In early October, there were indications that an important bottom was forming in the precious metals arena.

The following excerpts are from a (timely?) article I put up on October 4th—Unabated selling, dry powder, the upside of buying when you’re the only bidder in the room – a Guru roundup (Part 1)

(click on the following charts to bring them more into focus)

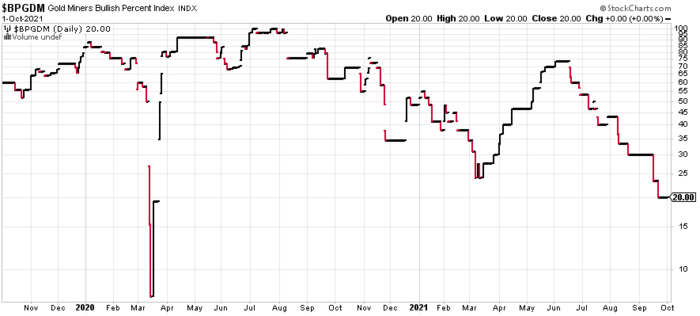

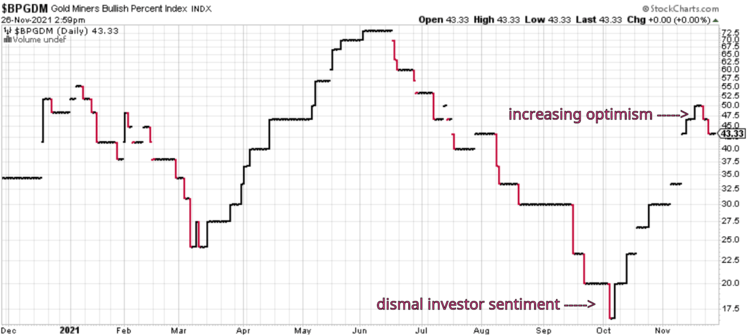

One indication that this sector-wide correction is getting long in the tooth is the current level of negative sentiment—the pervasive despair among investors as measured by the Gold Miners Bullish Percent Index. Not since the 2020 market crack has pessimism sucked thus and so.

Bottoms have a way of forming when negative emotions run this deep.

Psychologically, it’s effortless buying during an uptrend, especially when the online message boards abound with bullish I-can’t-believe-how-freakin-great-this-company-is type commentary.

But when sentiment is this bad—when fund managers and hapless retail investors toss their positions with little regard for intrinsic value—it’s difficult, painful even, stepping up to the plate and initiating purchases.

Buying severely depressed stocks is a counterintuitive process—an exercise that should trigger a host of negative emotions on a gut level.

In cycles past, my biggest wins in this arena stemmed from overriding my reluctance and apprehension, holding my nose, and willing myself to pull the trigger on my trading platform. This is the act of a true contrarian: Standing alone. Buying when you’re the only bidder in the room.

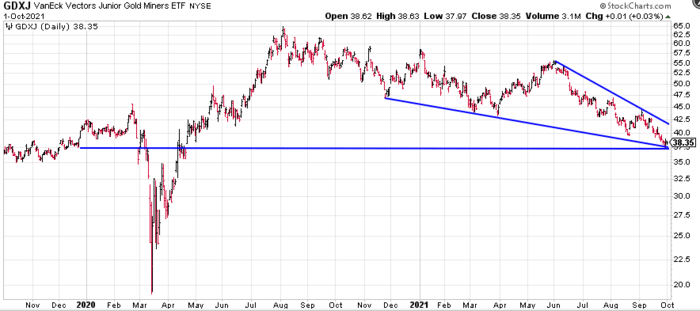

Though charting is a largely subjective exercise—surety depends on how sharp your pencil is—it can be a valuable tool. At the very least, it can help structure your thinking where entry and exit points are concerned.

This chart of the VanEck Junior Gold Miners ETF (GDXJ), augmented by my support/trendlines, tells me that the sector may be in the process of bottoming out.

A disciplined chartist always looks for more evidence.

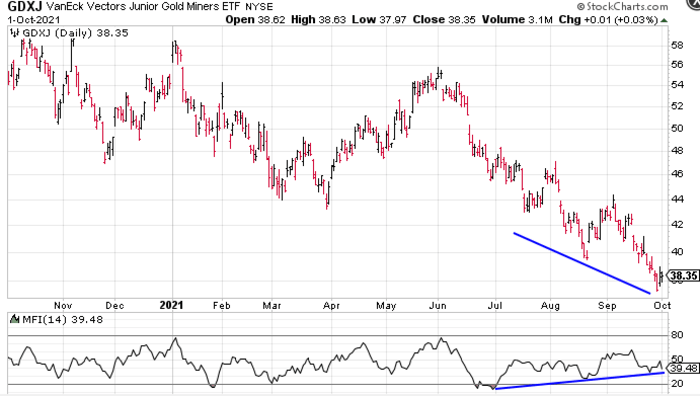

Back in my rookie days, my trading mentor stressed the importance of Divergences (positive and negative). A Positive Divergence occurs when the price of a commodity, index, or stock prints a new low while a momentum indicator (Money Flow, for example) registers a higher low.

This next image zooms in on the GDXJ and shows a classic Positive Divergence in the making.

The new lows in the GDXJ versus the higher lows in the MFI is an indication that the downtrend is losing momentum.

The correlation between the negative sentiment readings, the various support/trendlines, and this Positive Divergence lends validity to the notion that a bottom may be near.

Back to the here and now

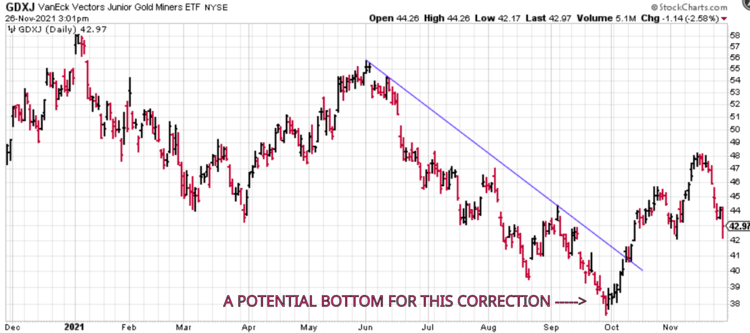

The GDXJ was trading at $38.35 when I published that piece in early October—it traded north of $48.00 in recent sessions, having broken out from the downtrend line presented above…

The GDX? It has a similar price pattern and breakout.

The other chart I featured in early October—the Gold Miners Bullish Percent Index (BPGDM)—now depicts greatly improved sentiment in the gold arena.

The crux of the matter: it could be game on for the precious metals sector, despite the brutal lashing the metal and shares have endured over the past few sessions. This latest round of WHAT FOR started when Federal Reserve Governor Christopher Waller got all hawkish with his metaphors in a speech to the Center for Financial Stability last Friday

The selloff found a new gear on Monday when President Biden re-nominated Jerome Powell to the big chair at the Fed (Gold traders don’t like the Fed Chair).

Scrolling back up to the current GDXJ chart, we want to see a higher low printed here. If we get a close below $42.00 on significant volume, all bets are off (the GDXJ is currently hovering around $43.00 as I edit this piece).

On the GDX, the $31.00 level needs to hold.

Enough politics and TA.

Cultivating options in the junior arena

It’s essential to keep in mind that every day a mining company digs ore out of the ground—every day they’re open for business—their mineral inventory contracts.

Whether we’re talking about a Senior, a Mid, or a Small Producer, a robust pipeline of development projects is the key to long-term survival in this business.

The brutal bear market of the past decade forced many of these companies to dramatically scale back exploration spending. Unable to grow their project pipelines organically, through exploration, many of these producing entities are forced to take on the role of acquirer… predator.

A mine’s impermanence is what makes investing in this sector so damn compelling. If a Junior tags a significant new discovery, you can bet it’ll be stalked by a pack of resource-hungry predators.

In recent weeks we’ve seen M&A activity in the gold sector begin to pick up. Late last September Agnico Eagle and Kirkland Lake announced their intention to combine in a deal valued at $13.4 billion.

More recently, Australian-based Newcrest took out Pretium in a deal valued at $3.5 billion.

If the pace of M&A is indeed beginning to accelerate, companies with significant resources, or new discoveries on their books, likely have a target on their back.

