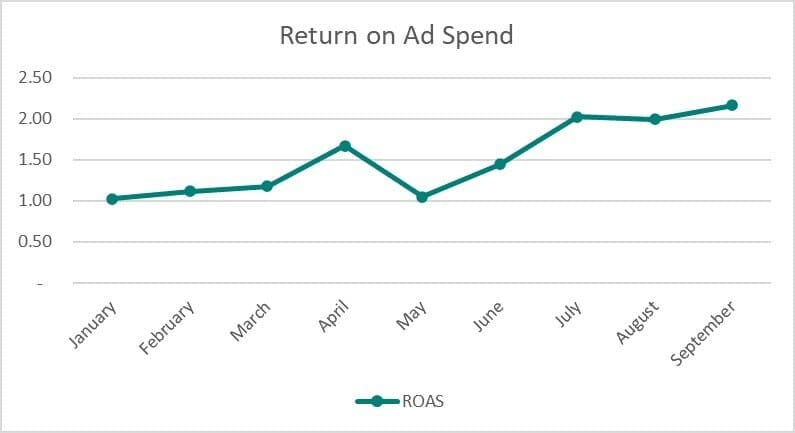

With this in mind, in the last few quarters, Vejii has focused on improving its gross margins, reducing the cost of customer acquisition (CAC), and increasing return on ad spend (ROAS). As a result, Vejii expects these efforts to have a positive impact on the Company as it continues to deploy capital to scale its CAC. There’s a joke in here somewhere. Furthermore, revenues throughout Q3 2021 and the year continue to be favorably impacted by the Company’s strategy to expand its product offering. Vejii is also focusing on logistics solutions, like same-day delivery in key markets, which is expected to drive higher average order values and order frequency.

As previously mentioned, Vejii is focused on increasing its ROAS. That being said, during the nine-month period ending September 30, 2021, the Company’s ROAS continued to trend upwards, indicating a significant improvement over the past nine months. According to Vejii, this trend has continued to improve into Q4 2021. Additionally, Vejii has driven down its CAC over the last few months. More specifically, for September 2021, CAC for new customer accounts was $67.43, which continued to trend downward in October.

With the increasing competition among CPG brands competing for the same limited shelf space and the same large retailers, we believe Vejii is well-positioned for growth as our ability to offer an ever-growing selection is not limited to a retail footprint. We welcome partnering with brands across every category of plant-based and sustainable products, as we continue to expand our distribution reach and gain new customers,” continued Kory Zelickson.

In his commentary, Kory Zelickson states that Vejii is “not limited to a retail footprint.” With this in mind, it is worth noting that the Global Food and Grocery Retail Market was valued at USD$11.7 trillion in 2019. Having a retail footprint sounds pretty good, right? However, this market is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2020 to 2027. On the other hand, the Global Online Grocery Market is expected to reach a value of USD$1.1 trillion by 2027.

While this market’s value is significantly overshadowed by the Global Food and Grocery Retail Market, it is expected to expand at an impressive CAGR of 24.8% from 2020 to 2027. Increasing adoption of online shopping is expected to accelerate this market’s growth during the forecast period. With this in mind, the Global Online Grocery Market may not be as valuable, but it is expanding at a rapid rate, which looks good for companies like Vejii that already have skin in the online retail market. If you would like to know more about Vejii, check out Equity Guru’s exclusive interview with Kory Zelickson below!

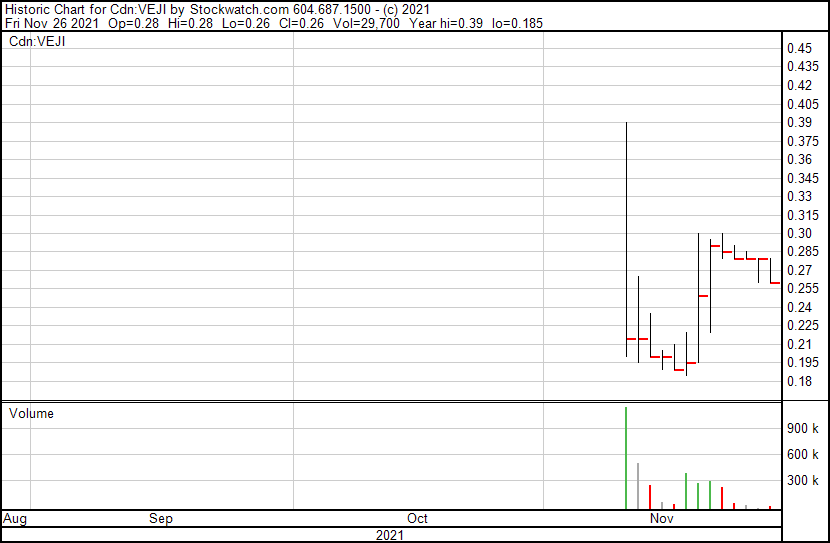

Vejii’s share price opened at $0.28 and is down -7.14%. The Company’s shares were trading at $0.26 as of 10:03 AM ET.