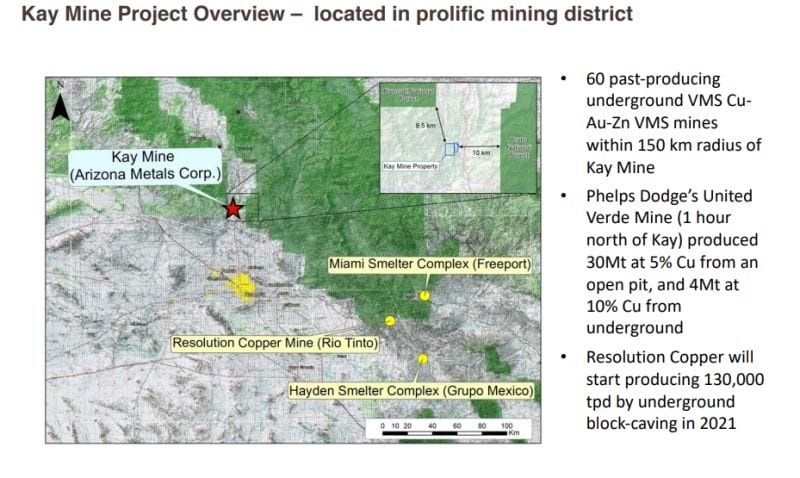

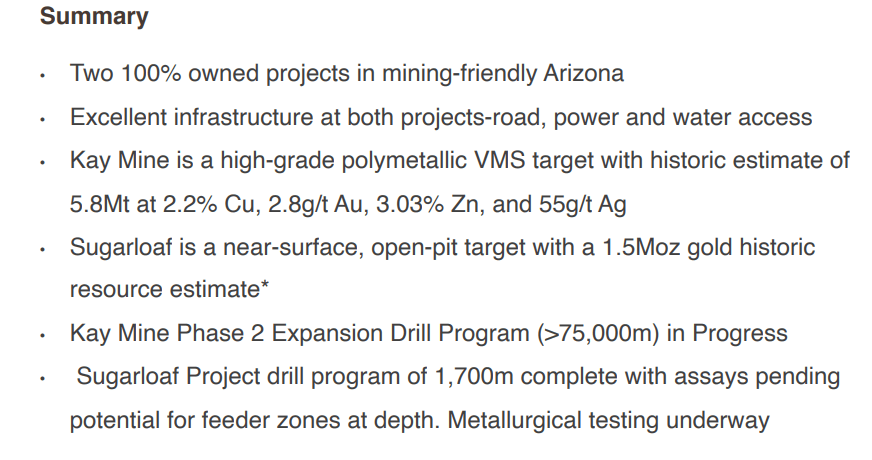

Arizona Metals (AMC.V) is a mining company that owns two properties in yup you guessed it, Arizona. The two properties are the 100% Kay Mine which has a historic estimate by Exxon minerals in 1982. This includes a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.”

This historic estimate has not been verified as a current mineral resource. Enter Arizona Metals.

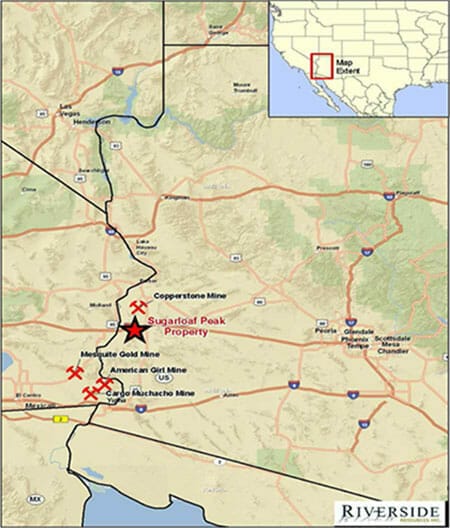

The Kay Mine project is surrounded by 60 past producing high-grade underground mines. Always good as this increases the chance of a big discovery if the veins travel into Arizona Metal’s claims.

Recent news details drilling insects which can read in detail here.

The second project is the Sugar Loaf Peak Property. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t.

Here are some reasons to invest in Arizona Metals:

All important notes, but I know you have come here to hear my analysis.