A list of ExploreCos with sub-$20M market caps

What follows is not a complete list by any measure. I’ve become familiar with some of these companies and appreciate the underlying fundamentals. Some merely pique my curiosity. In one or two cases, I may have issues with how the companies are run, but Mother Nature—the underlying geology—doesn’t give a rats ass what I think or say, so I embrace the opportunity to be proven wrong.

FYI, the watchlist function over at ceo.ca is the perfect tracking tool. The following video, hosted by ceo.ca moderator and friend Chris @Vaughan, will show you the ropes…

How to use CEO.CA Part 2 – Watchlists

Due to the length of this list—to prevent this roundup from turning into War and Peace—I’m offering only a cursory peak under the hood. You need to conduct your own due diligence.

Though this sector is often fraught with risk, one decent discovery hole can trigger a processional effect that can be downright inspiring, life-changing even.

I’m giving you half of my sub-$20M list (alphabetically A thru K) today, the other half (M thru V) on Monday, November 29th.

Altan Rio Minerals (AMO.V)

- 96.65 million shares outstanding

- $13.53M market cap based on its recent $0.14 close

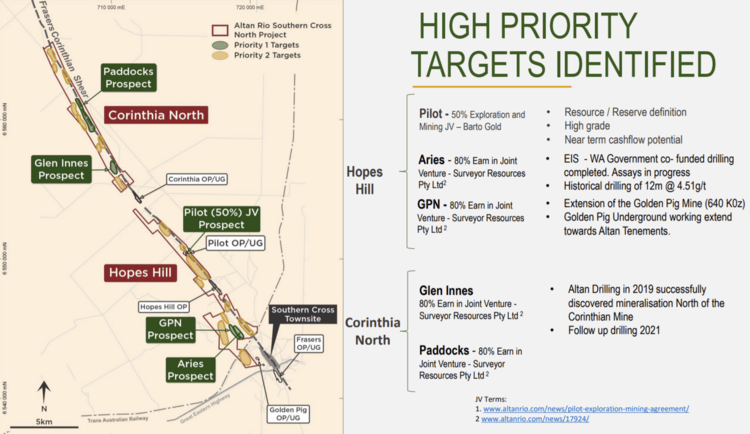

Altan Rio has received coverage here in recent months, perhaps best presented in my September 2nd piece titled Altan Rio Minerals (AMO.V) poised to unlock gold-rich potential at its Southern Cross Project in Western Australia.

The Company holds a strategic land position in a vastly under-explored region of the prolific Yilgarn Craton (YC) of Western Australia. YC boasts an extraordinary mineral endowment hosting the likes of Murchison (>30M ounces), Laverton (41M ounces), Leonora (>44M ounces), Kalgoorlie (>160M ounces).

Altan Rio’s flagship Southern Cross Project, a largely untapped stretch of highly prospective terra firma, encompasses some 139.6 square kilometers of a significant gold hosting structure—the Frasers-Corinthian Shear Zone—along the northern portion of the Southern Cross Greenstone Belt.

The Company has defined multiple high-priority drill targets along this greenstone belt.

There’s a lot of depth to this play, one that will unfold in stages, the first being a highly anticipated drill campaign designed to further expand a gold discovery at the historic Pilot Mine.

Pilot RC Drilling Program to Re-Commence at the High Grade Pilot Deposit

Additional insight can be drawn via the following Guru articles…

Mining for the layman: Altan Rio Minerals (AMO.V) is unknown, unseen, and potentially unreal

Aston Bay (BAY.V)

- 163.98 million shares outstanding

- $9.02M market cap based on its recent $0.055 close

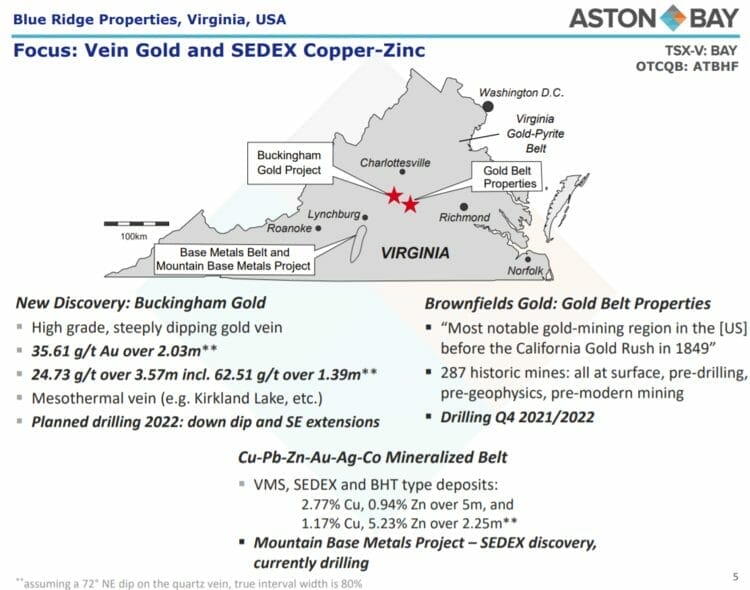

Expertly run Aston Bay is largely focused on the discovery potential of its Blue Ridge Properties in Virginia—a vastly underexplored region that has seen little in the way of modern exploration methods.

Recent exploration efforts tagged a significant new gold discovery at its Buckingham Gold Property, a discovery marked by two high-grade hits: 35.61 g/t Au over 2.03 meters and 24.73 g/t Au over 3.57 meters (including 62.51 g/t Au over 1.39 meter).

There was a flurry of recent trading activity surrounding its Mountain Base Metals Project in recent sessions. The following headline was the catalyst:

Thomas Ullrich, CEO:

“We are excited to partner with another local private landowner to examine the tremendous potential in this under-explored base metal belt. We have significantly expanded the mineralized footprint and confirmed that this is a sedimentary exhalative (SEDEX) system. This is just what our team, led by Don Taylor, has been targeting. SEDEX deposits are an important source of base metals world-wide and are prized for their large scale potential and consistency. Well-known SEDEX deposits include Red Dog in Alaska, Sullivan in British Columbia and Mount Isa in Australia. These deposits form in basin environments and usually form camps with multiple occurrences. The prospective lithologies in Virginia that Don Taylor targeted as a potential SEDEX host are virtually unexplored for this deposit type before now. Samples from the initial drillholes are at the lab and we eagerly await the results. We are excited to continue drilling.”

A recent option agreement covering the Company’s Storm Copper and Seal Zinc projects should see these two Nunavut properties come back into the light. Australian-based American West Metals stands to earn 80% in the projects by spending C$10 million over nine years, $2 million of which is a firm commitment over the first two field seasons. Commencement of a round of geophysics—a ground electromagnetic (EM) geophysical survey—was announced on August 11th to light-up potential drill targets.

Baru Gold (BARU.V)

- 190.17 million shares outstanding

- $19.97M market cap based on its recent $0.0105 close

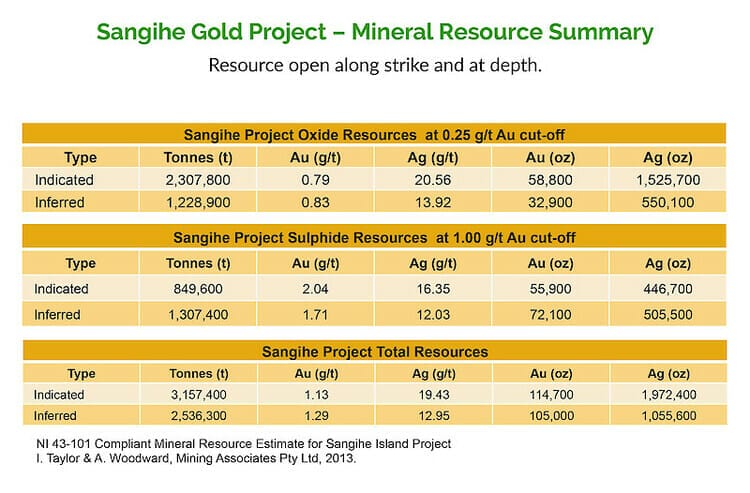

Baru’s flagship asset—the Sangihe Gold Project—consists of 42,000 hectares covering the southern half of Sangihe Island, located between the northern tip of Sulawesi Island (Indonesia) and the southern tip of Mindanao (Philippines).

