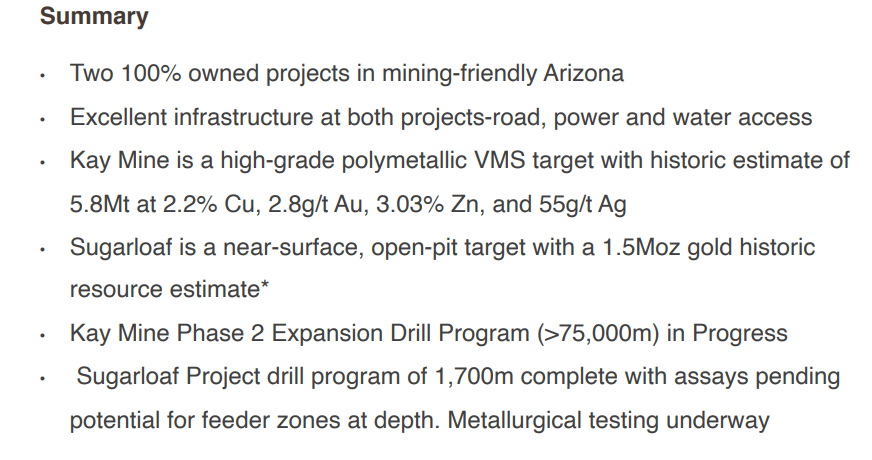

Arizona Metals (AMC.V) is a mining company that owns two properties in, you guessed it, Arizona. The two properties are the 100% Kay Mine which has a historic estimate by Exxon minerals in 1982. This includes a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.”

They also have a great ticker. Got to give it to them. I bet some Canadian traders may have bought Arizona Metals instead of AMC Entertainment. Jokes aside, this is one of the top Gold plays right now fundamentally and technically.

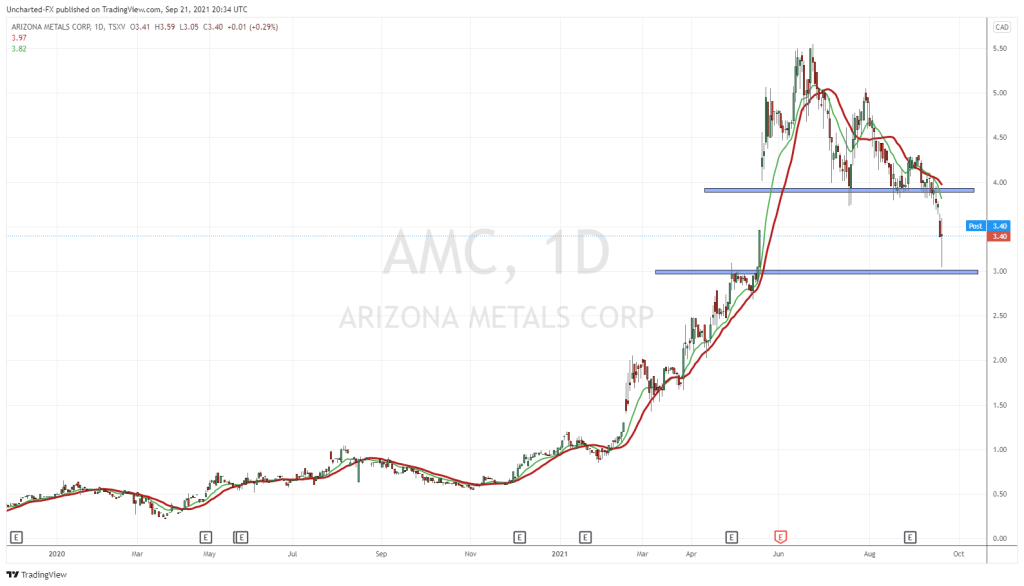

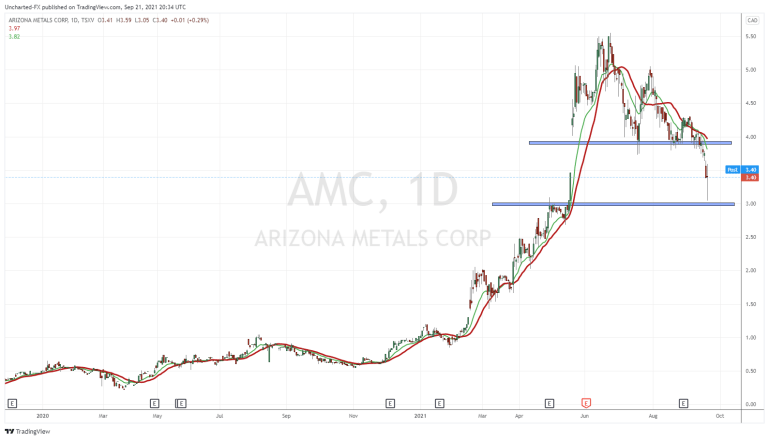

The last time I covered Arizona Metals was more than a month ago. September 22nd 2021. In the technical portion, I covered a major support zone that was being tested. The $3.00 zone. Here is the chart, and also my article for a reminder.