Gold. You either love it, or hate it. But many top money managers now believe Gold should make up some allocation in all balanced portfolio’s. If you bullish on Gold, then you want to pick up some miners. When Gold moves, the miners move with Gold but on steroids.

I am one of those who think Gold and other commodities are still relatively cheap compared to everything else in the markets.

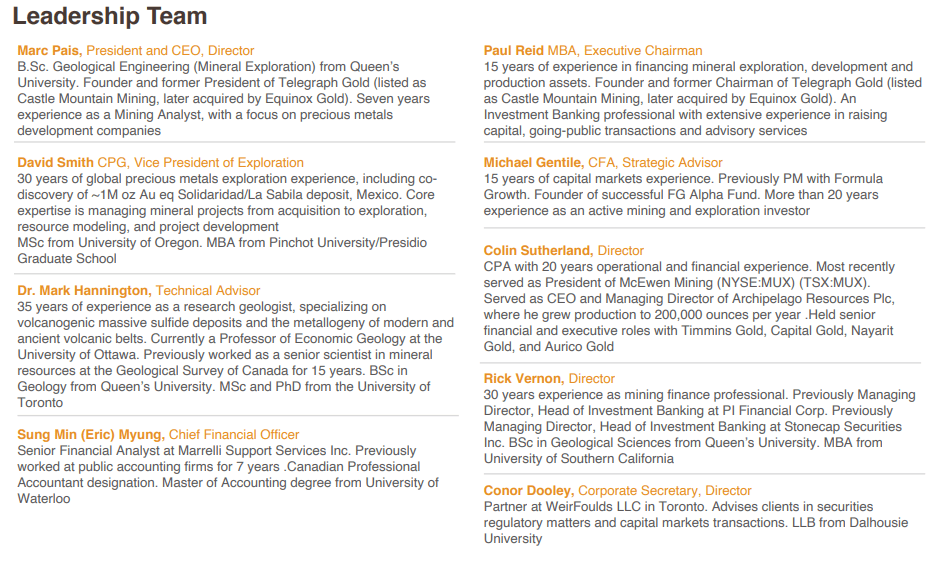

When it comes to miners I look at three things: Management, Jurisdiction, and the Cash position.

When it comes to management, we want to look for a team with years of experience in the mining industry. If members of the team were involved in one or two past discoveries, that helps. In the case of Arizona Metals, we have a check in this box.

We have a team involved with past discoveries and acquisitions. In summary, the team has found a project, de risked it, and then was bought by a middle tier or major tier miner. If they have done it once, they can do it again.

In terms of jurisdiction, Arizona is one of the best. It is the leading producer of Copper, and ranked number 2 out of 77 for investment attractiveness by the Fraser Institute in 2020.

Cash? A $21 million raise was done in April of 2021. They are cashed up for drilling. Which means catalysts for share holders. This has the potential of an exciting discovery.