While management was fast-tracking Sangihe to production (cash-flow was expected earlier this year after receiving the ‘all-clear’ from the Indonesian Ministry of Energy and Mineral Resources), the Company was dealt several rounds of What-for. After diligent action on management’s part, the Company is now pushing Sangihe aggressively along the development curve—the first gold pour is expected in January.

Baru has a 70% working interest in the project—three Indonesian companies hold the remaining 30%.

Baru management, a seasoned team of mine builders and rock kickers, has its sights set on a modest heap leach scenario.

Stage One of the Sangihe mine plan will see the production of roughly 1,000 ounces of gold per month when the facility is fully operational. AISC could be as low as $800 per oz.

On October 20th, the Company signaled its intention to conduct a structural study for the entire Sangihe Island ‘Contract of Work’ area:

Baru Gold Announces Structural Study

Additional insights can be gleaned via the following Guru offering:

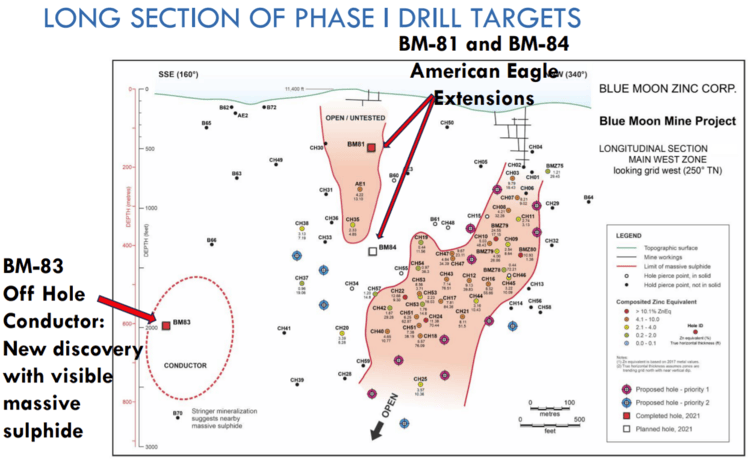

Blue Moon Metals (MOON.V)

- 148.08 million shares outstanding

- $7.4M market cap based on its recent nickel close

Blue Moon has also received coverage here in the past.

The Company’s flagship Blue Moon Project is a VMS play in east-central California, in the Mariposa County foothills.

Blue Moon’s current NI 43-101 mineral resource stands at 7.8 million Inferred tons at 8.07% zinc equivalent (4.95% zinc, 0.04 oz/t gold, 0.46% copper, 1.33 oz/t silver), containing 771 million pounds of zinc, 300,000 ounces of gold, 71 million pounds of copper, and 10 million ounces of silver.

After a modest raise earlier in the year, the Company initiated a 2,400-meter drill campaign designed to test a number of high-impact targets that could represent new VMS lenses.

On November 8th, the Company announced visible massive to semi-massive sulfides in its drill core:

Blue Moon Discovers Additional Zone, West of Current Mineral Zone

Additional MOON insights can be gleaned via the following link:

Blue Moon Zinc (MOON.V) looks to drill flagship VMS project in Mariposa County, California

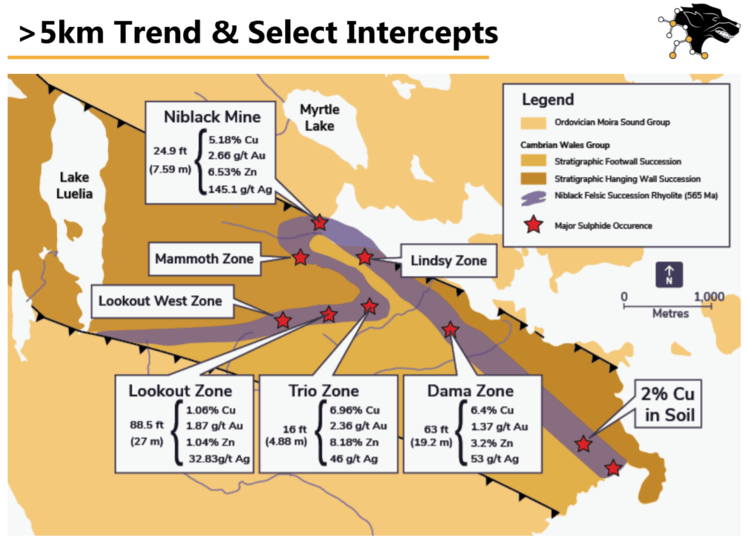

Blackwolf Copper and Gold (BWCG.V)

- 29.07 million shares outstanding

- $18.32M market cap based on its recent $0.63 close

Previously hailed as ‘Heatherdale,’ this expertly run exploreco holds a 100% interest in the high-grade Niblack VMS Project located at tidewater on Prince of Wales Island in southeast Alaska.

If you’ve been following these pages for any length of time you know that VMS deposits rarely occur in isolation—where there’s one deposit (or lens), there are often others.

Niblack boasts a high-grade polymetallic resource. At a US$50 net smelter return (NSR) cutoff, a November 2011 (43-101 compliant) resource shows:

- 5.6 million tonnes grading 0.95% copper, 1.75 g/t gold, 1.73% zinc, 29.52 g/t silver in the Indicated category; and

- 3.4 million tonnes grading 0.81% copper, 1.32 g/t gold, 1.29% zinc, 20.10 g/t silver in the Inferred category.

Within the Indicated resource block, there’s a continuous higher grade zone that holds 1.12 million tonnes grading 1.71% copper, 3.21 g/t gold, 3.83% zinc, 62.68 g/t silver (at a $150 NSR cut off).

That’s rich rock.

Metallurgical studies have yielded good recoveries via traditional methodologies (refer to slide #20 on the Company’s deck).

The geological sleuths at Blackwolf generated a new geological model for its five-kilometer-long trend of highly prospective VMS host rock, amplifying the resource expansion and discovery potential.

Highlights from a Q4 2020 10 hole surface campaign targeting the historic mine area include:

- LO20-213: 11.08 meters grading 2.33% Cu, 2.98 g/t Au, 45.0 g/t Ag, 1.78% Zn or 5.52% CuEq;

- LO20-213: 5.50 meters grading 4.32% Cu, 1.36 g/t Au, 30.8 g/t Ag, 4.43% Zn or 7.15% CuEq;

- LO20-215: 7.59 meters grading 5.18% Cu, 2.66 g/t Au, 145.1 g/t Ag, 6.53% Zn or 10.75% CuEq;

- LO20-215: 2.80 meters grading 6.10% Cu, 2.56 g/t Au, 56.4 g/t Ag, 0.84% Zn or 8.76% CuEq;

- LO20-219: 3.10 meters: grading 9.34% Cu, 4.25 g/t Au, 76.3 g/t Ag, 3.23% Zn or 14.25% CuEq;

- LO20-222: 4.74 meters grading 2.28% Cu, 0.33 g/t Au, 9.5 g/t Ag, 0.06% Zn or 2.63% CuEq;

- LO20-224: 1.50 meters grading 1.72% Cu, 8.02 g/t Au, 27.7 g/t Ag, 0.37% Zn or 7.78% CuEq.

Highlight intervals from a spring-of-2021 underground campaign targeting the Lookout Deposit include:

- U21-226: 27.00 meters averaging 1.06% Cu, 1.87 g/t Au, 32.83 g/t Ag, 1.04% Zn or 3.08% CuEq (including 4.00 meters averaging 2.61% Cu, 4.93g/t Au, 76.58 g/t Ag, 2.34% Zn or 7.69% CuEq);

- U21-227: 32.60 meters averaging 1.03% Cu, 1.49 g/t Au, 26.54 g/t Ag,0.92% Zn or 2.67% CuEq (including 3.00 meters averaging 2.37% Cu, 3.29 g/t Au, 58.97 g/t Ag, 1.42% Zn or 5.78% CuEq.

Other properties in Blackwolf’s project pipeline include Texas Creek, Cantoo, and Casey, in southeast Alaska—all peripheral to the prolific Golden Triangle of British Columbia.