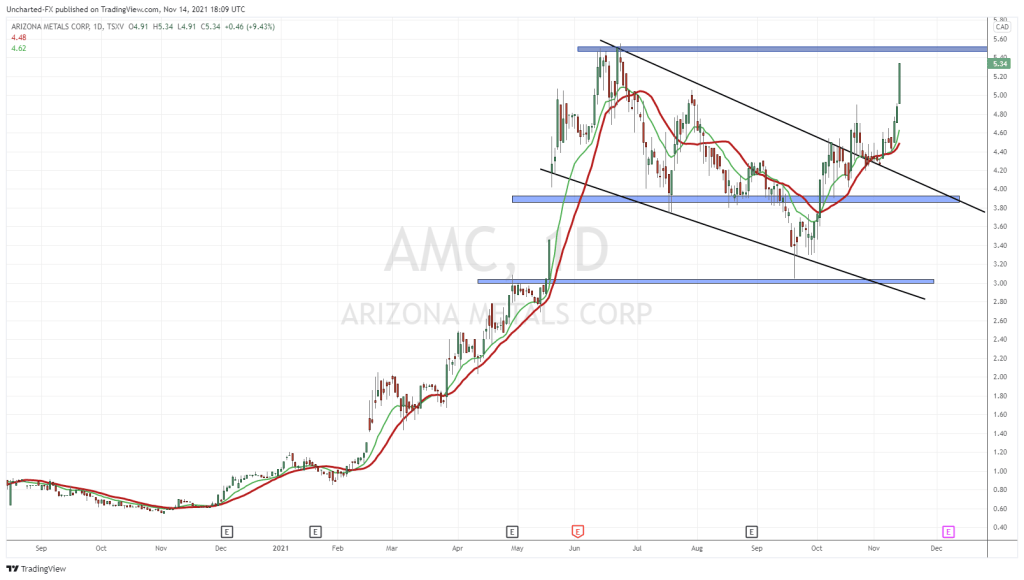

When we look at the current chart, you will see how Arizona Metals fared at support. Spoiler (well not really), it is good news for the bulls.

A quick refresher on the company, and recent news before delving into the technicals.

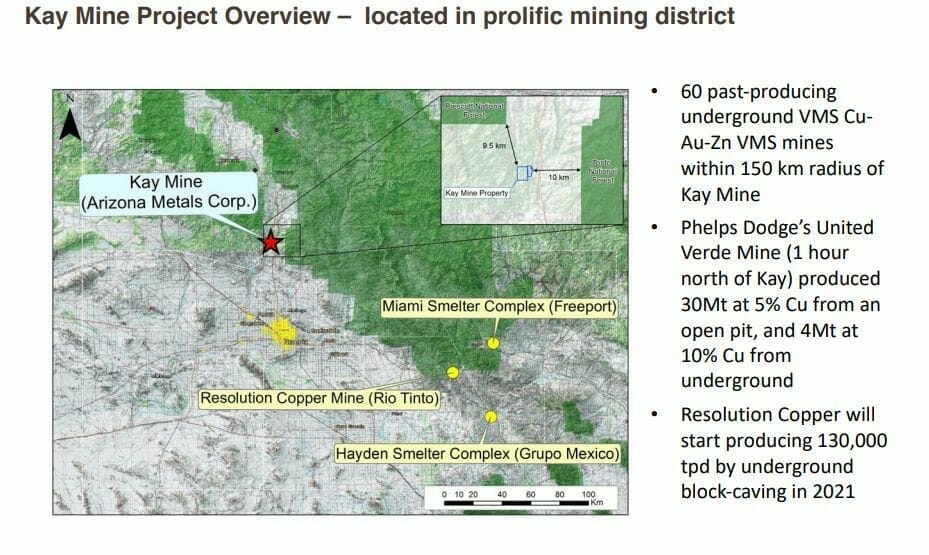

The Kay Mine project is surrounded by 60 past producing high-grade underground mines. Always good as this increases the chance of a big discovery if the veins travel into Arizona Metal’s claims.

We just had recent news on drilling. The full details can be read here. Or better yet, check out Greg Nolan’s coverage on Arizona Metals as a whole and their latest drill results. Greg believes there are more good drill results coming, and this project is one that will be scooped up by a major with a hefty premium to current price levels.

Arizona Metals Corp’s Kay Mine Drilling Expands Mineralized Zone with Intersects of

24 m @ 5.0% Cu, 0.6 g/t Au, 1.0% Zn, and 23 g/t Ag; 53 m @ 2.9 g/t Au, 0.5 % Cu, 3.4%