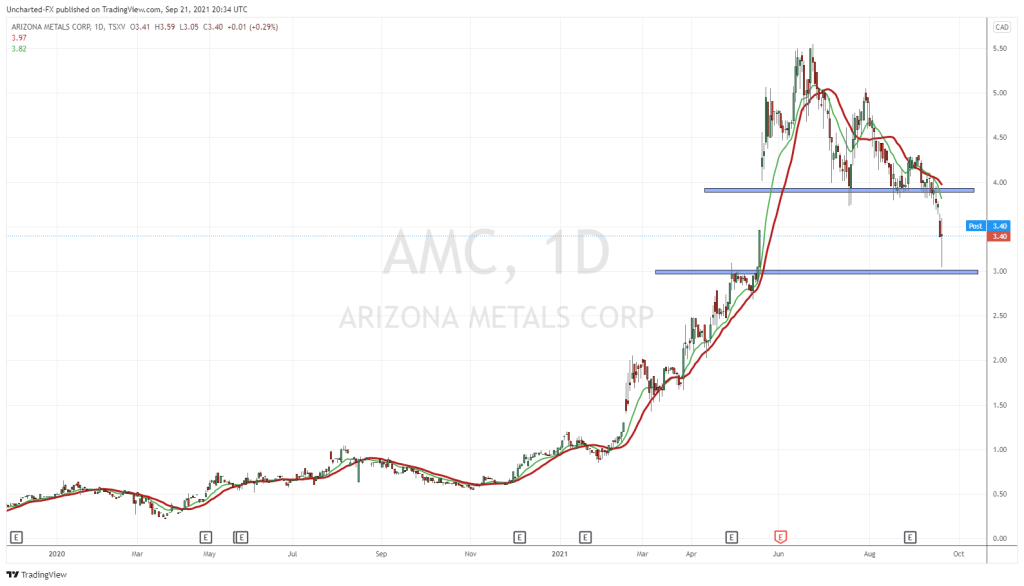

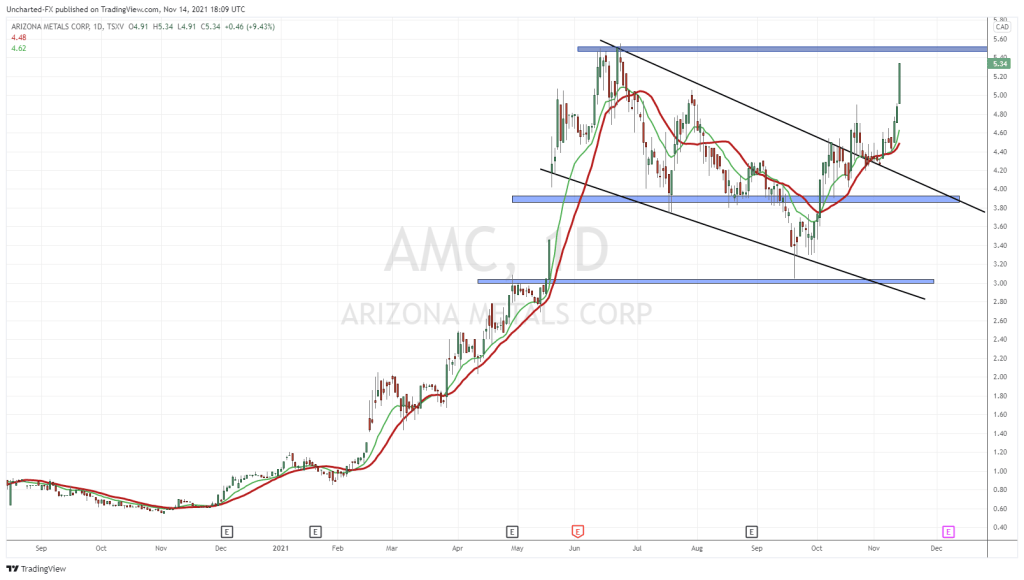

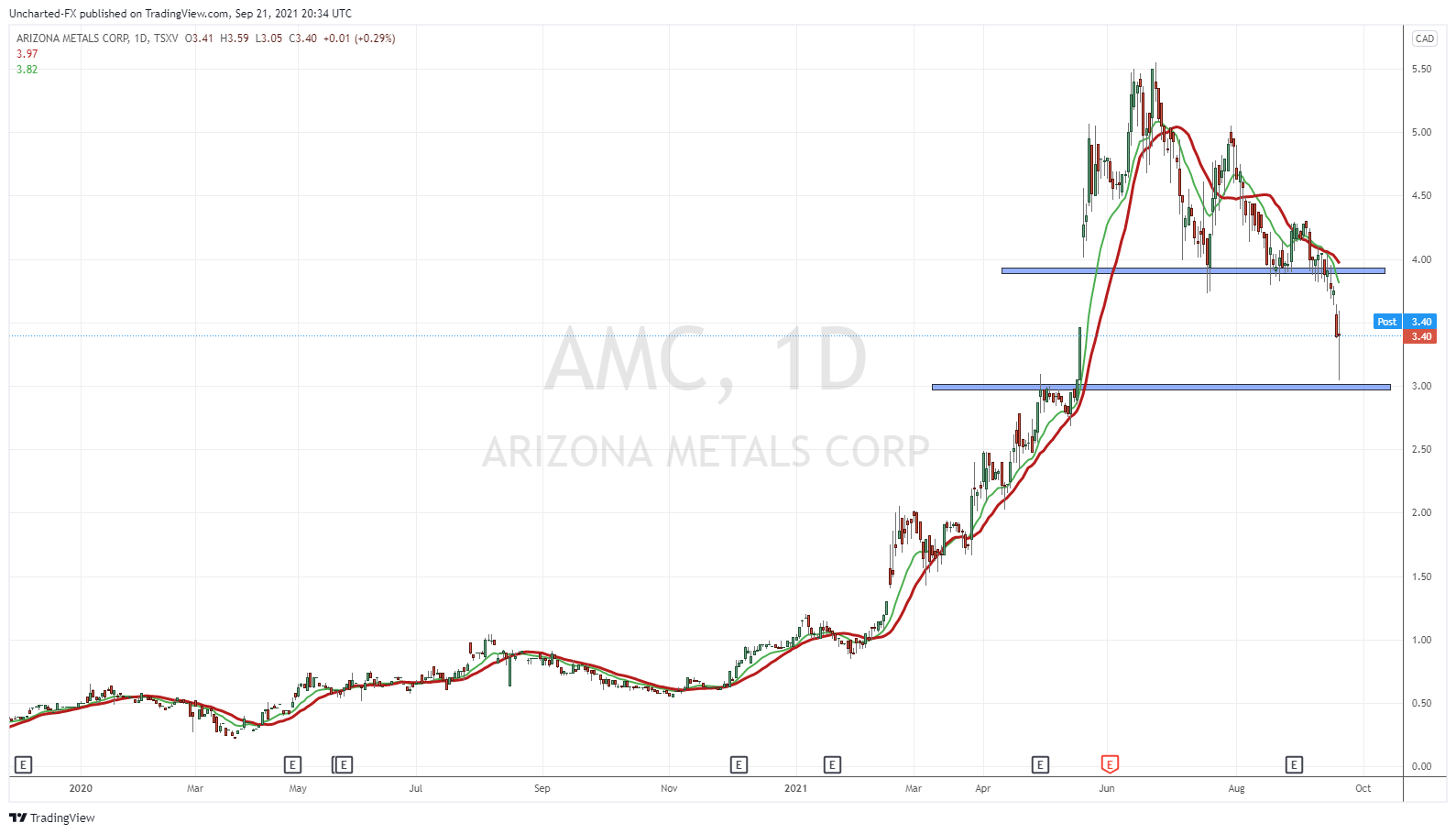

The market likes Arizona Metals. Take a look at the chart! The stock is up 233% year to date, and has a market cap of $287 million. The stock at its highest point of $5.55 was up over 437% for the year.

The stock popped in May on a new discovery at Kay Mine.

Since then, the stock turned toppy, even printing a head and shoulders pattern. $4.00 was a major support zone which held three times but then broke down just last week. More so to do with the drop on Gold with a stronger US Dollar.

As you can see, the $3.00 zone is where I drew a support. Tuesday September 21st saw wild price action. Markets are volatile given the China Evergrande situation and the Fed speaking on Wednesday the 22nd. Arizona Metals dropped, but we have evidence of buyers stepping in close to support at $3.00 with this large wick. Good signs.

What comes next depends partly on Gold and the markets, and future catalysts by management. If I was going to enter long, I would wait until after the Fed announcement. However, what I would like to see is some sort of basing or range. Ideally this happens at $3.00. If this breaks, then we will have to find this basing at new support down at $2.50 or $2.00. Alternatively, a close back above $4.00 would be huge. We would regain the zone we broke down. Very bullish.

One final thing I want to add: There is a gap. Note the gap between $3.50 and $4.00. Well it has been filled. Not looking too good. This is generally seen as a bearish signal, indicating further downside. As someone who follows markets on a daily basis, I find this interesting as it comes during a Fed week.

In summary, recent market volatility provides concern for entering currently. Wait for things to calm down, and let major high risk market moving events to pass. If you are someone bullish Gold and Copper for the long term, then Arizona Metals is worth your attention. It meets the criteria of experienced management who has done it before, a great jurisdiction, and cash.