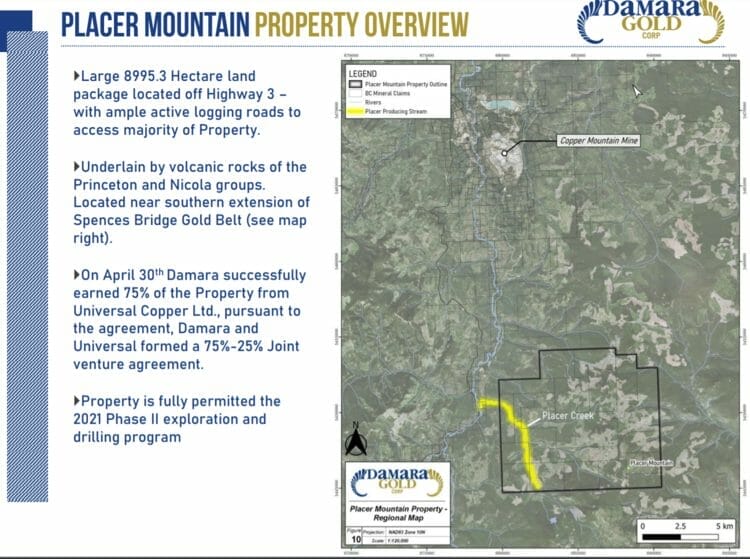

Damara Gold (DMR.V)

- 57.76 million shares outstanding

- $4.91M market cap based on its recent $0.085 close

Damara is focused on the Princeton region of southern British Columbia, an area that played host to one of the more spectacular gold rushes in the province’s history—a boom sparked by John Chance’s Granite Creek discovery in 1885.

At the 7:35 mark, there’s a great story about a man named ‘Johansen’ who stashed several hundred ounces of platinum nuggets (the Chinese miners kept their platinum, the White miners tossed it thinking it had no value). He buried the pail somewhere in the vicinity of his cabin on Granite Creek, intending to retrieve it after he returned from a trip to the Kootenay’s. He never returned. The platinum is still buried there. Somewhere.

Active mines in the region include Copper Mtn’s Copper Mountain Mine (a 31+ year mine life). Significant (new) discoveries in the area include Westhaven’s Shovelnose discovery.

The Company is taking a disciplined approach to drill target definition at its flagship Placer Mountain Project via the application of good science—a combination of geochem and geophysics.

A modest Phase-1 drill campaign conducted earlier this year along the Alpha Vein showing tagged quartz veining in eight out of the nine holes drilled. Results included 1.0 meter of 48.60 g/t Au from 15 meters downhole (Hole PG-20-001) and 4.0 meters of 7.07 g/t Au and 101g/t Ag from 29 meters downhole (Hole PG-20-005).

As part of the aforementioned disciplined geochem/geophyz approach, the Company reported completion of a Phase II soil sampling program on October 15th. A mechanized trenching program was also initiated.

On November 19th, Damara dropped the following headline:

Damara Gold Discovers New Zone, Completes Trenching and Commences Core Drilling on Placer Mountain

An excerpt from this press release:

Trenching Completed at the New Kodiak Zone Discovery

The Company has now completed a mechanized trenching program consisting of the collection of 110 continuous chip samples from a combined total of 322 meters in 4 separate trenches across the newly discovered Kodiak Vein Zone. Mineralized quartz veins were intersected on the western end of Trenches 1, 2 and the eastern end of Trench 3. Bedrock exposure in Trench 4 was limited to one short section due to deep overburden and did not adequately test the strike extension of the vein system. The series of veins intersected are closely spaced, typically 10-50 cm in width and spatially associated with narrow felsic dykes within granitic intrusive rocks. The veins display stronger sulfide mineralization and wider alteration halo’s than is observed at the Main Zone. Assays remain pending for all trench samples.

Grab Samples Confirm Presence of Gold-Silver Mineralization

Rush assays from 10 selected float grab samples collected by soil samplers at the new Kodiak Zone ranged from below detection up to 70.6 g/t gold and 244 g/t silver. The grab samples were collected from two separate areas. One area is 750 meters southwest along trend of the Kodiak Zone veins and the other is 200 meters south-southeast, on a possible separate trend. Neither area has yet had follow up trenching. The Company awaits analytical results for both the trench samples as well as 660 infill and extension soil samples collected during the Phase II program. The results will be used to design a follow up program of maiden core drilling this year as well as further soil sampling, trenching, ground geophysics in 2022.

A 2,000 meter drill campaign is currently underway.

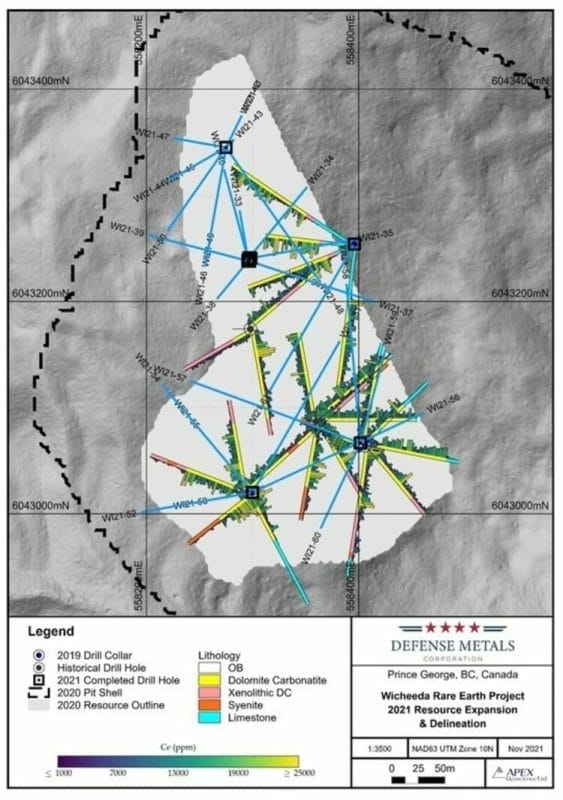

Defense Metals (DEFN.V)

- 80.58 million shares outstanding

- $18.53M market cap based on its recent $0.23 close

Defense Metals is no stranger to these pages.

On November 9th, Defense announced the completion of a 2021 drill program at its Wicheeda Rare Earth Element (REE) Project. Designed to expand the mineralized envelope and upgrade the existing resource to higher confidence categories, this campaign saw 5,349 meters drilled in 29 holes.

Defense Metals Completes Resource Expansion Drilling Program

As it currently stands, the Wicheeda deposit has an Indicated resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and an Inferred resource of some 12,100,000 tonnes averaging 2.90% LREO.

Recent in-depth coverage can be reached by tapping the following link:

Defense Metals (DEFN.V) announces landmark MOU with Sinosteel Corporation

Update: Yesterday (November 24th), the Company released a highly anticipated PEA via the following headline:

A cursory look at the study’s metrics:

- The project has a pre-tax net present value (NPV) of $765 million1, and after-tax NPV of $512 million, at 8% discount rate;

- The pre-tax internal rate of return (IRR) is 20%, and the after-tax IRR is 16%;

- The capital payback is 5 years from start of production, and assumes partial self-funding of construction of hydrometallurgical plant from concentrate sales;

- Revenues average $397 million per year from sale of REE mineral concentrate (years 1-4) and mixed REE hydrometallurgical precipitate (years 5-16).

Operating margin of 65.2%; - Production of a saleable high-grade flotation-concentrate, with average 43% total rare earth oxide (TREO) for the life of the mine. It will be sold to market directly for years 1-4 and will then feed a project hydrometallurgical plant starting in year 5;

- Project near to key infrastructure;

- Base case economics were calculated using rare earth oxide (REO) prices of US$5.76/kg TREO in flotation concentrate and US$14.04/kg TREO in mixed REE carbonate precipitates.

Discovery Harbour Resources (DHR.V)

- 94.51 million shares outstanding

- $3.31M market cap based on its recent $0.035 close

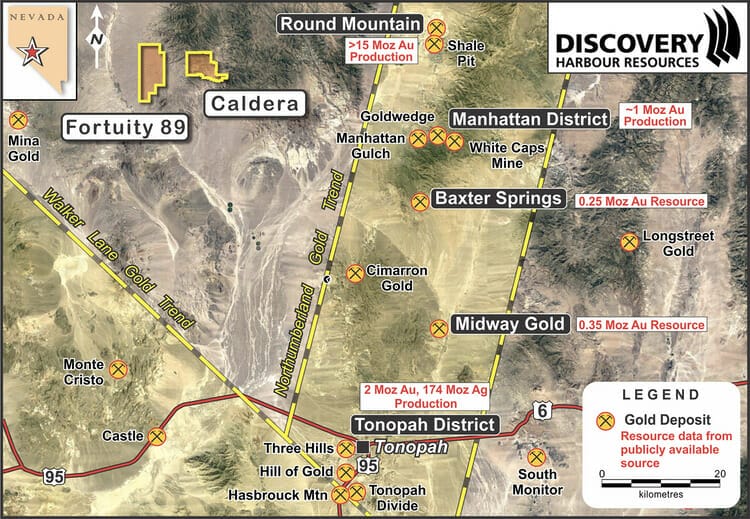

Discovery Harbour is a good example of the type of setup that can help trigger positive price trajectory: Solid management, a world-class mining jurisdiction (Nevada), multiple high-priority drill targets underpinned by a good correlation between layers of geophysics and geochem, a reasonably tight share structure, and a modest valuation. New discoveries in this mining-friendly state, should they demonstrate the potential for grade and scale, will fall in the crosshairs of every producing entity on the continent.