Zn, and 36 g/t Ag; and 11.4 m @ 5.9% Cu, 5.8 g/t Au, 3.2% Zn, and 185 g/t Ag

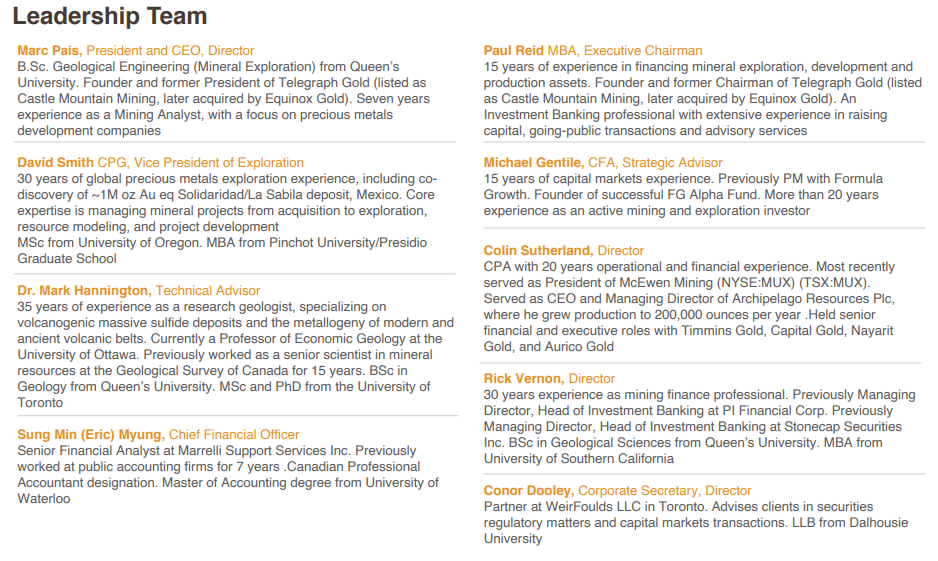

A few things to check out for before you invest in the explorers. Good jurisdiction ie: not an AK-47 country. Arizona Metals is in Arizona, which was voted 2nd out of 77 for investment attractiveness by the Fraser Institute in 2020. Management. Good management is key, and you want to be with winners. A team that has had experience in the mining sector and have had discoveries and/or buyouts.

Finally, the cash position. We want to make sure the company has cash so it won’t dilute shares on a possible raise, but also that the company has the funds to create a catalyst that will be positive for the stock. In this case, money is going into the ground for drilling.

Just recently, Arizona Metals has expanded its war chest with an upsize to a previously announced bought deal financing:

Arizona Metals Corp. is pleased to announce it has entered into an amended agreement with Stifel GMP and Clarus Securities Inc. to increase the size of the previously-announced offering. Pursuant to the amended terms of the Offering, the Lead Underwriters have agreed to purchase, on a bought deal basis, 10,600,000 common shares of the Company at a price of C$4.25 per Common Share , consisting of 7,500,000 Common Shares issued from treasury for gross proceeds to the Company of C$31,875,000 and 3,100,000 Common Shares sold by certain existing shareholders for gross proceeds of C$13,175,000.

The Company has agreed to grant the Underwriters an over-allotment option to purchase up to an additional 1,125,000 Common Shares under the Treasury Offering at the Offering Price, exercisable in whole or in part, at any time and from time to time on or prior to the date that is 30 days following the closing of the Offering to cover over-allotments, if any, and for market stabilization purposes. If this option is exercised in full, an additional C$4,781,250 in gross proceeds will be raised pursuant to the Treasury Offering and the aggregate gross proceeds of the Treasury Offering will be C$36,656,250.

I am also bullish commodities in general because of the inflation trade. Gold triggered a very important breakout last week. If you follow my work on Equity Guru, or are a member of the Equity Guru Discord channel, then you know I have been watching the Gold chart like a hawk. Super bullish both Gold and Silver. Gold broke a trendline, but the big breakout was a close above $1830. This resistance zone held four times in the recent past. As long as Gold remains above this zone, we are heading to $1900 and higher.

If you want more information on Gold and why I am bullish on this break, check out one of my recent Market Moment on Gold, Silver and Inflation in general here.

Finally, here is the updated Arizona Metals chart. As you can see, we bounced above the $3.00 support mentioned more than a month ago. But do you see something else similar? Yup. Same flag pattern just like Gold, although I would argue this one looks a whole lot better because of the longer uptrend, or the ‘pole’ part of the structure. Nonetheless, we broke out and retested it just like Gold. And now we are taking off…just like Gold. We will be testing the $5.50 previous record highs this week, and if Gold does what the charts are telling us, then Arizona Metals will be printing new all time record highs.

The breakout of the flag was confirmed on October 20th. Since then, we have pulled back to retest the breakout flag pattern three times. On all three days, buyers stepped in. Just look at how the lower wicks bounce from the trendline. Epic stuff.

Not only that, but the volume profile is extremely bullish. The breakout on the 20th happened with BIG volume. Nearly 1 million shares traded. The days of the trendline retest had either above half a million, or just below half a million worth of shares traded. This is for a stock with an average volume of 135,968. I like what I am seeing. With the Gold breakout now confirmed, I expect to see a push higher in Gold stocks. Watch for Arizona Metals to make new record highs in the upcoming months with Gold above $1830 and heading to $1900. Market structure does not lie, and is the most powerful tool for trading and investing financial markets.

So in summary there are a lot of things I like about Arizona Metals. Experienced management. A great and safe jurisdiction. A cash position for drilling and catalysts for the stock. Gold breaking out, perhaps even as an inflation hedge. The technical pattern on Arizona Metals itself. And finally, the volume of shares being traded after the breakout. All are very bullish indicators.