The Company’s Caldera Project, a property with numerous low sulphidation epithermal targets, was the focus of a recent 1,900-meter program that saw five high-priority targets tested with the business end of the drill bit. Unfortunately, this highly anticipated campaign fell short, delivering only marginal results.

Mark Fields, Discovery Harbour’s CEO stated, “Although we did not intersect the type of bonanza zone we were hoping for, the results point to the gold fertile nature of the mineralizing system at Caldera.”

Attention is now drawn to its Fortuity 89 Property, a JV with Australian-based Newcrest Mining.

A Fortuity 89 news update was released on October 28th:

Discovery Harbour and Newcrest Announce Fortuity 89, Nevada Drilling Plans, Extend Timing

Subject to drill rig availability and potential impacts from COVID-19, Newcrest plans to drill a minimum of eight drill holes and 3,400 metres beginning in January, 2022 to test a series of low sulphidation epithermal gold targets on Fortuity 89. Newcrest completed a successful initial exploration program in the spring which included a geophysical program encompassing a 675 line kilometre drone airborne magnetic survey, a 250 station ground gravity survey and a 45 line kilometre audio band magnetotellurics (AMT) resistivity survey as well as geological and alteration mapping and sampling with a soil geochemical program (see news release July 14, 2021). The three geophysical surveys showed anomalies consistent between each different geophysical method and the geological and alteration mapping, establishing promising drill targets. The drill targets are proximal to the very limited outcrop and extend into the large plain overlain by a gravel cover.

Let’s hope Newcrest succeeds in sourcing a rig.

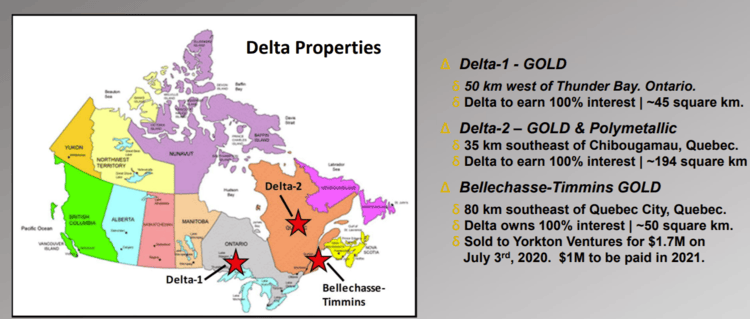

Delta Resources (DLTA.V)

- 37.98 million shares outstanding

- $11.01M market cap based on its recent $0.29 close

Delta has also seen its fair share of coverage here at Equity Guru.

The Company is actively exploring two highly prospective properties in two mining-friendly jurisdictions—Ontario and Quebec. Both projects have been subjected to multiple rounds of early-stage exploration—structural mapping, geochem, geophysics. Both are in the early innings of (potential) discovery and resource definition (Delta-2 is already lit up).

DELTA-1 is a wholly-owned 45 km2 project located in the Thunder Bay region of Ontario. Weighty (pristine) gold grain counts and an expansive gold-bearing alteration halo characterize a highly prospective regional structure.

DELTA-2 is divided into two distinct zones—Delta-2 Gold and Delta-2 VMS. This wholly-owned 170 km2 project is located in the prolific Chibougamau District of Quebec.

On November 17th, the Company announced the commencement of what promises to be an aggressive drill campaign—over 75 drill targets have been prioritized along this 194 square-kilometer property:

Delta Starts Drilling at Its Delta-2 Gold and VMS Property in Chibougamau, Quebec

Drilling has begun.

At the Delta-2 VMS project, Delta will be drill-testing:

- Three deep gravity anomalies with responses comparable to those over known world-class VMS deposits such as the Lemoine Mine (see press release June 22, 2021);

- Up to 30 high-priority VTEM conductors showing geophysical signatures typical of VMS deposits.

The current program will see 36 holes drilled for 7,400 meters.

In addition to drilling, a round of geophysics—gravity and VTEM surveys—is also planned to cover the newly acquired Dollier-Cartier property next door.

At the Delta-2 Gold, the Company will be drill-testing:

- Two structures hosting both the R14 gold prospect and Delta’s new OLI gold discovery (see press release on April 21, 2021). The structures span several kilometers and remain largely untested between the main occurrences and along strike;

- A new gold-bearing structure which hosts the Lone Pine gold occurrence where preliminary assay results have returned 18.8 g/t Au and 21.1 g/t Au in grab samples. The gold structure can be followed on LiDAR imagery for a strike length of up to 1.5 kilometers;

- Several never-tested structures outlined on LiDAR imagery—those shown to be gold-bearing as per Delta’s summer and fall 2021 program of geological mapping, sampling, prospecting, and mechanical trenching.

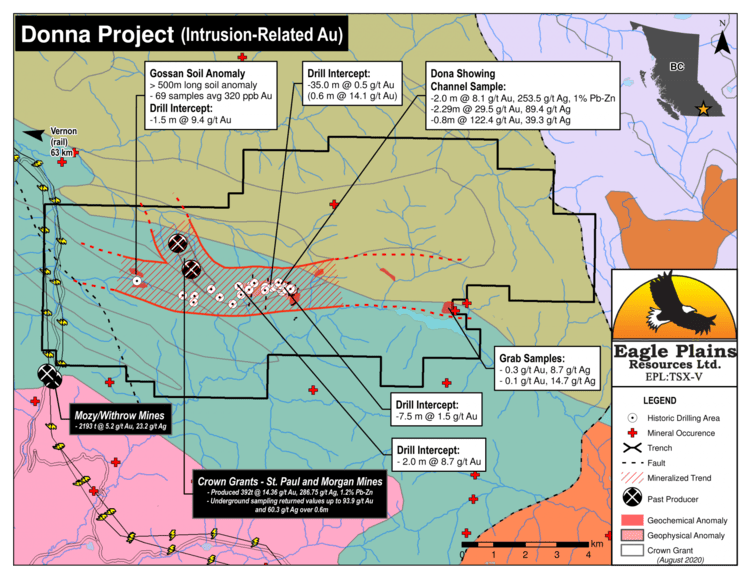

Eagle Plains Resources (EPL.V)

- 99.79 million shares outstanding

- $15.47M market cap based on its recent $0.155 close

Eagle Plains has been around for quite some time. The Company thrives on prospect generation; that is, management deploys the prospect generator business model with strategic partners who take on much of the risk, pushing a project further along the exploration and development curve for a majority stake.

Eagle Plains has honed its PGM model, and is known to:

- Research, acquire & develop mineral exploration projects using in-house geological expertise.

- Utilize the earn-in contributions of option partners to fund development of exploration projects.

- Generate revenue through Terralogic Exploration Inc., a wholly owned subsidiary.

- Spin-out advanced projects to make available for acquisition and create shareholder value.

This is a disciplined crew.

Exploration expenditures on EPL projects between 2011 and 2020 exceeded $22M, most of which was funded by third-party partners. This exploration work included extensive ground-based exploration work and 37,000 meters of diamond drilling.

The Company holds a vast portfolio of gold, base-metal, and uranium projects in Western Canada—many are at the drill-ready, or near drill-ready stage.

Projects generating headlines in recent months include Schotts Lake, Donna, Knife Lake, Slocan Graphite, and Pine Channel,

The most recent headline out of the Company laid out an option agreement involving its Slocan Graphite Project:

Eagle Plains Executes Option with Aben Resources on Slocan Graphite

The Company also has an extensive portfolio of royalty assets—2% Net Smelter Return Royalties (NSRs)—most of which carry buydown clauses.

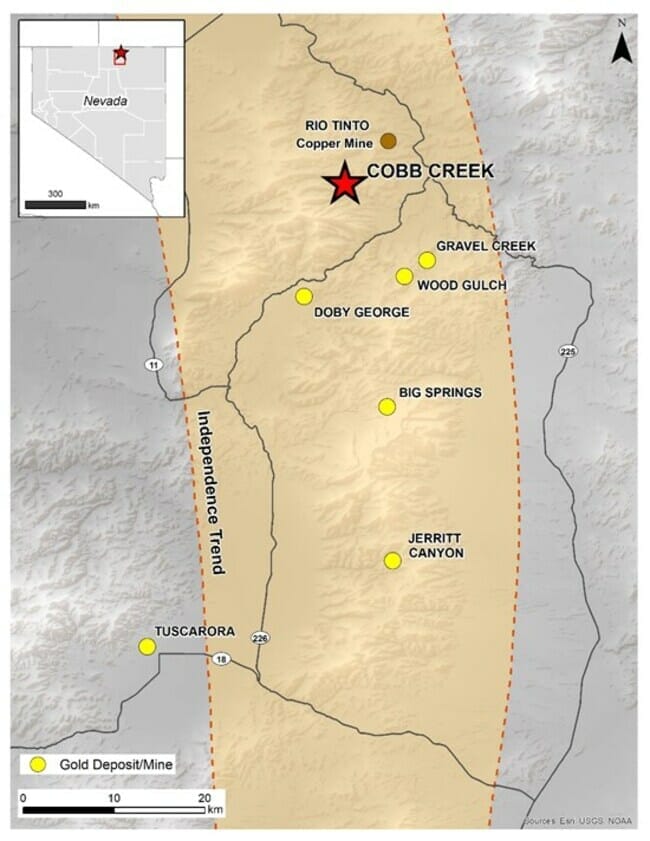

Fremont Gold (FRE.V)

- 146.11 million shares outstanding

- $3.65M market cap based on its recent $0.025 close

Run by a proven team of mine-finders, this Nevada-focused ExploreCo has assembled a portfolio of highly prospective projects along Nevada’s Carlin, Cortez, and Independence Trends.

2021 has been tough sledding for the Company as a 2020 drill campaign at the Griffon Project (top south of the Cortez Trend) failed to tag anything significant.

The Company then turned its focus to its North Carlin Gold Project (northern end of the Carlin Trend) in 2021, but again, a discovery in these (subsurface) Carlin layers proved elusive.

After a recent management change and a modest raise, the Company turned its focus to its Cobb Creek Project in Elko County Nevada.

“The Cobb Creek project occurs at the northern end of the Independence trend, one of the most important gold belts in northern Nevada and contains a non-N43-101 compliant, historic resource of 160,000 ounces gold, named the McCall deposit.”

An August 17th press release, aside from declaring newly acquired hectares, outlined plans for Cobb Creek—a round of geological mapping, rock chip sampling, a new systematic soil geochemical survey, and a ground magnetic survey.

Fremont Stakes More Ground at Cobb Creek Gold Project – Increases Property Area by 30%

This disciplined groundwork increases the odds of tagging a significant new discovery. With the Company’s tiny $3.65M valuation, any positive news on the exploration front should push this orphaned stock off these low-born levels.

For now, it’s a waiting game.

Freeport Resources (FRI.V)

- 96.1 million shares outstanding

- $12.01M market cap based on its recent $0.125 close

We’ve covered Freeport several times in these pages over the past 12 months.

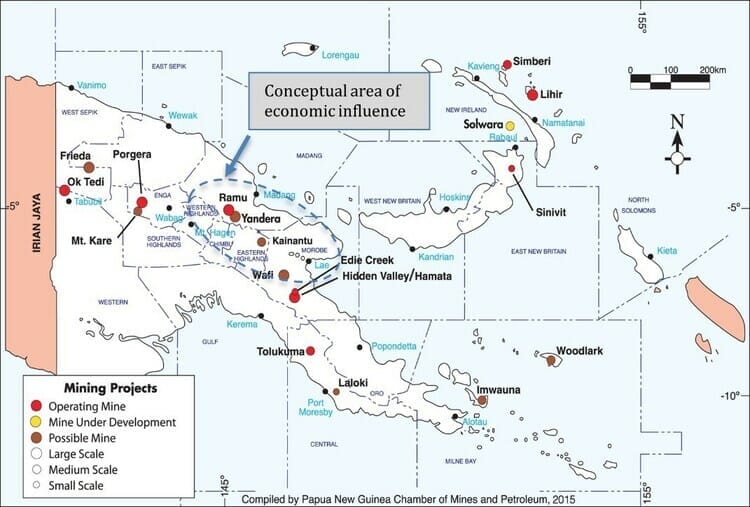

The Company acquired two massive copper-gold porphyry projects—Yandera and Star Mountains—within the prolific New Guinea Orogenic Belt, host to a truly epic sequence of ore bodies: Grasberg, Ok Tedi, Porgera, Hidden Valley, Wafi/Golpu, and Frieda River.

Grasberg… say no more.

Deemed one of the largest undeveloped copper deposits on the planet, a Yandera PFS completed by Worley Parsons in 2017 showed total resources of 959 million tonnes of copper equivalent at a grade of 0.37%.

Yandera’s breakdown is as follows: Measured & Indicated = 728 million tonnes grading 0.39% copper equivalent with 541 million tonnes categorized as Probable Reserves averaging 0.39% copper equivalent. The M&I resource equates to 6.2 billion pounds of copper equivalent—total resources equate to nearly 8 billion pounds of copper equivalent. Is it just me, or is that a lot of copper?

An August 16th headline:

Freeport Completes Acquisition of Yandera Copper Project

There are no economic studies on Star Mtn, but the project has an Inferred resource of some 210 Mt @ 0.4% Cu and 0.4 g/t Au for 840,000 tonnes of contained copper and 2.9 Moz of contained gold. This equates to roughly 7 million ounces of gold equivalent or 3 billion pounds of copper equivalent. Again, is it just me, or is that a lot of glitter and (red-orange) luster?

Two critical pieces of news concerning Star Mtn dropped earlier this year, including this mid-September headline:

Freeport Receives Extensions for Star Mountains Tenements EL 2467, EL 2001 and EL 1781

The Company hasn’t been generating much in the way of newsflow in recent months—Papua New Guinea is dealing with a host of challenges on multiple fronts.

A travel advisory dated November 15, 2021—Papua New Guinea Travel Advisory

Do not travel to Papua New Guinea due to COVID-19, crime, civil unrest, health concerns, natural disasters, and kidnapping. Some areas have increased risk. Read the entire Travel Advisory.

Despite these urgent issues, there are few regions left on this planet with this kind of mineral endowment.

Patience is required here.

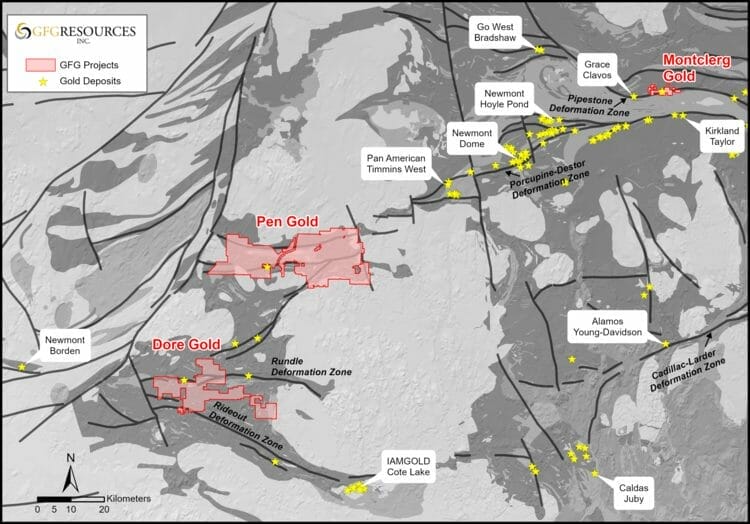

GFG Resources (GFG.V)

- 140 million shares outstanding

- $19.6M market cap based on its recent $0.14 close

GFG Resources is a company I’ve been tracking since the winter of 2019.

The Company is targeting district-scale gold deposits in Ontario and Wyoming.

In the Timmins Gold Camp of Ontario, the Company is exploring its Montclerg, Pen and Dore gold projects (the Timmins camp is credited with over 70 million ounces of Au).

In a November 8th press release, the Company trotted out its latest acquisition:

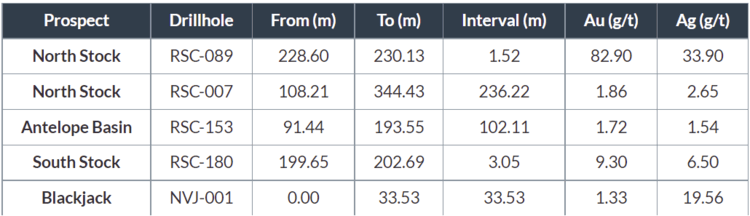

The Company’s wholly-owned Rattlesnake Hills Gold Project, located roughly 100 kilometers southwest of Casper, Wyoming, boasts district-scale potential.

Rattlesnake drill hole highlights…

An April 14th headline concerning Rattlesnake Hills:

“In Wyoming, the Company has partnered with Group 11 through an option and earn-in agreement to advance the Company’s Rattlesnake Hills Gold Project with a technology that could revolutionize the gold mining industry. The geologic setting, alteration and mineralization seen in the Rattlesnake Hills are similar to other gold deposits of the Rocky Mountain alkaline province which, collectively, have produced over 50 million ounces of gold.”

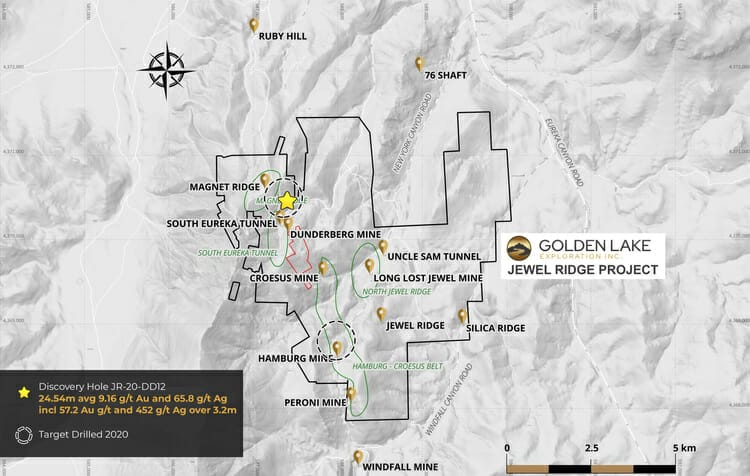

Golden Lake Exploration (GLM.C)

- 63.2 million shares outstanding

- $10.11M market cap based on its recent $0.16 close

Golden Lake is another Exploreco that is no stranger to these pages.

Jewel Ridge, located at the south end of Nevada’s prolific Battle Mountain-Eureka Trend, is the Company’s flagship. The property lies along strike and contiguous to Barrick’s past-producing (two million ounce) Archimedes/Ruby Hill mine to the north, and Timberline Resources’ advanced-stage Lookout Mountain Project to the south.

The property is host to several historic small gold mines aligned along a north-south-trending stratigraphic contact of Lower Paleozoic sedimentary rocks, as well as several other gold-mineralized zones with a variety of structural and lithological controls.

Multiple targets have been defined—Carlin-type gold mineralization is the quarry.

The Company triggered a flurry of speculative activity earlier this year when it tagged an impressive 9.16 g/t Au, 65.8 gg/t Ag, 1.03% Pb, and 1.90% Zn over 24.54 meters (from surface).

A higher bonanza-grade interval, from 15.21 meters to 18.44 meters, averaged 57.16 g/t Au, 452.0 g/t Ag, 7.23 % Pb, and 11.99% Zn over 3.23 meters.

On May 6th, the Company launched a 6,100 meter Phase-2 drill campaign to follow up on this high-grade discovery hole.

Initial Phase-2 results were released on July 22nd, the headline interval carrying 5.85 g/t Au, 18.3 g/t Ag, 0.38 % Pb, and 1.28 % Zn over 18.68 meters.

On September 16th, the Company released additional results from their Phase-2 campaign:

The Company is also active on its Copperview Property, a south-central British Columbia project adjacent to Kodiak Copper’s MPD Property.

A September 9th Copperview-related headline:

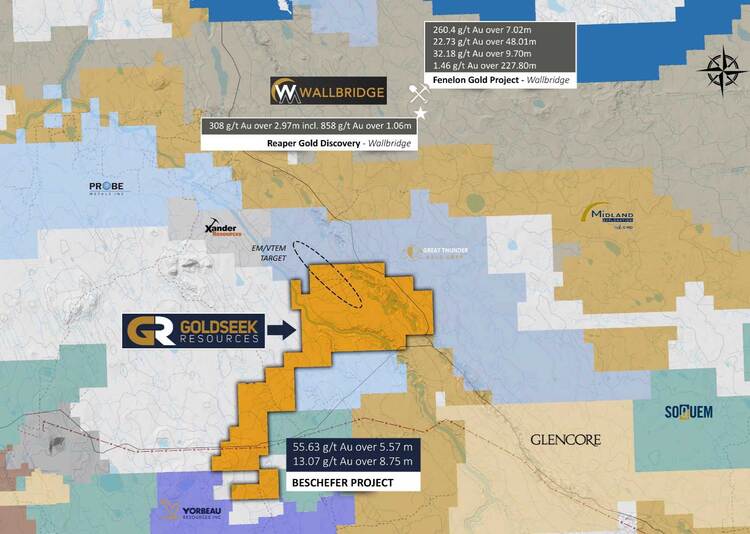

Goldseek Resources (GSK.C)

- 32.96 million shares outstanding

- $4.28M market cap based on its recent $0.13 close

Goldseek holds an extensive project pipeline in some of Canadas most prolific gold camps: Hemlo, Urban Barry, Quevillon, Val D’Or North, and Detour.

The Company’s flagship Beschefer Project is located roughly 30 kilometers southwest of Wallbridge’s Fenelon Gold Project—Fenelon holds multi-million-ounce potential.

Beschefer historical drill hole highlights:

- 55.63 g/t gold over 5.57 metres in hole BE13-038 (including 224 g/t over 1.23m);

- 13.07 g/t gold over 8.75 metres in hole B12-014 (including 58.5 g/t over 1.5m);

- 3.56 g/t gold over 28.4 metres in hole B14-006 (including 7.42 g/t over 5.5m);

- 10.28 g/t gold over 8.00 metres in hole B14-35 (including 86.74 g/t over 0.60m);

- 12.40 g/t gold over 3.78 metres in hole B11-003.

The highlight interval from the first seven holes of a recent 5,000-meter (18 hole) campaign tagged an impressive 4.92 g/t Gold over 28.65 meters (including 11.39 g/t Au over 9.1 meters).

An October 6th headline:

Goldseek Intersects 4.92 g/t Gold Over 28.65 Meters at Beschefer

On November 23rd, the Company announced additional results from its flagship project:

Goldseek Continues to Hit at Beschefer with 2.17 g/t Gold Over 13.2 Metres

Highlights:

- 2.17 g/t gold over 13.2 meters, including 3.9 g/t gold over 5.6 meters, in the Central Shallow Zone.

- 2.01 g/t gold over 13.0 meters in an up-dip East Zone Extension hole.

- 6 of 7 holes returned gold values supporting the continuity of the B14 gold-bearing structure.

- Base metal potential on intercepts is still to be determined based on alteration indicators and copper sulfide occurrences.

Jon Deluce, CEO:

“We are very excited to announce continued strong intercepts from our maiden 5,000-metre program at Beschefer. The results support the continuity of the northeast mineralized trend for over a kilometer once combined with all historical drilling. Our best results from this batch support identifying at least two gold shoots that present possibilities of down-dip extensions.

We look forward to the remainder of the results, with our three 100–175-metre extension/step-out holes on the East Zone still outstanding, which hit the mineralized zone with favourable indicators observed over intervals similar to previous holes. As we continue to process and report results, we are starting to plan our follow-up winter drill program with a targeted start in January 2022.”

Flash forward to November 25th: The Company released the final three stepouts from the untested East Zone ground.

Goldseek Intersects 0.96 g/t Gold over 19.9 Metres in East Zone Extension at Beschefer

Highlights from this November 25th press release:

- 0.96 g/t gold over 19.9 meters, including 1.56 g/t gold over 7.0 meters, in a 90-metre north-east step-out hole;

- Finely disseminated chalcopyrite observed between 30 and 200 meters—the three step-out holes carry copper potential (base metal results are pending);

- 15 of 17 holes returned gold values highlighted by 4.92 g/t gold over 28.65 meters (141 Metal Factor), including 11.39 g/t gold over 9.1 meters, the 2nd best intercept on the Property to date in terms of grade and thickness (BE-21-02);

- A follow-up drill program is being planned, and commencement is targeted for late January.

For a deeper delve into the Company, the following piece dated October 12th:

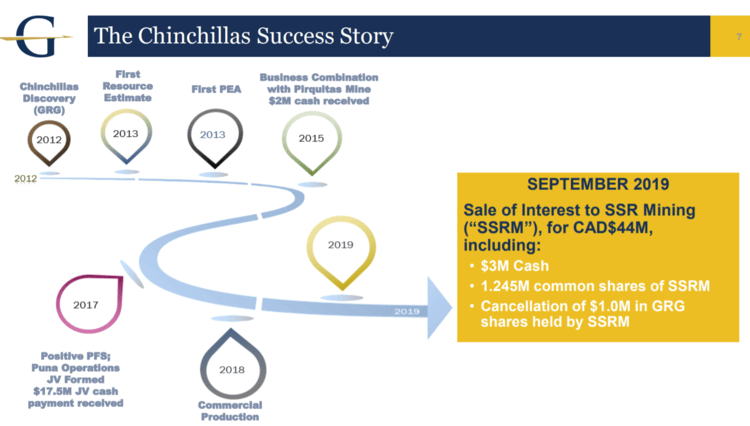

Golden Arrow Resources (GRG.V)

- 116.36 million shares outstanding

- $20.94 M market cap based on its recent $0.18 close

Covered in these pages intermittently over the years, Golden Arrow holds a portfolio of highly prospective projects in South America, specifically Argentina, Chile, and Paraguay (a recent foray).

Golden Arrow is actively exploring a portfolio that includes an epithermal gold project in Argentina, a district–scale frontier gold opportunity in Paraguay, a base-metal project in the heart of a leading mining district in Chile and more than 180,000 hectares of properties in Argentina.

Having monetized a major asset that started out as a grassroots exploration play, the Company boasts a solid track record of creating shareholder value.

Cash-rich, with ~$17.5M in cash & equivalents (including a large equity holding in SSR Mining), the Company generated a number of headlines in 2021.

The Company is currently drilling its Rosales Copper Project in Chile and its Tierra Dorada Gold Project in Paraguay.

An October 12th headline concerning a new acquisition:

Golden Arrow Executes Definitive Agreement for Libanesa Silver-Gold Project, Argentina

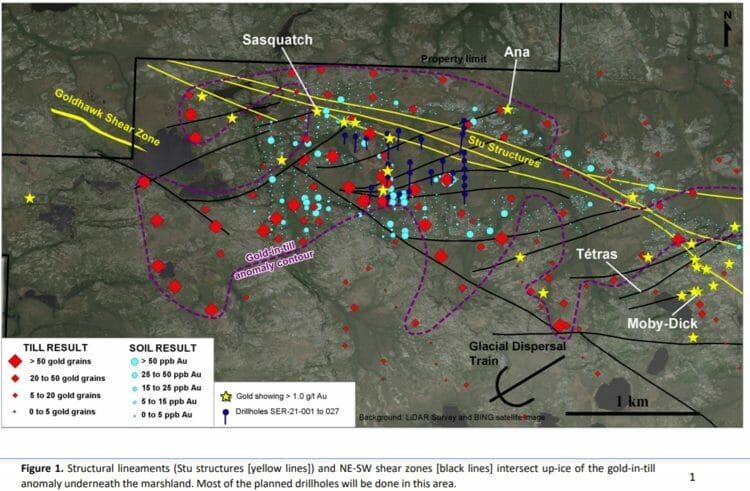

Harfang Exploration (HAR.V)

- 69.53 million shares outstanding

- $16.34M market cap based on its recent $0.235 close

Harfang’s flagship is its 28,565-hectare Serpent Project located in the James Bay region of Quebec. More than 35 orogenic gold and intrusion-related Cu-Au-Ag mineralized occurrences have been identified across the property to date.

On August 31st, the Company commenced a Phase-2, 3,500-meter drill campaign at Serpent—a program designed to test a series of high priority targets up-ice from a gold-in-till anomaly where surface gold showings and drilled auriferous shear zones were encountered during a previous campaign. Additional (newly defined) targets will also be tested during this second phase of drilling.

On September 28th, Harfang dropped the following headline:

Harfang continues to deliver high grade gold on the Serpent Project (James Bay, Québec)

Highlights from this summer-of-2021 exploration campaign include:

- Grab samples up to 345 g/t Au from Trench TR-21-26;

- Channel samples up to 208 g/t Au over 0.75 m (Powerline showing);

- Quartz-tourmaline boulders (up to 45.5 g/t Au) up-ice of the Moby-Dick gold structure;

- Metallic sieve analyses up to 3,710 g/t Au for the coarse fraction (>106 microns) confirming the abundance of coarse-grained gold grains.

The Company went on to state:

Our summer exploration program included excavating of 26 mechanical trenching, detailed geological mapping and prospecting. A total of 599 channel samples and more than 560 grab samples were collected so far. Trenching was carried out in specific areas around the marshland where earlier prospecting had revealed large gold-bearing quartz veins and shear zones. Recent prospecting was focused on selected areas around the marshland and in the northern part of the Property. A soil survey (B-horizon) with more than 800 samples was completed. Results from these soil samples and approximately 250 grab samples are pending.

This Phase-2 drill program wrapped up in early October.

Assays are pending.

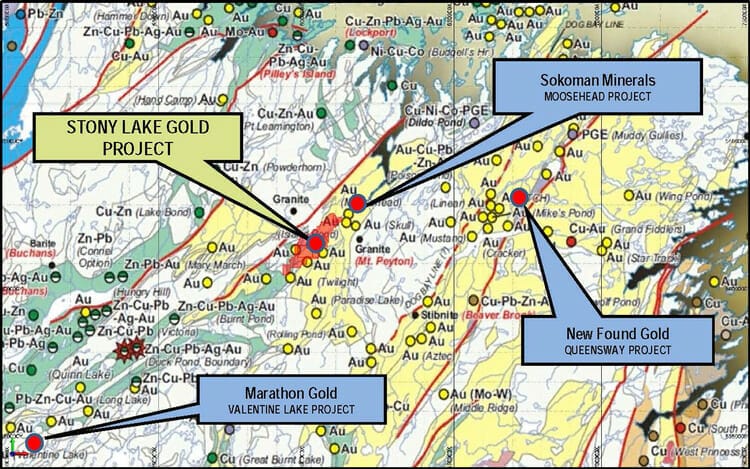

K9 Gold (KNC.V)

- 53.99 million shares outstanding

- $10.8M market cap based on its recent $0.20 close

I thought it best to include a micro-cap in the fray of the great Central Newfoundland gold rush.

K9’s Stony Lake Project is located along the Cape Ray/Valentine Lake structural trend of Central Newfoundland. The project covers 27 kilometers of prospective ground between Sokoman’s Moosehead Project to the northeast, and Marathon’s Valentine Lake Project to the southwest.

The Company completed a round of geophysics on the property earlier this year, as well as a soil sampling, trenching and mapping campaign.

On June 22nd, the Company launched a 5,000-meter first pass drill program. A couple of days later, it reported trench values—5.5 g/t Au over 4.0 meters. The Company also applied for a permit to double the size of its drill program to 10,000 meters.

On October 5th the Company reported four holes from its summer program with a highlight interval of 1.03 g/t Au over a core width of 7.9 meters. It reported the discovery of a new mineralized zone.

The last exploration update was tabled on October 7th via the following headline:

This play is in its early innings. Worth noting: Eric Sprott took down a $2.25M position in K9 at $0.30 per unit (each unit comprised of one share and a three year $0.40 warrant).

INTERMISSION

‘Unabated selling, dry powder, the upside of buying when you’re the only bidder in the room – a Guru roundup (Part 3)’ is on deck.

END

—Greg Nolan

Full disclosure: None of the companies featured above are Equity Guru marketing clients at this time. However, Goldseek Resources and Defense Metals are Highballer clients (color me especially biased regarding these two). The author owns shares of Defense and Goldseek.